The Lok Sabha just passed India's most sweeping gaming legislation in 7 minutes, banning all real-money gaming. This isn't just government overreach, it's a complex tale of competing priorities and unintended consequences that will reshape India's digital future.🧵👇

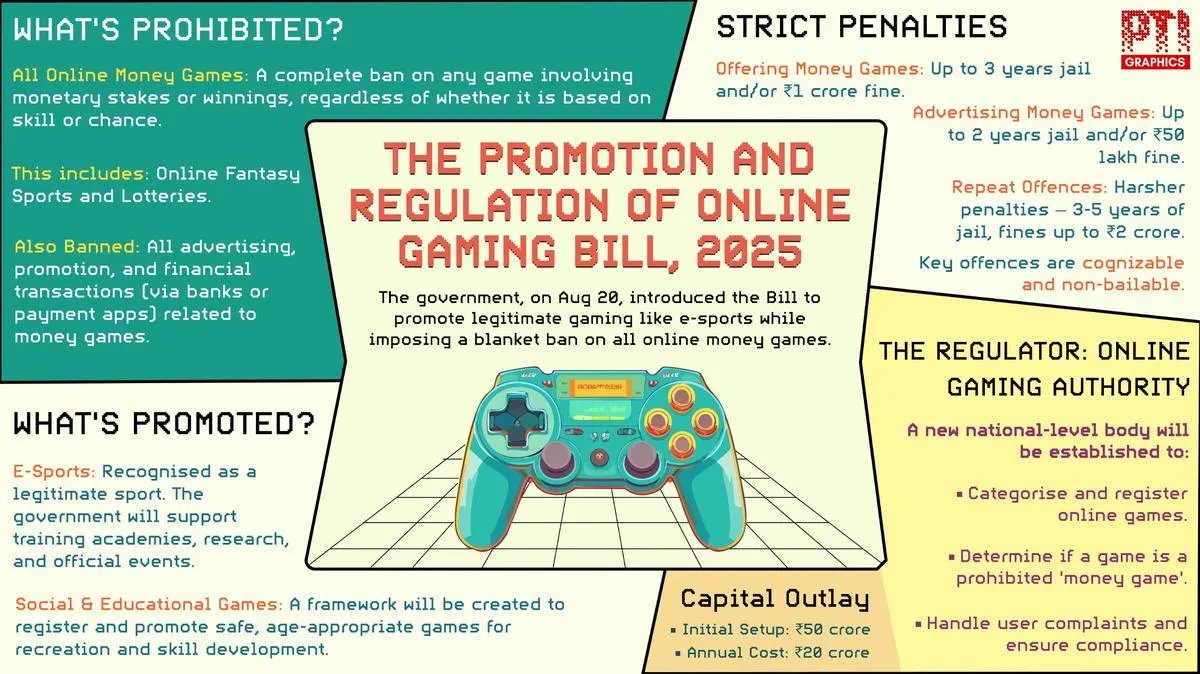

On August 20th, 2025, IT Minister Ashwini Vaishnaw introduced the Promotion and Regulation of Online Gaming Bill. Passed by voice vote in approximately seven minutes, despite opposition protests demanding detailed debate. But what exactly does this comprehensive ban cover?

The legislation targets "online money games" where users pay fees expecting monetary returns, "irrespective of whether such a game is based on skill, chance, or both." This crucial definition eliminates the traditional legal distinction between skill and chance that existed since 1867.

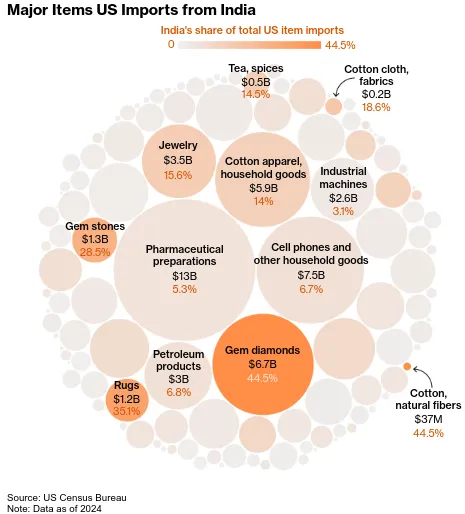

What's banned includes Dream11, online rummy, poker platforms, any games with cash prizes. What's promoted, e-sports like Fortnite and Call of Duty, which could receive government backing, training academies, official recognition. Social games without monetary stakes also remain legal.

The penalties are severe, operators face up to three years imprisonment and ₹1 crore fines. Advertisers risk two years imprisonment and ₹50 lakh fines. As the government noted, these fines would likely cost more than what you might win in a bet.

This ban didn't emerge in a vacuum. It culminates years of regulatory experimentation rooted in the colonial-era Public Gambling Act of 1867, more than one-and-a-half centuries ago, which distinguished between games of skill and chance.

Independent India initially supported this framework. In State of Andhra Pradesh v. K. Satyanarayana (1968), courts ruled rummy is skill-based. The 1996 case Dr. K.R. Lakshmanan v. State of Tamil Nadu extended this to horse racing, allowing the industry to flourish.

Various High Courts extended this logic to modern platforms. Fantasy sports, online poker received legal protection under this doctrine. If skill predominated over chance, the activity was considered legitimate business, with court rulings consistently supporting this view.

However, concerns mounted at state level. Starting 2017, Telangana and Andhra Pradesh attempted comprehensive bans. These faced legal challenges, with several High Courts striking down such bans as unconstitutional violations of the right to trade.

The central government initially took a moderate approach. April 2023 saw IT Rules amendments allowing self-regulatory bodies to certify "permissible" games, attempting to balance innovation with consumer protection. But implementation faced challenges with industry disagreements.

A critical turning point came with the GST decision in October 2023. The government implemented 28% tax on full face value of gaming deposits, the same rate as tobacco and alcohol. This wasn't just revenue, it signaled gaming as a "sin" category.

This tax generated a 412% increase in gaming tax revenue, collecting ₹6,909 crore in six months since launch. The 2025 bill overrides all past precedents about skill and chance, treating all monetized games identically regardless of their skill component.

This creates potential constitutional conflict. Legal experts argue the bill may violate Article 19(1)(g) by imposing disproportionate restrictions on legitimate businesses. Since "betting and gambling" is constitutionally a state subject, the Centre shouldn't have country-wide ban power.

However, the government cleverly framed this as online platforms encompassing all Indian states, making it a national concern requiring Central approach. The Supreme Court is currently hearing multiple cases on skill-versus-chance distinction, making timing particularly significant.

The government's reasoning centers on social welfare. IT Minister Ashwini Vaishnaw stated, "In extreme cases, children and young people are taking their own lives because of these financial losses." Karnataka recorded 32 gaming-related suicides in 2.5 years.

NIMHANS noted increasing patients addicted to real-money gaming apps. Over 140 million people play on these apps, nearly tripling during IPL season. During IPL, betting apps cause immense strain on bank IT systems due to transaction volumes.

The government characterized this as protecting citizens from harm over economic considerations. They estimate losses in tax revenue could reach ₹20,000 crore, but called it a calculated decision serving "larger public interest" with political unanimity on the problem.

Economic impacts are immediate. Dream11, with over ₹6000 crores FY23 revenue, reportedly decided to wind down real-money gaming business comprising two-thirds of revenue. Probo shut operations, pausing all money recharges. Games24x7, MPL, Winzo, Zupee face similar decisions.

Content creators and influencers, earning 20-30% of these companies' marketing budgets, are affected. Experts expect influencers from tier-2 and tier-3 towns, who depended on these apps for income, must find new revenue sources.

Industry critics argue prohibition won't eliminate demand but push users toward unregulated offshore platforms. They cite Telangana examples where local bans didn't eliminate gaming but made it harder to regulate and tax, with offshore platforms offering no consumer safeguards.

The government counters that allowing harmful activities because people might engage in worse alternatives isn't sound policy. They believe clear prohibition, combined with promoting healthier e-sports alternatives, can reduce harmful behavior while spurring e-sports investment.

This raises fundamental questions, should governments regulate betting by financially-sound people? Should government decide what qualifies as sport? The concerns about addiction, financial harm, security risks are real. The ultimate test, whether this protects users without creating worse alternatives.

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here:thedailybrief.zerodha.com/p/in-india-all…

All links here:thedailybrief.zerodha.com/p/in-india-all…

• • •

Missing some Tweet in this thread? You can try to

force a refresh