Every financial advisor learns the same business development playbook: cold calls, host expensive events, guilt existing clients for referrals.

Problem: It's completely backwards.

Here's how I grew 4x by doing the opposite

↓

Problem: It's completely backwards.

Here's how I grew 4x by doing the opposite

↓

The industry trained us specifically: Make 500 cold calls a week.

Expect 15 conversations. 5 appointments. 1 client.

• "Not interested."

• "Take me off your list."

• Countless hang-ups a day.

They called it "prospecting."

Expect 15 conversations. 5 appointments. 1 client.

• "Not interested."

• "Take me off your list."

• Countless hang-ups a day.

They called it "prospecting."

They drilled these mantras into us:

"Safeguard knowledge until someone pays."

"You can't make money giving advice away for free."

"Host events and guilt clients into bringing wealthy friends."

I believed every word.

"Safeguard knowledge until someone pays."

"You can't make money giving advice away for free."

"Host events and guilt clients into bringing wealthy friends."

I believed every word.

2011-2019: I followed all of their rule for 8 years.

The cold calls. The guilt tactics. The knowledge hoarding.

After another prospect hung up on me, I stared at the phone:

"There has to be a better way."

The cold calls. The guilt tactics. The knowledge hoarding.

After another prospect hung up on me, I stared at the phone:

"There has to be a better way."

2019: @FranWalsh73 and I left our old firm to start Opulus.

We ditched the cold calls but kept most of the playbook.

Still hosted events. Still safeguarded expertise. Revenue grew, but was starting to flat line.

I felt like I was fighting upstream. Something was still backwards.

We ditched the cold calls but kept most of the playbook.

Still hosted events. Still safeguarded expertise. Revenue grew, but was starting to flat line.

I felt like I was fighting upstream. Something was still backwards.

@FranWalsh73 End of 2023: The real turning point.

We had no newsletter.

We had no 𝕏 presence.

But noticed what a few young advisors were doing online.

"What if I tried the complete opposite of everything the financial industry taught?"

We had no newsletter.

We had no 𝕏 presence.

But noticed what a few young advisors were doing online.

"What if I tried the complete opposite of everything the financial industry taught?"

@FranWalsh73 2024: Committed to daily content creation.

Posted content that got 2 likes. Wrote newsletters nobody opened. Failed every single day.

But learned writing is a skill, not talent.

Kept showing up.

Posted content that got 2 likes. Wrote newsletters nobody opened. Failed every single day.

But learned writing is a skill, not talent.

Kept showing up.

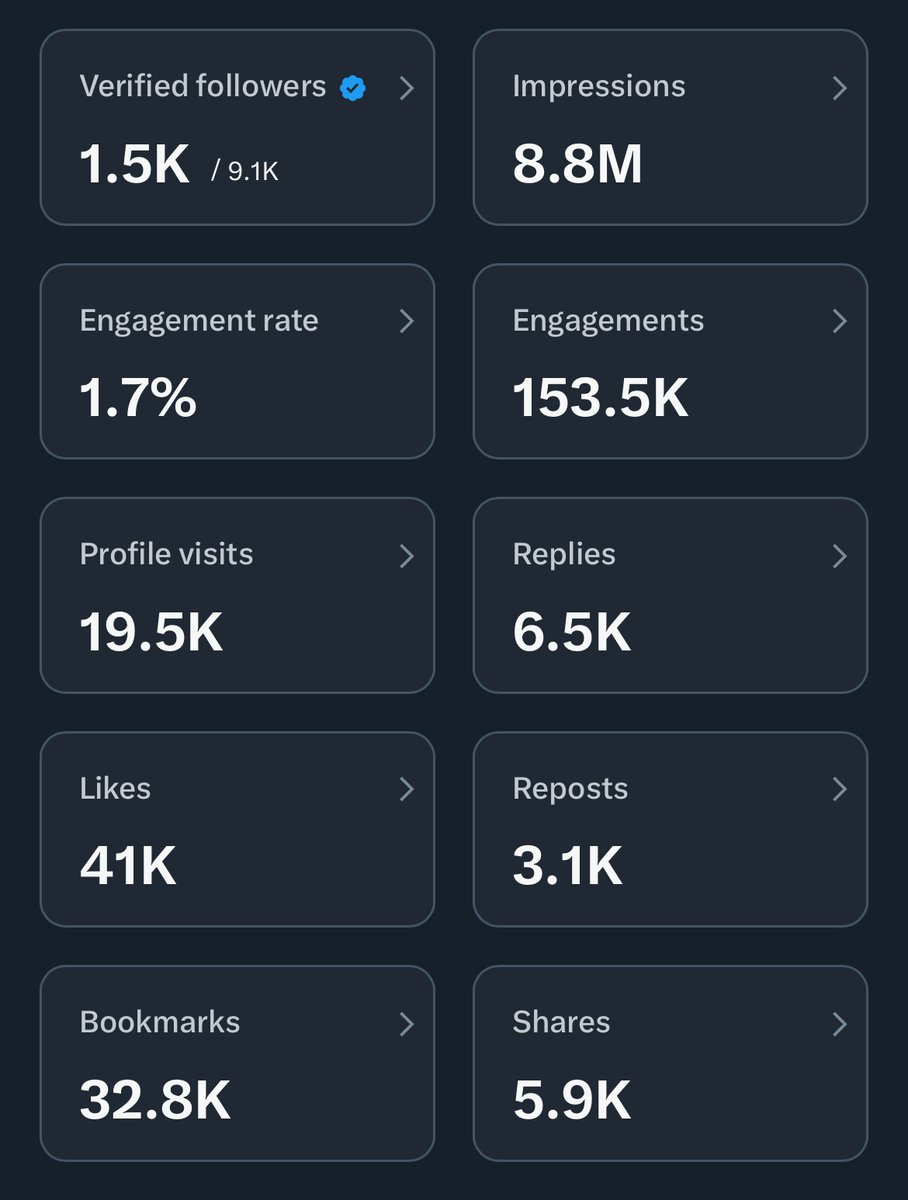

2025: After 12 months of daily practice, I developed the skill of writing.

Newsletter: 0 → 1,717 subscribers and 47,344 views YTD.

𝕏: 9,000+ followers, 8.8M impressions, 153K engagements, and 32.7K bookmarks YTD.

Learning to write unlocked everything: Quality content → quality conversations → quality clients.

Newsletter: 0 → 1,717 subscribers and 47,344 views YTD.

𝕏: 9,000+ followers, 8.8M impressions, 153K engagements, and 32.7K bookmarks YTD.

Learning to write unlocked everything: Quality content → quality conversations → quality clients.

@FranWalsh73 That content development revealed the leverage shift:

Old way: 500 calls → 1 client (500:1 ratio)

New way: Free content → trending towards 10M+ impressions in 2025

I stopped chasing. Started attracting.

Old way: 500 calls → 1 client (500:1 ratio)

New way: Free content → trending towards 10M+ impressions in 2025

I stopped chasing. Started attracting.

Content attraction changed everything about new business opportunies:

• Existing clients see our posts and refer friends

• Personal network feels comfortable engaging

• Referrals flow easier when people understand what we do

• Strangers find us through education

100% organic. No paid ads. Zero rejection required.

• Existing clients see our posts and refer friends

• Personal network feels comfortable engaging

• Referrals flow easier when people understand what we do

• Strangers find us through education

100% organic. No paid ads. Zero rejection required.

Once we had those conversations, we needed better questions.

I completely changed my discovery approach thanks to @thejustinwelsh framework:

1. What financial challenge are you trying to solve?

2. What have you already tried?

3. What do you think this is costing you?

4. How large a priority is solving this?

5. When do you need this resolved?

Real conversations vs. "How much money do you have?"

I completely changed my discovery approach thanks to @thejustinwelsh framework:

1. What financial challenge are you trying to solve?

2. What have you already tried?

3. What do you think this is costing you?

4. How large a priority is solving this?

5. When do you need this resolved?

Real conversations vs. "How much money do you have?"

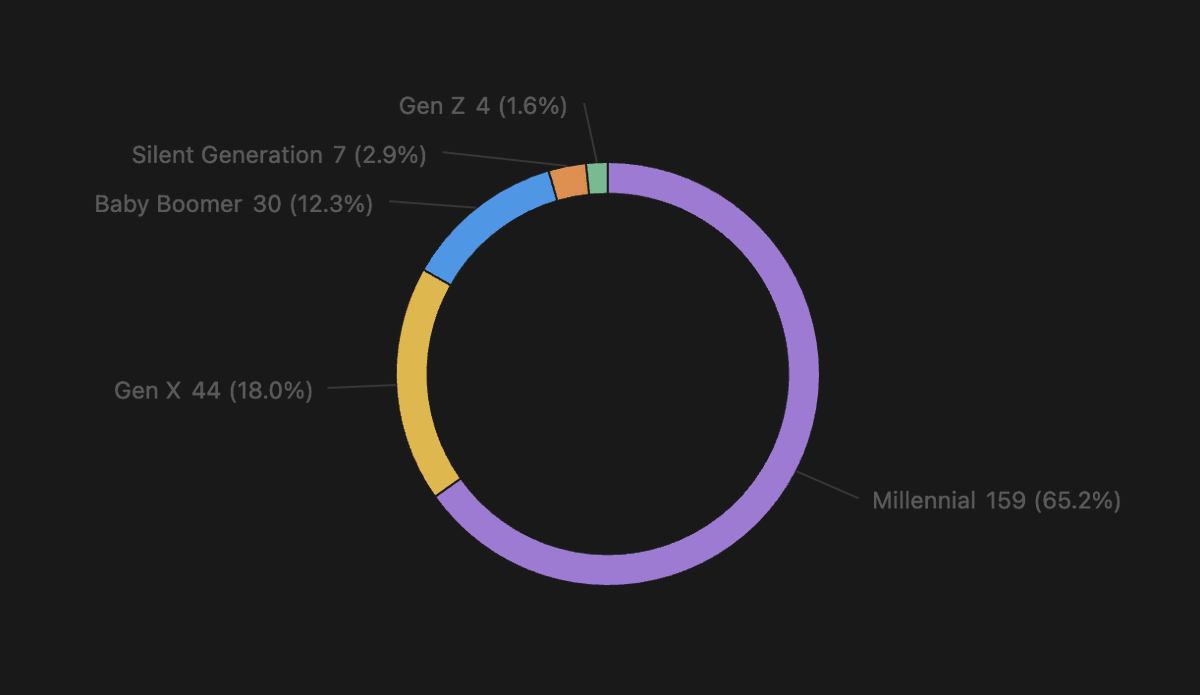

@FranWalsh73 @thejustinwelsh Those better questions attracted better clients:

Average income: ~$275,000/year

Average net worth: ~$1,600,000

65% are millennials who value education over sales pitches.

Average income: ~$275,000/year

Average net worth: ~$1,600,000

65% are millennials who value education over sales pitches.

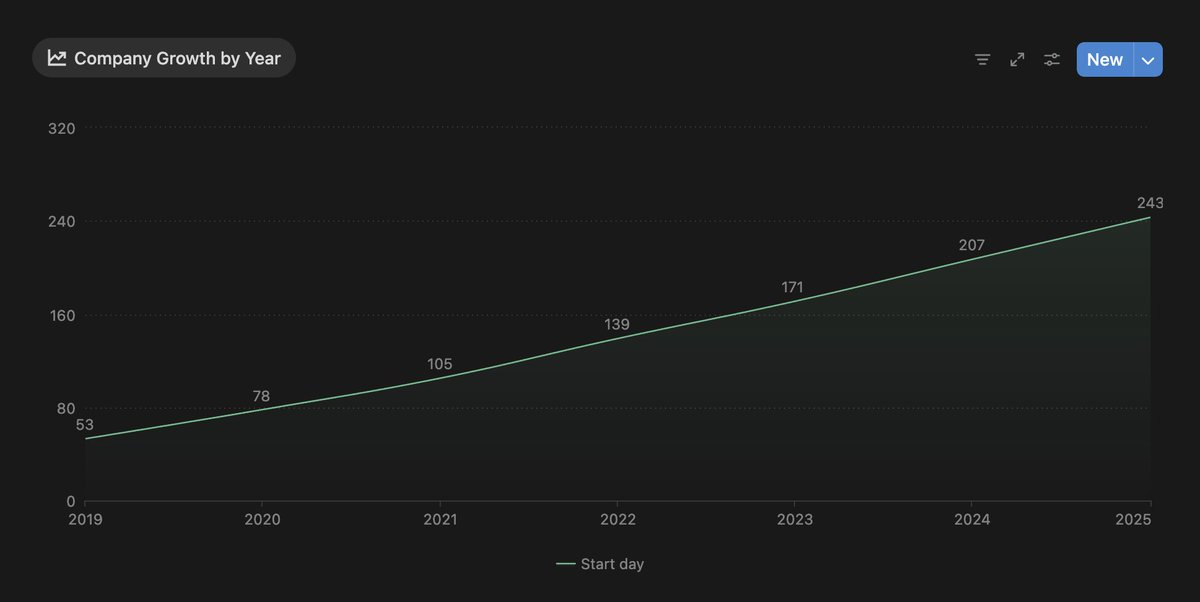

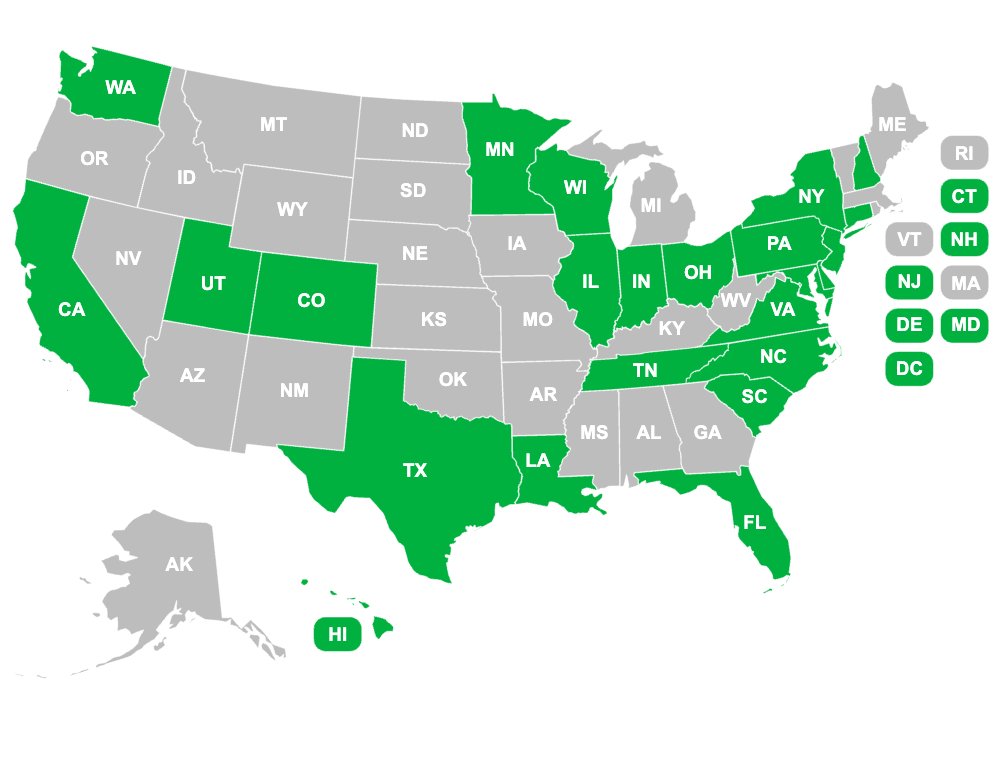

@FranWalsh73 @thejustinwelsh Better clients in one market led to organic expansion:

We serve 243 clients across 25 states.

Technology + relationships eliminated every location constraint the traditional industry said mattered.

We serve 243 clients across 25 states.

Technology + relationships eliminated every location constraint the traditional industry said mattered.

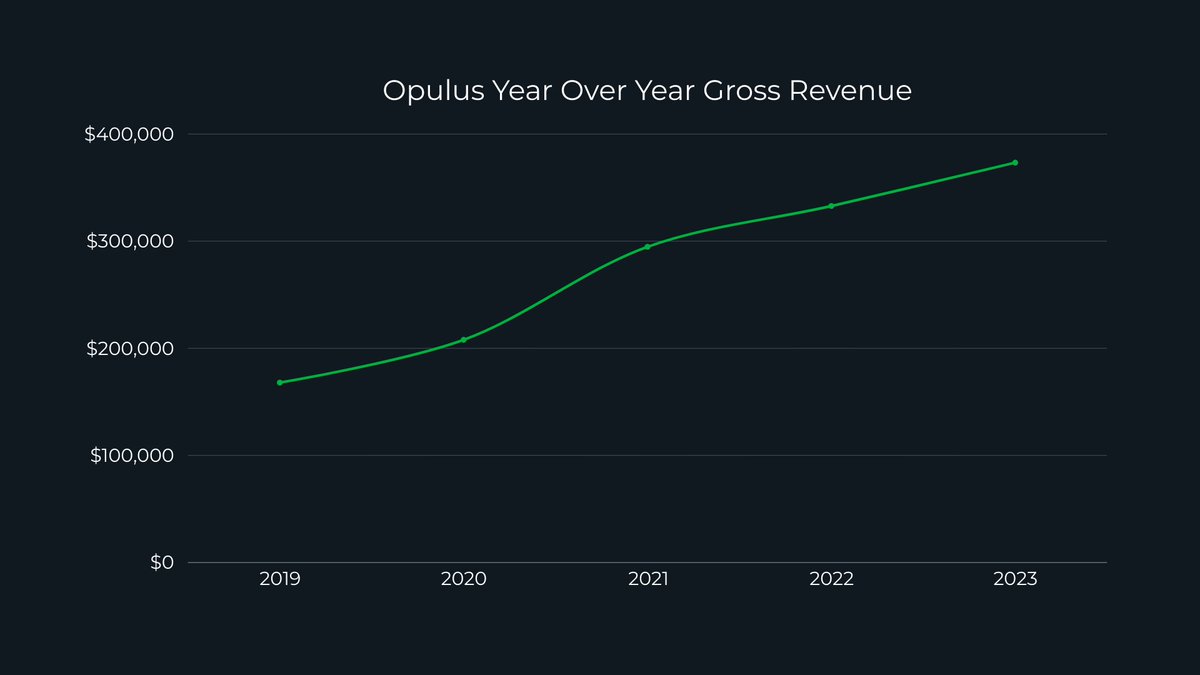

@FranWalsh73 @thejustinwelsh This expansion drove the revenue growth:

2019: $168K

2025: $690K projected

2026 Est: ~$850K

4x growth by doing the exact opposite of what the industry taught me.

2019: $168K

2025: $690K projected

2026 Est: ~$850K

4x growth by doing the exact opposite of what the industry taught me.

@FranWalsh73 @thejustinwelsh The last 6 years taught me something bigger than growing a business.

If the experts got this so wrong about building a practice, what else might traditional industries have completely backwards?

Trust your instincts about authenticity vs. manipulation.

If the experts got this so wrong about building a practice, what else might traditional industries have completely backwards?

Trust your instincts about authenticity vs. manipulation.

TL;DR — Traditional business training is backwards

• 500 cold calls/week → 100% organic leads

• Knowledge hoarding → Education first

• Countless hang-ups/day → Content creation

• $168K → $690K (4x growth)

• Local practice → 25 states

• Question everything they taught you

• 500 cold calls/week → 100% organic leads

• Knowledge hoarding → Education first

• Countless hang-ups/day → Content creation

• $168K → $690K (4x growth)

• Local practice → 25 states

• Question everything they taught you

That's it.

If you want more insights like this:

1. Follow me @ryanOpulus for more

2. RT the tweet below

Disclaimer: This is my personal opinion and experience working with high-income millennials. Not tax, financial, or legal advice. Always work with qualified professionals to understand your specific situation.

If you want more insights like this:

1. Follow me @ryanOpulus for more

2. RT the tweet below

Disclaimer: This is my personal opinion and experience working with high-income millennials. Not tax, financial, or legal advice. Always work with qualified professionals to understand your specific situation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh