Financial Statements For Beginners

Want to learn accounting?

Study these 9 simple infographics (a visual thread) ↓

Want to learn accounting?

Study these 9 simple infographics (a visual thread) ↓

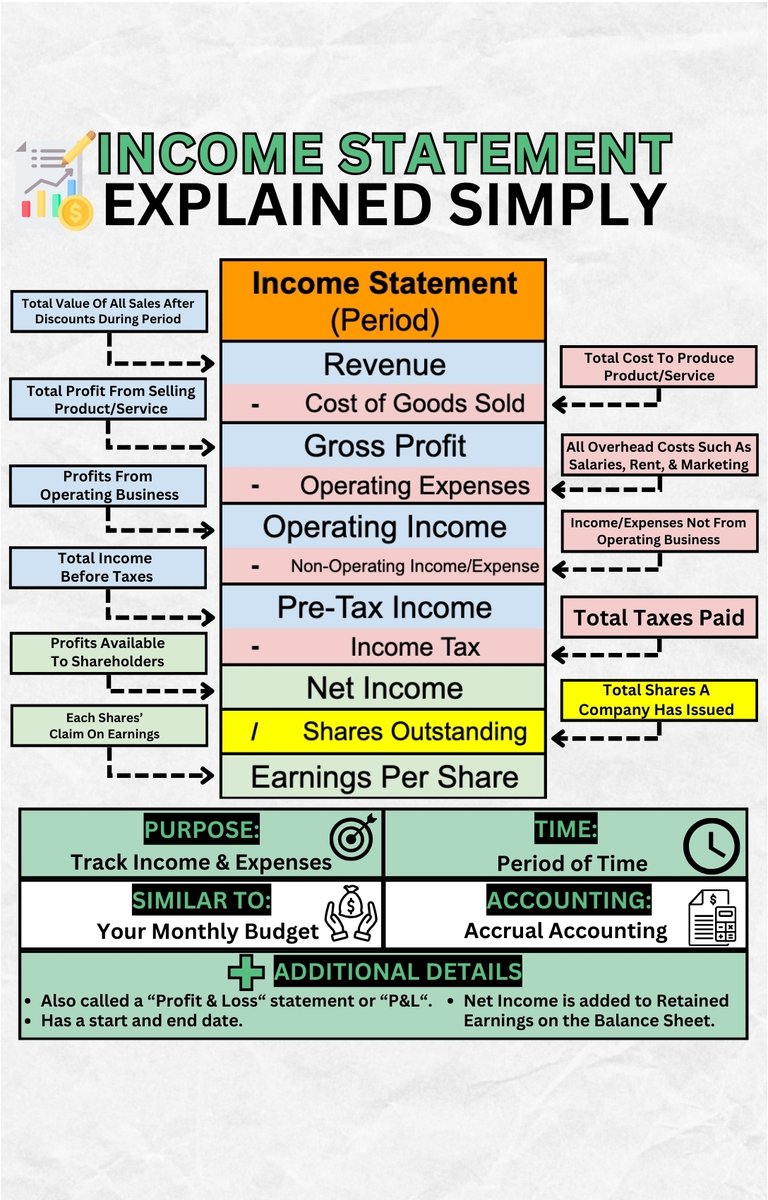

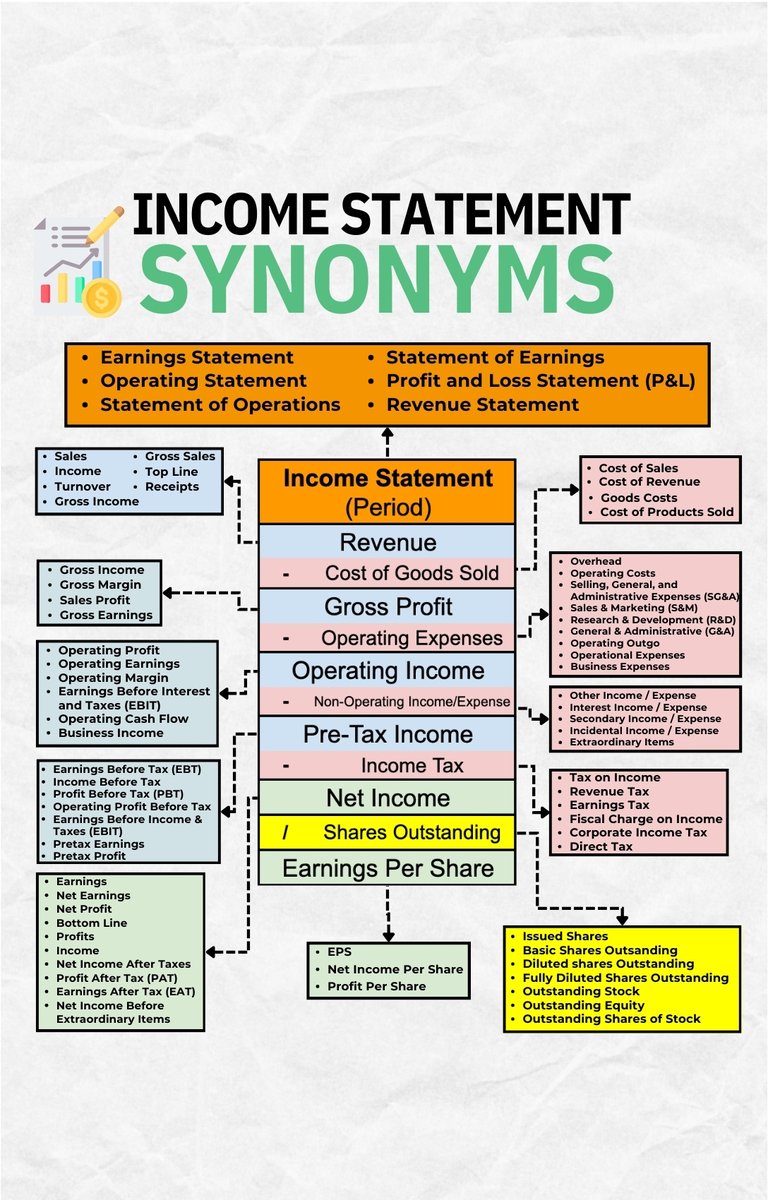

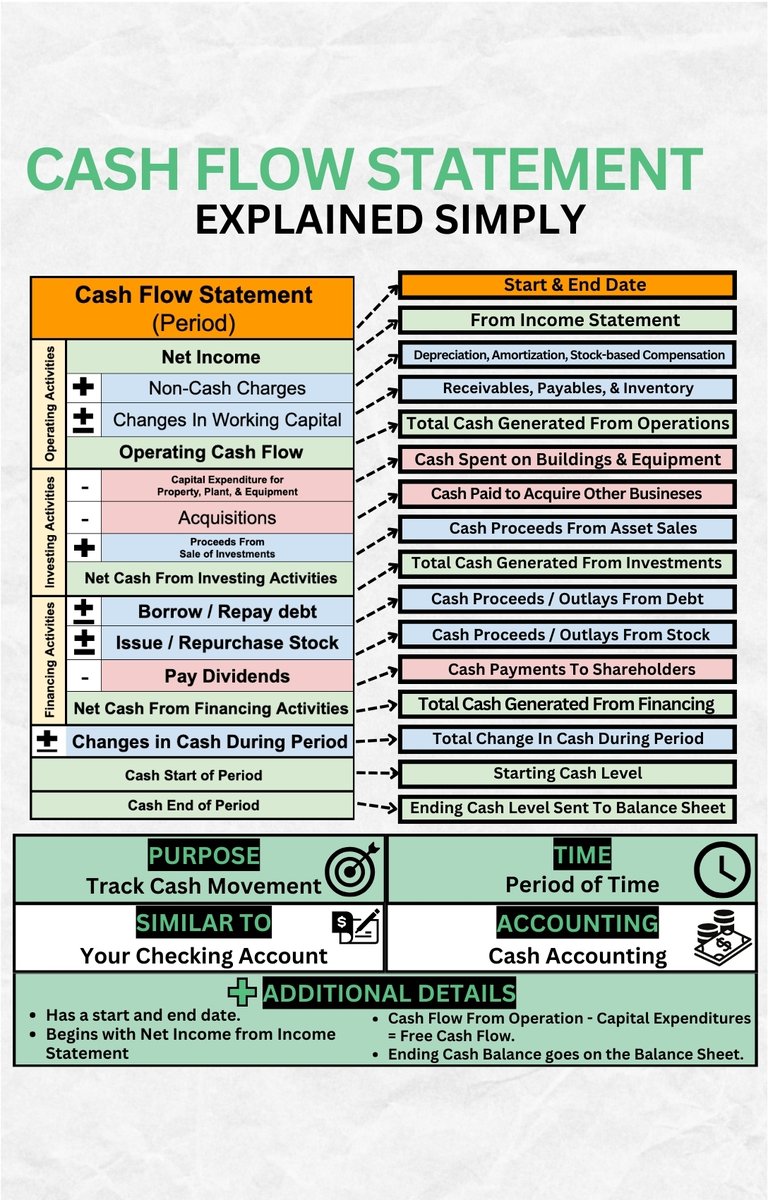

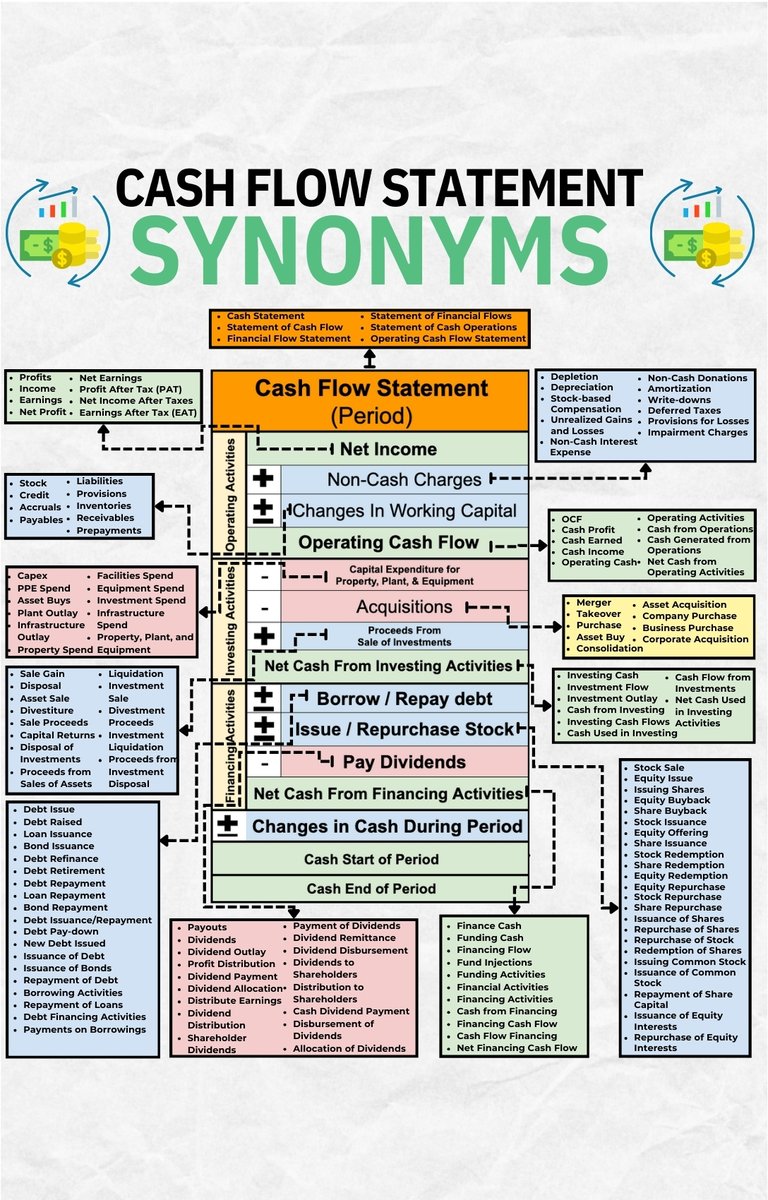

Financial Statements DO NOT have a universal layout

Here are some other balance sheet terms you might see:

Here are some other balance sheet terms you might see:

Follow me @BrianFeroldi for more content like this.

Want to share with your audience?

Retweet the first tweet below:

Want to share with your audience?

Retweet the first tweet below:

https://twitter.com/61558281/status/1960324690364223496

• • •

Missing some Tweet in this thread? You can try to

force a refresh