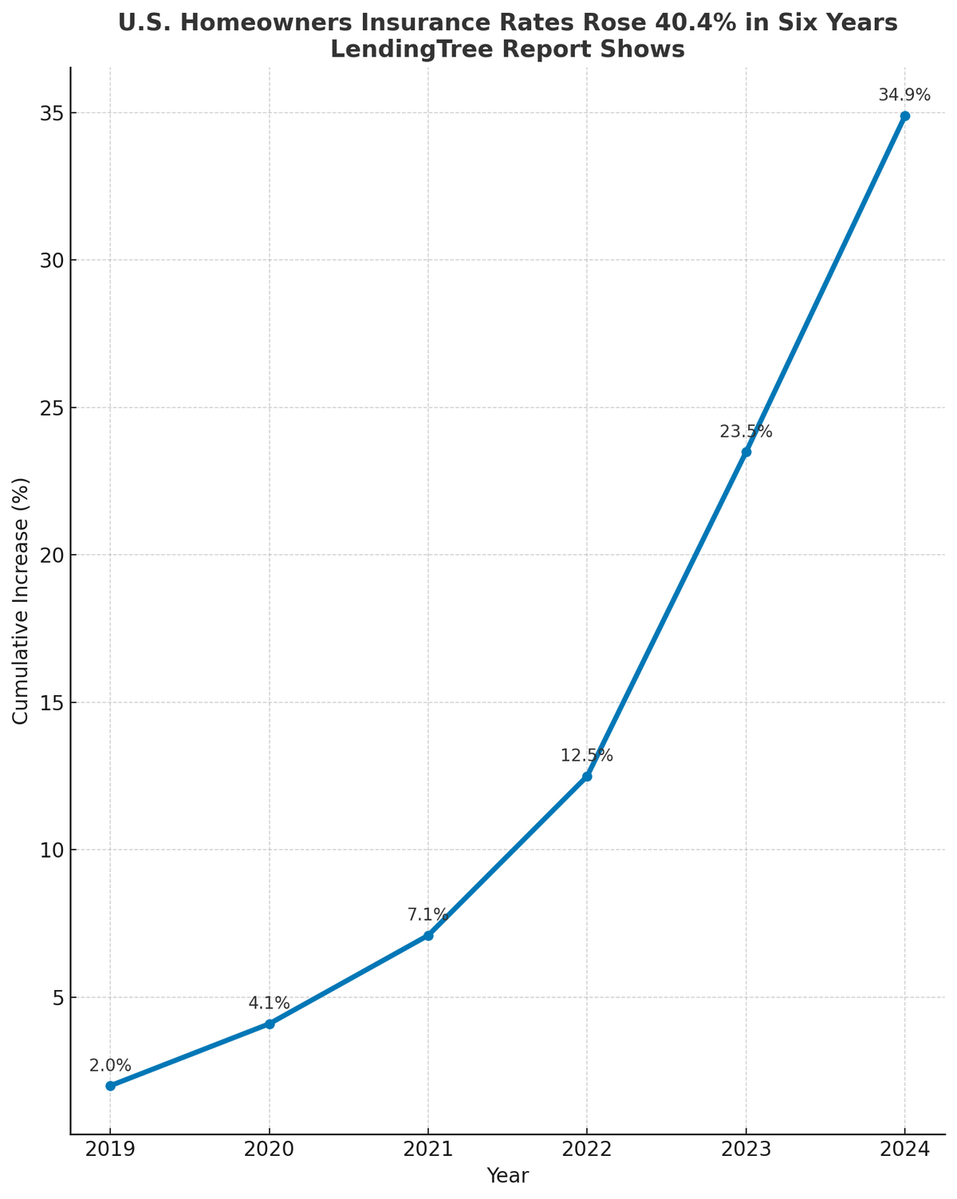

Private equity is losing millions in their $600B apartment empire.

They own 2.2 million U.S. apartments.

But they missed one insurance rule that's costing them a fortune.

Smart property owners are quietly cashing in.

The exact loophole they're using:

They own 2.2 million U.S. apartments.

But they missed one insurance rule that's costing them a fortune.

Smart property owners are quietly cashing in.

The exact loophole they're using:

Construction defect rights can be assigned to subsequent purchasers.

You don't need to be the original owner.

You can recover from contractor insurance years after buying the property.

Most purchase agreements completely miss this:

You don't need to be the original owner.

You can recover from contractor insurance years after buying the property.

Most purchase agreements completely miss this:

Standard PSAs only transfer "warranties."

That leaves millions on the table.

Smart buyers demand assignment of ALL construction-related claims.

This includes tort, negligence, and third-party beneficiary rights.

One paragraph unlocks everything:

That leaves millions on the table.

Smart buyers demand assignment of ALL construction-related claims.

This includes tort, negligence, and third-party beneficiary rights.

One paragraph unlocks everything:

These aren't maintenance issues.

Water intrusion. Fire safety violations. Structural failures.

They're construction defects covered by insurance.

The money comes from contractor CGL policies and design professional liability.

Not from sellers or previous owners:

Water intrusion. Fire safety violations. Structural failures.

They're construction defects covered by insurance.

The money comes from contractor CGL policies and design professional liability.

Not from sellers or previous owners:

Property condition assessments look for obvious problems.

They miss latent envelope defects.

They can't spot concealed code violations.

Standard due diligence doesn't distinguish recoverable defects from normal wear.

This blind spot costs institutional investors billions:

They miss latent envelope defects.

They can't spot concealed code violations.

Standard due diligence doesn't distinguish recoverable defects from normal wear.

This blind spot costs institutional investors billions:

Statutes of repose create hard deadlines.

Usually 6-10 years from completion.

Miss that window? Recovery becomes impossible.

No exceptions. No extensions.

We've seen owners lose millions by missing deadlines by weeks:

Usually 6-10 years from completion.

Miss that window? Recovery becomes impossible.

No exceptions. No extensions.

We've seen owners lose millions by missing deadlines by weeks:

A $120M apartment complex with $6M in defects changes everything.

That's a 5% basis reduction immediately.

Every $1 of preserved NOI adds $18 in value at a 5.5% exit cap.

IRR impact can exceed 200 basis points.

Yet most buyers never investigate:

That's a 5% basis reduction immediately.

Every $1 of preserved NOI adds $18 in value at a 5.5% exit cap.

IRR impact can exceed 200 basis points.

Yet most buyers never investigate:

The recovery process works in virtually every state.

But you need the right legal framework.

Proper assignment language at purchase.

Documentation before statutes expire.

Expert navigation of insurance carrier requirements:

But you need the right legal framework.

Proper assignment language at purchase.

Documentation before statutes expire.

Expert navigation of insurance carrier requirements:

Over 20 years, we've recovered millions from "normal aging."

Persistent leaks weren't bad luck.

HVAC failures weren't random.

Envelope degradation wasn't wear and tear.

They were design and construction defects with available insurance coverage:

Persistent leaks weren't bad luck.

HVAC failures weren't random.

Envelope degradation wasn't wear and tear.

They were design and construction defects with available insurance coverage:

Current apartment owners have unrealized recoveries right now.

That 7-year-old property with water issues?

The 5-year-old complex with systematic failures?

Those patterns indicate recoverable construction defects.

Insurance carriers are obligated to pay:

That 7-year-old property with water issues?

The 5-year-old complex with systematic failures?

Those patterns indicate recoverable construction defects.

Insurance carriers are obligated to pay:

At Gravely PC, we've systematized this recovery process.

We work on pure contingency.

You pay nothing unless we recover.

Recovery experts on insurance issues

We're the only Texas firm with insurance expertise specializing in this exact work:

We work on pure contingency.

You pay nothing unless we recover.

Recovery experts on insurance issues

We're the only Texas firm with insurance expertise specializing in this exact work:

If you own institutional property in Texas, you likely have recoverable defects.

We know which carriers to pursue.

We know the deadlines that matter.

We know how to maximize your recovery.

Let's unlock the value hiding in your properties.

We know which carriers to pursue.

We know the deadlines that matter.

We know how to maximize your recovery.

Let's unlock the value hiding in your properties.

I'm Marc Gravely

• Texas Business Champion

• Founder of Gravely PC, specializing in construction defects/insurance recovery

• Former insurance defense attorney who saw the light

Follow @MarcGravely for insights on the daily influence of insurance

Repost to help others grow

• Texas Business Champion

• Founder of Gravely PC, specializing in construction defects/insurance recovery

• Former insurance defense attorney who saw the light

Follow @MarcGravely for insights on the daily influence of insurance

Repost to help others grow

Video/Image Credits:

- The Structural World: youtube.com/watch?v=hRMuRH…

- miribina: youtube.com/watch?v=czHETu…

- cnbc: youtube.com/watch?v=mUijsC…

- The Structural World: youtube.com/watch?v=hRMuRH…

- miribina: youtube.com/watch?v=czHETu…

- cnbc: youtube.com/watch?v=mUijsC…

• • •

Missing some Tweet in this thread? You can try to

force a refresh