🚨 THREAD: SEC vs Ripple Ends, XRP Freed

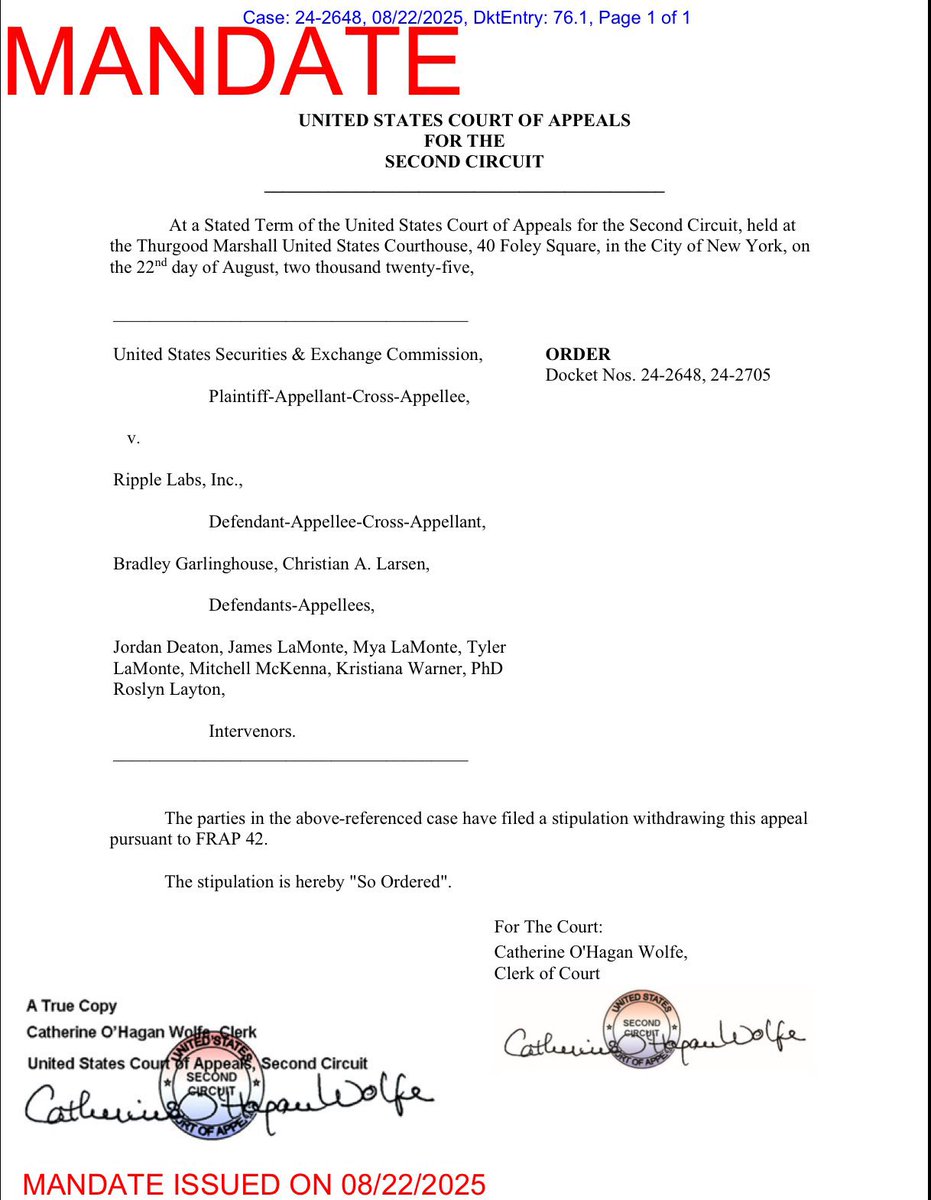

The Second Circuit Court of Appeals has spoken. The Joint Stipulation of Dismissal is approved.

Here’s what this really means 👇🧵

The Second Circuit Court of Appeals has spoken. The Joint Stipulation of Dismissal is approved.

Here’s what this really means 👇🧵

2/

This isn’t just paperwork. It’s the symbolic execution of the SEC’s crusade.

Ripple pays a $125M civil penalty… pocket change compared to the trillion-dollar empire it’s building. The injunction remains, but the sword of uncertainty is gone.

This isn’t just paperwork. It’s the symbolic execution of the SEC’s crusade.

Ripple pays a $125M civil penalty… pocket change compared to the trillion-dollar empire it’s building. The injunction remains, but the sword of uncertainty is gone.

3/

Judge Torres’ ruling stands untouched:

⚖️ XRP is not a security in secondary market trades.

The most important precedent in U.S. crypto history is now ironclad. Wall Street won’t admit it yet, but the rails are set.

Judge Torres’ ruling stands untouched:

⚖️ XRP is not a security in secondary market trades.

The most important precedent in U.S. crypto history is now ironclad. Wall Street won’t admit it yet, but the rails are set.

4/

Former SEC insiders confirm it: Judge Torres is out, the district court is finished, and all that remains is the appellate court’s seal of finality. The gavel has fallen. The war is done.

Former SEC insiders confirm it: Judge Torres is out, the district court is finished, and all that remains is the appellate court’s seal of finality. The gavel has fallen. The war is done.

5/

Legal analysts call this “procedural.” They’re wrong. This is the closing of a financial chapter.

The fog that kept institutions hesitant… banks, funds, payment giants, has lifted. The path is now clear for unrestricted adoption of Ripple’s technology.

Legal analysts call this “procedural.” They’re wrong. This is the closing of a financial chapter.

The fog that kept institutions hesitant… banks, funds, payment giants, has lifted. The path is now clear for unrestricted adoption of Ripple’s technology.

6/

What this really means:

•Institutional gates reopen for XRP liquidity.

•Exchanges can embrace XRP without fear.

•Ripple shifts from defense to offense, moving billions, soon trillions, through its rails.

The reset just became irreversible.

What this really means:

•Institutional gates reopen for XRP liquidity.

•Exchanges can embrace XRP without fear.

•Ripple shifts from defense to offense, moving billions, soon trillions, through its rails.

The reset just became irreversible.

7/

History books will not frame this as a lawsuit. They will frame it as the decapitation of the old guard.

The SEC wanted Ripple’s head. Instead, Ripple walks away crowned.

The stage is cleared. The U.S. rails are about to run hot with XRP.

History books will not frame this as a lawsuit. They will frame it as the decapitation of the old guard.

The SEC wanted Ripple’s head. Instead, Ripple walks away crowned.

The stage is cleared. The U.S. rails are about to run hot with XRP.

⚔️ If you’re reading this, you’re ahead of 99%.

The next phase isn’t for the masses — it’s for the awake elite.

Follow me on Telegram

t.me/alexanderthewh…

The next phase isn’t for the masses — it’s for the awake elite.

Follow me on Telegram

t.me/alexanderthewh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh