🚨 Jerome Powell just ripped up the Fed’s old playbook.

Jobs, inflation, interest rates everything’s being redefined.

This isn’t just about tomorrow’s cut, it’s about the next decade.

(a thread)

Jobs, inflation, interest rates everything’s being redefined.

This isn’t just about tomorrow’s cut, it’s about the next decade.

(a thread)

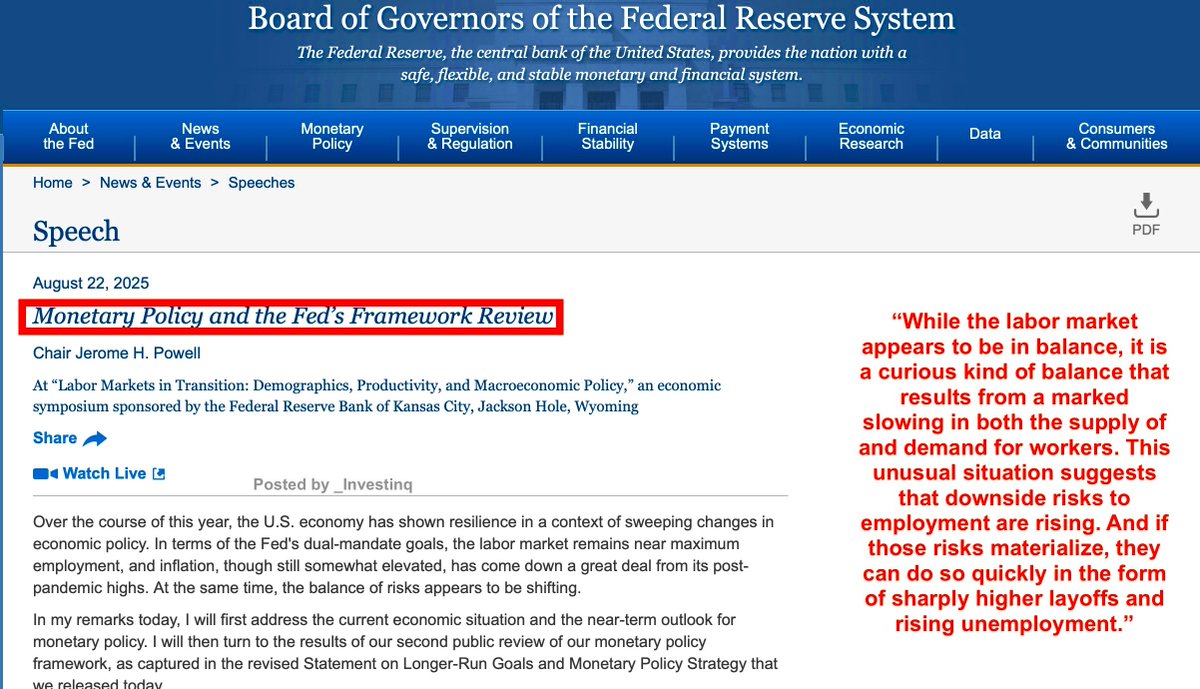

Powell began with the economy’s snapshot: “The labor market remains near maximum employment, and inflation, though still somewhat elevated, has come down a great deal from its post-pandemic highs.”

But he warned: “The balance of risks appears to be shifting.”

But he warned: “The balance of risks appears to be shifting.”

Translation: inflation is no longer the sole enemy.

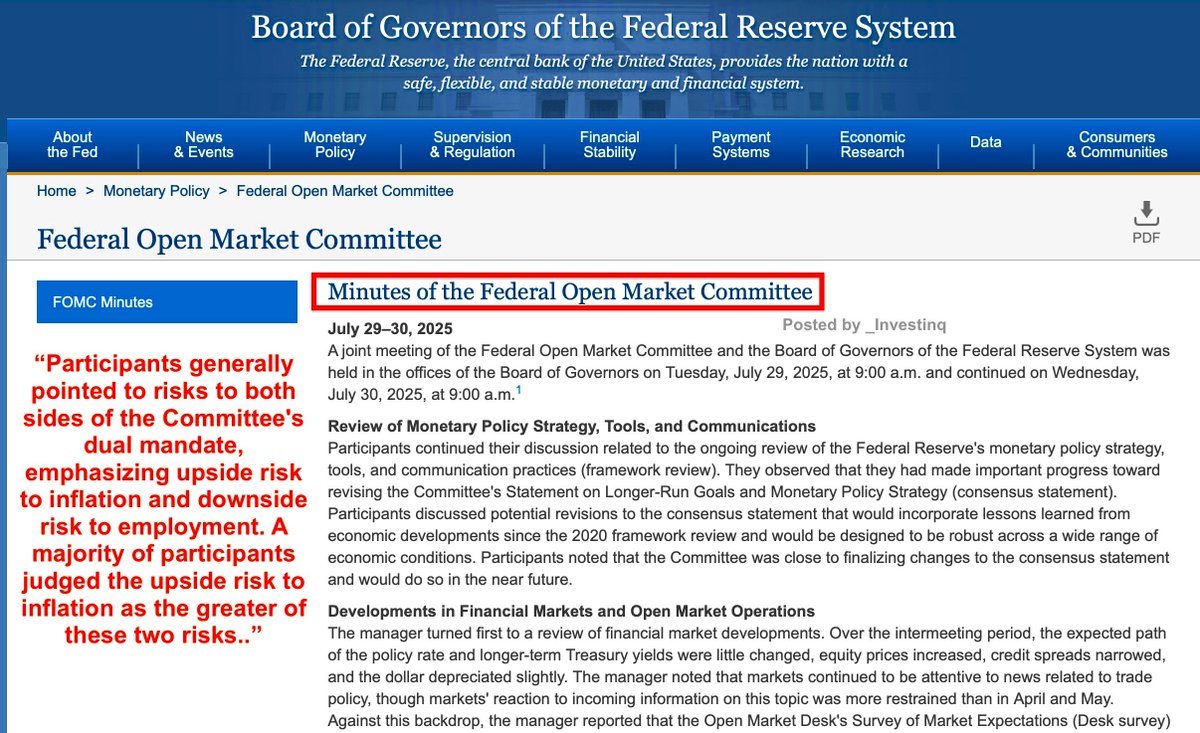

Risks to jobs are now rising. That’s a Fed nightmare because their dual mandate means they must balance both stable prices (inflation control) and maximum employment (jobs).

Risks to jobs are now rising. That’s a Fed nightmare because their dual mandate means they must balance both stable prices (inflation control) and maximum employment (jobs).

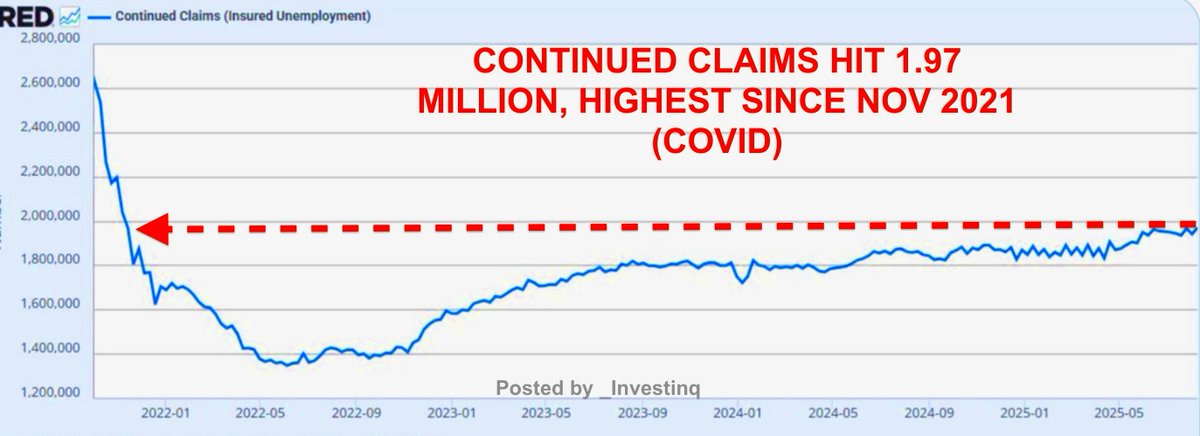

On jobs, Powell was blunt: “Payroll job growth slowed to an average pace of only 35,000 per month… down from 168,000 per month during 2024.”

Unemployment is 4.2% low historically but Powell said the slowdown in job growth has opened up a large margin of slack in the labor market.

Unemployment is 4.2% low historically but Powell said the slowdown in job growth has opened up a large margin of slack in the labor market.

He called it “a curious kind of balance” that comes from both labor demand (companies hiring) and labor supply (workers available) slowing at the same time.

It’s balance on paper but the kind that hides cracks underneath.

It’s balance on paper but the kind that hides cracks underneath.

“This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.”

It means the job market isn’t cooling smoothly, it could break suddenly if conditions worsen.

It means the job market isn’t cooling smoothly, it could break suddenly if conditions worsen.

GDP growth tells the same story.

GDP = the total value of goods and services produced in the economy.

It slowed to 1.2% in the first half of 2025, half the 2.5% pace of 2024. Powell hinted this may not just be short-term weakness but could reflect lower long-term growth potential.

GDP = the total value of goods and services produced in the economy.

It slowed to 1.2% in the first half of 2025, half the 2.5% pace of 2024. Powell hinted this may not just be short-term weakness but could reflect lower long-term growth potential.

On inflation, Powell didn’t mince words: “The effects of tariffs on consumer prices are now clearly visible.”

Tariffs = taxes on imported goods.

PCE inflation (a key price index the Fed watches) is at 2.6%. Core PCE, which strips out food and energy, is at 2.9%.

Tariffs = taxes on imported goods.

PCE inflation (a key price index the Fed watches) is at 2.6%. Core PCE, which strips out food and energy, is at 2.9%.

Still, he reassured:

“A reasonable base case is that the effects will be relatively short lived, a one-time shift in the price level."

"It will continue to take time for tariff increases to work their way through supply chains and distribution networks"

“A reasonable base case is that the effects will be relatively short lived, a one-time shift in the price level."

"It will continue to take time for tariff increases to work their way through supply chains and distribution networks"

Powell outlined two dangers: A wage–price spiral where workers demand higher pay to keep up with prices, and businesses raise prices again to cover it.

Inflation expectations rising, if households and businesses believe inflation will keep climbing, it often does.

Inflation expectations rising, if households and businesses believe inflation will keep climbing, it often does.

His sharpest line: “Come what may, we will not allow a one-time increase in the price level to become an ongoing inflation problem.”

Translation: if expectations slip, the Fed will not be afraid to hike rates even if that hurts jobs.

Translation: if expectations slip, the Fed will not be afraid to hike rates even if that hurts jobs.

Then Powell shifted to the framework review, the Fed’s once-every-five-years rulebook rewrite.

“Our revised Statement on Longer-Run Goals and Monetary Policy Strategy… describes how we pursue our dual-mandate goals.”

It’s basically the Fed’s constitution.

“Our revised Statement on Longer-Run Goals and Monetary Policy Strategy… describes how we pursue our dual-mandate goals.”

It’s basically the Fed’s constitution.

Context: In 2020, the Fed’s world was dominated by the effective lower bound (ELB) when rates hit zero and can’t go lower.

They responded with average inflation targeting: allowing inflation to run above 2% for a while if it had undershot.

They responded with average inflation targeting: allowing inflation to run above 2% for a while if it had undershot.

Then came COVID. Instead of too little inflation, we got the highest in 40 years.

Powell admitted: “There was nothing intentional or moderate about the inflation that arrived a few months after we announced our 2020 changes.”

Powell admitted: “There was nothing intentional or moderate about the inflation that arrived a few months after we announced our 2020 changes.”

So in 2025, the Fed ripped up that approach.

ELB is no longer the centerpiece. The “makeup” strategy is gone.

They returned to flexible inflation targeting always aiming at 2%, without intentional overshoots.

ELB is no longer the centerpiece. The “makeup” strategy is gone.

They returned to flexible inflation targeting always aiming at 2%, without intentional overshoots.

Powell: “The idea of an intentional, moderate inflation overshoot had proved irrelevant.”

Translation: they won’t deliberately let inflation run hot again. That experiment is over.

Translation: they won’t deliberately let inflation run hot again. That experiment is over.

They also dropped the 2020 language about “shortfalls” from maximum employment.

That phrase implied jobs always > inflation.

Now? Powell says the Fed can preemptively hike if the labor market looks too tight.

That phrase implied jobs always > inflation.

Now? Powell says the Fed can preemptively hike if the labor market looks too tight.

He hammered the importance of anchored expectations.

Anchored = people trust inflation will stay near 2%.

Powell: “We will act forcefully to ensure that longer-term inflation expectations remain well anchored.”

Anchored = people trust inflation will stay near 2%.

Powell: “We will act forcefully to ensure that longer-term inflation expectations remain well anchored.”

On continuity, Powell said: “We continue to view a longer-run inflation rate of 2 percent as most consistent with our dual-mandate goals.”

Why 2%? It’s low enough to keep inflation out of daily life, but high enough to give the Fed flexibility to cut rates when needed.

Why 2%? It’s low enough to keep inflation out of daily life, but high enough to give the Fed flexibility to cut rates when needed.

He also reminded: “Price stability is essential for a sound and stable economy and supports the well-being of all Americans.”

That line came straight from Fed Listens events, where workers explained the pain of rising prices on families.

That line came straight from Fed Listens events, where workers explained the pain of rising prices on families.

So what about cuts? Powell " risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation"

"Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance."

"Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance."

But he hedged: “Monetary policy is not on a preset course. FOMC members will make these decisions solely on their assessment of the data.”

In plain English: no formal promises but the groundwork for cuts is now in place.

In plain English: no formal promises but the groundwork for cuts is now in place.

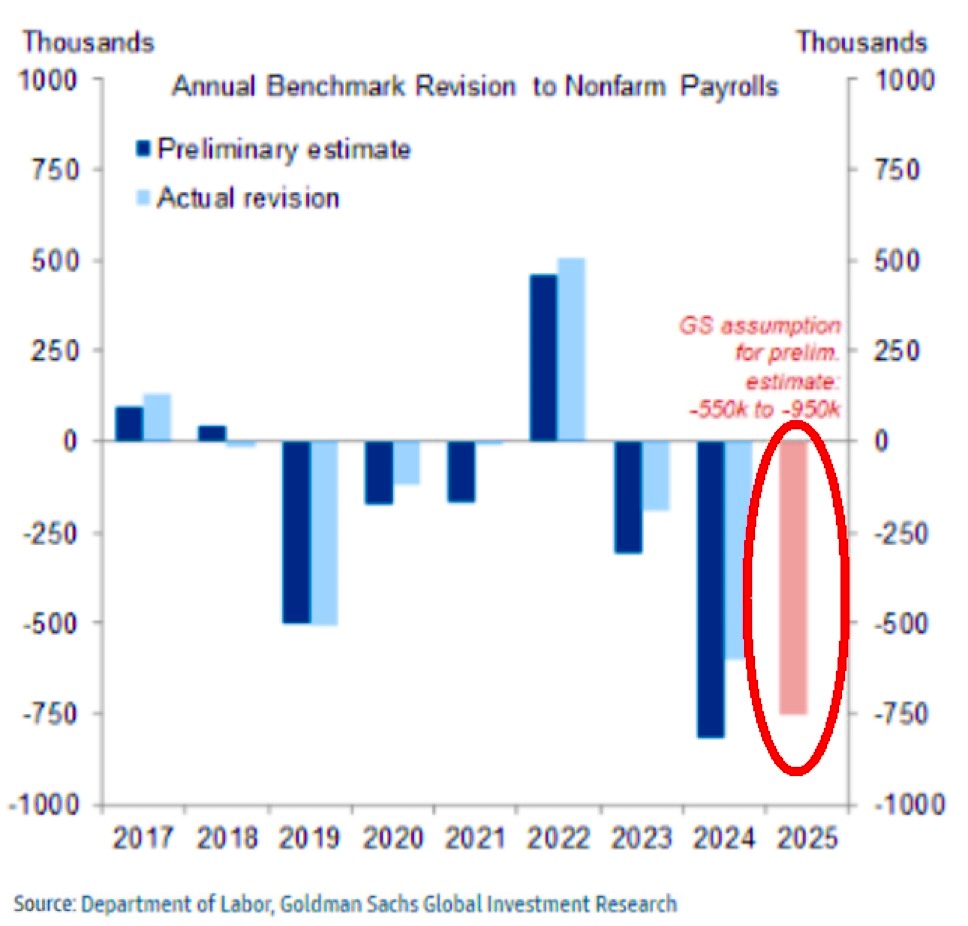

This is my takeaway: Powell will cut because the labor market will keep weakening unless we see a massive surprise in inflation.

We’ll likely see a massive revision on Sept 6th at the benchmark jobs revision then the cuts come right after.

The only question is whether it’s 25 bps or 50.

We’ll likely see a massive revision on Sept 6th at the benchmark jobs revision then the cuts come right after.

The only question is whether it’s 25 bps or 50.

If you found these insights valuable: Sign up for my Weekly FREE newsletter! thestockmarket.news

Correction: Sep 9th is when the annual job revisions comes out!

• • •

Missing some Tweet in this thread? You can try to

force a refresh