This is one of the world's richest families.

$18 billion net worth. 200 years of power.

But they just paid a $2.5 BILLION settlement for decades of crimes.

Here's how the DuPont family poisoned us for generations: 🧵

$18 billion net worth. 200 years of power.

But they just paid a $2.5 BILLION settlement for decades of crimes.

Here's how the DuPont family poisoned us for generations: 🧵

Meet Pierre Samuel DuPont.

He was French's King Louis XVI's trade advisor.

When the French Revolution erupted, he defended the monarchy.

Big mistake. He had to flee to America to avoid execution.

But in 1802, his son made a discovery that changed everything:

He was French's King Louis XVI's trade advisor.

When the French Revolution erupted, he defended the monarchy.

Big mistake. He had to flee to America to avoid execution.

But in 1802, his son made a discovery that changed everything:

Éleuthère Irénée DuPont found America's gunpowder was terrible.

He'd been trained by Antoine Lavoisier, France's greatest chemist.

So he brought superior French gunpowder techniques to America and opened a mill in Delaware.

The War of 1812 exploded his business overnight...

He'd been trained by Antoine Lavoisier, France's greatest chemist.

So he brought superior French gunpowder techniques to America and opened a mill in Delaware.

The War of 1812 exploded his business overnight...

Wars became the DuPont money machine:

- War of 1812: Made them rich

- Civil War: Made them richer

- World War I: Made them the largest explosives supplier in America

Each conflict meant massive government contracts and guaranteed profits.

But the real genius came later:

- War of 1812: Made them rich

- Civil War: Made them richer

- World War I: Made them the largest explosives supplier in America

Each conflict meant massive government contracts and guaranteed profits.

But the real genius came later:

By 1917, they had a problem.

Wars end. Explosives demand crashes.

But they discovered something brilliant: the same chemical processes used for explosives worked for civilian products.

Nitrocellulose from gunpowder became paints, solvents, artificial leather, dyes...

Wars end. Explosives demand crashes.

But they discovered something brilliant: the same chemical processes used for explosives worked for civilian products.

Nitrocellulose from gunpowder became paints, solvents, artificial leather, dyes...

The 1930s brought their breakthrough invention.

A young scientist named Roy Plunkett was developing refrigerants.

He accidentally created a mysterious white powder.

Heat resistant. Chemically inert. Nothing would stick to it.

They called it Teflon. The "wonder material."

A young scientist named Roy Plunkett was developing refrigerants.

He accidentally created a mysterious white powder.

Heat resistant. Chemically inert. Nothing would stick to it.

They called it Teflon. The "wonder material."

World War II made Teflon essential:

Raincoats, airplanes, auto parts, metal coatings.

By the 1950s, it was in cookware worldwide.

Non-stick pans in every kitchen.

DuPont became unstoppable. But they had a secret:

Raincoats, airplanes, auto parts, metal coatings.

By the 1950s, it was in cookware worldwide.

Non-stick pans in every kitchen.

DuPont became unstoppable. But they had a secret:

In 1962, internal DuPont scientists warned Teflon "may not be so inert."

1965: Studies linked it to "polymer fume fever."

1970s: Their own research found liver enlargement in rats.

The scientists advised "extreme caution".

The public never heard these warnings...

1965: Studies linked it to "polymer fume fever."

1970s: Their own research found liver enlargement in rats.

The scientists advised "extreme caution".

The public never heard these warnings...

The cover-up got worse.

1981: Female workers were suddenly moved away from Teflon production areas.

No explanation given.

Pregnant colleagues had given birth to babies with eye defects, strange nostrils, and ear problems.

C8 chemicals were found in infant blood cords.

1981: Female workers were suddenly moved away from Teflon production areas.

No explanation given.

Pregnant colleagues had given birth to babies with eye defects, strange nostrils, and ear problems.

C8 chemicals were found in infant blood cords.

C8 became known as "forever chemicals" (PFAS).

Once in your body, they stay for decades.

Once in the environment, they never break down.

DuPont knew this in the 1960s.

But they kept selling Teflon anyway...

Once in your body, they stay for decades.

Once in the environment, they never break down.

DuPont knew this in the 1960s.

But they kept selling Teflon anyway...

By 2000, the truth leaked out.

PFAS were found in drinking water near DuPont factories.

Independent researchers linked them to cancers, developmental delays, hormonal disruption.

An internal DuPont email admitted: "It gets into our blood and is too persistent."

PFAS were found in drinking water near DuPont factories.

Independent researchers linked them to cancers, developmental delays, hormonal disruption.

An internal DuPont email admitted: "It gets into our blood and is too persistent."

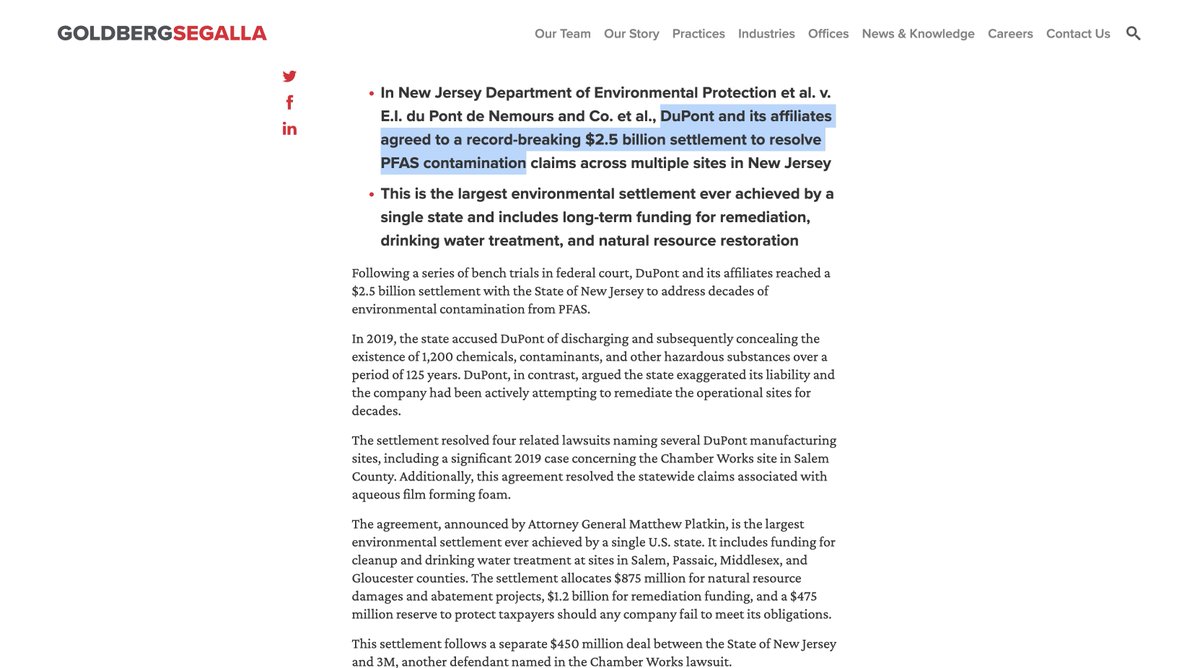

The legal reckoning finally came.

2025: DuPont paid $2.5 billion in settlements.

But critics called it "a slap on the wrist."

They'd made tens of billions while poisoning the planet.

The damage? Forever chemicals are now in nearly every human's blood.

2025: DuPont paid $2.5 billion in settlements.

But critics called it "a slap on the wrist."

They'd made tens of billions while poisoning the planet.

The damage? Forever chemicals are now in nearly every human's blood.

The DuPont legacy is a perfect contradiction:

They created nylon, Kevlar, synthetic rubber.

Materials that revolutionized textiles and saved lives.

But they also created the most persistent toxins in human history.

And they knew the dangers from day one...

They created nylon, Kevlar, synthetic rubber.

Materials that revolutionized textiles and saved lives.

But they also created the most persistent toxins in human history.

And they knew the dangers from day one...

The lesson isn't about avoiding innovation.

It's about corporate accountability.

When companies prioritize endless growth over human health, the results poison generations.

DuPont proves that some "progress" comes with invisible costs we're still paying today.

It's about corporate accountability.

When companies prioritize endless growth over human health, the results poison generations.

DuPont proves that some "progress" comes with invisible costs we're still paying today.

Smart investors recognize that true long-term value isn't built on hiding dangers.

It's built on sustainable, transparent strategies that compound over time.

Here's how:

It's built on sustainable, transparent strategies that compound over time.

Here's how:

Investors: Our platforms have already helped over 40,000 investors automate their investments.

We have over $150M in assets under management.

Sign up for FREE here: surmount.ai/strategies?utm…

We have over $150M in assets under management.

Sign up for FREE here: surmount.ai/strategies?utm…

That's it. Thanks for reading.

Follow me @LogWeaver, for more stories like this.

Follow me @LogWeaver, for more stories like this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh