My co-worker recently retired at 50.

Here’s the exact tax free withdrawal strategy he's using to fund his early retirement:

Here’s the exact tax free withdrawal strategy he's using to fund his early retirement:

The company he retired from had pretty great perks like a 100% 401(k) match on 6% of salaryand ESPP.

But here's the thing - most tax advantaged accounts lock up your money until retirement.

So, how can he use them to retire early?

But here's the thing - most tax advantaged accounts lock up your money until retirement.

So, how can he use them to retire early?

FireCalc shows that a 3.5% withdrawal rate has a 100% success rate over 30 years.

On a $1.5M portfolio, that works out to ~$52,500 a year you can take out.

But here's the tricky part - what’s the smartest way to pull that money while keeping your taxes as low as possible?

On a $1.5M portfolio, that works out to ~$52,500 a year you can take out.

But here's the tricky part - what’s the smartest way to pull that money while keeping your taxes as low as possible?

Let’s say my coworker has a $1.5M portfolio split like:

> $1M in a traditional 401(k)

> $300K in a taxable brokerage

> $200K in a Roth IRA

He also has a paid off house, meaning his monthly burn rate is pretty low. Here's how he can do it:

> $1M in a traditional 401(k)

> $300K in a taxable brokerage

> $200K in a Roth IRA

He also has a paid off house, meaning his monthly burn rate is pretty low. Here's how he can do it:

1. SEPP

The first move would be to roll over 401(k) into 2 separate IRAs with a 60%-40% split

Because we will use the 60% account and set up the Substantially Equal Periodic Payments (SEPP).

That way, you can pull income without triggering the 10% early withdrawal penalty

The first move would be to roll over 401(k) into 2 separate IRAs with a 60%-40% split

Because we will use the 60% account and set up the Substantially Equal Periodic Payments (SEPP).

That way, you can pull income without triggering the 10% early withdrawal penalty

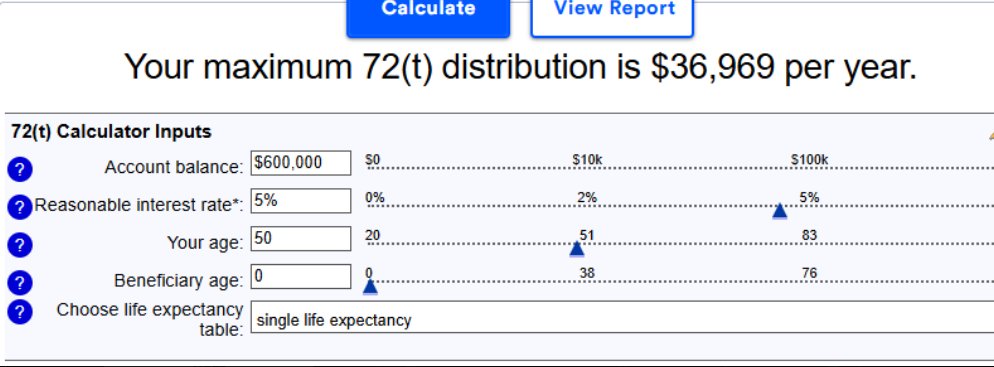

Using a 72(t) calculator, a $600,000 SEPP setup would generate ~$36,969 per year in distributions from your IRA without any penalty:

2. Brokerage Account

The $300,000 in a taxable brokerage (let’s say all in $VTI) would give us ~$3,720 in annual dividends (~95% are qualified)

Because the total taxable income will be under $48,350, all of those dividends would be taxed at the 0% long term capital gains rate.

The $300,000 in a taxable brokerage (let’s say all in $VTI) would give us ~$3,720 in annual dividends (~95% are qualified)

Because the total taxable income will be under $48,350, all of those dividends would be taxed at the 0% long term capital gains rate.

On top of the dividends, the $300,000 brokerage account is made up of 75% capital gains and 25% basis.

That means you could sell ~$10,500 of VTI each year ($7,875 in LTCG). And since we're still under the income threshold, those gains would also be taxed at the 0% rate.

That means you could sell ~$10,500 of VTI each year ($7,875 in LTCG). And since we're still under the income threshold, those gains would also be taxed at the 0% rate.

Adding it all up (SEPP withdrawals + dividends + capital gains) he's looking at about $54,189 of cash per year (~3.5% withdrawal rate)

3. Roth IRA

In this setup, he wouldn’t even need to touch the Roth, but contributions can always be withdrawn tax and penalty free.

3. Roth IRA

In this setup, he wouldn’t even need to touch the Roth, but contributions can always be withdrawn tax and penalty free.

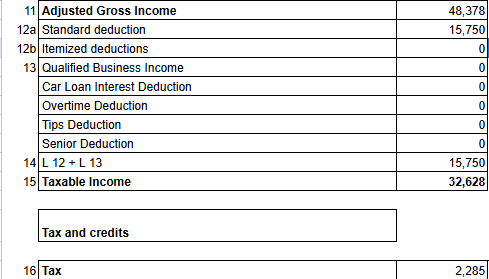

Running the numbers, he'd only owe ~$2,285 in federal taxes in 2025.

And depending on the state, there might be no state income tax.

So, he would have ~$50,000 of cash tax-free, or ~$4,100/mo. With a paid off house, he can easily live off this amount (+ACA subsidies)

And depending on the state, there might be no state income tax.

So, he would have ~$50,000 of cash tax-free, or ~$4,100/mo. With a paid off house, he can easily live off this amount (+ACA subsidies)

Before Social Security benefits and required minimum distributions (RMDs) start, you could also consider Roth conversions to shrink your 401(k) balance.

While not needed in this case, it might be needed if your pre-tax 401k is large.

While not needed in this case, it might be needed if your pre-tax 401k is large.

If you liked this breakdown, please help spread this message by:

1. reposting

2. sending this to a friend or family

3. following me @money_cruncher for more CPA breakdowns

1. reposting

2. sending this to a friend or family

3. following me @money_cruncher for more CPA breakdowns

• • •

Missing some Tweet in this thread? You can try to

force a refresh