🪙 India’s Credit Card Compass

🔍 Simplifying rewards, comparing top cards, & boosting your savings—without jargon!

✨ Easy tips | Card reviews | Find your perfe

How to get URL link on X (Twitter) App

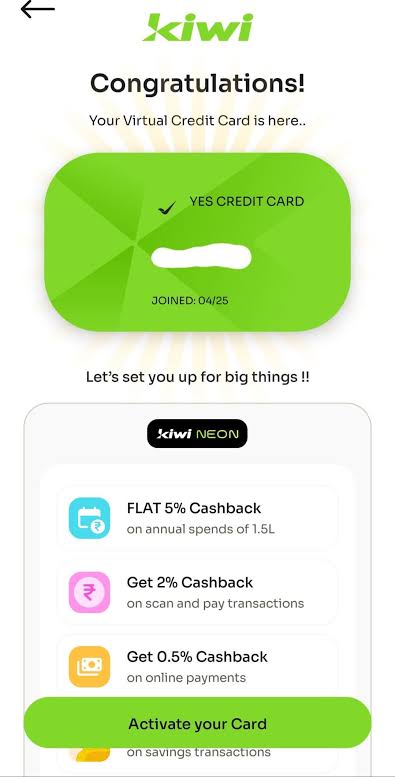

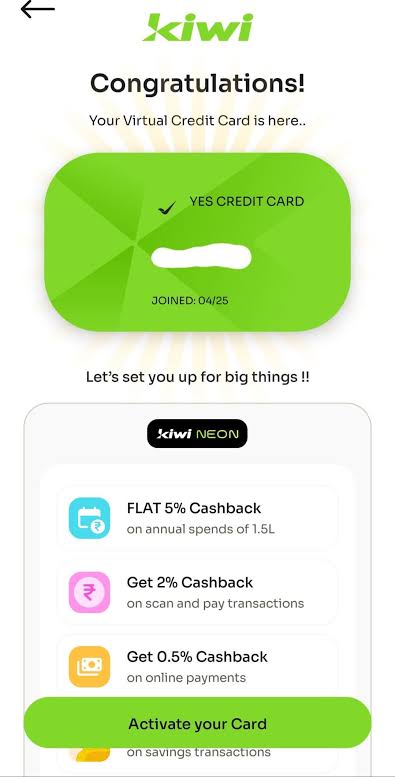

🚀 The Kiwi card is a Lifetime Free RuPay credit card by Yes Bank, tailor-made for UPI lovers. Scan & pay anywhere with UPI, and get credit-card-style cashback on every transaction. No annual fees. Ever.

🚀 The Kiwi card is a Lifetime Free RuPay credit card by Yes Bank, tailor-made for UPI lovers. Scan & pay anywhere with UPI, and get credit-card-style cashback on every transaction. No annual fees. Ever.