Everyone's obsessed with rental properties for passive income.

But what if I told you Bitcoin mining delivers rental-property-style cash flow with 70% better returns?

Let's break down the math that most investors are missing🧵

But what if I told you Bitcoin mining delivers rental-property-style cash flow with 70% better returns?

Let's break down the math that most investors are missing🧵

The big question:

How much capital do you need to generate $100K in annual passive income?

With real estate, you'd need around $1M-$2M in property.

With Bitcoin mining?

About $350K deployed with the right setup

*Under current market conditions

How much capital do you need to generate $100K in annual passive income?

With real estate, you'd need around $1M-$2M in property.

With Bitcoin mining?

About $350K deployed with the right setup

*Under current market conditions

First, let's define what we mean by "Bitcoin mining" in 2025:

In most profitable cases, it's not computers in the garage.

It's institutional-grade facilities running specialized hardware at scale with professional management.

In most profitable cases, it's not computers in the garage.

It's institutional-grade facilities running specialized hardware at scale with professional management.

Let's compare a $350K investment:

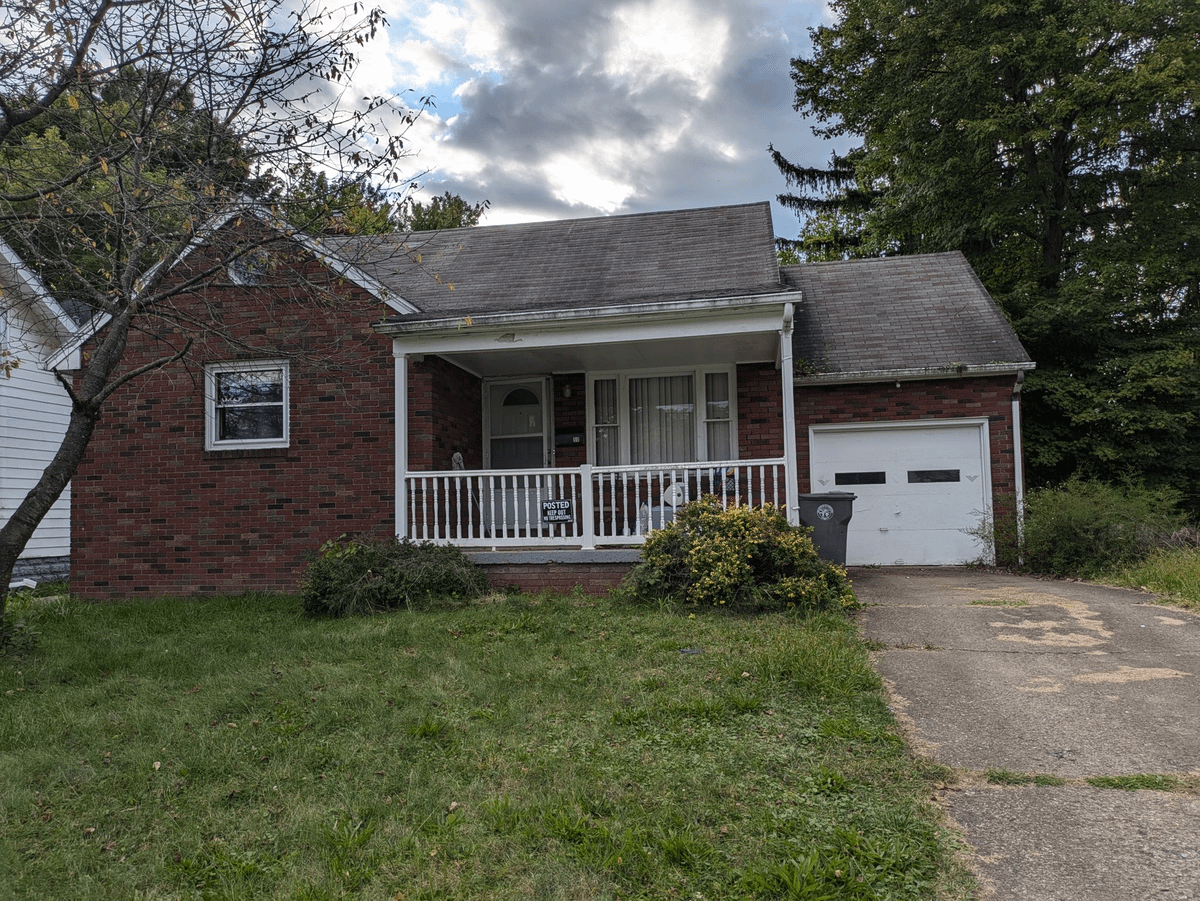

REAL ESTATE: $350K house

• $2,500/month rental income

• $30K annual revenue

• ~$7K maintenance costs

• $23K net annual income (6.5% yield)

This does not include property taxes, insurance, major renovations, etc.

• $2,500/month rental income

• $30K annual revenue

• ~$7K maintenance costs

• $23K net annual income (6.5% yield)

This does not include property taxes, insurance, major renovations, etc.

BITCOIN MINING: $350K worth of S21+ hydro miners

• 32 miners at $11,000 each.

• 0.185 BTC mined per month under fixed current conditions

• $10,915 monthly electricity/maintenance cost @ $0.08/kWh

• $113K net annual income under fixed conditions (32% yield)

• 32 miners at $11,000 each.

• 0.185 BTC mined per month under fixed current conditions

• $10,915 monthly electricity/maintenance cost @ $0.08/kWh

• $113K net annual income under fixed conditions (32% yield)

This hypothetical scenario is for informational purposes only.

It's NOT indicative of any specific outcome or performance.

Results will vary, and Bitcoin is volatile.

We make no promises regarding your investment success, apart from what we uphold as a service provider.

It's NOT indicative of any specific outcome or performance.

Results will vary, and Bitcoin is volatile.

We make no promises regarding your investment success, apart from what we uphold as a service provider.

32% APY Bitcoin mining vs 6.5% APY real estate.

"But wait," you say.

"Mining equipment depreciates while real estate appreciates!" True.

But the math can STILL favor mining even after accounting for this.

"But wait," you say.

"Mining equipment depreciates while real estate appreciates!" True.

But the math can STILL favor mining even after accounting for this.

Let's factor in 33% annual market value depreciation on mining equipment:

Year 1: $350K -> $234K

Year 2: $234K -> $156K

Year 3: $156K -> $104K

Your $350,00 investment lost 70% of its market value.

But how much Bitcoin did it earn?

Year 1: $350K -> $234K

Year 2: $234K -> $156K

Year 3: $156K -> $104K

Your $350,00 investment lost 70% of its market value.

But how much Bitcoin did it earn?

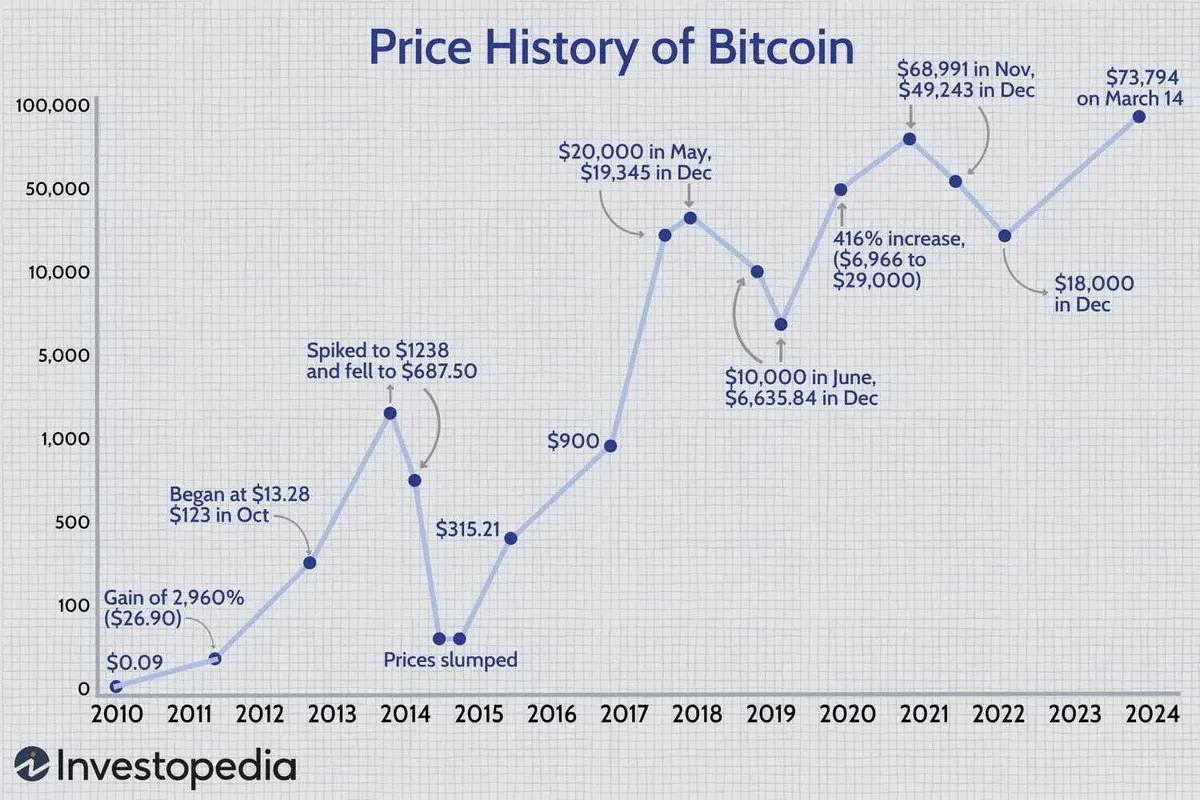

Bitcoin has a 120% 10-year CAGR

Bitcoin price is up 75% in 1YR

Mining difficulty is up 50%

So 25% increase in miner spread.

Year 1: $113K

Year 2: $141K

Year 3: $176K

Total earnings: $430K

NAV decay: $245,000

Net: $185,000

Bitcoin price is up 75% in 1YR

Mining difficulty is up 50%

So 25% increase in miner spread.

Year 1: $113K

Year 2: $141K

Year 3: $176K

Total earnings: $430K

NAV decay: $245,000

Net: $185,000

There is also 100% Bonus Depreciation for mining.

As an example, 15% savings from writing off $350k is $52,500

We have also seen clients 100% depreciate book value while the machine market value appreciates.

Machine value is largely based on Bitcoin cyclicality and price.

As an example, 15% savings from writing off $350k is $52,500

We have also seen clients 100% depreciate book value while the machine market value appreciates.

Machine value is largely based on Bitcoin cyclicality and price.

Compare to real estate over 3 years:

• $69K total rental income

• $44K appreciation (4% annually)

Total earnings: $69K

NAV appreciation: $44K

Net: $113K

Real estate also takes much longer to depreciate book value (20+ years)

• $69K total rental income

• $44K appreciation (4% annually)

Total earnings: $69K

NAV appreciation: $44K

Net: $113K

Real estate also takes much longer to depreciate book value (20+ years)

Bitcoin mining ($185K) vs Real estate ($113K)

You also have much better liquidity with mining.

You also have much better liquidity with mining.

Mining requires less expertise than real estate:

• Purchase machines vs Purchase home

• Choose a property manager

• Deploy immediately vs wait for renters

• Get paid daily vs Get paid monthly

• Get paid in scarce money vs printable money

• Purchase machines vs Purchase home

• Choose a property manager

• Deploy immediately vs wait for renters

• Get paid daily vs Get paid monthly

• Get paid in scarce money vs printable money

TLDR:

Bitcoin mining can significantly outperform real estate.

It is more volatile, but this is how it can outperform.

Bitcoin mining can significantly outperform real estate.

It is more volatile, but this is how it can outperform.

Bitcoin is now at $110,000 without:

• Leaks

• Roof repairs

• Plumbing problems

• Tenants

• Property managers

• Insurance premiums

• Property taxes

• HOA

• Lead paint

• Outdated kitchen

• Leaks

• Roof repairs

• Plumbing problems

• Tenants

• Property managers

• Insurance premiums

• Property taxes

• HOA

• Lead paint

• Outdated kitchen

Real estate is up 50% in the last 5 years WITH all these cons.

Bitcoin is up 1,205% in the last 5 years WITHOUT the cons.

Eventually, real estate investors will realize you can skip the headaches and turn electricity into Bitcoin without any of the above.

Bitcoin is up 1,205% in the last 5 years WITHOUT the cons.

Eventually, real estate investors will realize you can skip the headaches and turn electricity into Bitcoin without any of the above.

We are in the business of helping investors gain exposure to Bitcoin mining

If you found this post valuable, consider reposting to reach others like yourself:

Want to accumulate Bitcoin through mining?

simplemining.io

If you found this post valuable, consider reposting to reach others like yourself:

Want to accumulate Bitcoin through mining?

simplemining.io

• • •

Missing some Tweet in this thread? You can try to

force a refresh