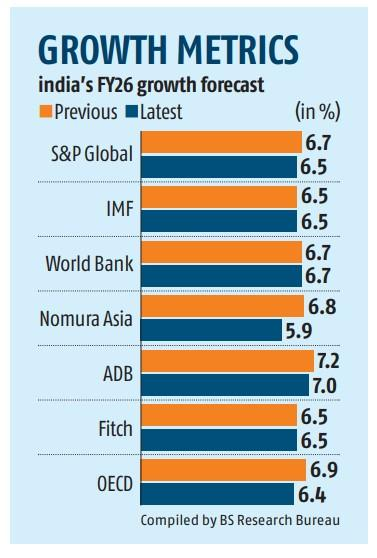

"Tariff Thunderstorm" crushing Indian Economy?

Request you read till the end.

Brightest Economy of the world hit a major setback when 'friend' Trump announced 50% tariff.

Few even declared Indian economy 'Dead' and GDP to sink.

But here’s the twist:

60% of India's GDP is domestic consumption.

And Modi govt have already fired 3 economic cannons:

Request you read till the end.

Brightest Economy of the world hit a major setback when 'friend' Trump announced 50% tariff.

Few even declared Indian economy 'Dead' and GDP to sink.

But here’s the twist:

60% of India's GDP is domestic consumption.

And Modi govt have already fired 3 economic cannons:

1. Massive income tax relief much before Trump Tariff

2. GST overhaul,

3. Low-inflation fueled credit expansion.

Instead of a slowdown, India might roar ahead with demand-led growth. This isn’t coincidence—it’s a pre-emptive strategy.

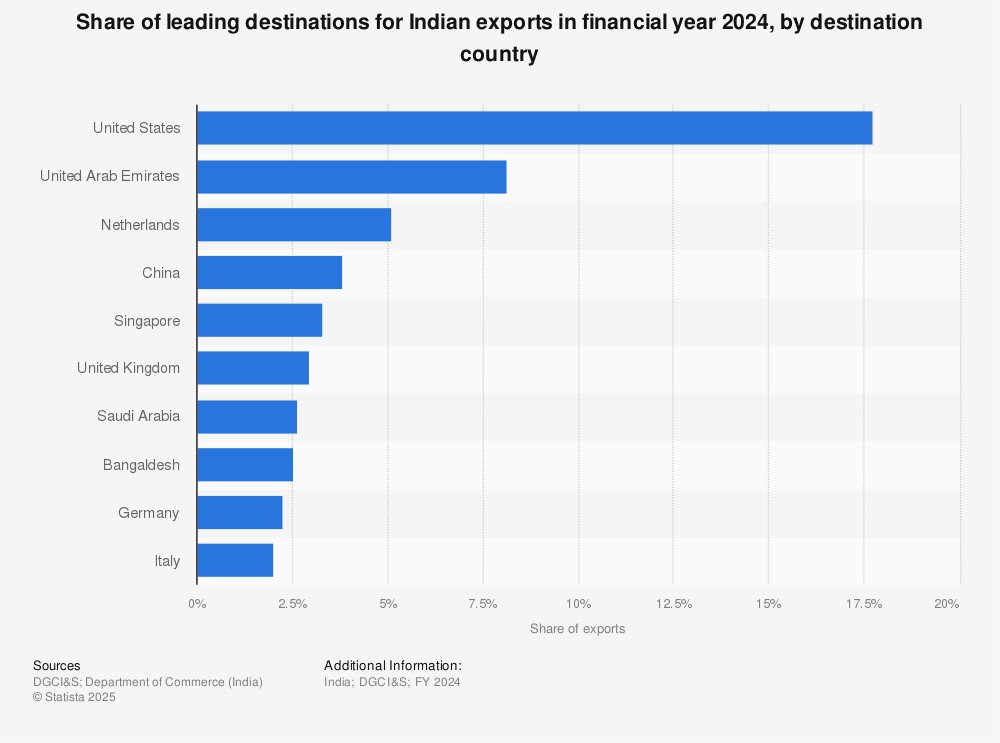

For India, the U.S. is a top export market (~$77 bn in 2024). Higher tariffs will hurt textiles, IT, pharma & engineering goods.

Through income tax reforms, GST overhaul, inflation control, and smart trade diversification, India is pivoting from export dependency to domestic demand strength.

Let’s decode how 1 lakh crore tax relief can become 5 lakh crore in consumption, GST rationalisation frees supply chains, CPI-led repo cuts boost credit, and Russia offsets U.S. trade loss.

2. GST overhaul,

3. Low-inflation fueled credit expansion.

Instead of a slowdown, India might roar ahead with demand-led growth. This isn’t coincidence—it’s a pre-emptive strategy.

For India, the U.S. is a top export market (~$77 bn in 2024). Higher tariffs will hurt textiles, IT, pharma & engineering goods.

Through income tax reforms, GST overhaul, inflation control, and smart trade diversification, India is pivoting from export dependency to domestic demand strength.

Let’s decode how 1 lakh crore tax relief can become 5 lakh crore in consumption, GST rationalisation frees supply chains, CPI-led repo cuts boost credit, and Russia offsets U.S. trade loss.

Income Tax Relief Multiplier:

India's biggest strength is its own domestic market which is capturing whole world's attention.

Modi govt made a solid move to increase domestic consumption.

The 2025 Budget’s big bang: Income Tax-free up to ₹12 lakh. This is not just middle-class relief — it’s a demand bomb.

IMF’s KV Subramanian estimates ₹1 lakh crore in tax cuts can multiply into ₹5 lakh crore in consumption — nearly 2.7% of GDP.

Why?

India's biggest strength is its own domestic market which is capturing whole world's attention.

Modi govt made a solid move to increase domestic consumption.

The 2025 Budget’s big bang: Income Tax-free up to ₹12 lakh. This is not just middle-class relief — it’s a demand bomb.

IMF’s KV Subramanian estimates ₹1 lakh crore in tax cuts can multiply into ₹5 lakh crore in consumption — nearly 2.7% of GDP.

Why?

Because households spend 80% of what they save, and each rupee circulates at multiple levels — groceries, transport, services, manufacturing.

That’s a classic Keynesian multiplier at play. Even conservative economists peg it at ~₹2–3 lakh crore extra consumption.

Either way, this cushions India’s growth from export headwinds and creates a massive domestic demand buffer.

Income Tax relief was to create disposable income. Other canon it fired was to make marker more lucrative for consumer:

That’s a classic Keynesian multiplier at play. Even conservative economists peg it at ~₹2–3 lakh crore extra consumption.

Either way, this cushions India’s growth from export headwinds and creates a massive domestic demand buffer.

Income Tax relief was to create disposable income. Other canon it fired was to make marker more lucrative for consumer:

GST Overhaul as Demand Booster:

The GST revamp is another game-changer. Rates are being rationalised to reduce litigation, improve compliance, and lower prices for essentials.

Analysts estimate GST simplification could free ₹1.5–2 lakh crore locked in working capital for SMEs.

Lower indirect tax burdens mean goods are cheaper → higher household consumption → stronger supply chains.

The GST Council’s focus on reducing slabs to 3, while taxing luxury/“sin goods” higher, balances fiscal prudence with demand growth.

This overhaul not only boosts compliance (collections already crossed ₹2 lakh crore/month in 2025) but also injects affordability at the consumer end.

In a tariff-hit world, GST reform is India’s silent demand insurance.

Do you remember hue and cry about GST labelled as Gabbar Singh Tax?

Same GST is now going to make Indian economy roar like Babbar sher.

The GST revamp is another game-changer. Rates are being rationalised to reduce litigation, improve compliance, and lower prices for essentials.

Analysts estimate GST simplification could free ₹1.5–2 lakh crore locked in working capital for SMEs.

Lower indirect tax burdens mean goods are cheaper → higher household consumption → stronger supply chains.

The GST Council’s focus on reducing slabs to 3, while taxing luxury/“sin goods” higher, balances fiscal prudence with demand growth.

This overhaul not only boosts compliance (collections already crossed ₹2 lakh crore/month in 2025) but also injects affordability at the consumer end.

In a tariff-hit world, GST reform is India’s silent demand insurance.

Do you remember hue and cry about GST labelled as Gabbar Singh Tax?

Same GST is now going to make Indian economy roar like Babbar sher.

This reform alone could unlock ₹1.98–2.4 lakh crore in extra consumption and add 0.5–0.7% to GDP. For households, it’s savings; for the govt, it’s a domestic demand rocket.

Govt is shifting towards volume vs value. It means govt can still collect similar amount of tax but via more volume than value per tax.

But people and supplier will have relief. It is going to put market on steroid of demand.

Govt is shifting towards volume vs value. It means govt can still collect similar amount of tax but via more volume than value per tax.

But people and supplier will have relief. It is going to put market on steroid of demand.

Inflation Control & Repo Impact:

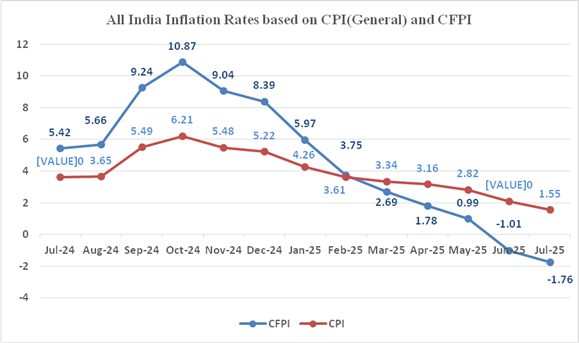

CPI inflation has been cooling, hovering close to 1.7% for month of July and overall at 4.8% in mid-2025.

This isn’t just a headline number — it changes the credit game.

With inflation anchored, the RBI can ease monetary policy. Repo rate cuts (already down 50 bps this year) reduce borrowing costs for both households and businesses.

Cheaper EMIs boost home & auto demand; lower working capital costs spur SME growth. Historically, a 100 bps repo cut adds 0.3–0.4% to GDP growth.

As U.S. tariffs threaten exports, India’s low inflation → low rates → high credit cycle acts as a domestic growth accelerator. A healthy credit market offsets global shocks by pushing local demand higher.

CPI inflation has been cooling, hovering close to 1.7% for month of July and overall at 4.8% in mid-2025.

This isn’t just a headline number — it changes the credit game.

With inflation anchored, the RBI can ease monetary policy. Repo rate cuts (already down 50 bps this year) reduce borrowing costs for both households and businesses.

Cheaper EMIs boost home & auto demand; lower working capital costs spur SME growth. Historically, a 100 bps repo cut adds 0.3–0.4% to GDP growth.

As U.S. tariffs threaten exports, India’s low inflation → low rates → high credit cycle acts as a domestic growth accelerator. A healthy credit market offsets global shocks by pushing local demand higher.

Trade Diversification Beyond U.S.

Export to US is just 17% of Indian exports by value.

India isn’t sitting idle on exports either. U.S. tariffs may target textiles or pharma, but India has already expanded its export footprint.

UK, UAE, Australia FTA is live, EU-India trade talks are progressing, and Africa is emerging as a new $100 bn+ market by 2030.

Non-U.S. exports (to ASEAN, Middle East, EU) already make up 75%+ of India’s trade. Even if U.S. demand slows, diversification ensures continuity.

Sectors like chemicals, mobile exports (₹1.5 lakh crore in FY25), and processed food are increasingly headed to non-U.S. markets. This hedging cushions Indian exporters from a single-market tariff shock.

Export to US is just 17% of Indian exports by value.

India isn’t sitting idle on exports either. U.S. tariffs may target textiles or pharma, but India has already expanded its export footprint.

UK, UAE, Australia FTA is live, EU-India trade talks are progressing, and Africa is emerging as a new $100 bn+ market by 2030.

Non-U.S. exports (to ASEAN, Middle East, EU) already make up 75%+ of India’s trade. Even if U.S. demand slows, diversification ensures continuity.

Sectors like chemicals, mobile exports (₹1.5 lakh crore in FY25), and processed food are increasingly headed to non-U.S. markets. This hedging cushions Indian exporters from a single-market tariff shock.

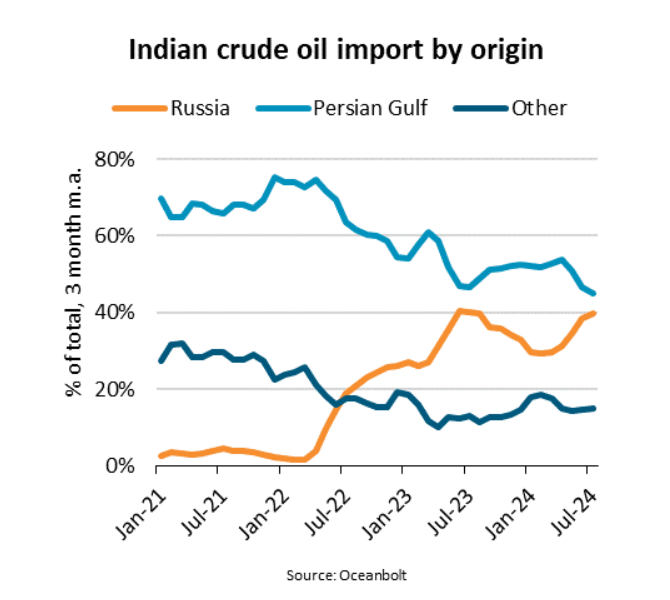

Russian Oil Discount: The Silent Shield

Energy is India’s biggest import bill.

By sourcing discounted Russian crude, India has saved $10+ billion in FY24–25.

These savings directly lower the current account deficit, strengthen the rupee, and free fiscal space for domestic spending.

More importantly, cheaper energy reduces inflationary pressures, making repo rate cuts sustainable.

Think of it this way: every dollar saved on imports is a dollar freed for consumption or investment.

Even if U.S. tariffs dent exports, Russia’s oil discount keeps India’s macro stability intact — ensuring trade shocks don’t snowball into inflation shocks. This import strategy is as critical as export diversification.

Energy is India’s biggest import bill.

By sourcing discounted Russian crude, India has saved $10+ billion in FY24–25.

These savings directly lower the current account deficit, strengthen the rupee, and free fiscal space for domestic spending.

More importantly, cheaper energy reduces inflationary pressures, making repo rate cuts sustainable.

Think of it this way: every dollar saved on imports is a dollar freed for consumption or investment.

Even if U.S. tariffs dent exports, Russia’s oil discount keeps India’s macro stability intact — ensuring trade shocks don’t snowball into inflation shocks. This import strategy is as critical as export diversification.

Corporate & Capex Cycle

The private capex cycle is showing signs of revival — credit to industry rose 13% YoY in 2025, with infra, energy, and housing leading. Corporate tax cuts in earlier budgets (down from 30% to 22%) + PLI schemes have freed cash for reinvestment.

Combine this with government-led infra spend (₹11 lakh crore in FY26 budgeted capex), and you see a dual engine.

Even if exports face tariffs, capex ensures domestic job creation & income multipliers.

This translates into higher consumption and faster growth — keeping India’s GDP momentum intact around 7–7.5% even in a protectionist global environment.

The private capex cycle is showing signs of revival — credit to industry rose 13% YoY in 2025, with infra, energy, and housing leading. Corporate tax cuts in earlier budgets (down from 30% to 22%) + PLI schemes have freed cash for reinvestment.

Combine this with government-led infra spend (₹11 lakh crore in FY26 budgeted capex), and you see a dual engine.

Even if exports face tariffs, capex ensures domestic job creation & income multipliers.

This translates into higher consumption and faster growth — keeping India’s GDP momentum intact around 7–7.5% even in a protectionist global environment.

So what’s the big picture?

Is India Tariff-Proof?

The Modi govt’s playbook ensures India isn’t hostage to U.S. trade politics.

Tax relief + GST overhaul → consumption firewall.

Low inflation → credit-led demand.

Russian oil → macro stability.

Trade diversification → export hedging.

Capex → job creation.

Together, this means even ...

Is India Tariff-Proof?

The Modi govt’s playbook ensures India isn’t hostage to U.S. trade politics.

Tax relief + GST overhaul → consumption firewall.

Low inflation → credit-led demand.

Russian oil → macro stability.

Trade diversification → export hedging.

Capex → job creation.

Together, this means even ...

...if Trump continues tariffs, India can still clock 7%+ growth while advanced economies struggle.

In fact, India could turn into the world’s last large consumption-driven growth story — attracting FDI and replacing tariff-hit export reliance with resilient domestic demand.

In fact, India could turn into the world’s last large consumption-driven growth story — attracting FDI and replacing tariff-hit export reliance with resilient domestic demand.

In 2018, Trump’s tariffs on China rattled global trade.

In 2025, India is different.

Through domestic demand multipliers, GST rationalisation, inflation control, trade pivots, and energy arbitrage, Modi govt has already pre-empted tariff wars.

The message is clear: India’s growth story no longer depends on U.S. benevolence.

With ₹5 lakh crore in new consumption potential, stable macros, and diversified trade, India is scripting an economic firewall.

Tariffs may slow others, but India is playing a different game — one of resilience, consumption, and confidence.

In 2025, India is different.

Through domestic demand multipliers, GST rationalisation, inflation control, trade pivots, and energy arbitrage, Modi govt has already pre-empted tariff wars.

The message is clear: India’s growth story no longer depends on U.S. benevolence.

With ₹5 lakh crore in new consumption potential, stable macros, and diversified trade, India is scripting an economic firewall.

Tariffs may slow others, but India is playing a different game — one of resilience, consumption, and confidence.

• • •

Missing some Tweet in this thread? You can try to

force a refresh