8 years ago, India promised "one nation, one tax" with GST. Today, as the government prepares GST 2.0 as a potential "Diwali gift," the reality is more complex. While GST expanded the tax base dramatically, it created new challenges for MSMEs, exporters, and India's middle class.🧵👇

Before GST, doing business across Indian states felt like navigating different countries. A truck from Maharashtra to Tamil Nadu would stop at multiple checkposts, pay different taxes at each border, juggling central excise, state VAT, service tax, and octroi.

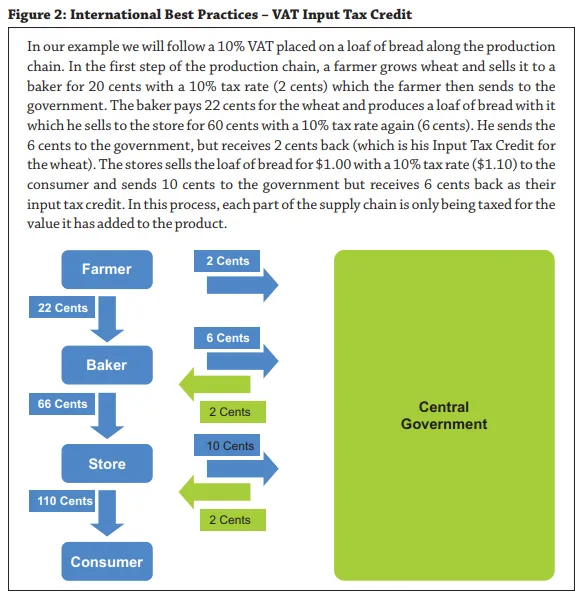

The cascading effect was particularly damaging. A textile manufacturer would pay excise duty on raw materials, then state VAT on intermediate products, paying taxes twice over the same products with no way to offset them. Final prices contained taxes on taxes.

GST promised to fix this through Input Tax Credit (ITC). Under GST, that textile manufacturer pays tax on selling price but gets back ITC for tax paid on raw materials. Taxes would effectively only be paid on value added, creating a cleaner, more efficient system.

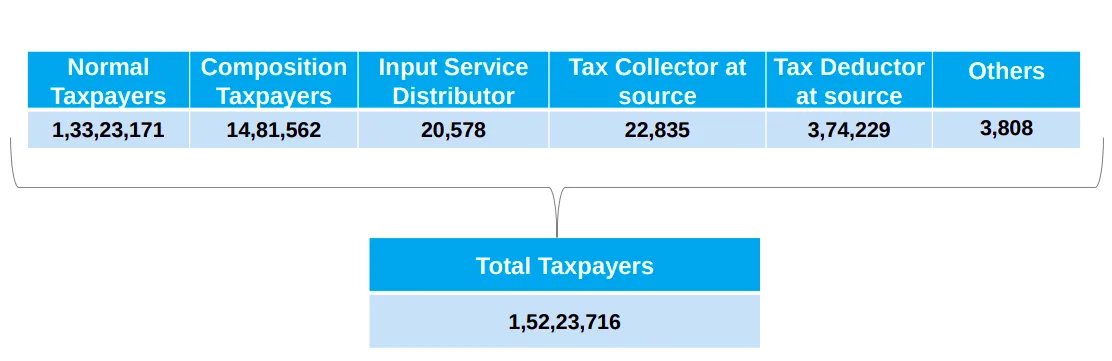

Eight years later, GST has made real progress. India's tax base expanded from 6.5 million registered taxpayers at launch to over 15 million GST registrations today. This represents a fundamental shift toward economic formalization.

GST collections have grown dramatically. From modest beginnings to over ₹22.1 lakh crore in FY2024-25, demonstrating the system's revenue potential. Between FY21 and FY25, gross GST collected more than doubled to ₹25 lakh crore.

Interstate business became far easier. In 2022, the Ministry of Transport reported truck travel times reduced by 20-30%, with uniform tax rules across states being a key reason. State border checkposts that created traffic jams are largely gone.

This efficiency translates into real economic value. Companies that previously maintained warehouses in multiple states to avoid interstate taxes can now optimize supply chains better. As companies avail ITC, final prices of goods are lower across states.

The digitization revolution has been quiet but significant. E-way bills track goods movement, e-invoicing ensures real-time transaction reporting, and data analytics help identify evasion patterns. The GST Network has matured into the backbone of GST processing.

However, GST's actual design created unique complexities. India adopted five main slabs: 0% for essentials, 5% for basic necessities, 12% for standard goods, 18% for consumer products, and 28% for luxury goods. This multi-rate structure creates endless classification disputes.

Is a cake a standard good or consumer product? Is a food item a "cake" taxed at 18% or "biscuit" taxed at different rates? Such questions consume enormous administrative resources and can be used for rent-seeking.

The multi-rate structure created "inverted duty structures" where inputs are taxed higher than outputs. In textiles, synthetic fiber is taxed at 18%, yarn at 12%, and final cloth at 5%. Businesses must file claims for massive ITC refunds at each step.

Major sectors remain excluded: petroleum, electricity, alcohol, and real estate. These constitute 33-55% of states' indirect tax collections, making them politically untouchable. These inputs for India's 63 million MSMEs are subject to cascading taxes.

For MSMEs, the multi-rate structure forces even the smallest trader to become a tax expert. A small retailer dealing in paper products must navigate different rates: pamphlets (5%), letterheads (12%), files (18%), hardbound registers (28%).

The biggest MSME issue is the ITC-claiming mechanism. A small manufacturer can only claim ITC after their supplier files their tax return and the government verifies it. If the supplier delays filing or makes errors, the buyer's working capital gets blocked indefinitely.

While MSMEs constitute over 92% of taxpayers but generate only 12% of collections, the compliance burden is a structural problem every small entrepreneur faces. These aren't just scaling barriers, they could mean the difference between running today and shutting down tomorrow.

GST's benefits aren't evenly distributed. Despite states having two-thirds of votes in the GST Council, the system created unexpected federal tensions. The central government guaranteed states 14% annual revenue growth, but collections grew slower than projected.

The compensation period ended in June 2022, leaving states facing a "fiscal cliff." While designed to include states, GST ironically created forces that centralized power, as states cannot unilaterally respond to local fiscal needs.

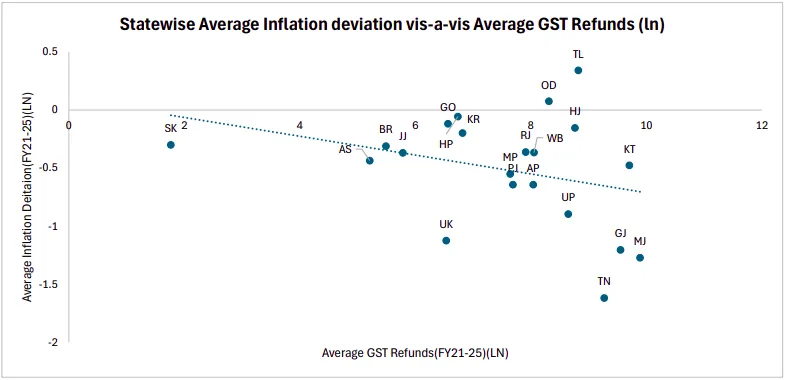

The distributional impact hits the middle class hardest. Their services consumption jumped from 15% service tax to 18% GST, creating immediate inflationary pressure. They consume more manufactured goods in 12% and 18% slabs compared to the wealthy.

GST 2.0 reforms promise simplification: 5% for merit goods, 18% for standard items, plus 40% for sin goods. 99% of items currently at 12% would move to 5%, while 90% of goods in 28% slab would drop to 18%.

SBI calculates GST reforms could lose ₹85,000 crores in revenue but boost household consumption by ₹1.98 lakh crore. For every rupee of GST revenue lost, consumption multiplies by 2.3 times. The stock market anticipates reforms with excitement.

But consumption faces broader challenges: slowing wages, 19% urban youth unemployment, and US tariff threats to exports. As long as tax burden remains on buyers and inputs continue being double-taxed, MSMEs will find little relief. Only time will tell if GST 2.0 becomes the "good and simple tax" it was meant to be.

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here:thedailybrief.zerodha.com/p/in-india-all…

All links here:thedailybrief.zerodha.com/p/in-india-all…

• • •

Missing some Tweet in this thread? You can try to

force a refresh