Unpacking the #Ripple/Gemini news. What exactly is going on? The whole may be greater than the sum of it's parts. (It gets weird in #5) This week has brought interesting news to ponder if this is more than just a loan ⤵️

1/8

1/8

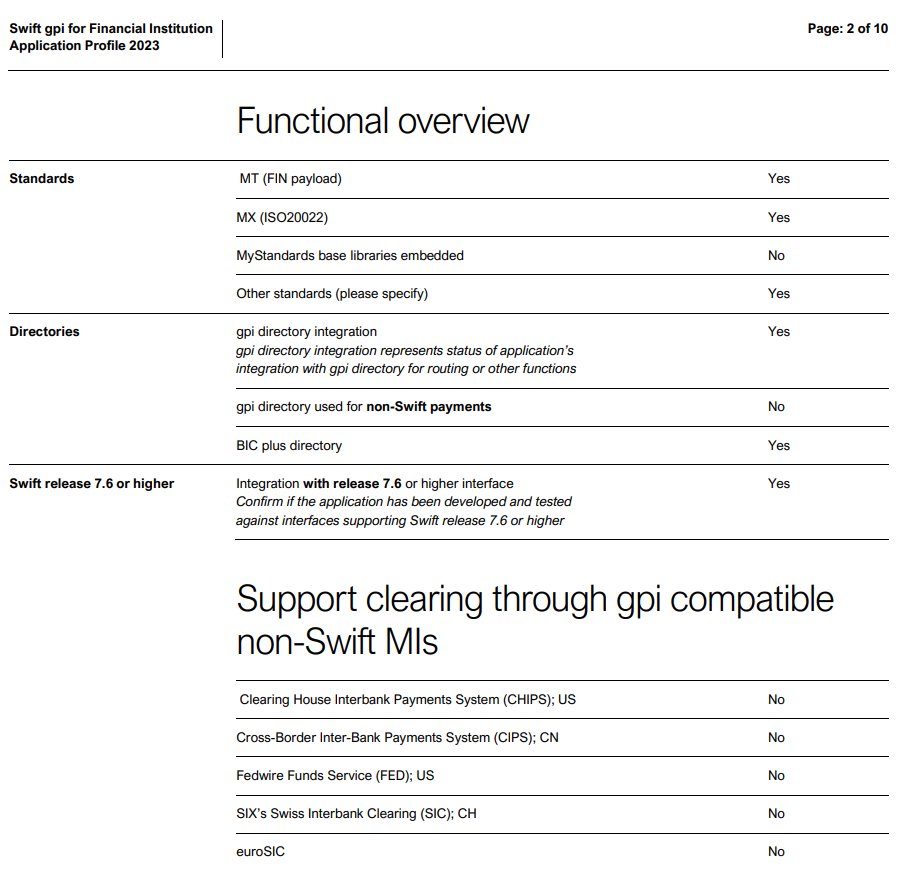

2⃣Gemini’s SEC filing shows a revolving credit facility from #Ripple, a line of credit basically, up to $75M USD, expandable to $150M.

> Min draw is $5M

> Interest 6.5% or 8.5% depending on the collateral, which likely includes crypto.

Pretty standard before an IPO, but⤵️

> Min draw is $5M

> Interest 6.5% or 8.5% depending on the collateral, which likely includes crypto.

Pretty standard before an IPO, but⤵️

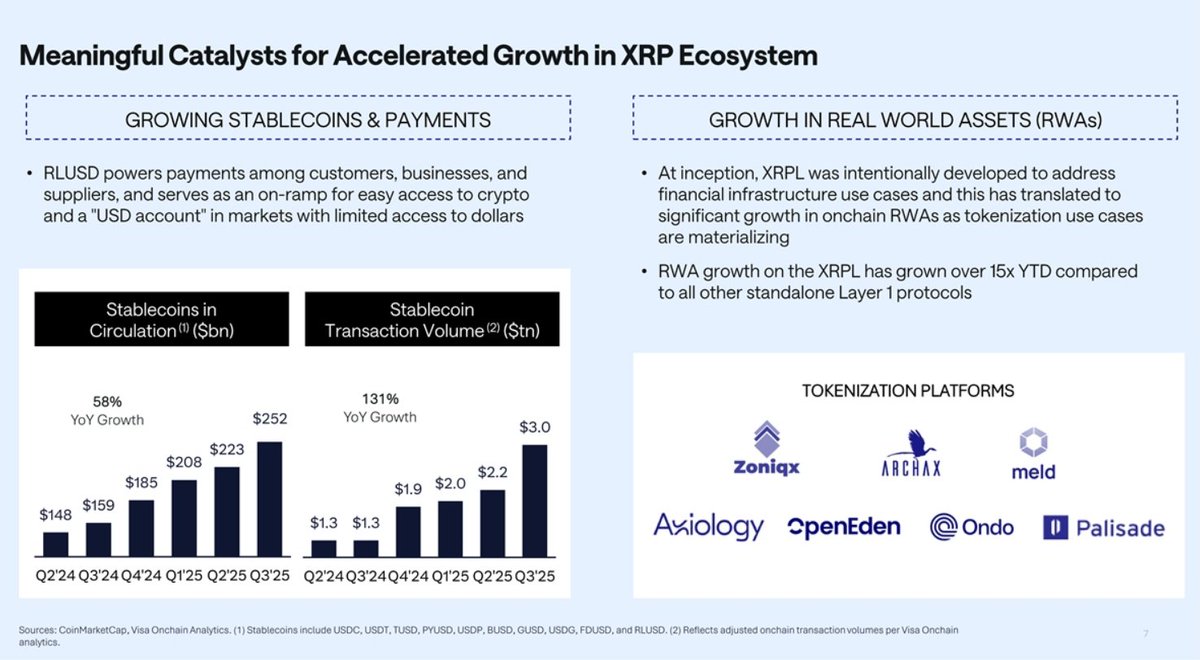

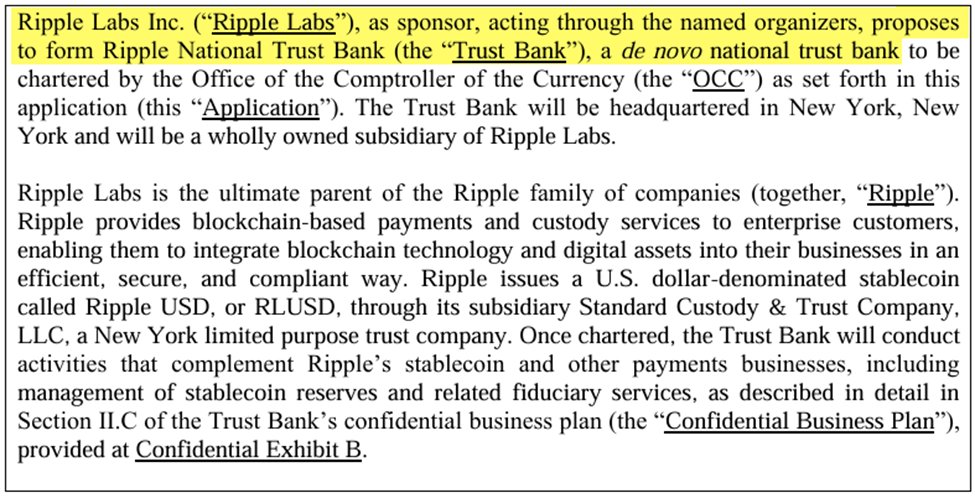

3⃣The unusual part is that once Gemini borrows past $75M, additional draws can be in #RLUSD. It doesn't require or force RLUSD use, it just makes it available. It could embed RLUSD into a regulated exchange’s financing, but they don't have to.

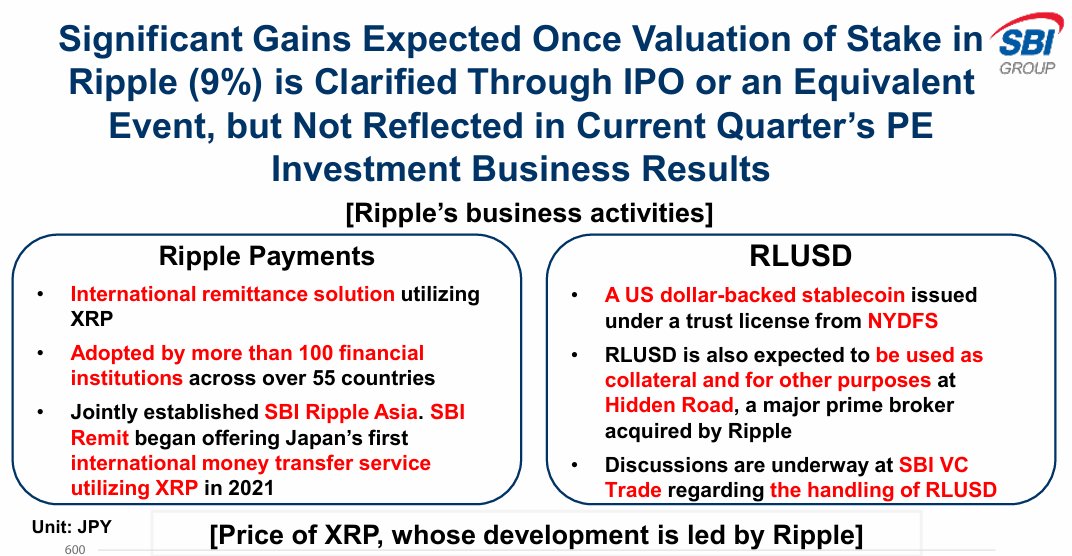

4⃣ So #Ripple immediately gains distribution & legitimacy by inserting #RLUSD into an SEC-filing. Gemini gets flexibility later with no obligation, great if USDT faces MiCA limits, or USD banking tightens, or it wants a “regulatory-ready stablecoin” story for investors.

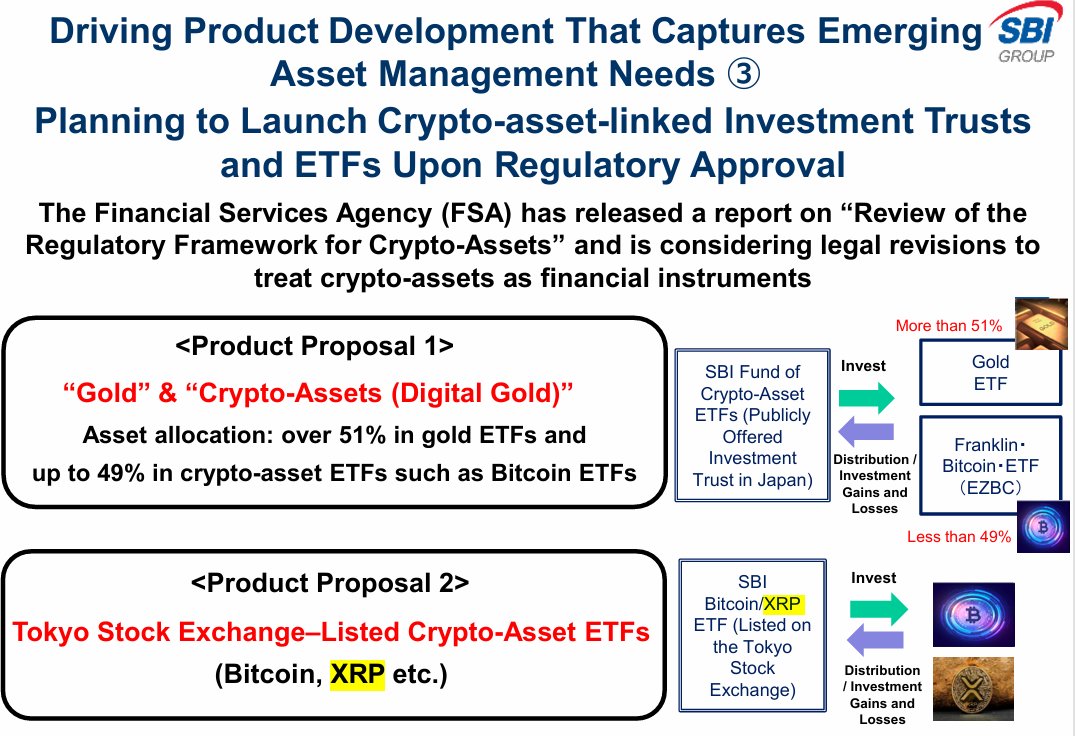

5⃣ By coincidence, Gemini received a MiCA license just yesterday in Malta, and #Ripple, through it's new Luxembourg facility applied for a MiCA EMI license in July. So both are preparing for compliance in the EU.

6⃣ And then the NYC billboard appeared featuring an #XRP branded Mastercard (issued by WebBank), saying "Prepare your bags" for an announcement 8.25.25. The card is backed by $75m from #Ripple & Gemini.

7⃣ Where have we heard $75m before? That's right, the initial load amount before #RLUSD becomes an option. Are they already at the threshold? Probably not - the SEC filing says they haven't drawn on the loan as of 8.15.25. Still... Is this more than coincidence?

8⃣ If so, and this is speculative, #Ripple could be effectively underwriting Gemini's IPO liquidity and a new payment product opening doors for #RLUSD to be used in the background. MiCA compliantly. Again, just grasping at straws, speculating how what we see might fit together.

TL:DR - what a coincidence Gemini borrowed $75m from Ripple, with option for #RLUSD to $150m right when both are pitching in $75m to launch an #XRP branded credit card and secure MiCA compliance.

ref.

sec.gov/Archives/edgar…

bitcoinist.com/ripple-geminis…

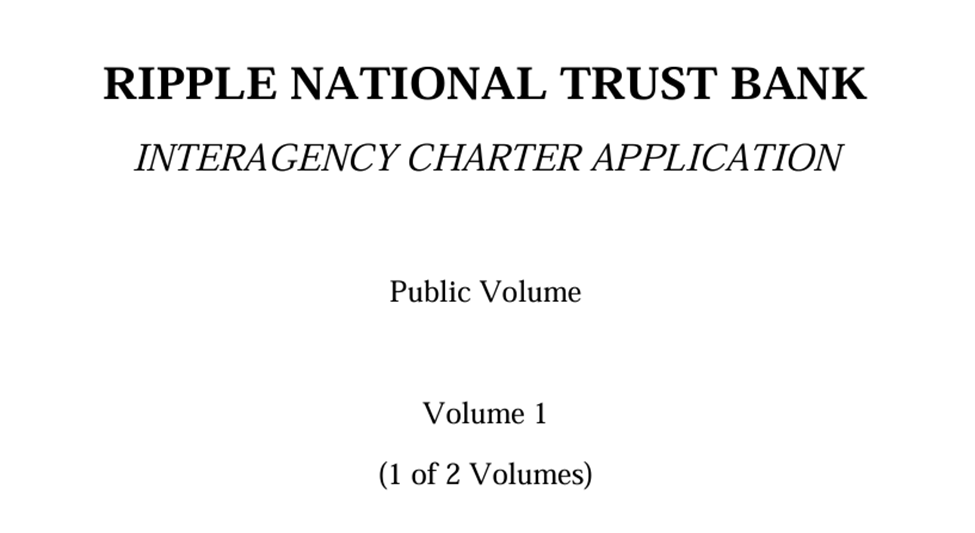

ledgerinsights.com/ripple-plans-r…

ainvest.com/news/xrp-news-…

blockchainmagazine.net/xrp-mastercard…

gemini.com/blog/gemini-re…

paymentexpert.com/2025/08/20/rip…

sec.gov/Archives/edgar…

bitcoinist.com/ripple-geminis…

ledgerinsights.com/ripple-plans-r…

ainvest.com/news/xrp-news-…

blockchainmagazine.net/xrp-mastercard…

gemini.com/blog/gemini-re…

paymentexpert.com/2025/08/20/rip…

• • •

Missing some Tweet in this thread? You can try to

force a refresh