2007: HYD - Google’s 1st office in India

2010: HYD - Facebook’s 1st office in India

2015: BLR - Twitter’s 1st office in India

OpenAI’s 1st India hire is a Public Policy head and their 1st India office opening in New Delhi signals one thing:

Any global entity serious about AI in India will have to approach Public Policy / Govt relations in a formal manner.

Sam Altman has led on this front:

2010: HYD - Facebook’s 1st office in India

2015: BLR - Twitter’s 1st office in India

OpenAI’s 1st India hire is a Public Policy head and their 1st India office opening in New Delhi signals one thing:

Any global entity serious about AI in India will have to approach Public Policy / Govt relations in a formal manner.

Sam Altman has led on this front:

(a) He came to India in Feb ‘25 to discuss “OpenAI for Countries” with the Govt of India.

(b) In May ‘25 - OpenAI enabled local data residency for Indian ChatGPT users.

(c) Last week, OpenAI launched India focused pricing with ChatGPT Go

Unlike social media & ride hailing, AI has an upfront & clear public policy implication - no surprises here for the Govt; they're taking global & sovereign AI very seriously (e.g. the ₹10,300 crore IndiaAI Mission budget)

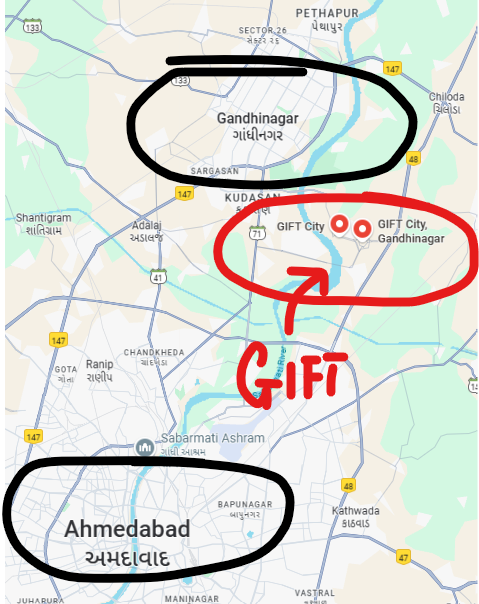

Today, OpenAI announced its 1st office in India will open in New Delhi;

Sure, you can argue that Google, FB & Twitter launched Indian offices in engineering hubs whereas Delhi is our capital city.

(b) In May ‘25 - OpenAI enabled local data residency for Indian ChatGPT users.

(c) Last week, OpenAI launched India focused pricing with ChatGPT Go

Unlike social media & ride hailing, AI has an upfront & clear public policy implication - no surprises here for the Govt; they're taking global & sovereign AI very seriously (e.g. the ₹10,300 crore IndiaAI Mission budget)

Today, OpenAI announced its 1st office in India will open in New Delhi;

Sure, you can argue that Google, FB & Twitter launched Indian offices in engineering hubs whereas Delhi is our capital city.

The wider NCR belt also has several Tech companies (Paytm, Policybazaar, Eternal etc) and the global MNCs have offices in NCR (e.g. Microsoft) - so this isn’t just a politically motivated move.

OpenAI is going down the same path as Google, Meta etc of localization - pricing is done, team will be built - it will be VERY interesting to see what product changes now happen given they are serious about India

OpenAI is going down the same path as Google, Meta etc of localization - pricing is done, team will be built - it will be VERY interesting to see what product changes now happen given they are serious about India

India is the 2nd largest market for ChatGPT per the OpenAI team.

However, apart from pricing & some language capability - OpenAI hasn’t launched any specific products for the Indian market.

Compare this to Perplexity which has Perplexity Finance for India.

I do believe the next phase of OpenAI’s journey in India will be to launch India specific products - Google did this incredibly well with GPay (then know as Tez) and their NBU initiative.

Exciting times ahead.

However, apart from pricing & some language capability - OpenAI hasn’t launched any specific products for the Indian market.

Compare this to Perplexity which has Perplexity Finance for India.

I do believe the next phase of OpenAI’s journey in India will be to launch India specific products - Google did this incredibly well with GPay (then know as Tez) and their NBU initiative.

Exciting times ahead.

Btw - a person who doesn't want to be quoted said: "Why should BLR have all the fun?"

Another, more serious person said: "AI CAPEX is beyond India's private sector and would need to be done via PPP like our physical infrastructure, hence unlike other Tech themes, Govt has a bigger role to play in AI"

Another, more serious person said: "AI CAPEX is beyond India's private sector and would need to be done via PPP like our physical infrastructure, hence unlike other Tech themes, Govt has a bigger role to play in AI"

• • •

Missing some Tweet in this thread? You can try to

force a refresh