No investment advice, not professor Kahneman. Tracking XRP/Ripple/Xahau developments w/ sources. No riddles, prices, giveaways or DM's; just work.

How to get URL link on X (Twitter) App

2. One clause requires Evernorth to buy #XRP equal to the advance funding proceeds within ten days of closing. (Opinion) The contract uses “purchase,” not “transfer” or “acquire from Ripple” so I believe these are open market buys.

2. One clause requires Evernorth to buy #XRP equal to the advance funding proceeds within ten days of closing. (Opinion) The contract uses “purchase,” not “transfer” or “acquire from Ripple” so I believe these are open market buys.

2⃣ What are these funds?

2⃣ What are these funds?

2⃣Gemini’s SEC filing shows a revolving credit facility from #Ripple, a line of credit basically, up to $75M USD, expandable to $150M.

2⃣Gemini’s SEC filing shows a revolving credit facility from #Ripple, a line of credit basically, up to $75M USD, expandable to $150M.

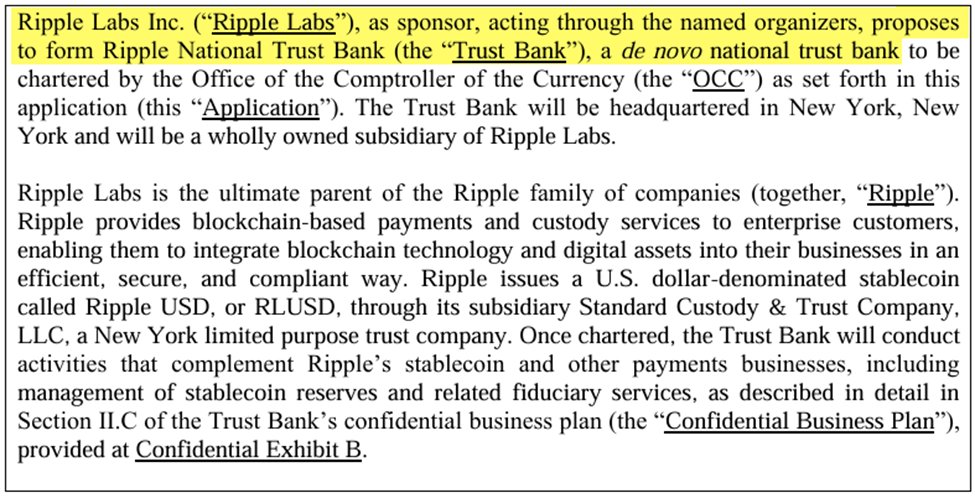

2⃣First, and maybe obviously, Ripple is applying to charter a limited purpose OCC-regulated national trust bank. It would enable custody of RLUSD reserves and operating regulated infrastructure for tokenized finance and …...future Fed access (?).

2⃣First, and maybe obviously, Ripple is applying to charter a limited purpose OCC-regulated national trust bank. It would enable custody of RLUSD reserves and operating regulated infrastructure for tokenized finance and …...future Fed access (?).

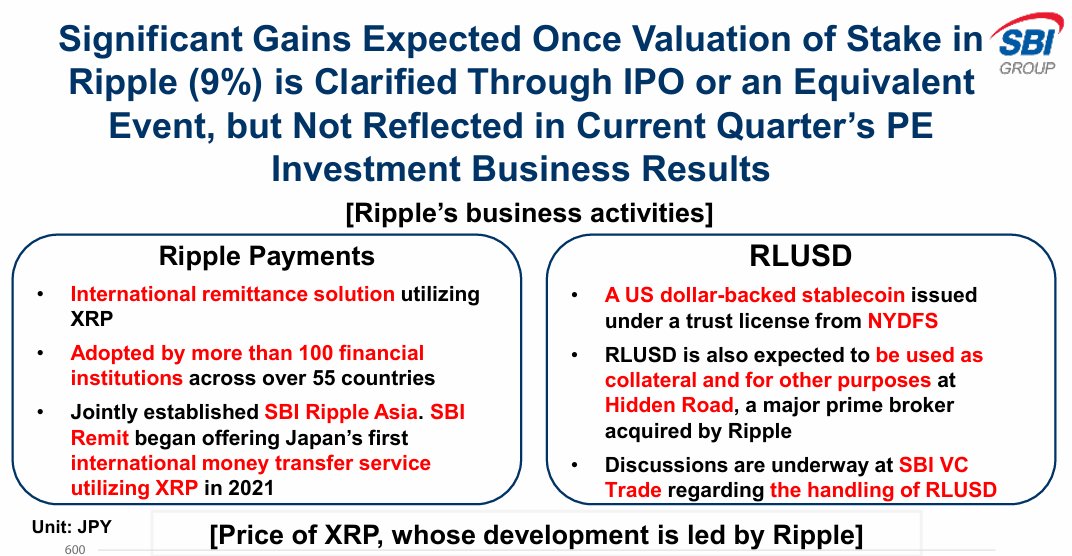

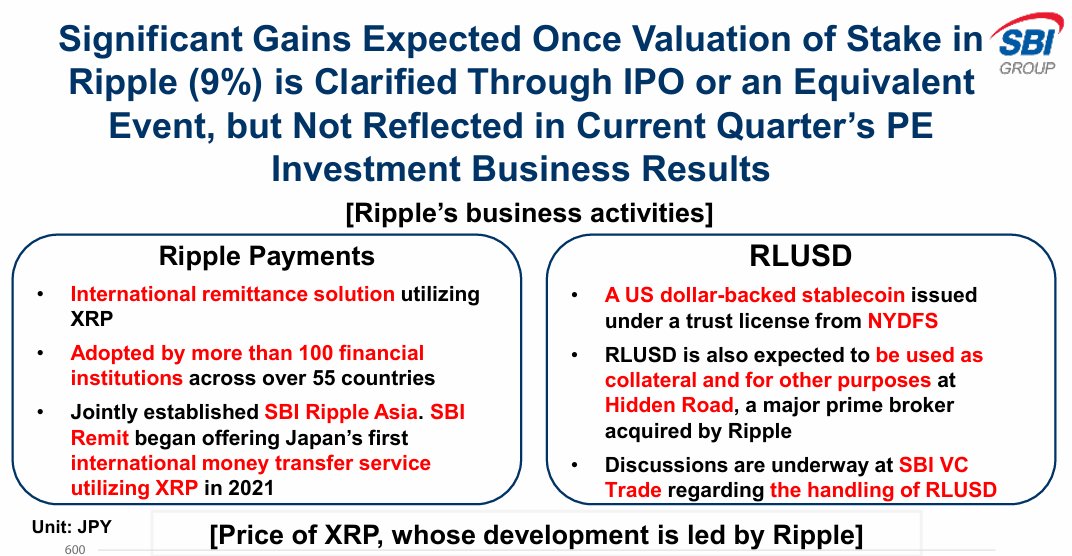

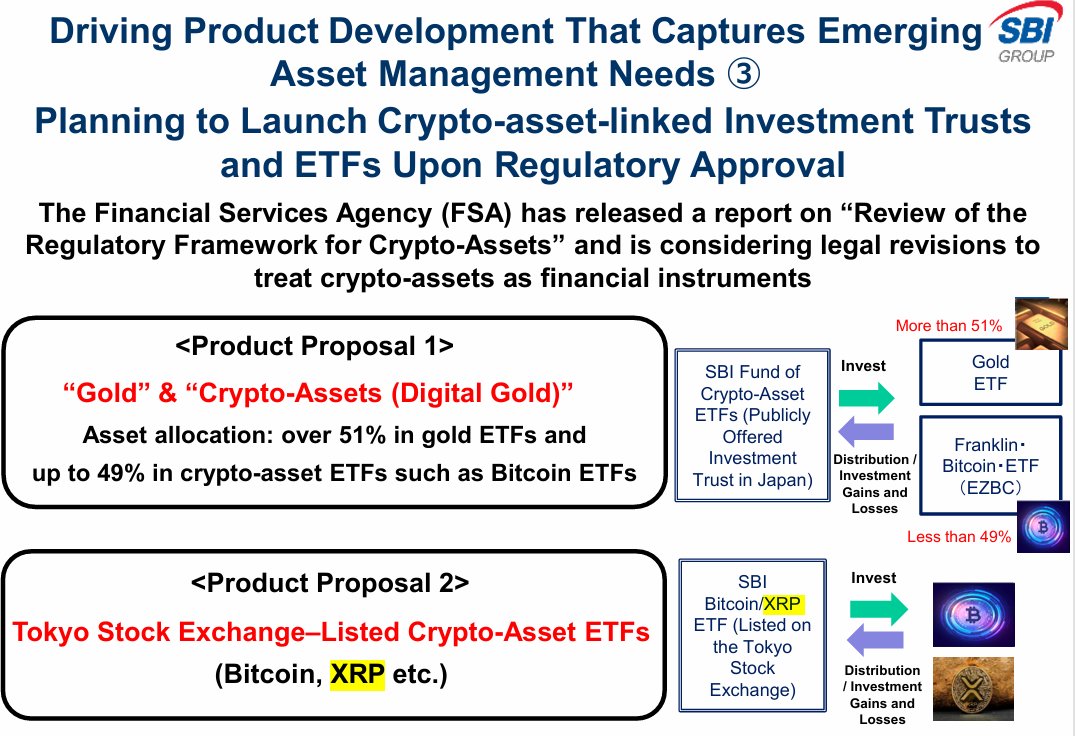

[2] They seem to be for crypto ETFs, including #XRP

[2] They seem to be for crypto ETFs, including #XRP

2. Eastnets is a “SWIFT Certified Service Bureau” that facilitates access to SWIFT’s global messaging network. They’re a licensed 3rd party like Accenture or ACI Worldwide that provides infrastructure for financial institutions to process xborder payments.

2. Eastnets is a “SWIFT Certified Service Bureau” that facilitates access to SWIFT’s global messaging network. They’re a licensed 3rd party like Accenture or ACI Worldwide that provides infrastructure for financial institutions to process xborder payments.

2. Yesterday, @sentosumosaba discovered this provocative document. An SBI Holdings investor, GAM Investments, is asking SBI to consider buying back #XRP. It's a great catch, thank you!

2. Yesterday, @sentosumosaba discovered this provocative document. An SBI Holdings investor, GAM Investments, is asking SBI to consider buying back #XRP. It's a great catch, thank you!https://x.com/sentosumosaba/status/1868281454020718792

https://twitter.com/Fortress_io/status/1699793873395191813

https://twitter.com/daniel_wwf/status/16639632321287045332. As written, XLS38d Bridges require "witness" servers, a 3rd party server that verifies a chain locks up assets to be represented on another. A witness server testifies Chain A locked up 100 XRP in a "door account" & the the door account on Chain B issued a wrapped 100 eXRP.

2. Let's get this out of the way upfront - the preceding pic is from their '22 Annual Report, as is most of this info. They went nuts with the "Ripple" theme, but they are an aquafarm co, so not a #Ripple advert 😅

2. Let's get this out of the way upfront - the preceding pic is from their '22 Annual Report, as is most of this info. They went nuts with the "Ripple" theme, but they are an aquafarm co, so not a #Ripple advert 😅

If this isn't a change, it could be important corporate clarity. They are not one payments network among many, a Wise or Visa competitor. They are fundamentally about crypto, the XRPL in particular, and this is better reflected in the marketing now.

If this isn't a change, it could be important corporate clarity. They are not one payments network among many, a Wise or Visa competitor. They are fundamentally about crypto, the XRPL in particular, and this is better reflected in the marketing now.

2. The doc is straight to the point, using 3 partners to demonstrate 3 use cases for #RippleNet.

2. The doc is straight to the point, using 3 partners to demonstrate 3 use cases for #RippleNet.

2. Based in Dubai, by far the country serviced most is India (if I have accurate data). On it's own, this isn't remarkable, but given India's crypto ambivalence, it's a strong move to use ODL in corridors that might require INR?

2. Based in Dubai, by far the country serviced most is India (if I have accurate data). On it's own, this isn't remarkable, but given India's crypto ambivalence, it's a strong move to use ODL in corridors that might require INR?

2. The main co offers all manner of services including cards and white labeled mobile apps.

2. The main co offers all manner of services including cards and white labeled mobile apps.

2. First, according to XRPL.org there are 2 types of assets on the XRPL.

2. First, according to XRPL.org there are 2 types of assets on the XRPL.

https://twitter.com/801_XRP/status/1616101144107053062

Now these functions are integrated into one service, "RippleNet," a payment suite managing messaging with the option to use "On Demand Liquidity" (ODL), an $XRP using product, if desired. Bilateral agreements are no longer necessary between users.

Now these functions are integrated into one service, "RippleNet," a payment suite managing messaging with the option to use "On Demand Liquidity" (ODL), an $XRP using product, if desired. Bilateral agreements are no longer necessary between users.