MMT vs Old School impact of interest rates 101

These are my thoughts which could be completely wrong and have been formed by a fair amount but not exhaustive readings on MMT. Try to read this as a work in progress and a middle ground between two extreme views.

These are my thoughts which could be completely wrong and have been formed by a fair amount but not exhaustive readings on MMT. Try to read this as a work in progress and a middle ground between two extreme views.

The question at hand is whether increasing interest rates is restrictive on or stimulative to economic activity.

Here's where you are going to get angry. My answer is "it depends"

Let's posit two worlds

1. A world with only private and no government debt

2. A world with

Here's where you are going to get angry. My answer is "it depends"

Let's posit two worlds

1. A world with only private and no government debt

2. A world with

no private debt and only public debt.

In world 1. (this is the by and large the OG world) when a central bank increases interest rates above the level that they would otherwise settle in a (market based no fed world) the effect is to decrease demand for borrowing and increase

In world 1. (this is the by and large the OG world) when a central bank increases interest rates above the level that they would otherwise settle in a (market based no fed world) the effect is to decrease demand for borrowing and increase

demand for savings. As long as interest rates are set artificially high it should seem clear that borrowers will buy or build real assets less and despite higher incomes from lenders and savers due to higher interest rates there is artificial disincentive for

savers to consume. Both savers and borrowers spend less and GDP is restricted. Again assuming the interest rate is artificially high relative to market rates.

In world 2 there are no private borrowers there are only savers. If the central bank increases interest rates

In world 2 there are no private borrowers there are only savers. If the central bank increases interest rates

To artificially high levels (not clear why they would in this sort of world). Savers get more money just like in world 1 and just like in world one they are disincentivized to spend that money because interest rates are so high.

But in both worlds (which I didn't mention in

But in both worlds (which I didn't mention in

World 1 and perhaps should have). Some portion of the increased income does get spent despite the disincentive of higher savings rate.

Otoh no one has private debt and so borrowers are hardly impacted by the increase in rates as they have no need

Otoh no one has private debt and so borrowers are hardly impacted by the increase in rates as they have no need

to borrow to refinance existing debt. Of course those who want to borrow will be discouraged so even in world 2 there is some disincentive to borrow

World 2 nets to a world where increases in interest rates are stimulative and inflationary and World 1 nets to the opposite

World 2 nets to a world where increases in interest rates are stimulative and inflationary and World 1 nets to the opposite

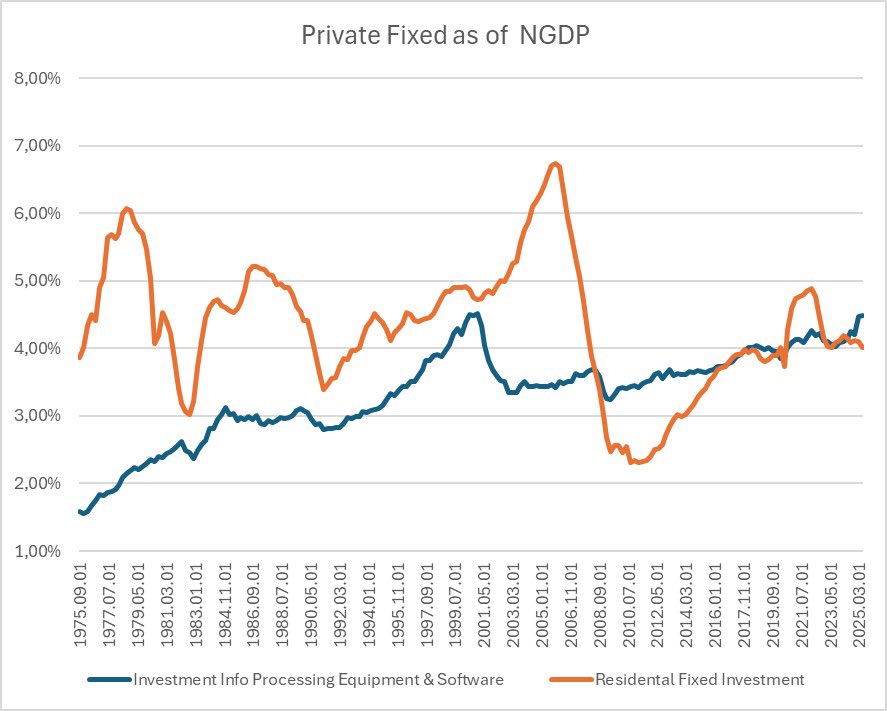

Real world is some of both and some of both had shifted from lots of world 1 to lots of both world 1 and world 2. That shift has likely been part of the reason that the fed funds monetary lever has never been less useful. Which way does it all sum up. That's a question

No one can answer by yelling from the sidelines with zealotry MMT or zealotry OG. You have to examine every borrower and saver and estimate their propensity to borrow and lend based on changes not only in short term interest rates but on many factors including wealth and asset

Prices, and bank willingness and ability to lend, and on going fiscal policy shifts, and monetary levers like QE and QT. OG monetary policy in a World 1 like world was easy. Today it's less easy and frankly at least half and probably more than half of the FOMC seem to only care

about the time trusted OG lever.

So what's the answer Andy? I don't f'ing know. But a tipping point where higher rates are stimulative is either upon us already or my strong belief is we are a heck of a lot closer to that tipping point than 10 years ago. My view it doesn't

So what's the answer Andy? I don't f'ing know. But a tipping point where higher rates are stimulative is either upon us already or my strong belief is we are a heck of a lot closer to that tipping point than 10 years ago. My view it doesn't

matter. We are close enough that little tweaks or even medium sized tweaks of the fund rate has uncertain impact. While tweaks to reserves, issuance duration, and fed flow and stock of Assets has a certain impact and isn't being addressed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh