Eight months after Trump has been inaugurated and we of course have now the EU US deal. What do we know about Trumponomics?

I would say my read is the Miran paper is a blueprint for Trump actions so far on trade. Let's see what I mean by that. And this has consequences of how Trump sees India, which I think is not just escalation to gain leverage.

I would say my read is the Miran paper is a blueprint for Trump actions so far on trade. Let's see what I mean by that. And this has consequences of how Trump sees India, which I think is not just escalation to gain leverage.

First, let's talk about an important ally, the EU. The details are out and I would say this is actually rather good for the EU in the context of out of control Trump tariffs.

Why? EU tariffs are NOT stacked. They are ceilings. As in, they get 15% max, including sectoral tariffs like auto (including car parts), pharma, semiconductor, lumber etc but not steel & alum, which they are still trying to negotiate. There are some additional exemptions for EU products such as aircraft, parts, generic pharmas & ingredients etc.

Why? EU tariffs are NOT stacked. They are ceilings. As in, they get 15% max, including sectoral tariffs like auto (including car parts), pharma, semiconductor, lumber etc but not steel & alum, which they are still trying to negotiate. There are some additional exemptions for EU products such as aircraft, parts, generic pharmas & ingredients etc.

Meaning, to trade for this 15%, the EU is falling closer into the US orbit via investment and trade as well as defense, which it is working on being more self sufficient with increased spending but not just yet.

Anyway, what can you say about other allies? It means South Korea and Japan can and hopefully have similar terms.

Remember that reciprocal tariffs under IEEPA aren't the only ones. Section 232s are pretty scary and more stuff being added all the time without warnings.

An example is steel where a few days ago 400 more products were added to include steel derivatives.

So if you want to have access, this is basically what the costs are and so what does that tell you about others? Here I go back to the Miran paper.

Anyway, what can you say about other allies? It means South Korea and Japan can and hopefully have similar terms.

Remember that reciprocal tariffs under IEEPA aren't the only ones. Section 232s are pretty scary and more stuff being added all the time without warnings.

An example is steel where a few days ago 400 more products were added to include steel derivatives.

So if you want to have access, this is basically what the costs are and so what does that tell you about others? Here I go back to the Miran paper.

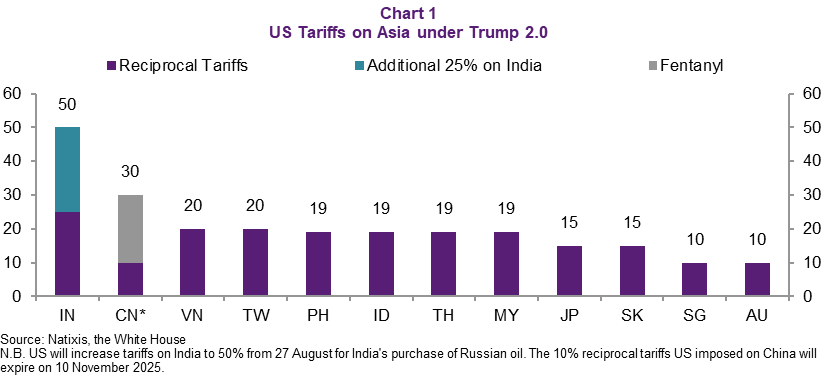

So here is Asia so far. Note for China, it's actually 55% if we include Trump 1.0 but here is just Trump 2.0.

India sticks out like a sore thumb with the added 25%. Even before, 25% is second highest.

China at 55% is highest if we include Trump 1.0.

India sticks out like a sore thumb with the added 25%. Even before, 25% is second highest.

China at 55% is highest if we include Trump 1.0.

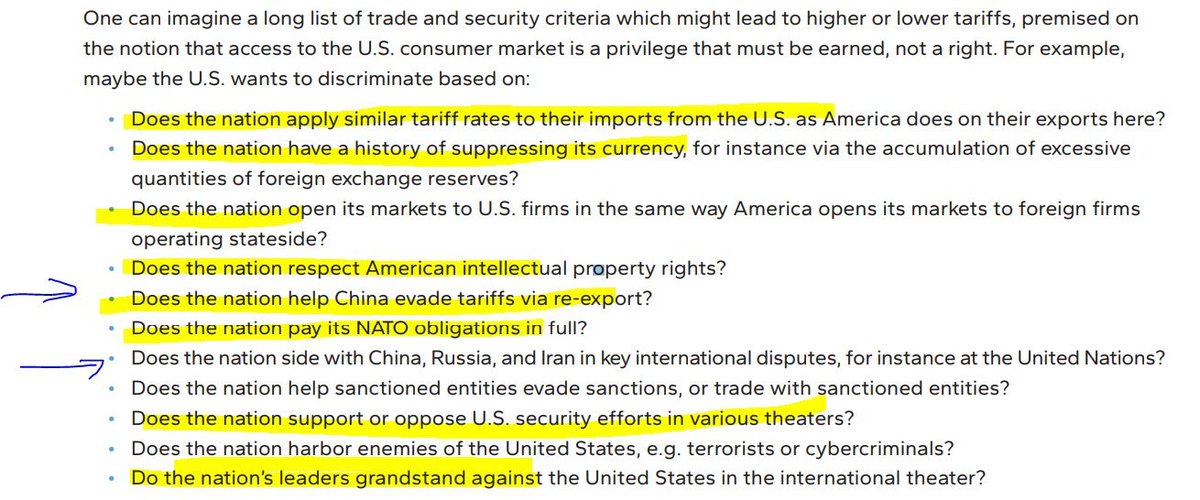

In the Miran paper, Trump is reorganizing allies/neutral/siding with Russia/China and then finally Russia/China.

So now we see that the EU, Japan, and SK are falling into US orbit of having 15% (only EU is confirmed that tariffs are not stacked so far) and will be drawn closer via more investment and defense collaboration etc.

Southeast Asia except Singapore (10%, which obvs while playing both China and the US but tilts towards US) is 20%-ish level with ambiguity on STACKED or not and also UNCERTAINTY ON SECTORAL and finally 40% transshipment applies to all countries and not just Southeast Asia.

Where does India stand?

So now we see that the EU, Japan, and SK are falling into US orbit of having 15% (only EU is confirmed that tariffs are not stacked so far) and will be drawn closer via more investment and defense collaboration etc.

Southeast Asia except Singapore (10%, which obvs while playing both China and the US but tilts towards US) is 20%-ish level with ambiguity on STACKED or not and also UNCERTAINTY ON SECTORAL and finally 40% transshipment applies to all countries and not just Southeast Asia.

Where does India stand?

First, I don't work in the Trump admin or have any INSIDE knowledge. This is just my read on what I have seen in actions, and while they have oscillated in intensity, the DIRECTION has been clear.

Trump knows who the adversaries are. Russia and China. They are not our friends. That being said, he is IMPATIENT and want quick wins and he realizes he can't. Russia and China are waiting him out. Putin for example keeps negotiating with Trump but it's clear he's just buying time and so Trump will have to make choices that he doesn't like to make.

For India, I am not a geopolitical expert but obvious if you read the timeline of US India relationships, they have been somewhat characterized but not great historically. The US sanctioned India not too far back for trying to develop nuclear weapons etc. It's only since Obama that this tilt for India has happened.

As in, they have a shared interest of, well, I would say the fear of China & of course and democracy and all that but I don't think that matters as much.

Where they don't share interests is many. Pakistan is an example. Russia is another.

The US would like India to be more adversarial to Russia, which won't happen.

India wants the US to be more adversarial to Pakistan, which well...

Btw, China is the same except China doesn't want the same as the US and China and India do have on-going border disputes and China has basically GAINED power into India's traditional sphere of influence - namely Sri Lanka, Bangladesh, and of course Maldives as well as other countries.

Therefore, we go back to why the US and India warmed ties, which obviously have FRACTURED since, well, according to India, the Pakistan mediation, well before tariffs.

Trump knows who the adversaries are. Russia and China. They are not our friends. That being said, he is IMPATIENT and want quick wins and he realizes he can't. Russia and China are waiting him out. Putin for example keeps negotiating with Trump but it's clear he's just buying time and so Trump will have to make choices that he doesn't like to make.

For India, I am not a geopolitical expert but obvious if you read the timeline of US India relationships, they have been somewhat characterized but not great historically. The US sanctioned India not too far back for trying to develop nuclear weapons etc. It's only since Obama that this tilt for India has happened.

As in, they have a shared interest of, well, I would say the fear of China & of course and democracy and all that but I don't think that matters as much.

Where they don't share interests is many. Pakistan is an example. Russia is another.

The US would like India to be more adversarial to Russia, which won't happen.

India wants the US to be more adversarial to Pakistan, which well...

Btw, China is the same except China doesn't want the same as the US and China and India do have on-going border disputes and China has basically GAINED power into India's traditional sphere of influence - namely Sri Lanka, Bangladesh, and of course Maldives as well as other countries.

Therefore, we go back to why the US and India warmed ties, which obviously have FRACTURED since, well, according to India, the Pakistan mediation, well before tariffs.

Here is a timeline of US-India relations in case you are interested. A bit of a history lesson for those not as familiar starting from PM Nehru's 1949 visit to the US.

cfr.org/timeline/us-in…

cfr.org/timeline/us-in…

Okay, this can go on too long so I'll go straight to the point. The assumption from the Indian side is that Trump is just being Trump and that he's upping the ante for leverage to get India to open AGRICULTURE + DAIRY.

First, this is a misunderstanding. Trump actually doesn't care that much about this. Look at EU, Japan and South Korea. None had to open up their "bottom line", which for SK is rice and beef etc. But if you have a bottom line, then you offered something else, and that they offered INVESTMENT. Will this happen? Who knows. But they did.

So I knew that a deal wasn't going to come for India. Remember that India STARTED OUT AHEAD OF VIETNAM, which faced the threat of 46% while India was only 26%.

First, this is a misunderstanding. Trump actually doesn't care that much about this. Look at EU, Japan and South Korea. None had to open up their "bottom line", which for SK is rice and beef etc. But if you have a bottom line, then you offered something else, and that they offered INVESTMENT. Will this happen? Who knows. But they did.

So I knew that a deal wasn't going to come for India. Remember that India STARTED OUT AHEAD OF VIETNAM, which faced the threat of 46% while India was only 26%.

Here is my Times of India op-ed on why I concluded that Modi wasn't going to give Trump much.

Why? Well, the UK does was very LIGHT in how much India was going to open up. It was supposedly a free trade agreement but the opening up is very gradual.

And there's nothing wrong with that. It's going to do things at its own pace.

But for Trump team, well, if you have >100% tariffs on autos + >35% tariff on agri etc, 25% tariff on India seems fair.

Btw, India used to have tariff free to the US as emerging markets had preferential access but Trump canceled that as he didn't think it was fair given high tariffs in India etc.

timesofindia.indiatimes.com/blogs/voices/u…

Why? Well, the UK does was very LIGHT in how much India was going to open up. It was supposedly a free trade agreement but the opening up is very gradual.

And there's nothing wrong with that. It's going to do things at its own pace.

But for Trump team, well, if you have >100% tariffs on autos + >35% tariff on agri etc, 25% tariff on India seems fair.

Btw, India used to have tariff free to the US as emerging markets had preferential access but Trump canceled that as he didn't think it was fair given high tariffs in India etc.

timesofindia.indiatimes.com/blogs/voices/u…

So here is why I want to go back to the Miran paper on how Trump team sees India. First, India pivot is what the geopolitical experts in DC etc thought of as they, well, under Obama, started to move to shore up the Asia Pacific to counter China.

Remember TPP? Dead under Trump 1.0. Gone.

India, well, for Trump is transactional. He doesn't mind it but i would imagine if you do the questions below of the fact that India sees Russia as a friend and upped the buying of oil, which Trump sees as, well not helpful to his trying for a quick end to the war, well, well, well.

Anyway, I am not defending this move. It is just my read of how Trump team sees it. The 25% can just disappear as quick as they appeared (deadline is 27th August).

But Trump has limited interest in helping India gain more of China high-tech supply chain. Read his comments about Apple moving to India to sell to the US.

China has ZERO interest in India gaining more of China supply chain - it has curbed equipment export.

Remember TPP? Dead under Trump 1.0. Gone.

India, well, for Trump is transactional. He doesn't mind it but i would imagine if you do the questions below of the fact that India sees Russia as a friend and upped the buying of oil, which Trump sees as, well not helpful to his trying for a quick end to the war, well, well, well.

Anyway, I am not defending this move. It is just my read of how Trump team sees it. The 25% can just disappear as quick as they appeared (deadline is 27th August).

But Trump has limited interest in helping India gain more of China high-tech supply chain. Read his comments about Apple moving to India to sell to the US.

China has ZERO interest in India gaining more of China supply chain - it has curbed equipment export.

Is this a China/Russia win? Well, Russia has always been able to count in India as a friend and buyer of oil since 2022, so it I suppose can count on it more.

For India, the relationship with Russia is not just about oil but arms and hedge to China.

Given the fact that it is not yet self sufficient in arms, it needs friends or imports.

Long story short, I see chances of the 25% slapped on India by the US disappear. I also see it sticking. Look at Switzerland. Got 39% for not much reasoning at all.

Also Brazil got 10% reciprocal tariff but 40% on random reason not related to trade or say geopolitics.

Btw, at any given point, I am not making any normative argument of whether this is FAIR or UNFAIR or STRATEGICALLY SOUND. But rather, of what I see how they see it.

For India, the relationship with Russia is not just about oil but arms and hedge to China.

Given the fact that it is not yet self sufficient in arms, it needs friends or imports.

Long story short, I see chances of the 25% slapped on India by the US disappear. I also see it sticking. Look at Switzerland. Got 39% for not much reasoning at all.

Also Brazil got 10% reciprocal tariff but 40% on random reason not related to trade or say geopolitics.

Btw, at any given point, I am not making any normative argument of whether this is FAIR or UNFAIR or STRATEGICALLY SOUND. But rather, of what I see how they see it.

So the question is what comes next if Trump team decides to stick with 50%. I suppose there can be retaliation and what not but I doubt it.

Why? India tariffs are high so no need to retaliate. It got pretty high tariffs.

It can move into other spheres like purchases of Boeings, arms, services etc.

But I don't think such escalation would occur. I think India will just ride this out and hope this is a Trump thing not a consistent US foreign policy approach.

Either way, I feel the same way for India as I felt when Vietnam got 46% - very sad about it. But now, the tide has turned for Vietnam. Many there actually feel decent about the 20% and in fact seeing this as an opportunity to gain even more export market share and investment.

Why? India tariffs are high so no need to retaliate. It got pretty high tariffs.

It can move into other spheres like purchases of Boeings, arms, services etc.

But I don't think such escalation would occur. I think India will just ride this out and hope this is a Trump thing not a consistent US foreign policy approach.

Either way, I feel the same way for India as I felt when Vietnam got 46% - very sad about it. But now, the tide has turned for Vietnam. Many there actually feel decent about the 20% and in fact seeing this as an opportunity to gain even more export market share and investment.

If we were to look at this optimistically, one can say that externally challenges MAY and USUALLY spur DOMESTIC REFORMS that are politically more difficult.

GST rationalization is one. But the real reforms India needs is much deeper - labor, land and I suppose the agrarian sector in general. All these things are unlikely tackled but they could.

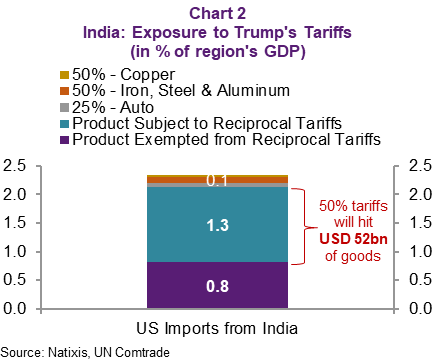

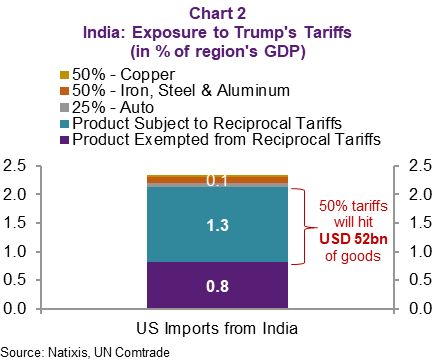

The reality is exports as a share of GDP is small. Exports to the US is just a bit above 2% of GDP and the affected sectors are just USD52bn of goods.

So say we are looking at potentially a 26bn LOSS of exports if 50% goes into effect.

But that is a simplistic way to calculate impact to GDP.

GST rationalization is one. But the real reforms India needs is much deeper - labor, land and I suppose the agrarian sector in general. All these things are unlikely tackled but they could.

The reality is exports as a share of GDP is small. Exports to the US is just a bit above 2% of GDP and the affected sectors are just USD52bn of goods.

So say we are looking at potentially a 26bn LOSS of exports if 50% goes into effect.

But that is a simplistic way to calculate impact to GDP.

For most, they say, well, if 50% sticks, then, well that's a rounding error or say 50bps or 70bps to GDP impact.

If we cut GST and rationalize it, then it's not a big deal. Growth may even go UP!

That certainly can be true. But the reality is that India labor market is totally under-employed. So while we can say that this is rounding error, the fact that 800m people receive free gains and the government every year has to give income to farmers to make up for low output tell us that survival is not being questioned but prosperity for the low skilled is.

If we cut GST and rationalize it, then it's not a big deal. Growth may even go UP!

That certainly can be true. But the reality is that India labor market is totally under-employed. So while we can say that this is rounding error, the fact that 800m people receive free gains and the government every year has to give income to farmers to make up for low output tell us that survival is not being questioned but prosperity for the low skilled is.

• • •

Missing some Tweet in this thread? You can try to

force a refresh