🧵 Re-Evaluating ULTY Performance Since the New Strategy: NAV Decline Since 7/21/25 (Post-New Strategy Peak) & 10-Year DRIP Projections

ULTY's March 2025 strategy revamp (direct holdings, protective puts, credit spreads) aimed to stabilize the fund amid high yields. But with NAV declining ~9.5% since July 21, 2025 (from ~$6.33 to $5.73 as of Aug 19), is it working? Let's re-evaluate performance, causes of the slide, and run updated 10-year projections for $100K with 100% DRIP starting July 25, 2025, in bull, stagnant, and bear markets. Hypotheticals based on data 👇

ULTY's March 2025 strategy revamp (direct holdings, protective puts, credit spreads) aimed to stabilize the fund amid high yields. But with NAV declining ~9.5% since July 21, 2025 (from ~$6.33 to $5.73 as of Aug 19), is it working? Let's re-evaluate performance, causes of the slide, and run updated 10-year projections for $100K with 100% DRIP starting July 25, 2025, in bull, stagnant, and bear markets. Hypotheticals based on data 👇

1/9. The Strategy Change: What Happened in March 2025?

Pre-March: ULTY used synthetic positions, leading to heavy NAV erosion (~70% drop from launch Feb 2024 at $20 to ~$7 by March).

Post-Change: Shifted to direct ownership of 15-30 high-vol U.S. stocks (e.g., NVDA, MSTR), added OTM puts for downside cushion (~5-10%), credit call spreads for moderate upside capture, and flexible call writing. Weekly distributions started.

Goal: Boost income (~85% yield) while reducing erosion risks.

Pre-March: ULTY used synthetic positions, leading to heavy NAV erosion (~70% drop from launch Feb 2024 at $20 to ~$7 by March).

Post-Change: Shifted to direct ownership of 15-30 high-vol U.S. stocks (e.g., NVDA, MSTR), added OTM puts for downside cushion (~5-10%), credit call spreads for moderate upside capture, and flexible call writing. Weekly distributions started.

Goal: Boost income (~85% yield) while reducing erosion risks.

2/9. Performance Re-Evaluation: Total Return Since March

From March 10 to Aug 19, 2025 (~5.5 months):

- Total Return (price + reinvested divs): ~27.7% (outpaced Nasdaq 100's 18.4%).

- Price Return: ~ -15% (NAV from ~$6.79 Mar 6 to $5.73).

- Annualized Return: ~60% (total, driven by divs). Vol ~33%; Sharpe ~1.10 (good for short period).

Revamp succeeded in boosting total returns via better protection, but NAV erosion (~34% ann. rate) persists due to distros.

From March 10 to Aug 19, 2025 (~5.5 months):

- Total Return (price + reinvested divs): ~27.7% (outpaced Nasdaq 100's 18.4%).

- Price Return: ~ -15% (NAV from ~$6.79 Mar 6 to $5.73).

- Annualized Return: ~60% (total, driven by divs). Vol ~33%; Sharpe ~1.10 (good for short period).

Revamp succeeded in boosting total returns via better protection, but NAV erosion (~34% ann. rate) persists due to distros.

3/9. The NAV Decline Since July 21, 2025: Causes & Context

Since July 21 (NAV $6.33) to Aug 19 ($5.73): -9.5% (~2.4% weekly).

Causes:

- Distributions: Weekly ~$0.10/share ex-div drops (ROC reduces basis, not loss).

- Market/Vol Weakness: Tech dips (NVDA etc.), low vol reduces premiums.

- Strategy: Full downside in bears (puts limited cushion).

- Broader: Election/rate vol, AI slowdown.

Context: Slower than pre-revamp (~70% drop in year), but ongoing—total return positive ~5-7% since July 21. Worry if erosion > yields long-term.

Since July 21 (NAV $6.33) to Aug 19 ($5.73): -9.5% (~2.4% weekly).

Causes:

- Distributions: Weekly ~$0.10/share ex-div drops (ROC reduces basis, not loss).

- Market/Vol Weakness: Tech dips (NVDA etc.), low vol reduces premiums.

- Strategy: Full downside in bears (puts limited cushion).

- Broader: Election/rate vol, AI slowdown.

Context: Slower than pre-revamp (~70% drop in year), but ongoing—total return positive ~5-7% since July 21. Worry if erosion > yields long-term.

4/9. 10-Year Projection Setup: $100K with 100% DRIP from July 25, 2025

Start: July 25 NAV ~$6.25 → 16,000 shares.

Assumptions (updated from recent 85% yield, ~34% ann. erosion since March):

- Annual model (real weekly); DRIP compounds.

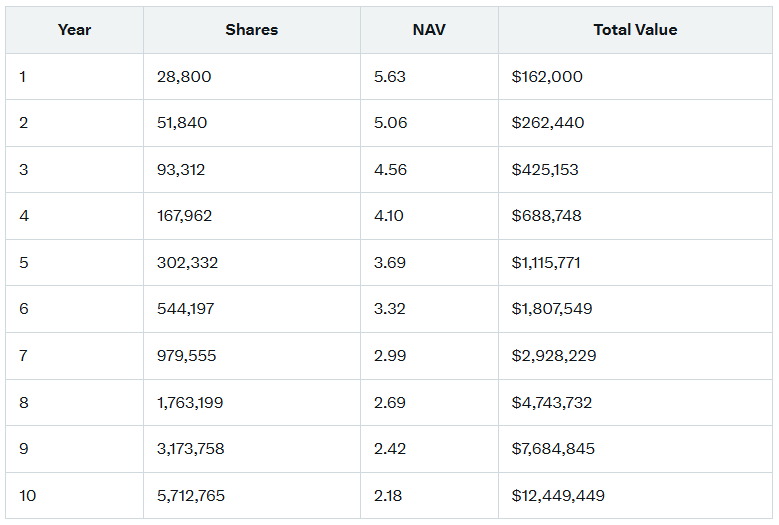

- Bull: 70% yield (vol sustains),

-10% NAV change (gains offset).

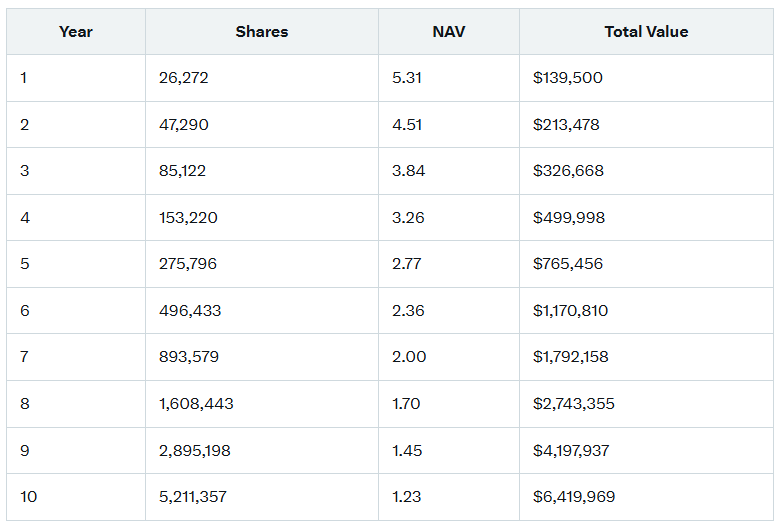

- Stagnant: 60% yield,

-15% NAV change.

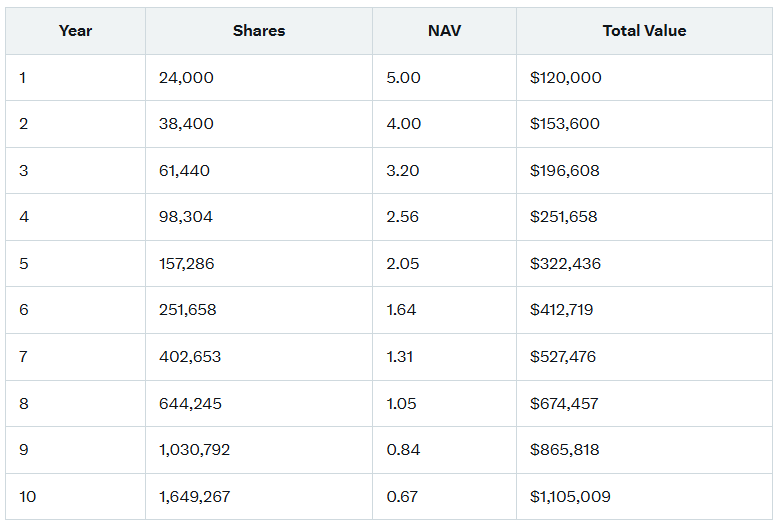

- Bear: 50% yield, -25% NAV change (vol thin, downside hits).

No taxes (ROC defers); projections illustrative.

Start: July 25 NAV ~$6.25 → 16,000 shares.

Assumptions (updated from recent 85% yield, ~34% ann. erosion since March):

- Annual model (real weekly); DRIP compounds.

- Bull: 70% yield (vol sustains),

-10% NAV change (gains offset).

- Stagnant: 60% yield,

-15% NAV change.

- Bear: 50% yield, -25% NAV change (vol thin, downside hits).

No taxes (ROC defers); projections illustrative.

6/9. Stagnant Market Projection: Steady Vol, Mild Erosion Balanced, yields dominate erosion.

End: ~$6.4M.

End: ~$6.4M.

8/9. Why These Projections & Realism

Model: Annual compounding (real weekly); yield from current ~85%, erosion from ~34% ann. since March.

Bull: Strong vol/gains reduce erosion.

Stagnant: Base case.

Bear: Vol dries, downside hits.

Risks: Assumptions vary; new fund history limited. DRIP offsets erosion via shares.

Model: Annual compounding (real weekly); yield from current ~85%, erosion from ~34% ann. since March.

Bull: Strong vol/gains reduce erosion.

Stagnant: Base case.

Bear: Vol dries, downside hits.

Risks: Assumptions vary; new fund history limited. DRIP offsets erosion via shares.

9/9. TLDR: ULTY since March 2025: Total return ~27.7% (strong), but NAV down ~15.6% from erosion/distros. Decline since July 21 (~9.5%) ongoing but slowed post-revamp. $100K DRIP from July 25 could grow to $1.1M (bear), $6.4M (stagnant), $12.4M (bull) over 10 years—yield powers despite slide.

📖 For Educational Purposes Only

🚨 Not Financial Advice

👉 Do Your Own Research

I drop educational threads daily. If value, ❤️ or 🔁 helps spread knowledge!

ULTY re-eval? Below!

📖 For Educational Purposes Only

🚨 Not Financial Advice

👉 Do Your Own Research

I drop educational threads daily. If value, ❤️ or 🔁 helps spread knowledge!

ULTY re-eval? Below!

• • •

Missing some Tweet in this thread? You can try to

force a refresh