🚨 5 Credit Score Myths That Are Costing Indians LAKHS!

95% of Indians believe these lies about CIBIL scores. The last one will shock you!

Let's bust these myths that banks don't want you to know 👇

95% of Indians believe these lies about CIBIL scores. The last one will shock you!

Let's bust these myths that banks don't want you to know 👇

MYTH #1: Higher Salary = Higher Credit Score ❌

REALITY: Your income has ZERO direct impact on your credit score

A person earning ₹25,000 with a perfect payment history will have a better score than someone earning ₹2 lakhs who defaults on EMIs!

Credit score = Credit behavior, NOT bank balance 💡

REALITY: Your income has ZERO direct impact on your credit score

A person earning ₹25,000 with a perfect payment history will have a better score than someone earning ₹2 lakhs who defaults on EMIs!

Credit score = Credit behavior, NOT bank balance 💡

MYTH #2: Checking Your Credit Score Hurts It ❌

REALITY: Checking your OWN score is a "soft inquiry" - it's 100% FREE and doesn't affect your score

Only when LENDERS check (hard inquiry) it might drop 1-5 points temporarily.

Check monthly = Smart financial habit! ✅

REALITY: Checking your OWN score is a "soft inquiry" - it's 100% FREE and doesn't affect your score

Only when LENDERS check (hard inquiry) it might drop 1-5 points temporarily.

Check monthly = Smart financial habit! ✅

MYTH #3: Closing Old Credit Cards Improves Your Score ❌

REALITY: This is FINANCIAL SUICIDE! 💀

Closing cards:

Increases your utilization ratio

Shortens credit history

Reduces available credit

Keep old cards active, even if you don't use them much

REALITY: This is FINANCIAL SUICIDE! 💀

Closing cards:

Increases your utilization ratio

Shortens credit history

Reduces available credit

Keep old cards active, even if you don't use them much

MYTH #4: Settlement vs Paid in Full - Same Thing ❌

REALITY: HUGE difference for your financial future!

"Paid in Full" = Hero status with lenders ✅

"Settled" = Red flag for 7 years ❌

Banks prefer borrowers who honor full commitments. Settlement = higher interest rates on future loans!

REALITY: HUGE difference for your financial future!

"Paid in Full" = Hero status with lenders ✅

"Settled" = Red flag for 7 years ❌

Banks prefer borrowers who honor full commitments. Settlement = higher interest rates on future loans!

MYTH #5: Zero Credit History is Better Than Bad Credit ❌

REALITY: No credit = No trust with lenders

Banks need to see HOW you handle credit, not IF you avoid it.

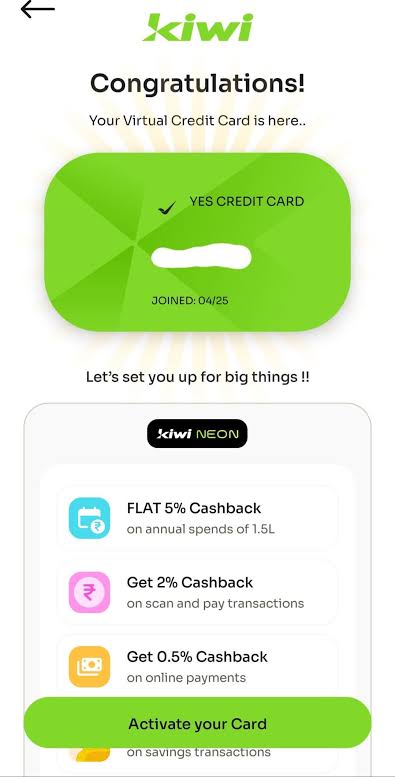

Start small

Get a basic credit card

Pay in full monthly

Build positive history gradually 📈

REALITY: No credit = No trust with lenders

Banks need to see HOW you handle credit, not IF you avoid it.

Start small

Get a basic credit card

Pay in full monthly

Build positive history gradually 📈

💰 THE REAL COST:

Believing these myths costs Indians:

Higher loan interest rates (2-5% extra)

Loan rejections

Lower credit limits

A 750+ score vs 650 score = ₹2-5 LAKH savings on a home loan

Believing these myths costs Indians:

Higher loan interest rates (2-5% extra)

Loan rejections

Lower credit limits

A 750+ score vs 650 score = ₹2-5 LAKH savings on a home loan

🎯 QUICK ACTION PLAN:

✅ Check score monthly (free!)(I personally use gpay)

✅ Keep utilization below 30%

✅ Never miss EMI/credit card payments

✅ Keep old cards active

✅ Mix of secured/unsecured credit

Knowledge = Money in your pocket! 💰

✅ Check score monthly (free!)(I personally use gpay)

✅ Keep utilization below 30%

✅ Never miss EMI/credit card payments

✅ Keep old cards active

✅ Mix of secured/unsecured credit

Knowledge = Money in your pocket! 💰

Found this helpful? 🔄 RT to save someone from these costly mistakes!

Follow @CardsavvyIndia for more credit card secrets that banks don't want you to know

What credit myth fooled you the longest? Comment below! 👇

Follow @CardsavvyIndia for more credit card secrets that banks don't want you to know

What credit myth fooled you the longest? Comment below! 👇

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh