Fed Chair Powell has caved:

In 1 month, the Fed will CUT rates and blame a "weaker labor market."

Meanwhile, we now have PPI inflation growth at a 3-year high and CPI inflation above 2% for 53-STRAIGHT months.

Don't own assets? You will be left behind. Here's why.

(a thread)

In 1 month, the Fed will CUT rates and blame a "weaker labor market."

Meanwhile, we now have PPI inflation growth at a 3-year high and CPI inflation above 2% for 53-STRAIGHT months.

Don't own assets? You will be left behind. Here's why.

(a thread)

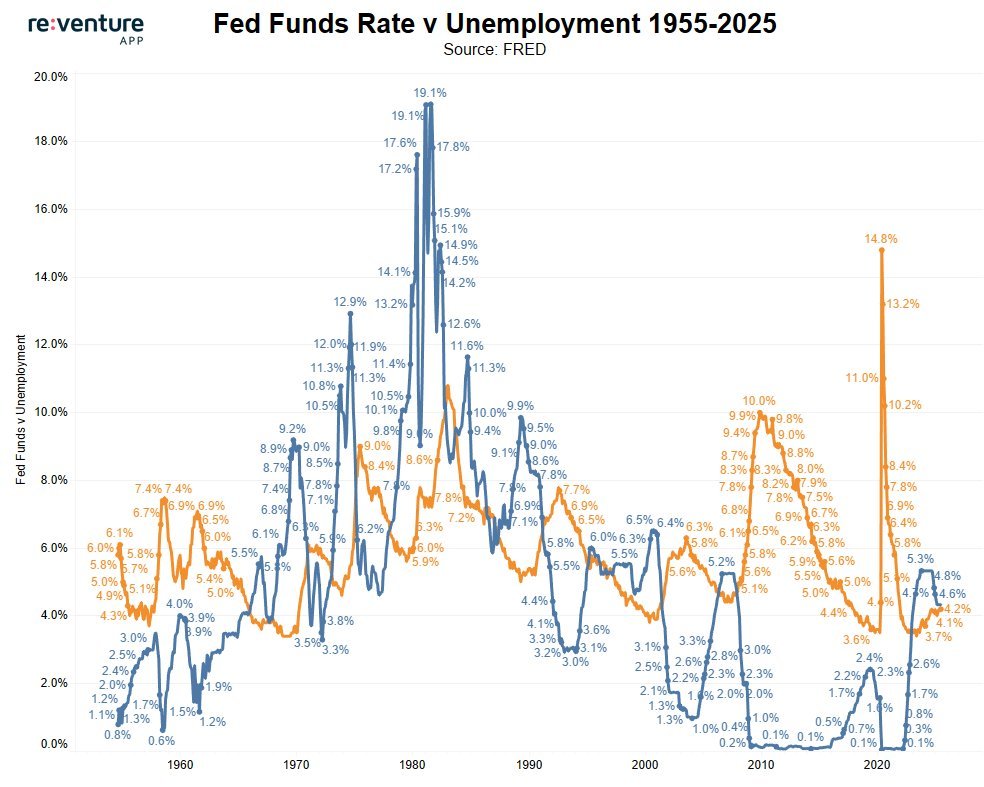

To better understand what's happening, you must first understand the Fed's mandate:

The Fed's purpose is to reduce unemployment and avoid inflation/deflation.

This is the Fed's "dual mandate."

Since 2021, the Fed has been laser-focused on the inflation side of this mandate.

The Fed's purpose is to reduce unemployment and avoid inflation/deflation.

This is the Fed's "dual mandate."

Since 2021, the Fed has been laser-focused on the inflation side of this mandate.

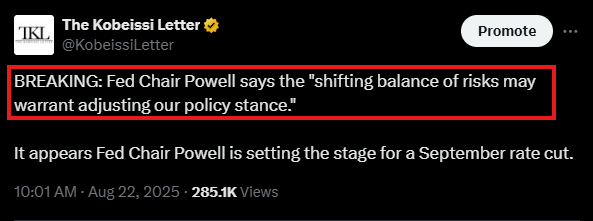

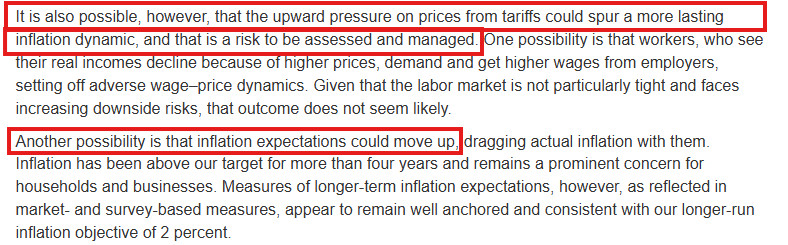

However, Fed Chair Powell just made a MASSIVE pivot:

Powell said the "shifting balance of risks may warrant adjusting our policy stance."

In other words, the Fed now views unemployment as a BIGGER risk than inflation.

This is a near-confirmation that rate cuts are coming.

Powell said the "shifting balance of risks may warrant adjusting our policy stance."

In other words, the Fed now views unemployment as a BIGGER risk than inflation.

This is a near-confirmation that rate cuts are coming.

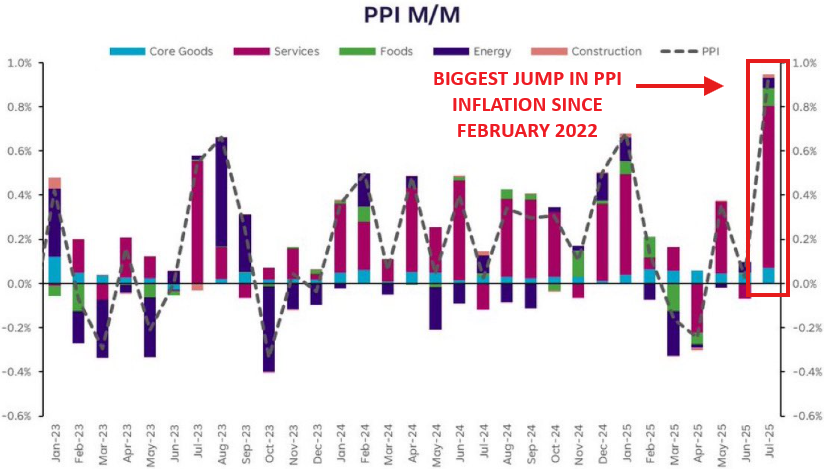

But, this shift isn't happening because inflation is at the Fed's 2% target.

In fact, Core CPI is back above 3.0% and PPI inflation just saw a +0.9% MoM jump, its biggest since 2022.

So, why have the risks shifted?

Because the labor market is clearly rapidly deteriorating.

In fact, Core CPI is back above 3.0% and PPI inflation just saw a +0.9% MoM jump, its biggest since 2022.

So, why have the risks shifted?

Because the labor market is clearly rapidly deteriorating.

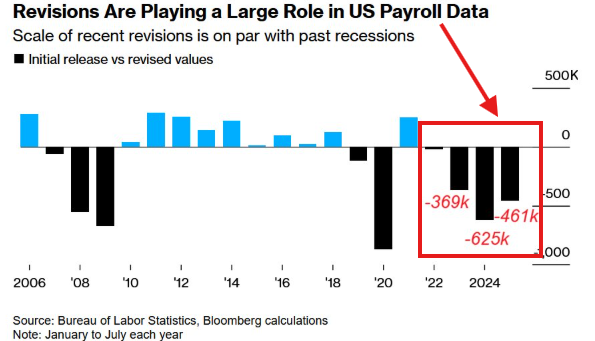

In the latest data, -258,000 jobs were revised out of the May and June data ALONE.

That's more than the entire population of Scottsdale, AZ.

Year-to-date, -461,000 jobs have been revised down.

As we have been saying, many leading indicators of the labor market are cracking.

That's more than the entire population of Scottsdale, AZ.

Year-to-date, -461,000 jobs have been revised down.

As we have been saying, many leading indicators of the labor market are cracking.

What does it all mean?

The Fed is set to cut rates into inflation which the stock market will love.

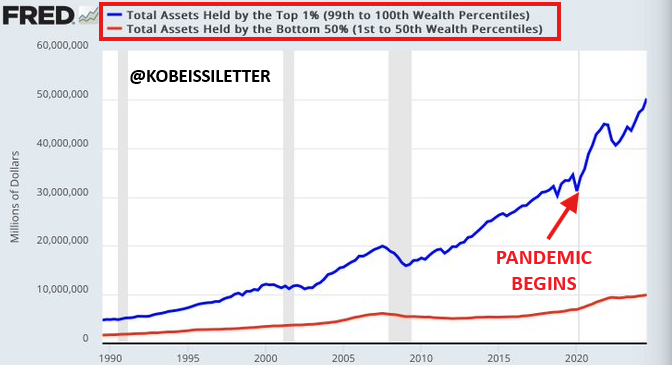

However, as inflation rebounds, those who do NOT own assets will see a similar situation to the post-pandemic era.

Wage growth will lag inflation and the wealth gap will grow.

The Fed is set to cut rates into inflation which the stock market will love.

However, as inflation rebounds, those who do NOT own assets will see a similar situation to the post-pandemic era.

Wage growth will lag inflation and the wealth gap will grow.

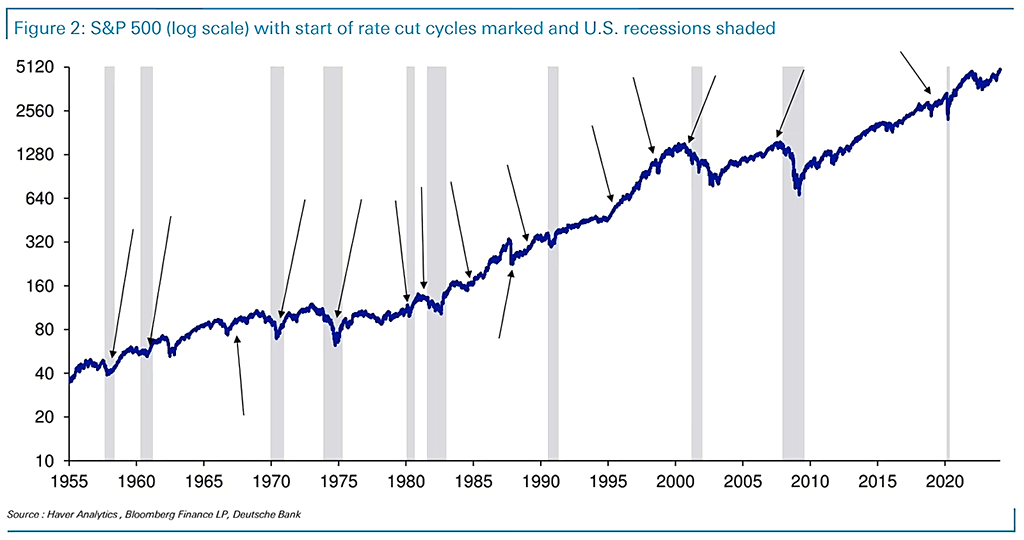

In fact, when the Fed cuts rates within 2% of all time highs, the S&P 500 loves it.

In 20 of the last 20 times this has happened:

The S&P 500 has risen an average of +13.9% over the following 12 months, per Carson Research.

Asset owners will party like its 2021.

In 20 of the last 20 times this has happened:

The S&P 500 has risen an average of +13.9% over the following 12 months, per Carson Research.

Asset owners will party like its 2021.

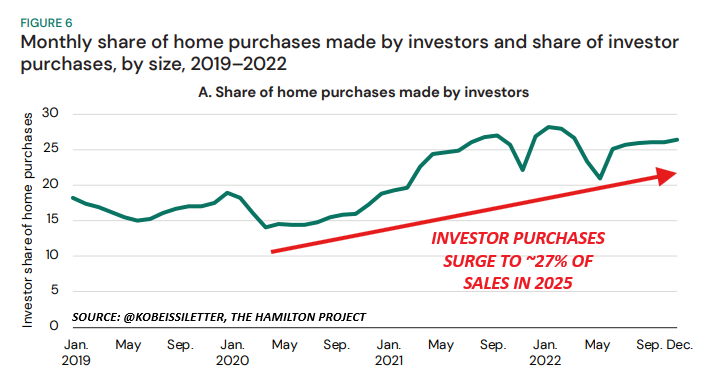

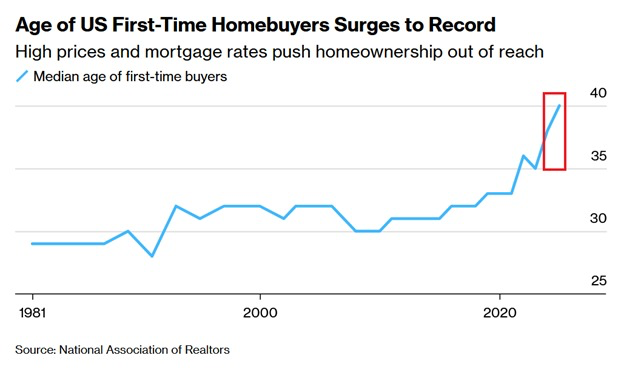

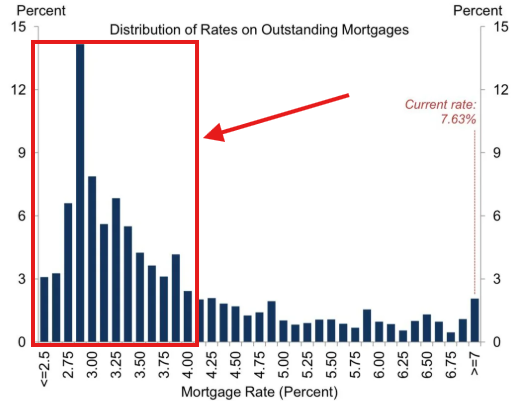

And, the "relief" in home prices likely won't come.

The Fed has made it clear that they will remain attentive to inflation risks.

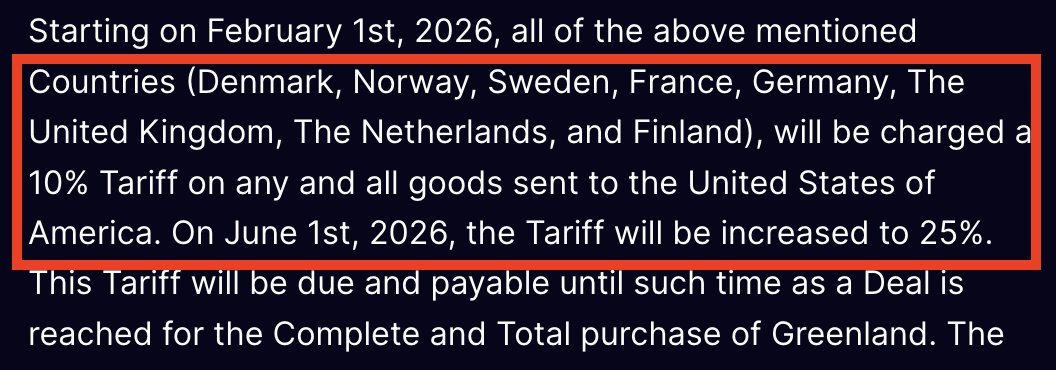

So, rate cuts are coming but not at an aggressive pace like the 300 bps that Trump wants.

Mortgage rates will drop, but it won't be enough.

The Fed has made it clear that they will remain attentive to inflation risks.

So, rate cuts are coming but not at an aggressive pace like the 300 bps that Trump wants.

Mortgage rates will drop, but it won't be enough.

Mortgage rates would need to drop enough to incentivize the 55%+ of homeowners with <4% rates to move.

But, rates won't drop enough for that to happen.

The result will be ~5% mortgages with higher demand but still limited supply.

Again, those without assets will be left behind.

But, rates won't drop enough for that to happen.

The result will be ~5% mortgages with higher demand but still limited supply.

Again, those without assets will be left behind.

And, it goes far beyond just stocks and real estate.

Take a look at Bitcoin and Gold which are up +450% and +105% in under 3 years.

The market knows elevated inflation is here to stay.

Gold has been a leading indicator for months.

Those who own assets are BEATING inflation.

Take a look at Bitcoin and Gold which are up +450% and +105% in under 3 years.

The market knows elevated inflation is here to stay.

Gold has been a leading indicator for months.

Those who own assets are BEATING inflation.

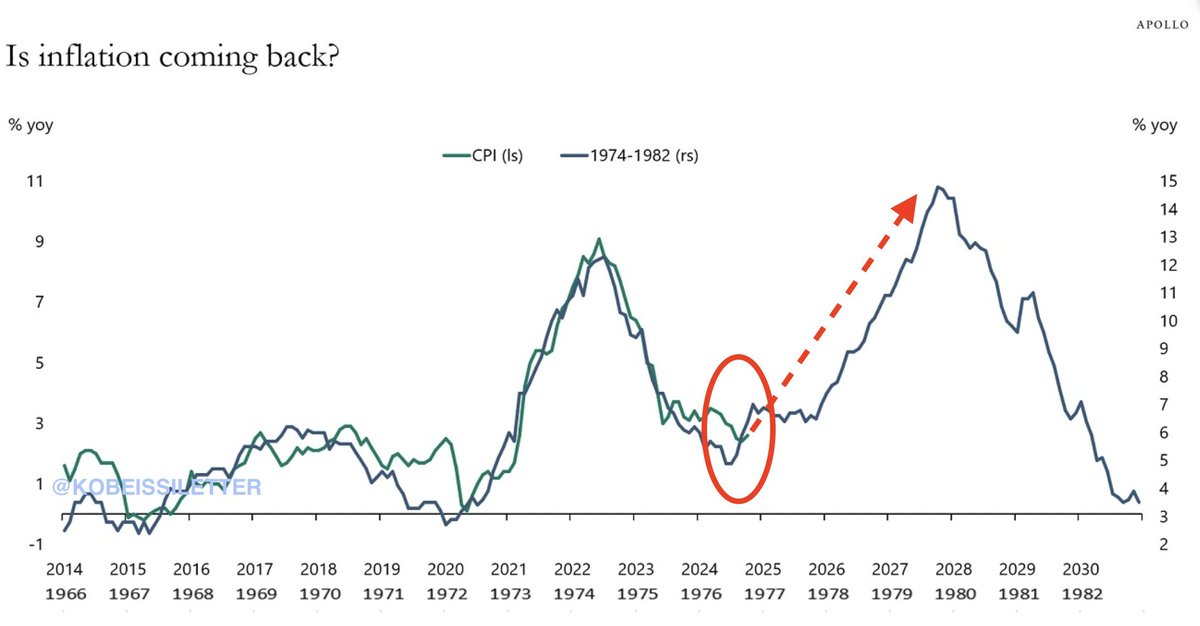

The last time the Fed cut rates into rising inflation was in the 1970s.

While we are NOT calling for a 1970s-style rebound to 15%+ inflation, it's worth looking at.

The math is simple:

When you stimulate demand into an already hot inflation picture, it gets hotter.

While we are NOT calling for a 1970s-style rebound to 15%+ inflation, it's worth looking at.

The math is simple:

When you stimulate demand into an already hot inflation picture, it gets hotter.

The result will be a continued historic widening of the wealth gap.

In the 1990 the wealth gap between the top 1% and the bottom 50% was $3 trillion.

Now the gap is $40 trillion.

The top 0.1% of Americans now hold 5.5 TIMES more wealth than the bottom 50% of Americans.

In the 1990 the wealth gap between the top 1% and the bottom 50% was $3 trillion.

Now the gap is $40 trillion.

The top 0.1% of Americans now hold 5.5 TIMES more wealth than the bottom 50% of Americans.

This trend will spread far beyond the US.

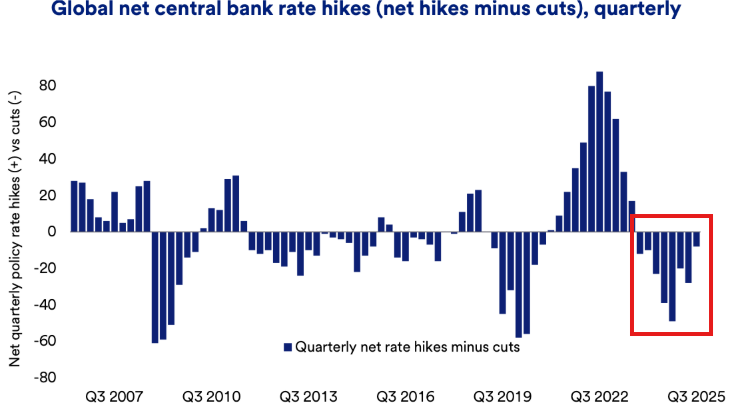

In fact, the Fed is actually "behind" on the current global rate cut cycle.

World central banks cut rates 15 times in May ALONE, the fastest monthly pace this year.

This also marks one of the largest waves of rate cuts this century.

In fact, the Fed is actually "behind" on the current global rate cut cycle.

