Here's how to avoid leverage and get >10% APR.

For the love of the game...

🚨A NON-LEVERAGED STABLECOIN THREAD🚨

🧵👇

For the love of the game...

🚨A NON-LEVERAGED STABLECOIN THREAD🚨

🧵👇

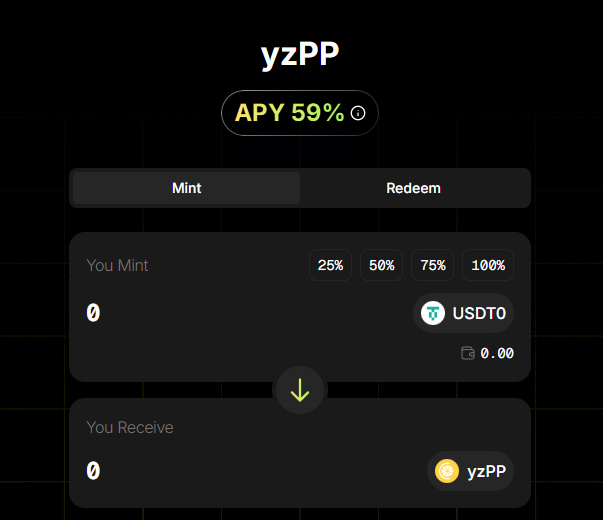

1) @pendle_fi

This is a no brainer both because the yields are consistently over 10% and because you get a FIXED RATE return.

Right now, you can lock in 18% APR on a number of great options for over 80 days.

This is a no brainer both because the yields are consistently over 10% and because you get a FIXED RATE return.

Right now, you can lock in 18% APR on a number of great options for over 80 days.

2) @infiniFi_

Infinifi's effectively a Pendle PT ETF that allows you to choose your duration exposure.

You can choose to be immediately liquid (siUSD) or have a 1 – 13 week unlock (yielding the entire time).

Yes, I use en dashes; no, I'm not an AI; yes we exist.

9 – 17% APY

Infinifi's effectively a Pendle PT ETF that allows you to choose your duration exposure.

You can choose to be immediately liquid (siUSD) or have a 1 – 13 week unlock (yielding the entire time).

Yes, I use en dashes; no, I'm not an AI; yes we exist.

9 – 17% APY

3) @gauntlet_xyz

Gauntlet is the king of curation.

They're currently getting 11.7% APY on their Gauntlet alpha vault, which has no fee to enter nor exist and currently no performance fee either.

And you can withdraw into USDC whenever you want.

Gauntlet is the king of curation.

They're currently getting 11.7% APY on their Gauntlet alpha vault, which has no fee to enter nor exist and currently no performance fee either.

And you can withdraw into USDC whenever you want.

4) @GearboxProtocol

There are FOUR great lending campaigns right now on Gearbox boasting >10% APY.

➢ USDC on @etherlink: 30%

➢ USDC on @hemi_xyz: 17%

➢ USDC on @ethereum: 16% (@ResolvLabs)

➢ USDC on @ethereum: 14% (@FalconStable)

There are FOUR great lending campaigns right now on Gearbox boasting >10% APY.

➢ USDC on @etherlink: 30%

➢ USDC on @hemi_xyz: 17%

➢ USDC on @ethereum: 16% (@ResolvLabs)

➢ USDC on @ethereum: 14% (@FalconStable)

5) @noon_capital

Noon has good base yields on sNOON (8-13%) BUT if you want to get consistently over 10%, there are TWO great Curve pools on @TacBuild.

➤ sUSN/USN: 16%

➤ USN/USDT: 17.5%

Noon has good base yields on sNOON (8-13%) BUT if you want to get consistently over 10%, there are TWO great Curve pools on @TacBuild.

➤ sUSN/USN: 16%

➤ USN/USDT: 17.5%

6) Two to look out for...

@solsticefi and @neutrl_labs are both launching soon.

➢ Solstice: 19%

➢ Neutrl: 29%

Solstice aims to be the Ethena of Solana (and is very well positioned to do so).

Neutrl is a strategy vault that taps into OTC basis for a large yield boost.

@solsticefi and @neutrl_labs are both launching soon.

➢ Solstice: 19%

➢ Neutrl: 29%

Solstice aims to be the Ethena of Solana (and is very well positioned to do so).

Neutrl is a strategy vault that taps into OTC basis for a large yield boost.

7) @protocol_fx

fxSAVE is one of the best vaults out there.

Currently at 13.65% with a projected APY of nearly 16%.

You can enter and exit this fxUSD stability pool with USDC, and its historical rates have been great.

fxSAVE is one of the best vaults out there.

Currently at 13.65% with a projected APY of nearly 16%.

You can enter and exit this fxUSD stability pool with USDC, and its historical rates have been great.

8) @hylo_so

Hylo has a stability pool where you can consistently get 10-20% APR on shyUSD.

One of the best stablecoin yields on @solana.

Hylo has a stability pool where you can consistently get 10-20% APR on shyUSD.

One of the best stablecoin yields on @solana.

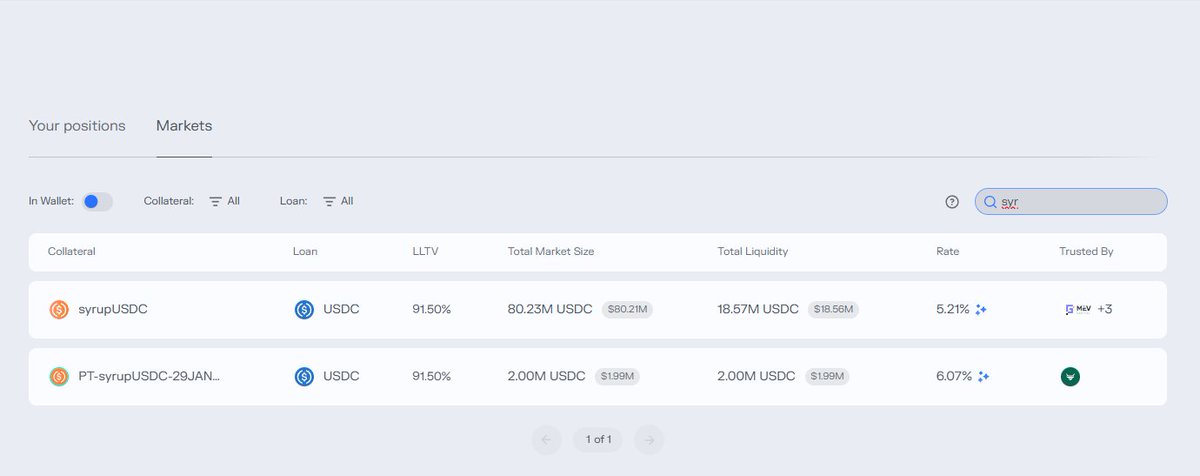

10) @syrupfi on @DriftProtocol

This one takes a bit of savvy.

But right now syrupUSDC is getting 12% APY for being used as margin on Drift.

That means you can run a Basis trade using syrupUSDC and get a really nice net yield.

Running a 2x short on $HYPE and then using @pendle_fi to fix a 15% APR on the long...

1/3 capital in syrupUSDC at 12%

► Net: +4%

Opening a 2x short on Hype at 15% average funding

► Net: +10%

Longing 2/3 capital in PT-vkHYPE at 15%

► Net: +10%

Total strategy APR: 24%

This one takes a bit of savvy.

But right now syrupUSDC is getting 12% APY for being used as margin on Drift.

That means you can run a Basis trade using syrupUSDC and get a really nice net yield.

Running a 2x short on $HYPE and then using @pendle_fi to fix a 15% APR on the long...

1/3 capital in syrupUSDC at 12%

► Net: +4%

Opening a 2x short on Hype at 15% average funding

► Net: +10%

Longing 2/3 capital in PT-vkHYPE at 15%

► Net: +10%

Total strategy APR: 24%

11: BONUS

Not really stablecoin, but look at @JupiterExchange's JLP go again...

It remains one of the best delta-muted ways to be exposed to crypto/defi.

And if you LP it against USDC on @MeteoraAG...

Not really stablecoin, but look at @JupiterExchange's JLP go again...

It remains one of the best delta-muted ways to be exposed to crypto/defi.

And if you LP it against USDC on @MeteoraAG...

That's it for now. Surely there are many more, but again, this was for non-leveraged >10% APR yields that are pretty sustainable and low maintenance.

Thanks for reading!

Thanks for reading!

• • •

Missing some Tweet in this thread? You can try to

force a refresh