A couple macro thoughts on some themes and where we stand.

The general consensus is that most think we are witnessing late cycle euphoria and likely close to a market top.

I’m open to that possibility it’s late innings but I don’t think we’ve remotely seen euphoria and I think Powell also just gave the market some monetary runway until the next Fed chair gets announced.

It is even possible Powell just ignited an even larger credit boom similar to 1998 allowing for more leverage in these growth sectors of the market like AI, Crypto, robotics, frontier tech, etc….

These bubbles tend to unwind when the leverage gets too large and the growth narrative unwinds.

So far the only real capex froth is in AI-we’ll hit that chart in a few.

First off let’s recall how the gold miner bubble unwound after 2008.

I was at a gold fund from 2010-2013 and saw the Capex bubble first hand. When the gold price finally burst the entire sector went thru a ten year deleveraging.

Now is the time to own gold miners- pricing power, insane margins, no leverage at all! Very early cycle!

The general consensus is that most think we are witnessing late cycle euphoria and likely close to a market top.

I’m open to that possibility it’s late innings but I don’t think we’ve remotely seen euphoria and I think Powell also just gave the market some monetary runway until the next Fed chair gets announced.

It is even possible Powell just ignited an even larger credit boom similar to 1998 allowing for more leverage in these growth sectors of the market like AI, Crypto, robotics, frontier tech, etc….

These bubbles tend to unwind when the leverage gets too large and the growth narrative unwinds.

So far the only real capex froth is in AI-we’ll hit that chart in a few.

First off let’s recall how the gold miner bubble unwound after 2008.

I was at a gold fund from 2010-2013 and saw the Capex bubble first hand. When the gold price finally burst the entire sector went thru a ten year deleveraging.

Now is the time to own gold miners- pricing power, insane margins, no leverage at all! Very early cycle!

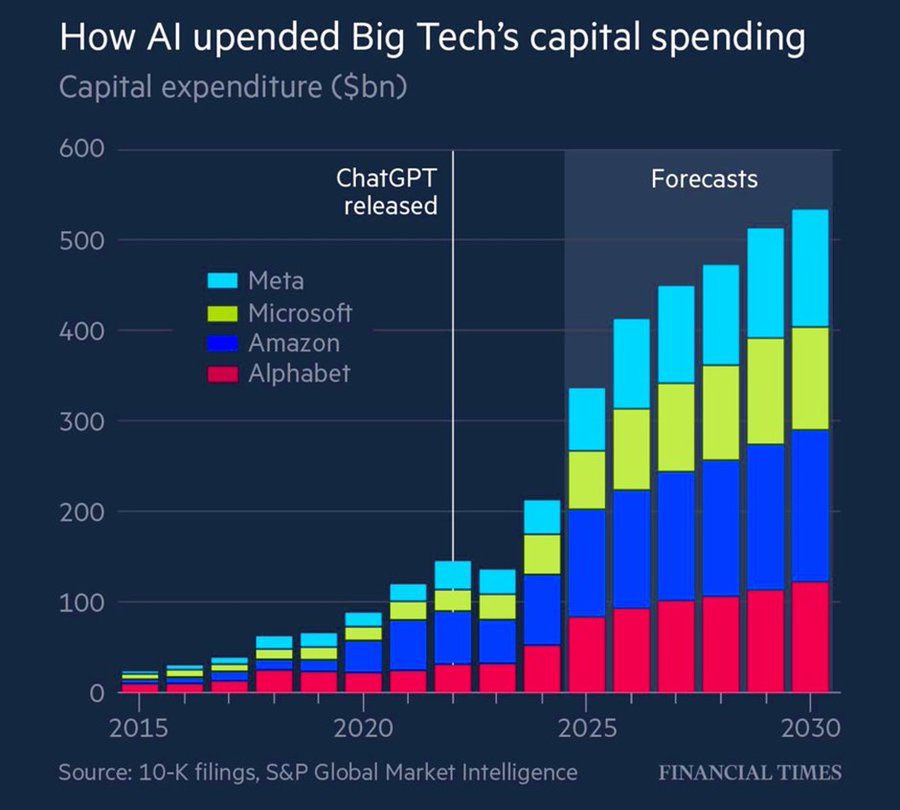

Next up let’s hit AI Capex.

$400 bln of Capex and it will add almost 2% to GDP which is insane. Outside of AI we are likely in a recession.

I think this is honestly the reason Powell hinted at easing.

I think @hkuppy nails this, but I also think it’s too early to call it a top.

We need a catalyst to burst the bubble and the credit markets are still salubrious with HY credit spreads low.

Inflation or a really bad AI bankruptcy could change the narrative here.

Stay on your toes in this sector but still has insane promise if the growth sustains.

It’s possible it does since the Govt can’t afford to lose this existential geopolitical battle.

$400 bln of Capex and it will add almost 2% to GDP which is insane. Outside of AI we are likely in a recession.

I think this is honestly the reason Powell hinted at easing.

I think @hkuppy nails this, but I also think it’s too early to call it a top.

We need a catalyst to burst the bubble and the credit markets are still salubrious with HY credit spreads low.

Inflation or a really bad AI bankruptcy could change the narrative here.

Stay on your toes in this sector but still has insane promise if the growth sustains.

It’s possible it does since the Govt can’t afford to lose this existential geopolitical battle.

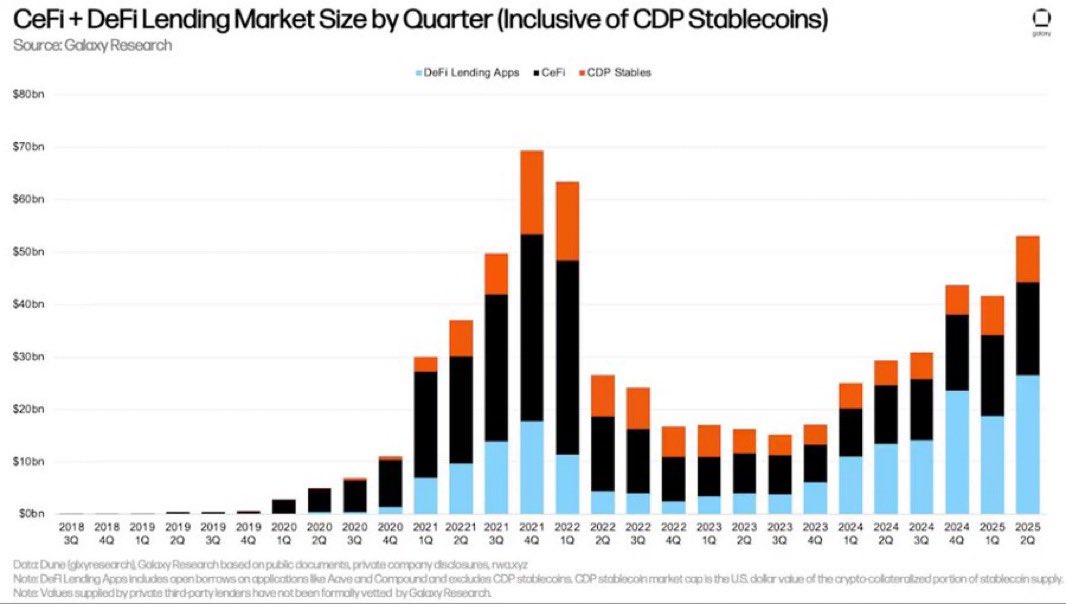

Last theme everyone wants to call a top in is crypto.

Remember that feeling of Euphoria of the FTX leverage and Genesis lending money hand over fist?

We have a lot more collateral in the crypto ecosystem now that is generating real revenue and leverage isn’t even remotely where it was in 2021.

I think we are still relatively early cycle in crypto.

When the capex and leverage spikes, beware.

If inflation goes up slowly this bull market has legs. If there is an outlier inflation number that spikes stay on your toes.

Watch credit spreads, but more importantly watch the charts.

We have not broken any serious downside levels yet.

Most of the pullback is just washing out the fast money leveraged retail traders.

Stay tuned sports fans!

@DTAPCAP @RaoulGMI @LynAldenContact

Remember that feeling of Euphoria of the FTX leverage and Genesis lending money hand over fist?

We have a lot more collateral in the crypto ecosystem now that is generating real revenue and leverage isn’t even remotely where it was in 2021.

I think we are still relatively early cycle in crypto.

When the capex and leverage spikes, beware.

If inflation goes up slowly this bull market has legs. If there is an outlier inflation number that spikes stay on your toes.

Watch credit spreads, but more importantly watch the charts.

We have not broken any serious downside levels yet.

Most of the pullback is just washing out the fast money leveraged retail traders.

Stay tuned sports fans!

@DTAPCAP @RaoulGMI @LynAldenContact

• • •

Missing some Tweet in this thread? You can try to

force a refresh