World central banks cut rates 15 times in May ALONE, the fastest monthly pace this year.

This also marks one of the largest waves of rate cuts this century.

The first rate cut of 2025 is coming in 1 month.

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are investable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are investable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

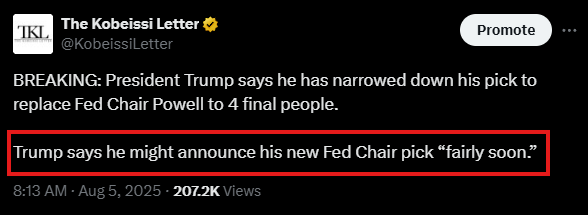

To top it all off, Fed Chair Powell's term ends in 8 months.

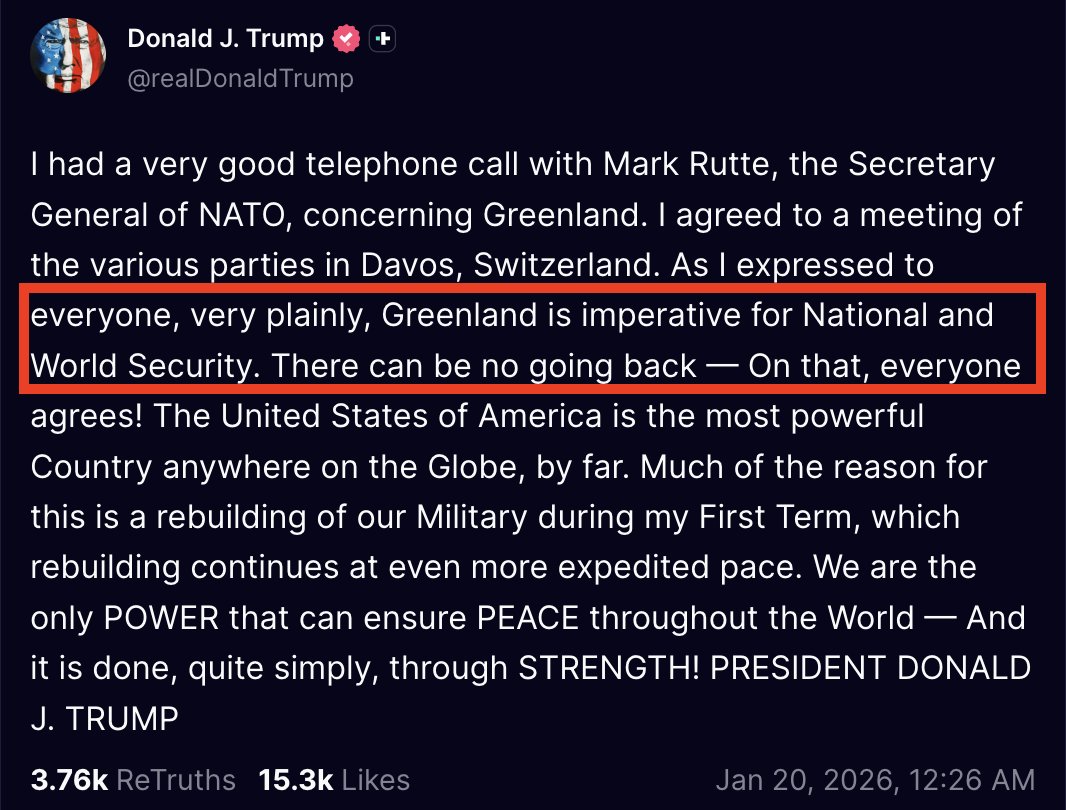

President Trump has explicitly stated that his new Fed Chair pick must cut rates.

Trump recently said he will likely announce his new Fed Chair pick “fairly soon.”

2026 will be a historic year for markets.

President Trump has explicitly stated that his new Fed Chair pick must cut rates.

Trump recently said he will likely announce his new Fed Chair pick “fairly soon.”

2026 will be a historic year for markets.

In reality, this trend is not new; it was just accelerated by the pandemic.

The top 1% of US households own 51% of stocks and the top 10% own 87% of stocks.

Position accordingly before the gap widens.

Follow us @KobeissiLetter for real time analysis as this develops.

The top 1% of US households own 51% of stocks and the top 10% own 87% of stocks.

Position accordingly before the gap widens.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh