Lyn Alden just dropped a bombshell in her latest newsletter:

The U.S. is taxing itself with the biggest tariff increase in modern history—$400–500B per year.

Fiscal brake meets monetary gas pedal. That tension? Rocket fuel for Bitcoin. 🧵👇

The U.S. is taxing itself with the biggest tariff increase in modern history—$400–500B per year.

Fiscal brake meets monetary gas pedal. That tension? Rocket fuel for Bitcoin. 🧵👇

During Trump’s first term, tariffs doubled from ~$40B to ~$80B annually. Manageable.

Now? We’re at a $360B run-rate, headed toward half a trillion. This is a structural change.

Now? We’re at a $360B run-rate, headed toward half a trillion. This is a structural change.

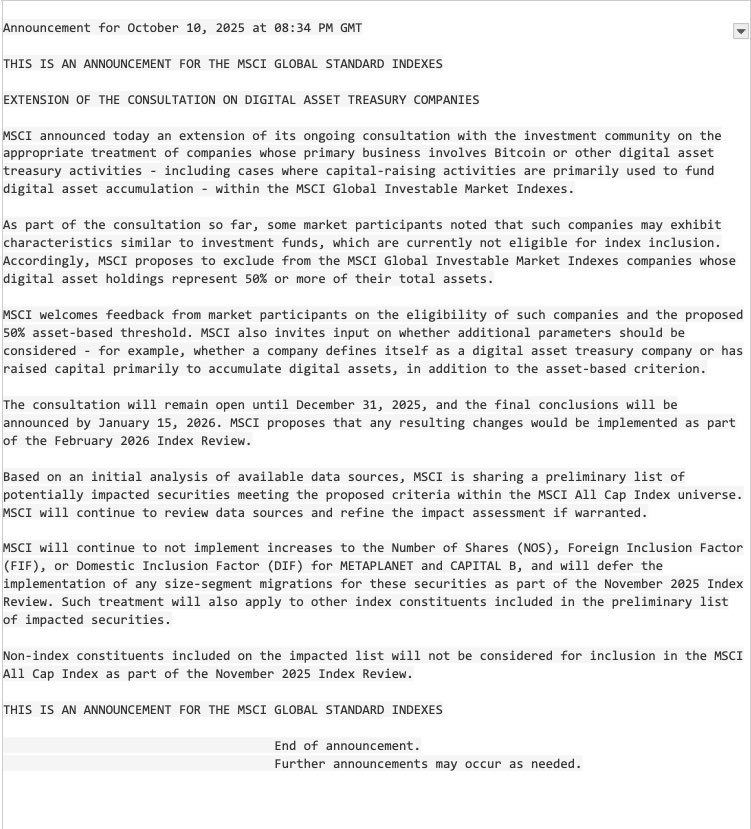

Imports haven’t gotten cheaper. Exporters aren’t absorbing costs.

A 15% tariff needs a 13% price cut to offset. A 20% tariff needs 16%.

None of that has happened.

So American consumers and businesses are footing the bill.

A 15% tariff needs a 13% price cut to offset. A 20% tariff needs 16%.

None of that has happened.

So American consumers and businesses are footing the bill.

For wealthier households, tariffs are a nuisance. For working families, they’re crushing. Disposable income gets eaten alive.

For businesses, it’s either shrink margins or raise prices. Either way: squeeze.

For businesses, it’s either shrink margins or raise prices. Either way: squeeze.

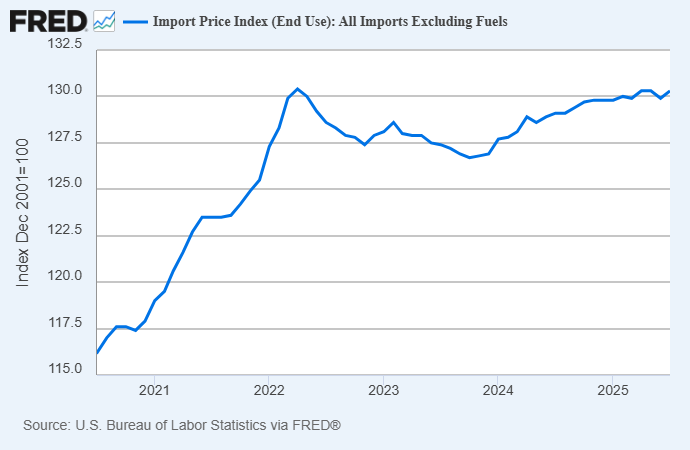

What about “bringing manufacturing back”?

The data say no. Tariffs alone aren’t sparking re-shoring. Construction spending is falling again after a subsidy-driven bump.

Carrots > sticks.

The data say no. Tariffs alone aren’t sparking re-shoring. Construction spending is falling again after a subsidy-driven bump.

Carrots > sticks.

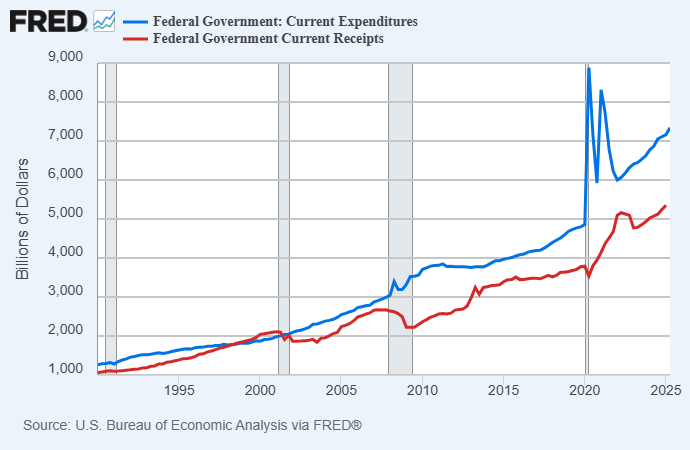

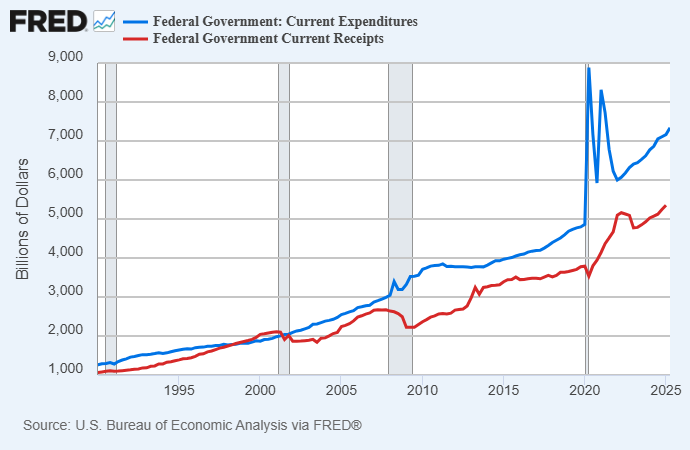

In theory, tariffs add ~$400–500B in revenue. But deficits don’t disappear.

Weaker growth means weaker tax receipts elsewhere. Net impact? Maybe ~$200B reduction.

The “Nothing Stops This Train” thesis still holds.

Weaker growth means weaker tax receipts elsewhere. Net impact? Maybe ~$200B reduction.

The “Nothing Stops This Train” thesis still holds.

The U.S. is still running ~$2T annual deficits (6–7% of GDP). Even best case, tariffs only shave that to ~5–6%.

Fiscal dominance remains. The train slows, but doesn’t stop.

That’s Bitcoin’s long-term setup.

Fiscal dominance remains. The train slows, but doesn’t stop.

That’s Bitcoin’s long-term setup.

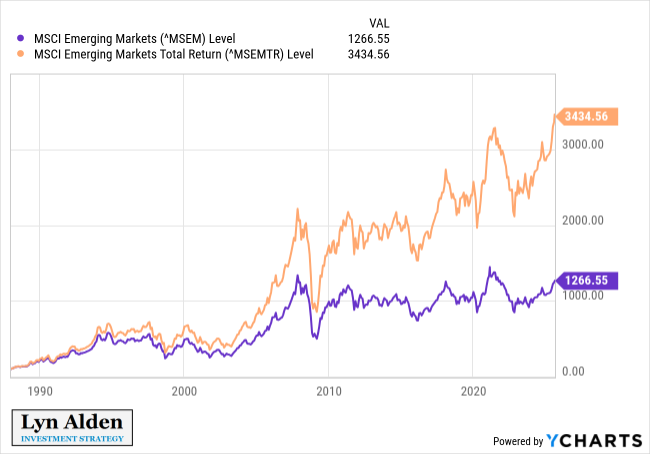

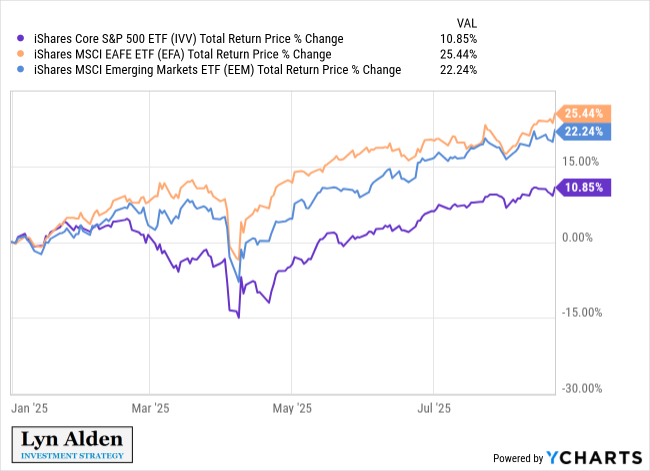

At the same time, monetary policy flips the other way.

Markets are pricing in Fed rate cuts starting in September through 2026. Dollar weaker. Liquidity looser.

That’s bullish for emerging markets, gold and especially Bitcoin.

Markets are pricing in Fed rate cuts starting in September through 2026. Dollar weaker. Liquidity looser.

That’s bullish for emerging markets, gold and especially Bitcoin.

As Lyn Alden shows, tariffs can’t fix fiscal dominance—only highlight it.

Every time the U.S. taxes and prints, the case for Bitcoin gets stronger.

Read her August 2025 newsletter: lynalden.com/august-2025-ne…

Every time the U.S. taxes and prints, the case for Bitcoin gets stronger.

Read her August 2025 newsletter: lynalden.com/august-2025-ne…

At Swan Private, we help high-net-worth investors navigate exactly this: fiscal dominance, monetary debasement, and why Bitcoin is the exit ramp.

If you’re ready to position ahead of the next wave, let’s talk.

swanbitcoin.com/private?utm_ca…

If you’re ready to position ahead of the next wave, let’s talk.

swanbitcoin.com/private?utm_ca…

• • •

Missing some Tweet in this thread? You can try to

force a refresh