The Fed drama worsens:

President Trump just signed an Executive Order which "fired" Fed Governor Cook due to a "Criminal Referral."

Never in the 111-year history of the Fed has a President fired a Fed Governor.

This would COMPLETELY shift the Fed. Here's why:

(a thread)

President Trump just signed an Executive Order which "fired" Fed Governor Cook due to a "Criminal Referral."

Never in the 111-year history of the Fed has a President fired a Fed Governor.

This would COMPLETELY shift the Fed. Here's why:

(a thread)

On August 25th, Trump published an Executive Order:

It cites Article II of the Constitution and the Federal Reserve Act, claiming she can be removed “for cause.”

The alleged “cause” is a criminal referral accusing Fed Governor Cook of false statements on mortgage documents.

It cites Article II of the Constitution and the Federal Reserve Act, claiming she can be removed “for cause.”

The alleged “cause” is a criminal referral accusing Fed Governor Cook of false statements on mortgage documents.

The "cause" stems from FHFA Director Bill Pulte:

He submitted a criminal referral to the DOJ alleging she declared 2 different properties as her "primary residence."

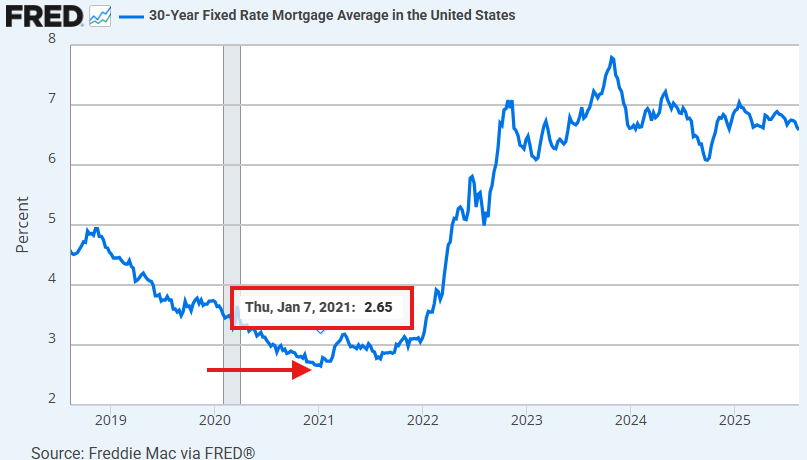

This occurred within a 2-week span in 2021, one in MI and one in GA.

Trump has called this "mortgage fraud."

He submitted a criminal referral to the DOJ alleging she declared 2 different properties as her "primary residence."

This occurred within a 2-week span in 2021, one in MI and one in GA.

Trump has called this "mortgage fraud."

But, here's why Trump cares so much:

There are 7 Fed Governors, including Fed Chair Powell, who vote on interest rate policy.

Currently, excluding Powell, Trump has appointed 3 of these 7.

If he is able to replace Fed Governor Cook, Trump-appointees would be the MAJORITY.

There are 7 Fed Governors, including Fed Chair Powell, who vote on interest rate policy.

Currently, excluding Powell, Trump has appointed 3 of these 7.

If he is able to replace Fed Governor Cook, Trump-appointees would be the MAJORITY.

As it stands, Fed Governor Cook's term does not expire until January 2038.

The Federal Reserve Act says they serve 14-year terms and can only be removed “for cause.”

This is intended to isolate the Fed from political pressure to allow it to function "independently."

The Federal Reserve Act says they serve 14-year terms and can only be removed “for cause.”

This is intended to isolate the Fed from political pressure to allow it to function "independently."

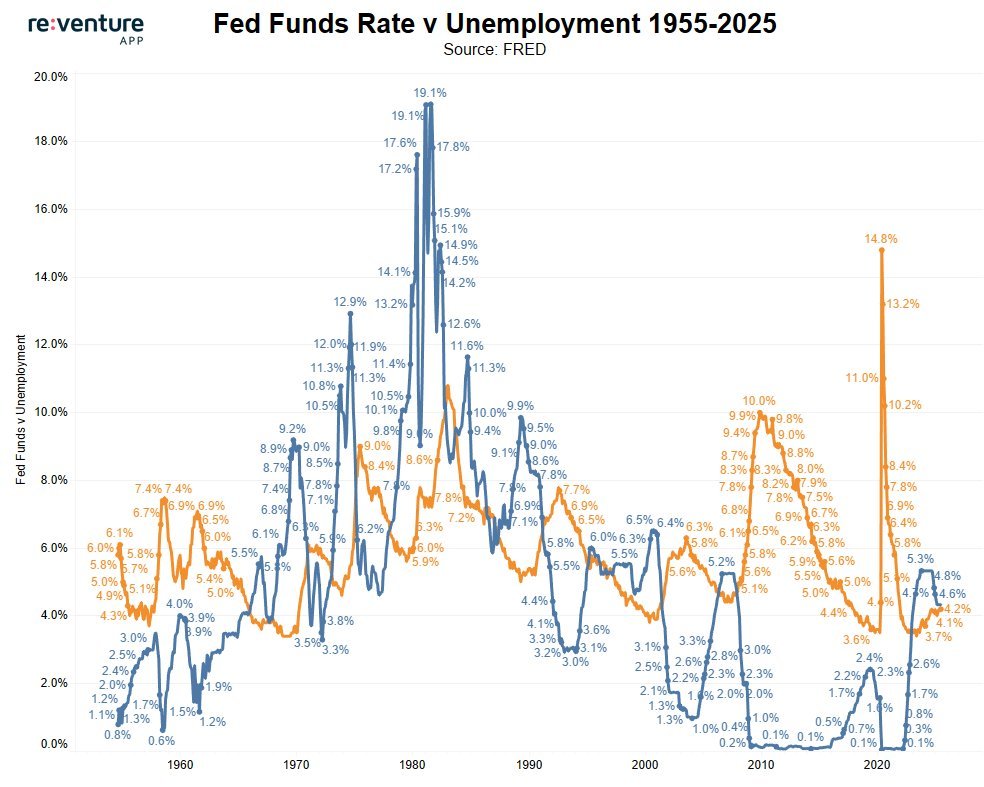

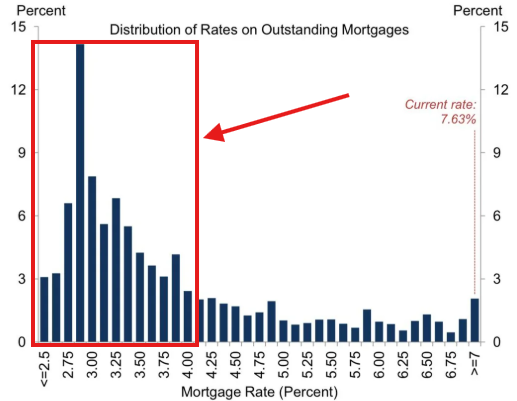

If Cook is removed, Trump's path to rate cuts becomes far more certain.

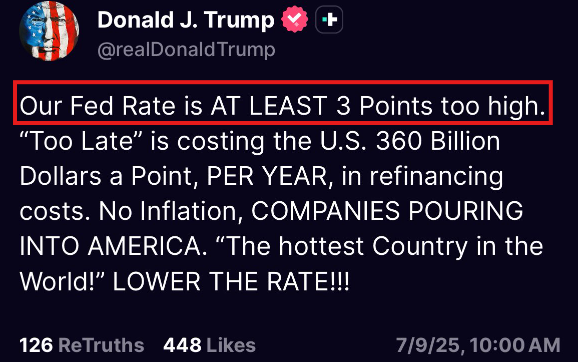

Trump is calling for 300 bps of rate cuts.

This would be 3 TIMES larger than the 100 bps cut on March 15th, 2020, the largest in history.

Governor Miran is already stating he is ready to cut rates.

Trump is calling for 300 bps of rate cuts.

This would be 3 TIMES larger than the 100 bps cut on March 15th, 2020, the largest in history.

Governor Miran is already stating he is ready to cut rates.

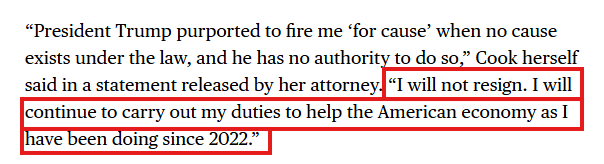

Hours ago, Fed Governor Cook and her lawyer responded:

She said that President Trump has no authority to fire her and that she will not resign.

Fed Governor Cook’s lawyer said they plan to take “whatever actions are needed to prevent” Trump’s “illegal action.”

She said that President Trump has no authority to fire her and that she will not resign.

Fed Governor Cook’s lawyer said they plan to take “whatever actions are needed to prevent” Trump’s “illegal action.”

This leaves the Fed in a difficult position:

Will Cook be able to resume duties as a Fed Governor while this case goes through the courts?

If so, would a ruling upholding Trump's Executive Order be applied retroactively?

This case is unprecedented and so are its implications.

Will Cook be able to resume duties as a Fed Governor while this case goes through the courts?

If so, would a ruling upholding Trump's Executive Order be applied retroactively?

This case is unprecedented and so are its implications.

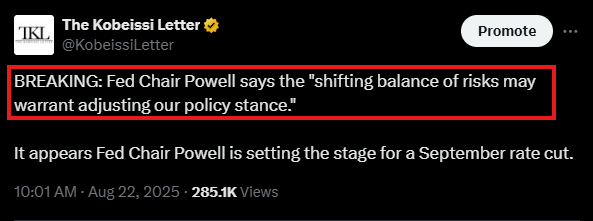

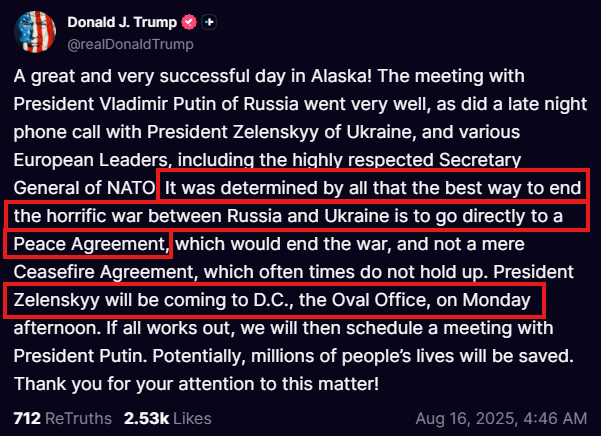

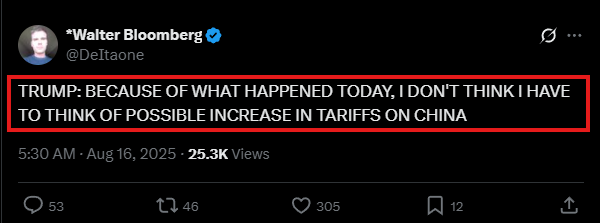

Ultimately, with or without Fed Governor Cook, a 25 bps rate cut is coming in 1 month.

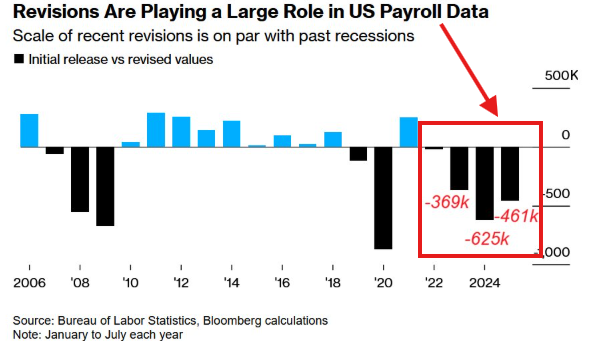

On Friday, Powell said the "shifting balance of risks may warrant adjusting our policy stance."

As the labor market slows down, the Fed will CUT rates and blame a "weaker labor market."

On Friday, Powell said the "shifting balance of risks may warrant adjusting our policy stance."

As the labor market slows down, the Fed will CUT rates and blame a "weaker labor market."

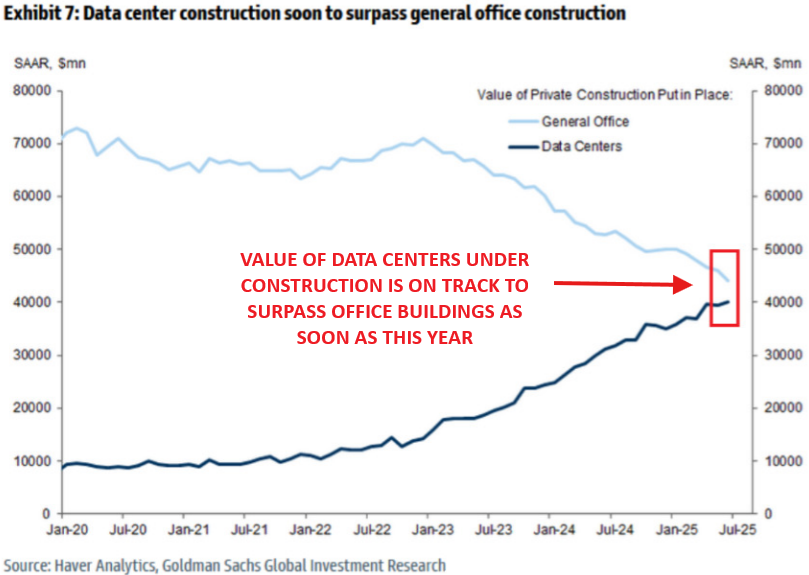

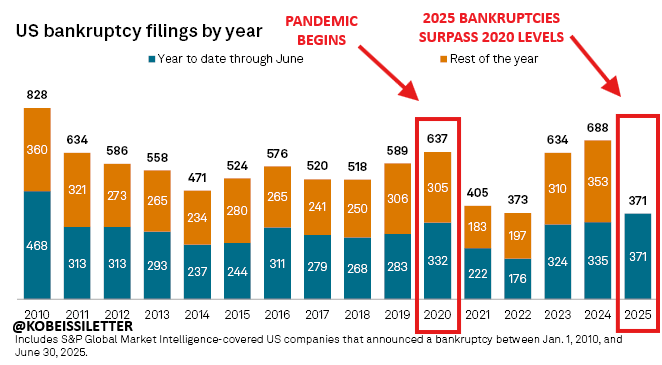

Ongoing changes at the Fed will have huge market implications:

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are investable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and crypto are investable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

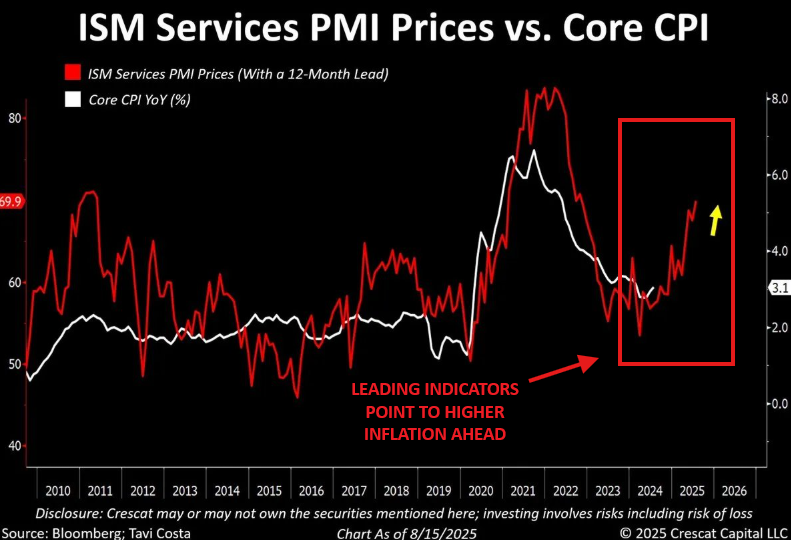

The Fed is set to cut rates with Core CPI inflation ABOVE 3%.

Since 1985, the Fed has only cut rates 1 time with Core CPI above 3% AND the 3m change was >0.3%: in 1990-1991.

It's a great time to own assets.

Follow us @KobeissiLetter for real time analysis as this develops.

Since 1985, the Fed has only cut rates 1 time with Core CPI above 3% AND the 3m change was >0.3%: in 1990-1991.

It's a great time to own assets.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh