🚨 SWIFT is now testing XRP for blockchain-based cross-border payments.

The cartel that ruled global finance for 50 years is bending the knee to Ripple’s rails.

The reset isn’t coming.

It’s already here. 🧵👇

The cartel that ruled global finance for 50 years is bending the knee to Ripple’s rails.

The reset isn’t coming.

It’s already here. 🧵👇

1/ SWIFT wasn’t built for speed or efficiency.

It was built for control, surveillance of global money flows.

But Ripple’s XRP Ledger?

It was designed for neutral, instant, unstoppable liquidity.

This is why SWIFT has no choice but to test it.

It was built for control, surveillance of global money flows.

But Ripple’s XRP Ledger?

It was designed for neutral, instant, unstoppable liquidity.

This is why SWIFT has no choice but to test it.

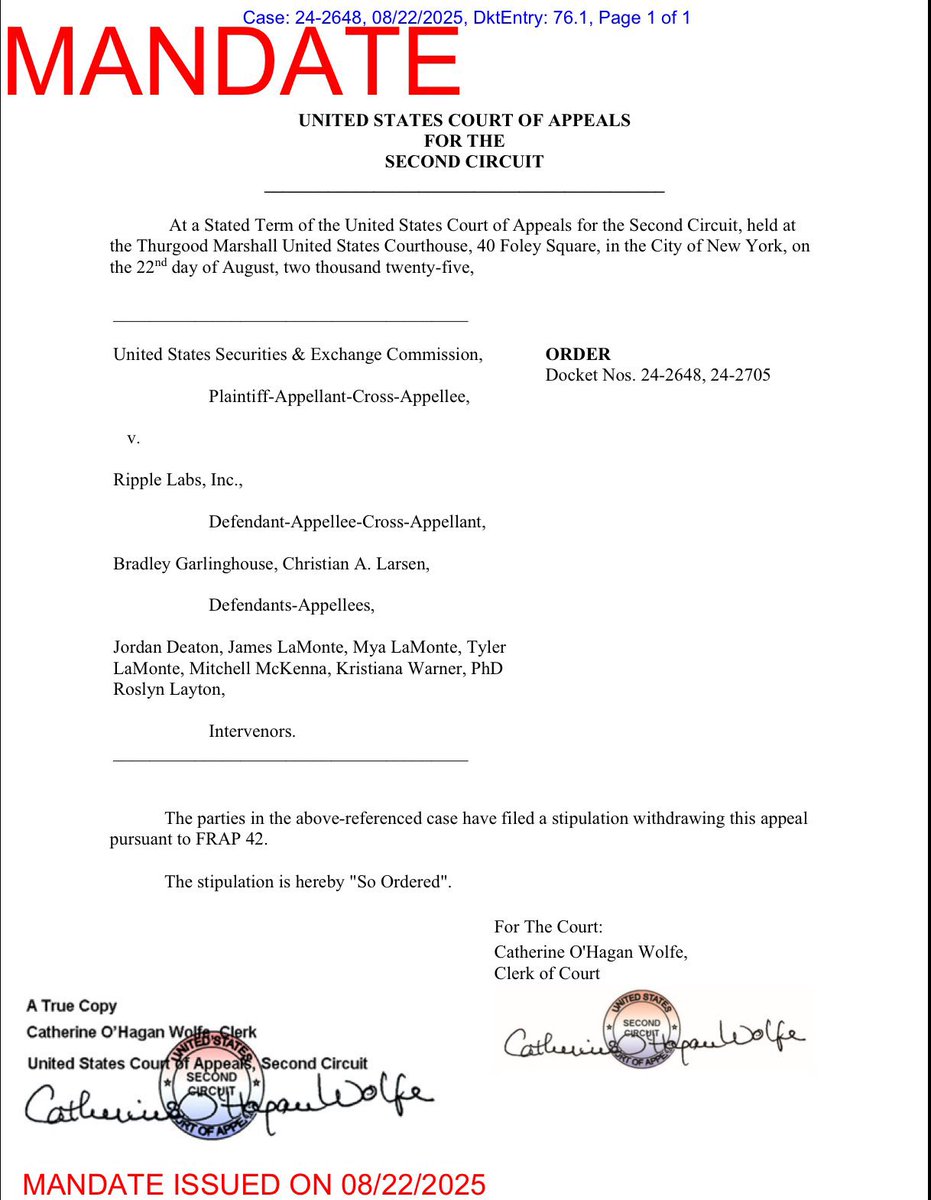

2/ Ripple has signed 1,700+ contracts and NDAs with banks, governments, and corporates.

The world thought Ripple was being “attacked” in the U.S. lawsuit.

In reality, the lawsuit was cover fire while the wiring was laid behind closed doors.

The world thought Ripple was being “attacked” in the U.S. lawsuit.

In reality, the lawsuit was cover fire while the wiring was laid behind closed doors.

3/ SWIFT doesn’t test “altcoins.”

They test systemic infrastructure.

The fact that XRP is on their rails proves:

Ripple has already infiltrated the bloodstream of global finance.

They test systemic infrastructure.

The fact that XRP is on their rails proves:

Ripple has already infiltrated the bloodstream of global finance.

4/ What does this mean?

SWIFT corridors + XRP =

✅ Instant global settlement

✅ Neutral bridge asset

✅ Tokenization-ready rails

✅ On-chain liquidity at scale

This isn’t a crypto play.

It’s the replacement of SWIFT itself.

SWIFT corridors + XRP =

✅ Instant global settlement

✅ Neutral bridge asset

✅ Tokenization-ready rails

✅ On-chain liquidity at scale

This isn’t a crypto play.

It’s the replacement of SWIFT itself.

5/ Ripple didn’t just beat the banks.

Ripple became the banks.

And now, even SWIFT is forced to test on Ripple’s battlefield.

This is checkmate.

Ripple became the banks.

And now, even SWIFT is forced to test on Ripple’s battlefield.

This is checkmate.

6/ Retail investors laugh at “XRP at $10k.”

But when global settlement flows, trillions per day, run through a scarce bridge asset,

math becomes prophecy.

The XRP price won’t be decided by speculators.

It will be decided by global liquidity demand.

But when global settlement flows, trillions per day, run through a scarce bridge asset,

math becomes prophecy.

The XRP price won’t be decided by speculators.

It will be decided by global liquidity demand.

7/ You’re early.

You’re holding the one asset SWIFT itself couldn’t kill.

Now they’re forced to use it.

The game is over.

The rails are live. ⚔️

You’re holding the one asset SWIFT itself couldn’t kill.

Now they’re forced to use it.

The game is over.

The rails are live. ⚔️

/END

👉 I’m forming an intel circle and sharing deeper documents, proofs, and patterns exclusively on Telegram:

t.me/alexanderthewh…

👉 I’m forming an intel circle and sharing deeper documents, proofs, and patterns exclusively on Telegram:

t.me/alexanderthewh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh