This is absolutely insane:

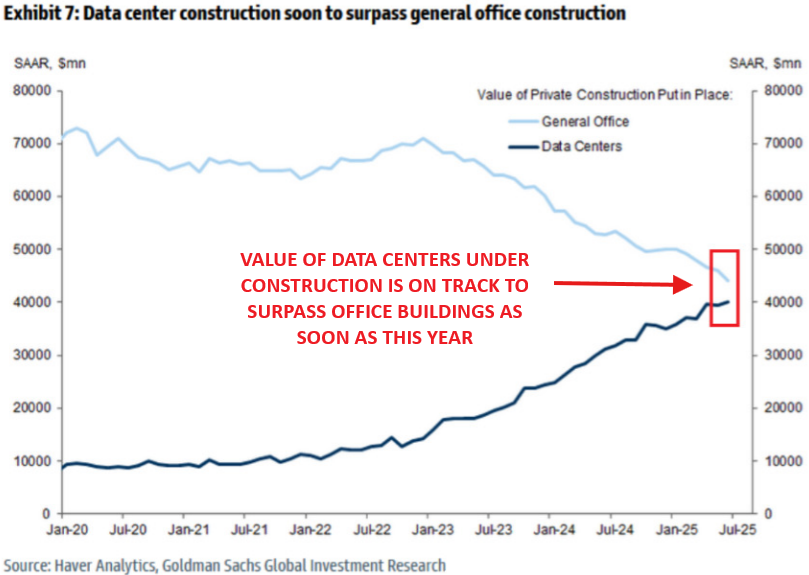

There are now $40 BILLION worth of US data centers under construction, up +400% since 2022.

For the first time in history, the value of US data centers under construction will soon EXCEED office buildings.

This is a historic shift.

(a thread)

There are now $40 BILLION worth of US data centers under construction, up +400% since 2022.

For the first time in history, the value of US data centers under construction will soon EXCEED office buildings.

This is a historic shift.

(a thread)

Meanwhile, office construction is collapsing as AI and digitalization continues to grow.

The total value of office buildings under construction has declined by nearly -50% since 2020.

The commercial real estate crisis continues to worsen amid the AI revolution.

The total value of office buildings under construction has declined by nearly -50% since 2020.

The commercial real estate crisis continues to worsen amid the AI revolution.

US office prices have fallen over -40% from there pre-pandemic peak.

Office vacancy rates reached 20.4% in Q1 2025, an all-time high.

To put this into perspective, the post-2008 Financial Crisis peak was ~17.5%

Where are developers turning to now? Data centers.

Office vacancy rates reached 20.4% in Q1 2025, an all-time high.

To put this into perspective, the post-2008 Financial Crisis peak was ~17.5%

Where are developers turning to now? Data centers.

Here's a chart of data center construction spending over the last 10 years.

Take a look at Nov. 2022, when ChatGPT launched.

Since then, CapEx has been pouring into the space and developers are flocking.

The craziest part is energy usage projections show we are STILL early.

Take a look at Nov. 2022, when ChatGPT launched.

Since then, CapEx has been pouring into the space and developers are flocking.

The craziest part is energy usage projections show we are STILL early.

Soon, this will be the most important chart in the market.

Data center energy consumption has reached a record 5% of total US power demand.

By 2030, data center energy consumption will exceed 10% of total US power demand.

The AI revolution is even bigger than you think.

Data center energy consumption has reached a record 5% of total US power demand.

By 2030, data center energy consumption will exceed 10% of total US power demand.

The AI revolution is even bigger than you think.

Additionally, data center load is set to account for up to 40% of net new demand added until 2030.

Overall, electricity demand for data centers is expected to grow at a compounded annual growth rate of +23% through 2030.

Energy will soon be the AI bottleneck.

Overall, electricity demand for data centers is expected to grow at a compounded annual growth rate of +23% through 2030.

Energy will soon be the AI bottleneck.

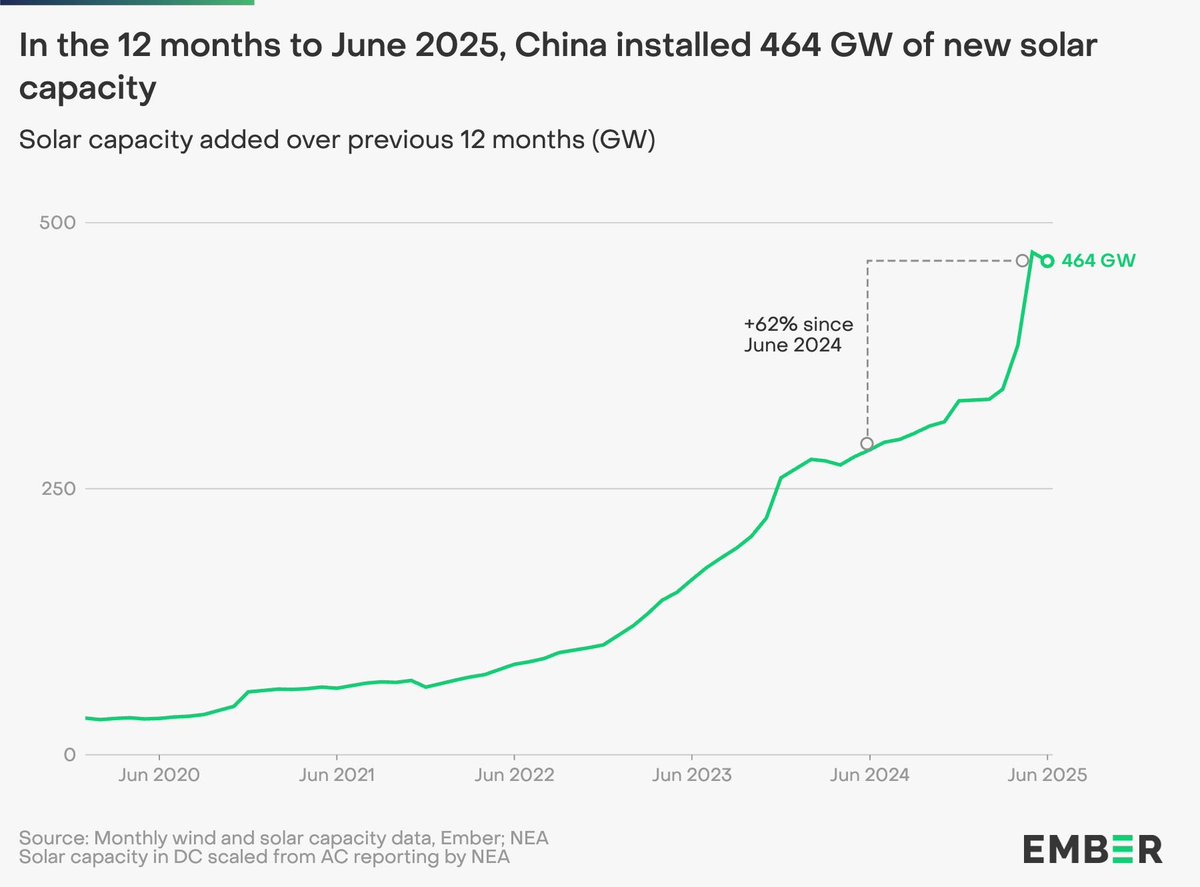

While everyone is taking about AI chips, China has been investing in energy.

The true AI bottleneck over the long run is not how many chips you can produce, it will be how much energy you can produce.

China installed 464 GW of solar capacity in the 12 months to June.

The true AI bottleneck over the long run is not how many chips you can produce, it will be how much energy you can produce.

China installed 464 GW of solar capacity in the 12 months to June.

As the office sector declines further, we expect to see office buildings converted into data centers.

Not only is new construction of data centers skyrocketing, but conversions will as well.

Meta, alone, just announced a $10 BILLION AI data center in Louisiana.

Not only is new construction of data centers skyrocketing, but conversions will as well.

Meta, alone, just announced a $10 BILLION AI data center in Louisiana.

As we look ahead, we think AI-related investment opportunities are going to broaden substantially.

Right now, it's all about chips.

AI is in the equivalent spot as to where the internet was in the late 1990s, when Amazon was attempting to create an online "check out" cart.

Right now, it's all about chips.

AI is in the equivalent spot as to where the internet was in the late 1990s, when Amazon was attempting to create an online "check out" cart.

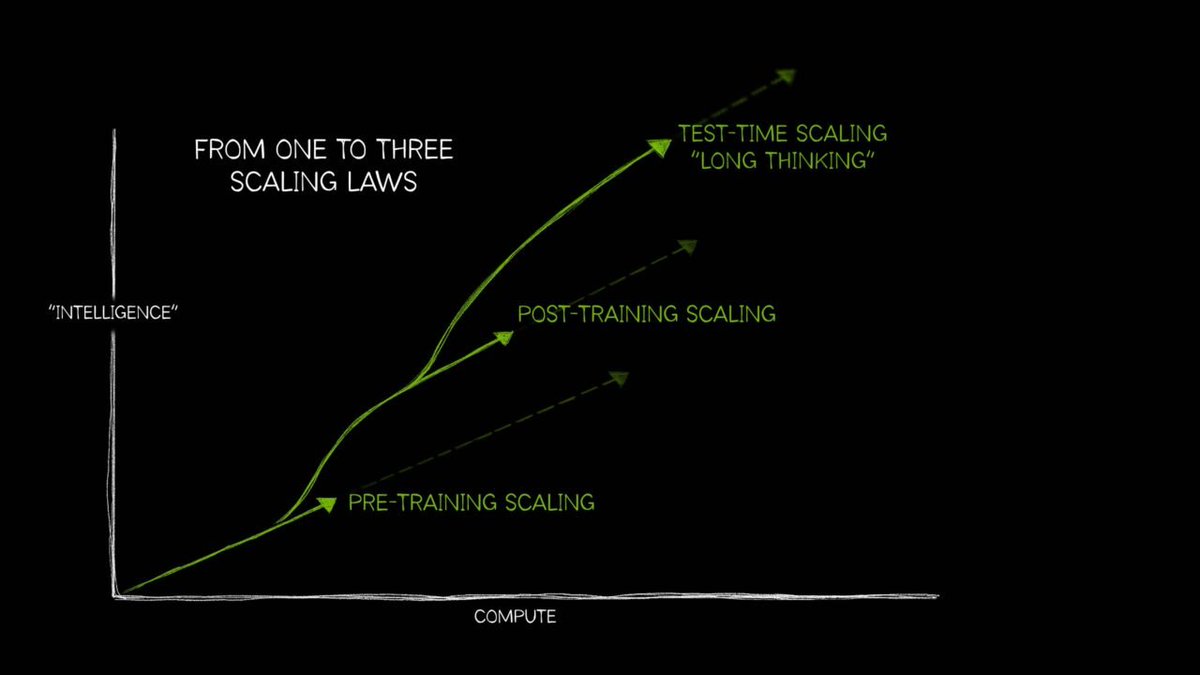

As the foundation for AI technology has been established, a new challenge is coming:

Scaling AI with limited resources on all fronts.

And, with every new necessity is a new investment opportunity.

Again, we are still in the first inning of the AI revolution.

Scaling AI with limited resources on all fronts.

And, with every new necessity is a new investment opportunity.

Again, we are still in the first inning of the AI revolution.

AI is the most disruptive technology in 25+ years.

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are huge.

Want to see our premium research?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are huge.

Want to see our premium research?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

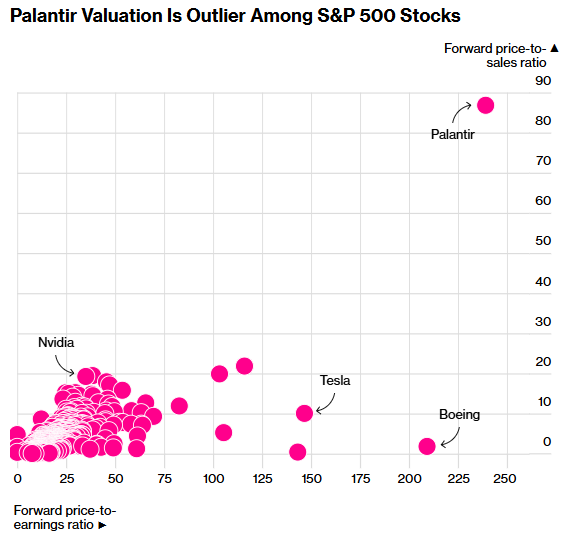

As with anything disruptive, calls for an "AI bubble" are here.

But, we believe AI is still early, with many large tech companies becoming cheaper on a forward multiple basis.

The AI revolution is heating up.

Follow us @KobeissiLetter for real time analysis as this develops.

But, we believe AI is still early, with many large tech companies becoming cheaper on a forward multiple basis.

The AI revolution is heating up.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh