🚨Health insurance plan with NO LIMITS?

That’s what Niva Bupa ReAssure 3.0 promises.

👉Unlimited cover

👉Day 1 coverage for 145 PEDs

👉OPD, global coverage

...and more

But is it really as limitless as it sounds?🤔

Let's break it down👇

#BeshakDecodes #review #notsponsored

That’s what Niva Bupa ReAssure 3.0 promises.

👉Unlimited cover

👉Day 1 coverage for 145 PEDs

👉OPD, global coverage

...and more

But is it really as limitless as it sounds?🤔

Let's break it down👇

#BeshakDecodes #review #notsponsored

🏥 First, what’s different about ReAssure 3.0?

It comes with an unlimited cover model - without bonus or restore benefits.

You can make multiple claims in a year, without worrying about exhausting your sum insured.

It comes with an unlimited cover model - without bonus or restore benefits.

You can make multiple claims in a year, without worrying about exhausting your sum insured.

🛏️ But unlimited cover ≠ unlimited room choices.

There are 4 variants, and the room rent limit varies across each:

• Classic: General room

• Select: Twin sharing room

• Elite: Any room (except Deluxe, Suite)

• Black: Any room

There are 4 variants, and the room rent limit varies across each:

• Classic: General room

• Select: Twin sharing room

• Elite: Any room (except Deluxe, Suite)

• Black: Any room

Choosing a higher room than eligible?

You’ll have to bear proportionate deductions.

beshak.org/insurance/heal…

You’ll have to bear proportionate deductions.

beshak.org/insurance/heal…

🩺 Key features across variants:

• All day-care treatments covered

• Pre-hospitalisation: 60 days

• Post-hospitalisation: 180 days

• Organ donor & domiciliary: covered up to SI

• Modern treatments: ₹1L limit (Classic/Select), no limit (Elite/Black)

• All day-care treatments covered

• Pre-hospitalisation: 60 days

• Post-hospitalisation: 180 days

• Organ donor & domiciliary: covered up to SI

• Modern treatments: ₹1L limit (Classic/Select), no limit (Elite/Black)

📍Lock the Clock:

Under Elite & Black variants, your age gets locked at entry for premium calculation - until you make a claim.

⚠️Premiums may still change based on external factors like inflation, etc.

Under Elite & Black variants, your age gets locked at entry for premium calculation - until you make a claim.

⚠️Premiums may still change based on external factors like inflation, etc.

⌛ Waiting periods:

• For specific illnesses: 24 months (can reduce to 12 months or increase to 36 months, with a rider)

• For PEDs: 36 months (can reduce to 24/12 months, with a rider)

• For specific illnesses: 24 months (can reduce to 12 months or increase to 36 months, with a rider)

• For PEDs: 36 months (can reduce to 24/12 months, with a rider)

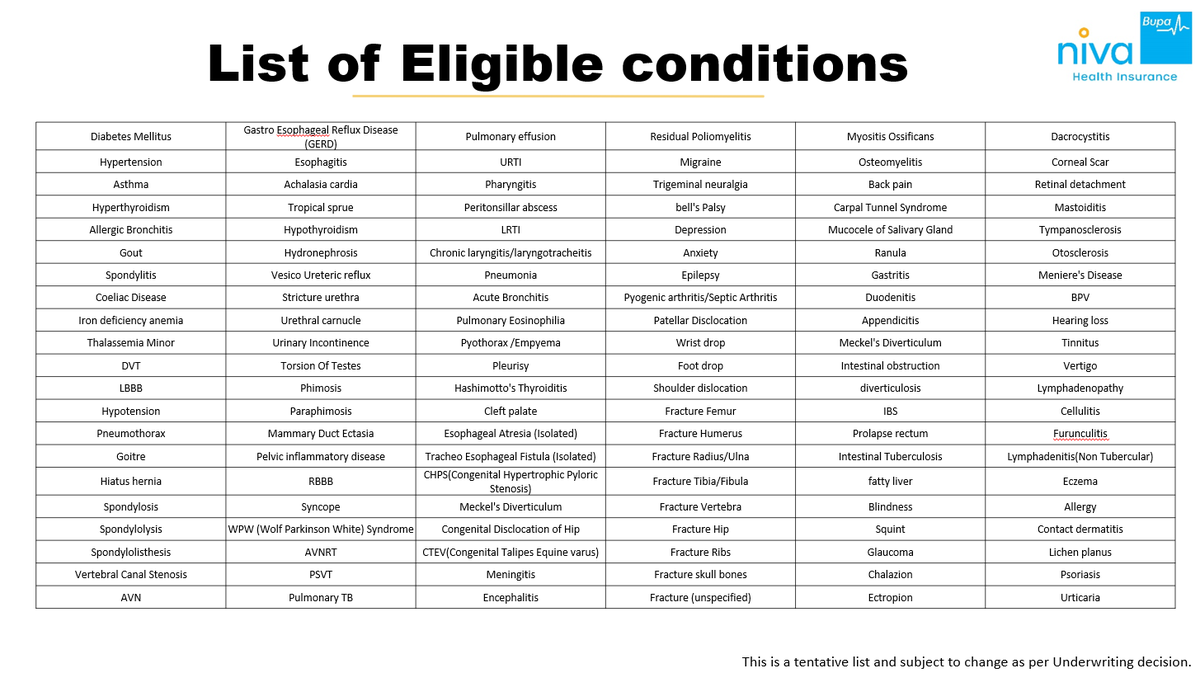

It also covers around 145 conditions covered from Day 1 if you choose to pay loading i.e. extra premium (check below image for the list of PEDs)

⚠️ Just note: Below list is tentative and final approval depends on underwriting.

⚠️ Just note: Below list is tentative and final approval depends on underwriting.

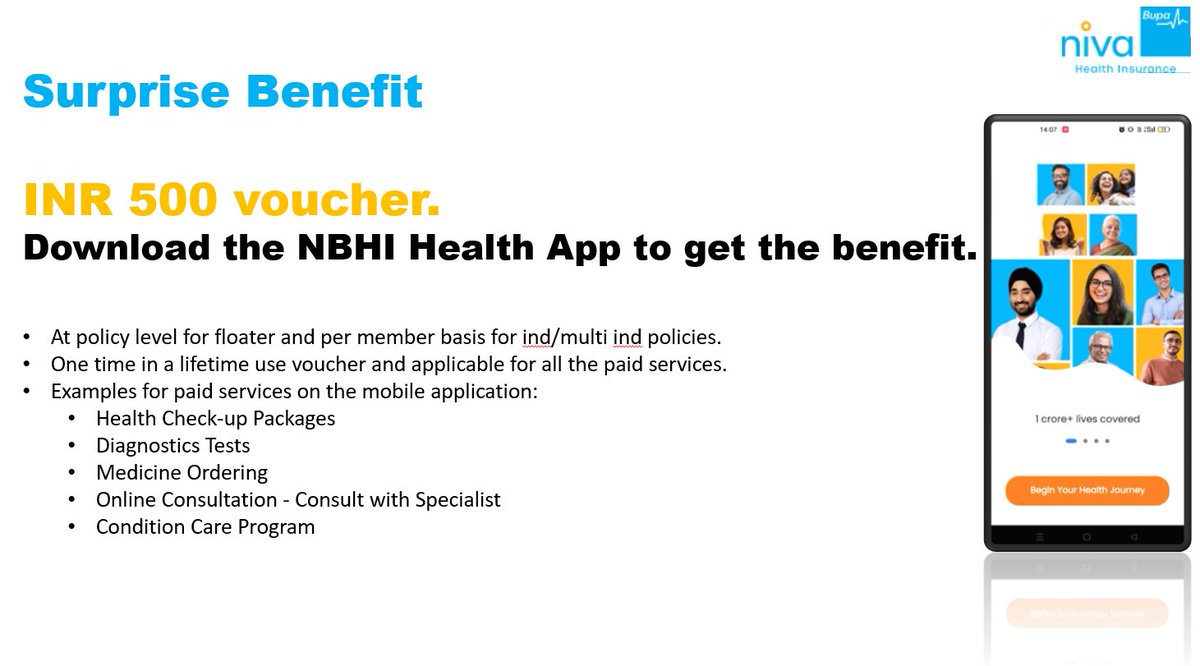

🧩 Then there’s Niva Bupa One - a membership offering:

✅ Priority claim handling

✅ Dedicated support

Interesting promise - we’ll need to see how it plays out during real claims.

✅ Priority claim handling

✅ Dedicated support

Interesting promise - we’ll need to see how it plays out during real claims.

💸 Copay & Deductible

There isn't any mandatory copay or deductible under the plan.

However, you can voluntarily opt for co-pay and deductible to lower your premium.

There isn't any mandatory copay or deductible under the plan.

However, you can voluntarily opt for co-pay and deductible to lower your premium.

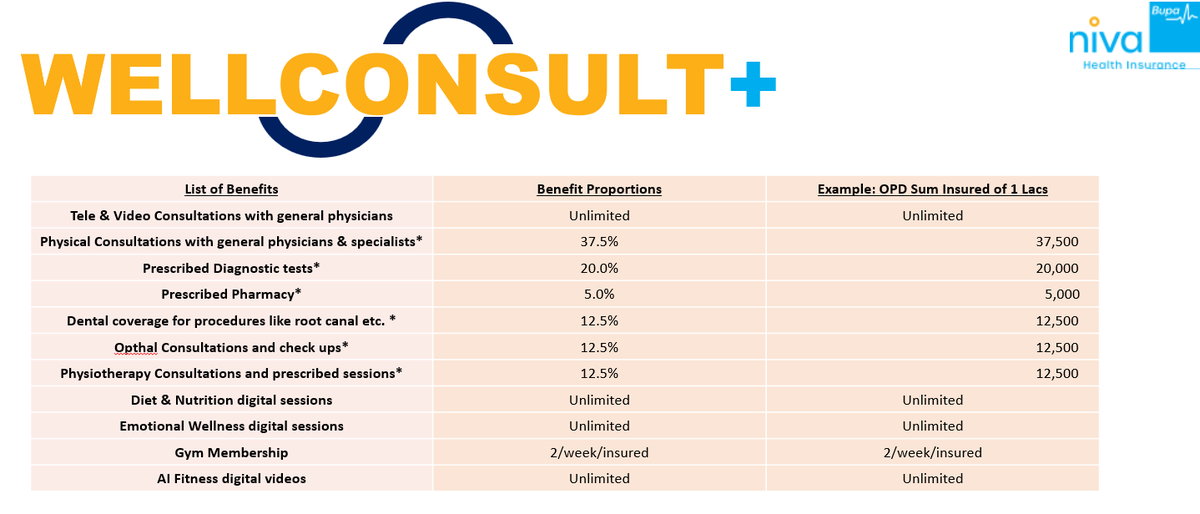

There are 10 benefits available under the OPD cover.

⚠️ If you claim via reimbursement, you’ll have to bear 20% of the approved claim amount as co-pay.

⚠️ If you claim via reimbursement, you’ll have to bear 20% of the approved claim amount as co-pay.

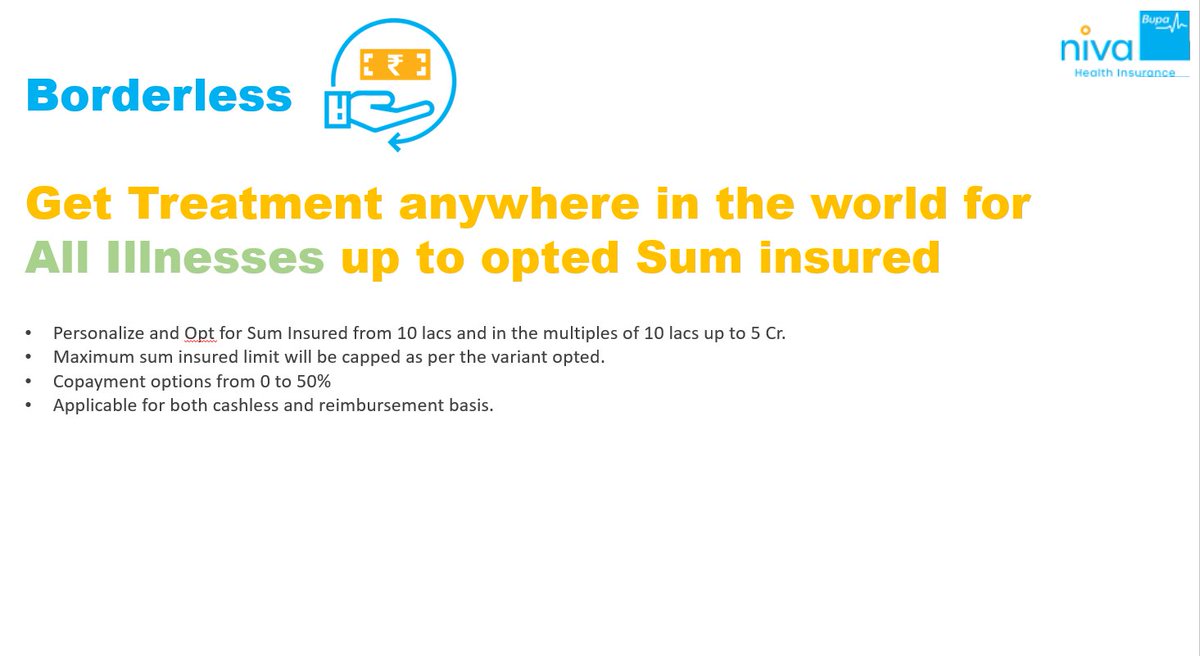

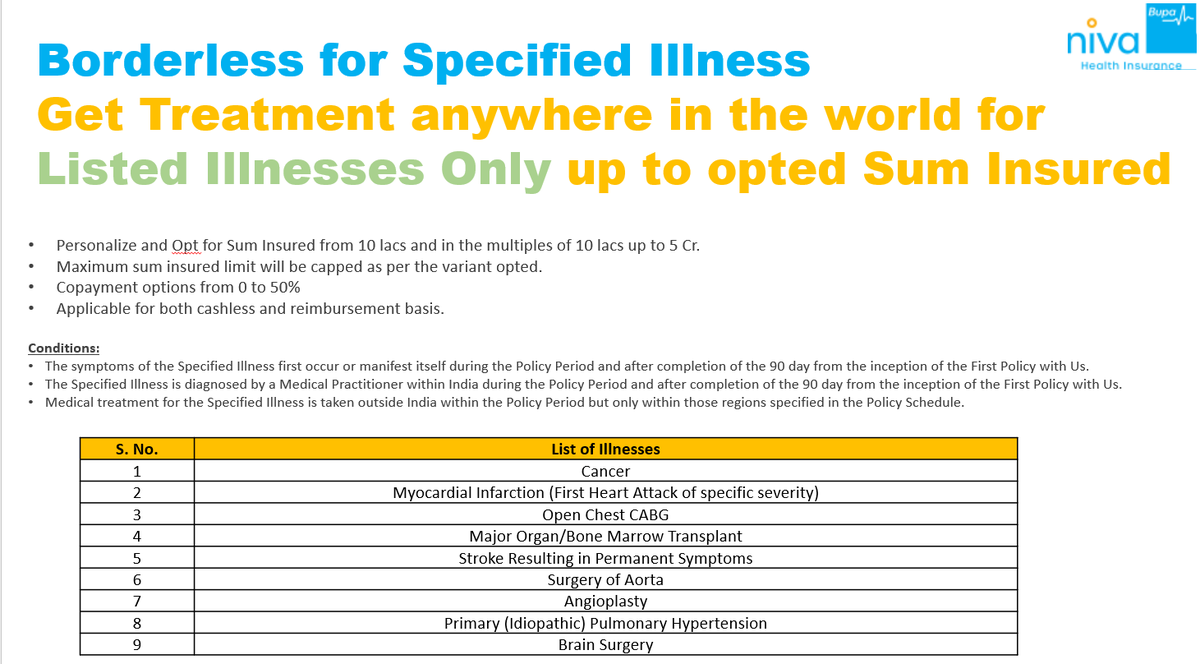

🌍 Want global coverage? You’ve got 2 options:

1️⃣ Borderless: Covers all illnesses globally

2️⃣ Borderless Select: Covers listed illnesses (like cancer, angioplasty, etc.)

1️⃣ Borderless: Covers all illnesses globally

2️⃣ Borderless Select: Covers listed illnesses (like cancer, angioplasty, etc.)

There's also an add-on that gives you a cashback for every year that you don’t make a claim under the plan. 💰

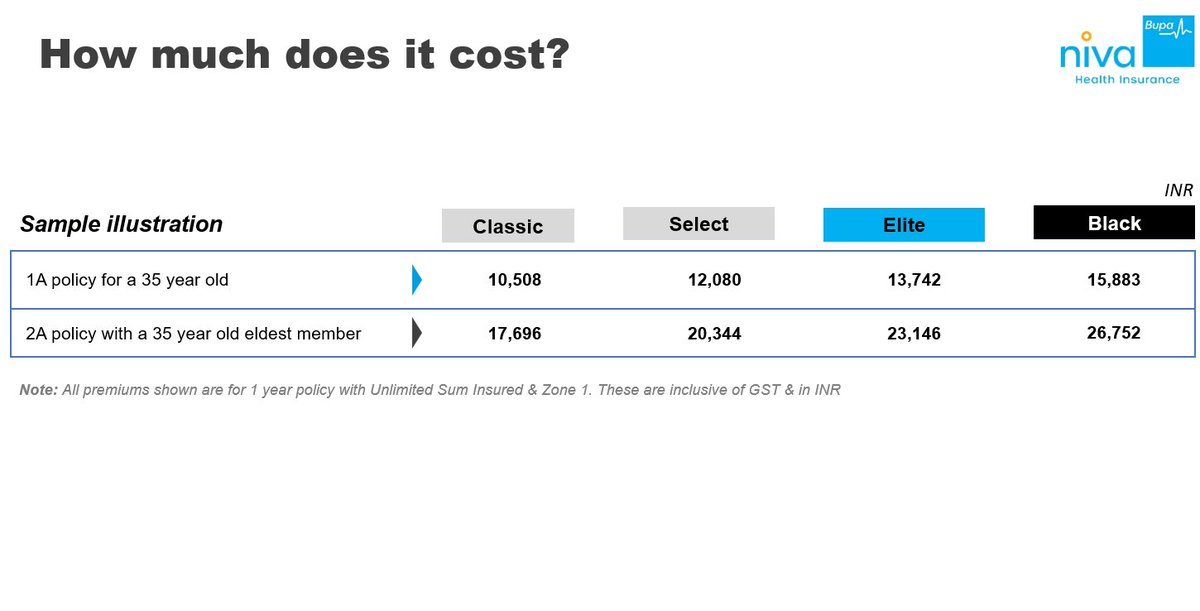

💸 And now, the big question - how expensive is the plan?

Here’s what the base premium looks like for a 35-year-old living in Zone 1 👇

Here’s what the base premium looks like for a 35-year-old living in Zone 1 👇

The detailed policy wording for ReAssure 3.0 is not yet publicly available.

As soon as it's released, we’ll update our Health Decoder tool with a complete breakdown of the plan’s features and fine print.

In the meantime, you can analyse & compare other plans already decoded on our website:

beshak.org/insurance/heal…

As soon as it's released, we’ll update our Health Decoder tool with a complete breakdown of the plan’s features and fine print.

In the meantime, you can analyse & compare other plans already decoded on our website:

beshak.org/insurance/heal…

Learned something new?

Let others make notes too.

Retweet the first tweet below and follow @BeshakIN for more :)

Let others make notes too.

Retweet the first tweet below and follow @BeshakIN for more :)

https://twitter.com/1281287883773505536/status/1960216866795958514

Thank you for your response.

For people who don't know, we are India's only independent research platform for insurance.

We help people find the right plans, experts - without getting influenced by insurers or their commissions

For people who don't know, we are India's only independent research platform for insurance.

We help people find the right plans, experts - without getting influenced by insurers or their commissions

• • •

Missing some Tweet in this thread? You can try to

force a refresh