Macro, Husband, Dad of 3 boys

Comments are my own personal opinion; not investment advice and not attributable to my employer.

Co-Host of @ForwardGuidance

How to get URL link on X (Twitter) App

If productivity gains are in the 100%+ then the choice to keep your money in Fiat Currency becomes obsolete.

If productivity gains are in the 100%+ then the choice to keep your money in Fiat Currency becomes obsolete.

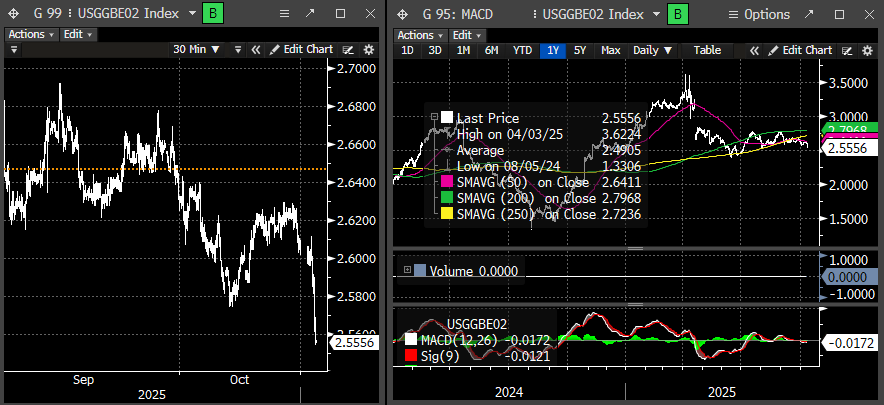

HY Credit CDS is a bit jumpy today.

HY Credit CDS is a bit jumpy today.

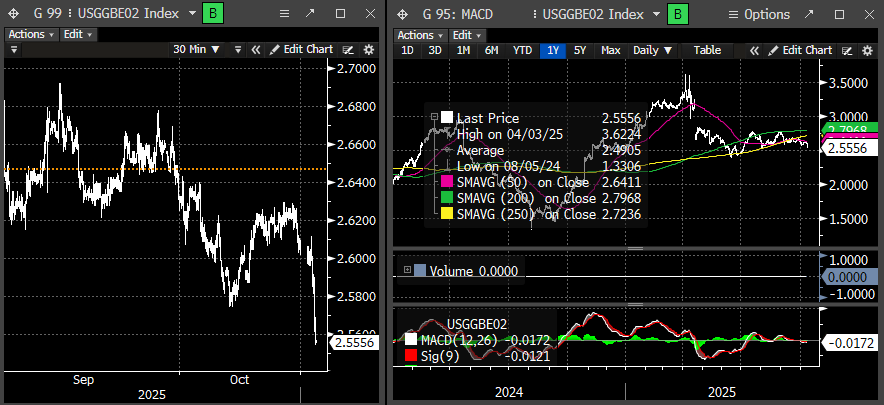

Credit Tightened a bit and HYG broke the 50 day. This will be important to watch going forward to see if the longer term bull has ended, but the economy is in way different shape and a lot of debt has been termed out.

Credit Tightened a bit and HYG broke the 50 day. This will be important to watch going forward to see if the longer term bull has ended, but the economy is in way different shape and a lot of debt has been termed out.