🚨 A ₹50L health cover TERMINATED over one missed detail.

Rejected claim. Cancelled policy.

Until an expert brought it back from the dead.

Here’s how 👇

#claimstories #healthinsurance #fineprint #policydetails

Rejected claim. Cancelled policy.

Until an expert brought it back from the dead.

Here’s how 👇

#claimstories #healthinsurance #fineprint #policydetails

In health insurance, even the smallest miss in your medical history can sink a claim.

Sometimes it’s paperwork.

Sometimes it’s wording.

Sometimes it’s your insurer’s interpretation.

And when that happens, you don’t want to be the one fighting alone.

Sometimes it’s paperwork.

Sometimes it’s wording.

Sometimes it’s your insurer’s interpretation.

And when that happens, you don’t want to be the one fighting alone.

Take this case.

Under a Beshak advisor’s guidance, a customer purchased a ₹50L health cover in 2022.

He disclosed diabetes…

…but missed its complication - diabetic retinopathy (an eye disorder caused by diabetes).

He served all waiting periods, thinking he was in the clear. ✅

Under a Beshak advisor’s guidance, a customer purchased a ₹50L health cover in 2022.

He disclosed diabetes…

…but missed its complication - diabetic retinopathy (an eye disorder caused by diabetes).

He served all waiting periods, thinking he was in the clear. ✅

First 2 claims for small hospitalisations?

Approved without a hitch.

Then came his third claim - ~₹50K for eye surgery.

This time, hospital records mentioned past eye problems.

The insurer noticed: this condition wasn’t disclosed at purchase. 😨

Approved without a hitch.

Then came his third claim - ~₹50K for eye surgery.

This time, hospital records mentioned past eye problems.

The insurer noticed: this condition wasn’t disclosed at purchase. 😨

Result:

❌ Claim rejected

❌ Policy terminated for non-disclosure

Why?

Because retinopathy is a diabetes complication. If it’s not disclosed, insurers can’t assess the risk level accurately.

And this time, the insurer had strong evidence in the hospital records.

❌ Claim rejected

❌ Policy terminated for non-disclosure

Why?

Because retinopathy is a diabetes complication. If it’s not disclosed, insurers can’t assess the risk level accurately.

And this time, the insurer had strong evidence in the hospital records.

Enter the Beshak Advisor.

He went through every claim document and the medical history.

Spoke directly to the Chief Distribution Officer and the underwriter.

Explained this was an honest oversight, not an attempt to hide info.

He went through every claim document and the medical history.

Spoke directly to the Chief Distribution Officer and the underwriter.

Explained this was an honest oversight, not an attempt to hide info.

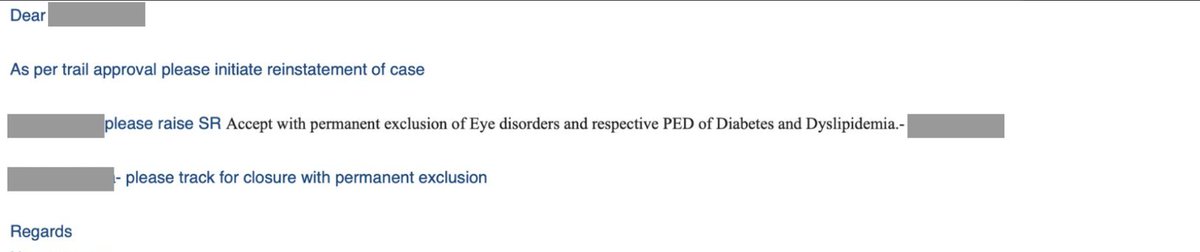

After back-and-forth negotiations, he convinced them to reinstate the policy - with conditions.

The insurer added permanent exclusions for:

✅ Eye disorder (retinopathy)

✅ Respective PEDs - diabetes & dyslipidemia

The insurer added permanent exclusions for:

✅ Eye disorder (retinopathy)

✅ Respective PEDs - diabetes & dyslipidemia

Note: Insurers don’t always list exact diagnoses.

Often, conditions are grouped under broader buckets like “eye disorders”, “diabetes-related complications” or “linked conditions”.

That’s why clear, detailed disclosure at the underwriting stage is critical.

Often, conditions are grouped under broader buckets like “eye disorders”, “diabetes-related complications” or “linked conditions”.

That’s why clear, detailed disclosure at the underwriting stage is critical.

The insurer did a tele-underwriting call to confirm final disclosures.

Outcome?

✅ Policy reinstated

✅ ₹50L cover intact (with permanent exclusion)

Without the expert’s intervention, the customer would’ve lost their entire cover over one missed detail.

Outcome?

✅ Policy reinstated

✅ ₹50L cover intact (with permanent exclusion)

Without the expert’s intervention, the customer would’ve lost their entire cover over one missed detail.

💡 What’s the takeaway?

A trusted insurance expert can help:

✔ Prevent policy cancellations

✔ Reverse rejections

✔ Fast track stuck claims

They know how to speak the insurer’s language, while you focus on recovery.

A trusted insurance expert can help:

✔ Prevent policy cancellations

✔ Reverse rejections

✔ Fast track stuck claims

They know how to speak the insurer’s language, while you focus on recovery.

At @BeshakIN , we’ve seen many people lose cover over avoidable mistakes.

Don’t risk it. Even a small health detail can change your claim outcome.

Get expert eyes on your policy before it’s too late 👇

beshak.org/?&utm_source=T…

Don’t risk it. Even a small health detail can change your claim outcome.

Get expert eyes on your policy before it’s too late 👇

beshak.org/?&utm_source=T…

• • •

Missing some Tweet in this thread? You can try to

force a refresh