Helping Millennials cut taxes, boost income, and build wealth • @InvestmentNews Best Wealth Managers Under 40 • @Investopedia Top 100 FA • Tweets ≠ Advice

How to get URL link on X (Twitter) App

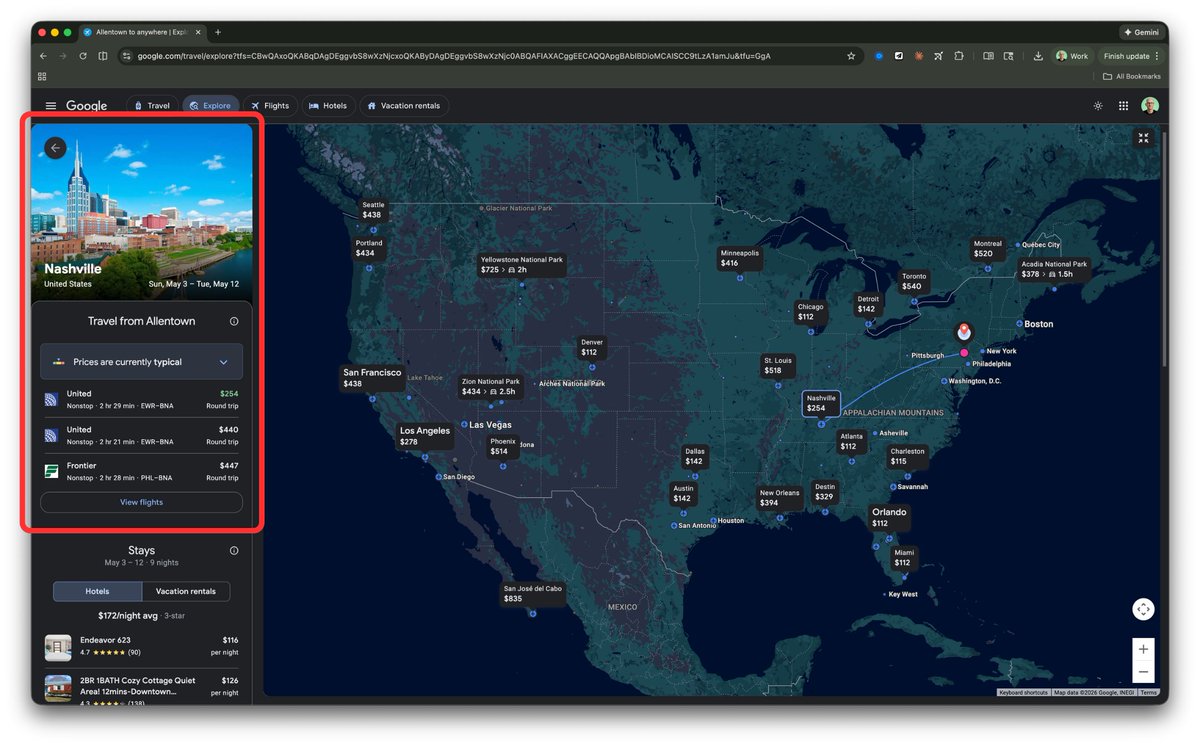

Most people search flights the expensive way:

Most people search flights the expensive way:

The hard truth?

The hard truth?

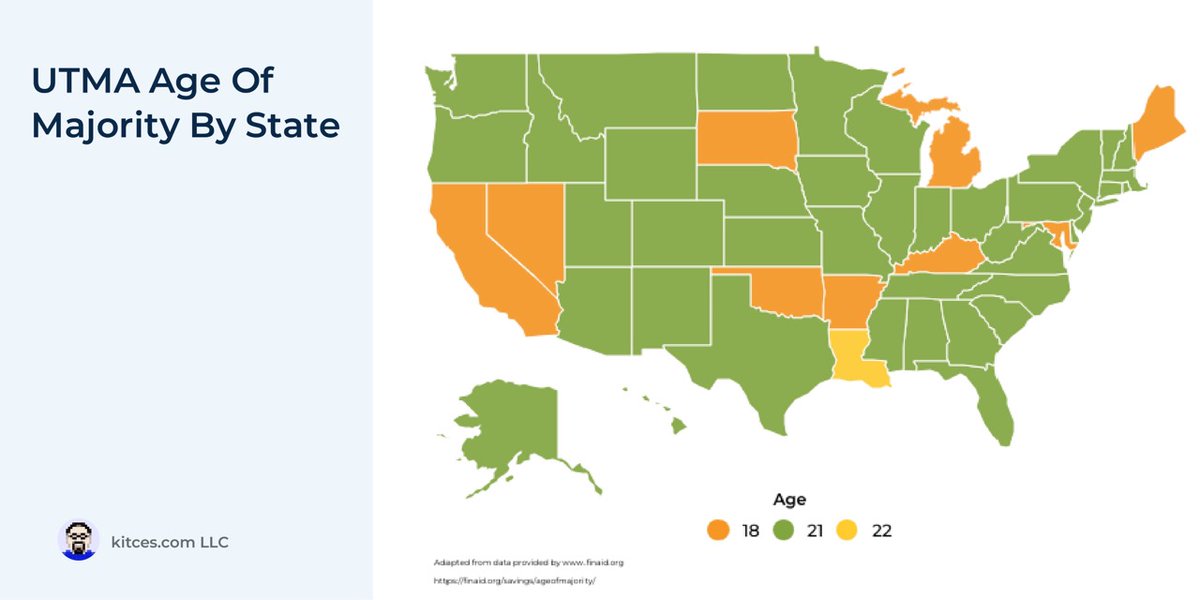

The IRS has a rule most parents don't know about.

The IRS has a rule most parents don't know about.

The industry trained us specifically: Make 500 cold calls a week.

The industry trained us specifically: Make 500 cold calls a week.

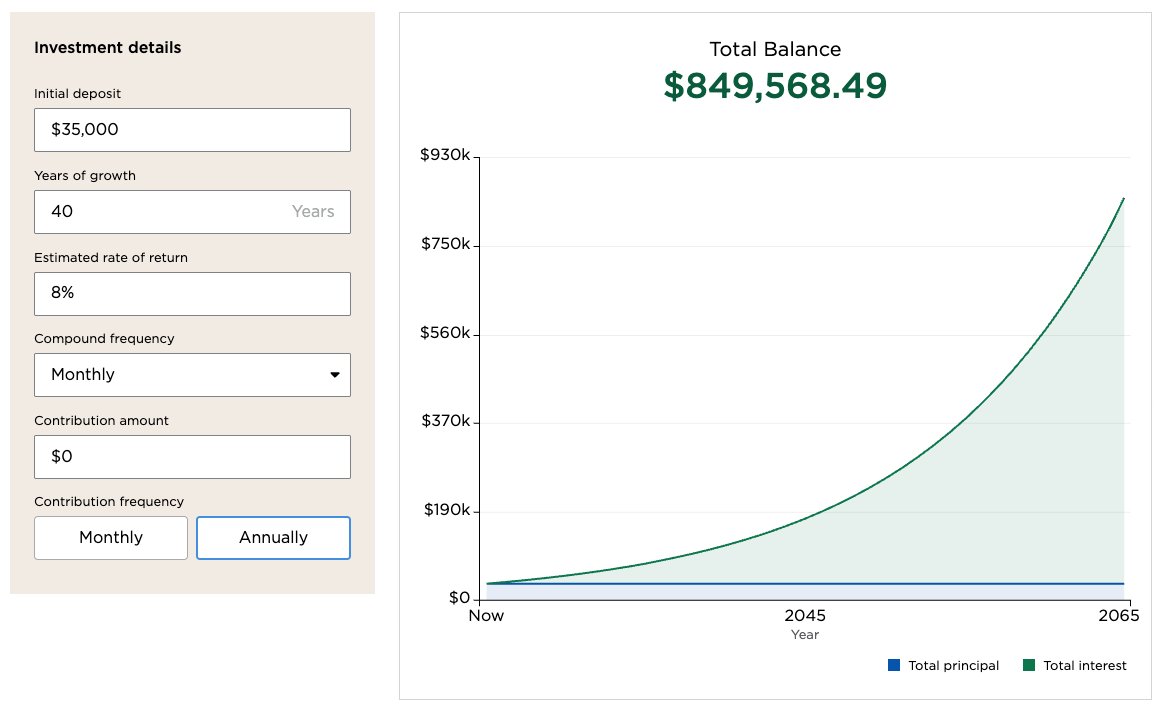

First, the opportunity:

First, the opportunity:

Ever notice how flight booking feels designed to empty your wallet?

Ever notice how flight booking feels designed to empty your wallet?

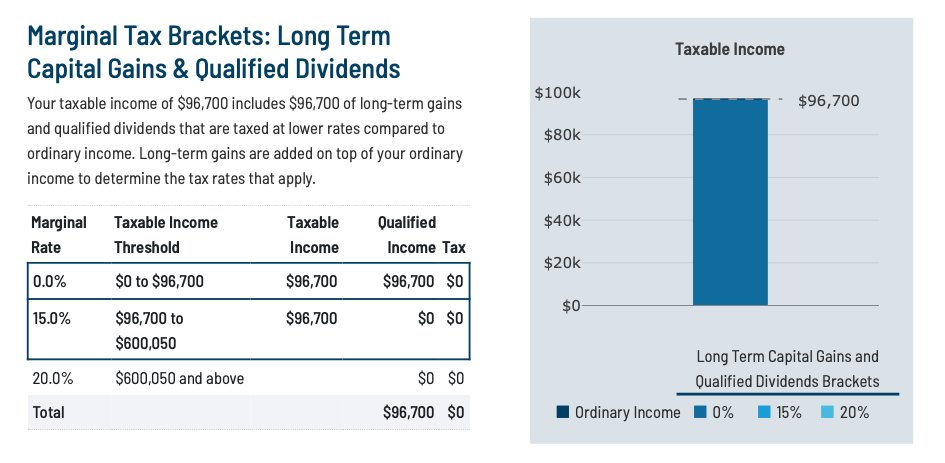

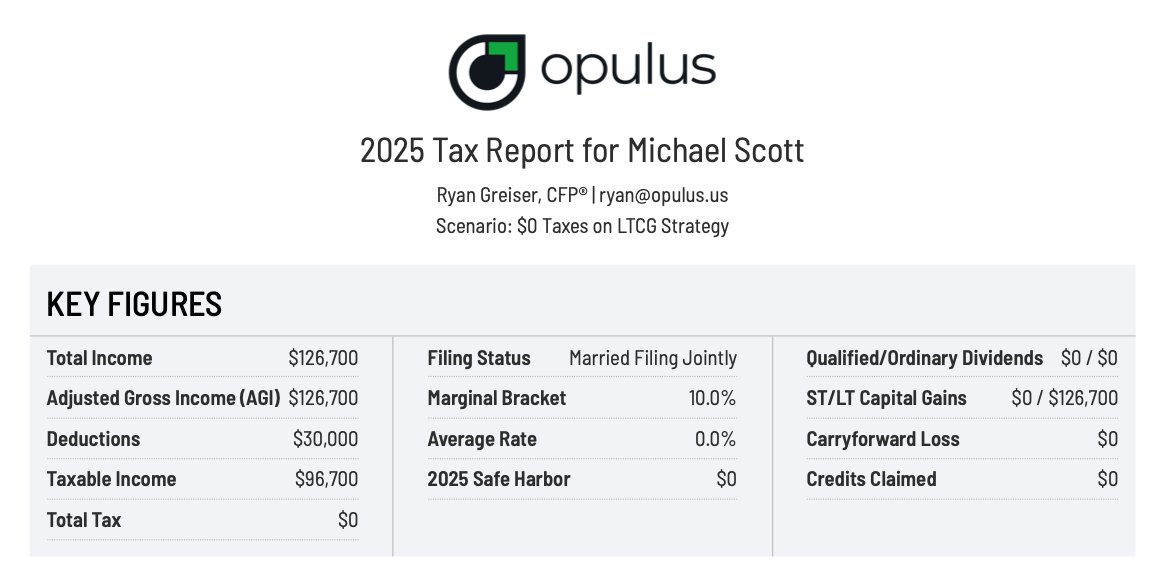

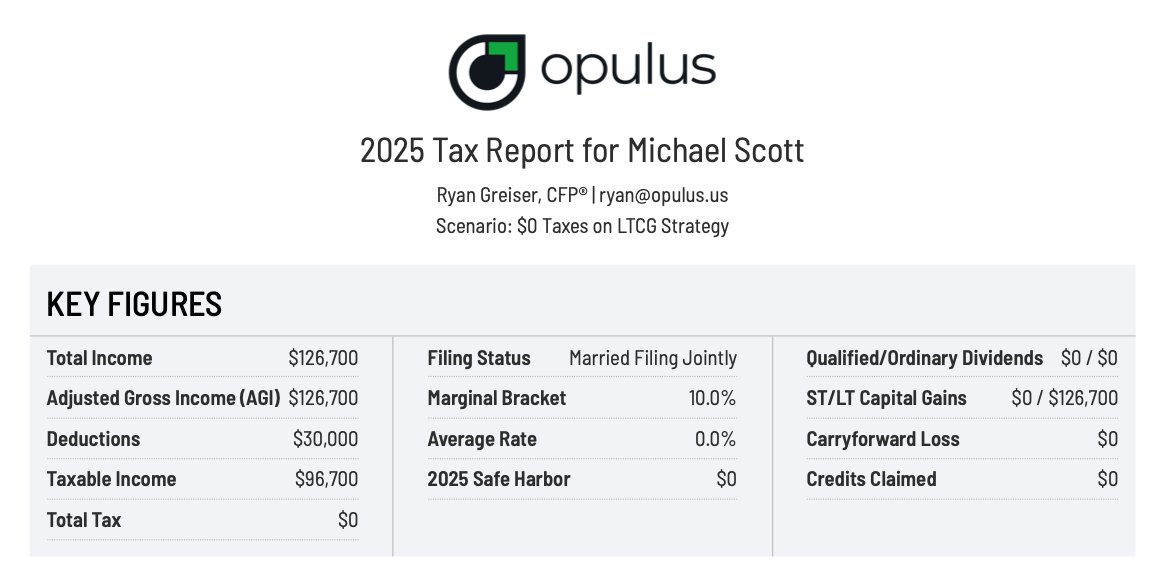

Here's the math behind the Zero-Tax strategy for 2025:

Here's the math behind the Zero-Tax strategy for 2025: