We sell, host, and repair Bitcoin miners in Iowa for as low as $0.07/kWh all in.

How to get URL link on X (Twitter) App

1) Clarity

1) Clarity

The Trump family didn't start as Bitcoin miners.

The Trump family didn't start as Bitcoin miners.

The big question:

The big question:

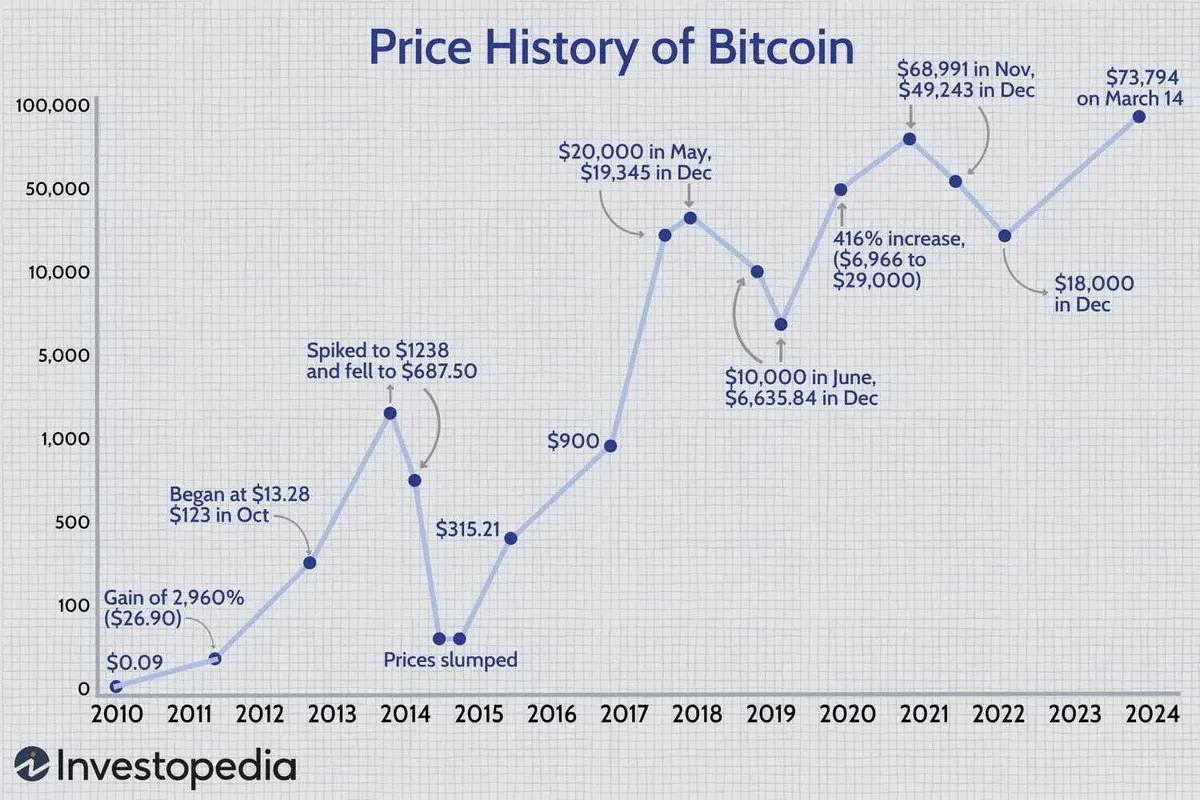

December 2017.

December 2017.

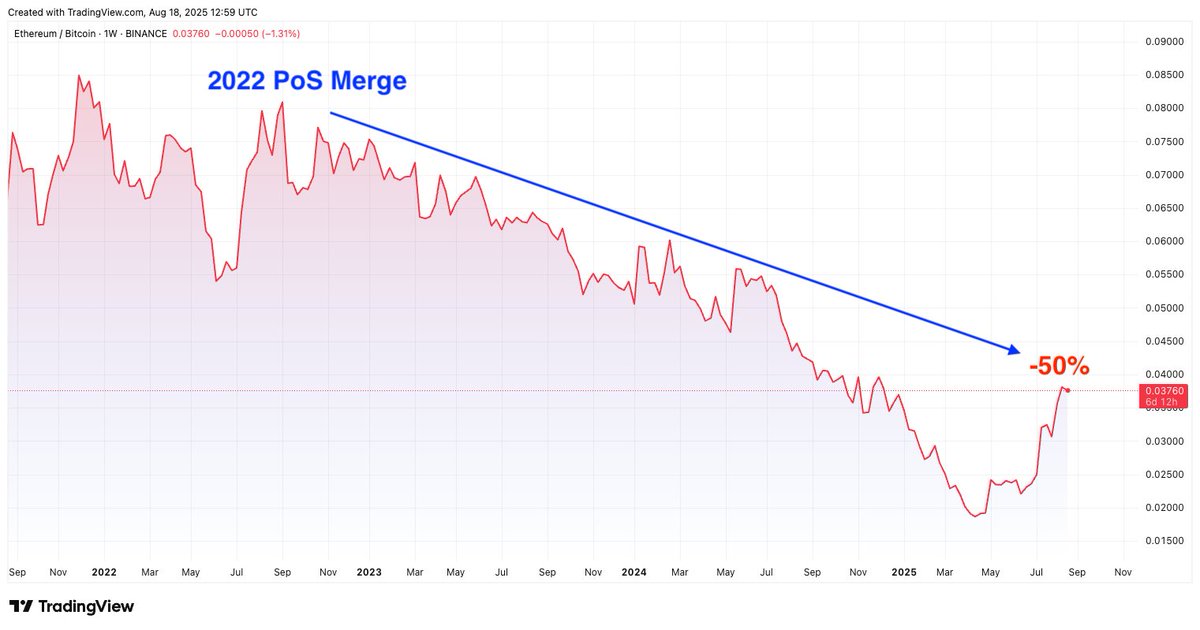

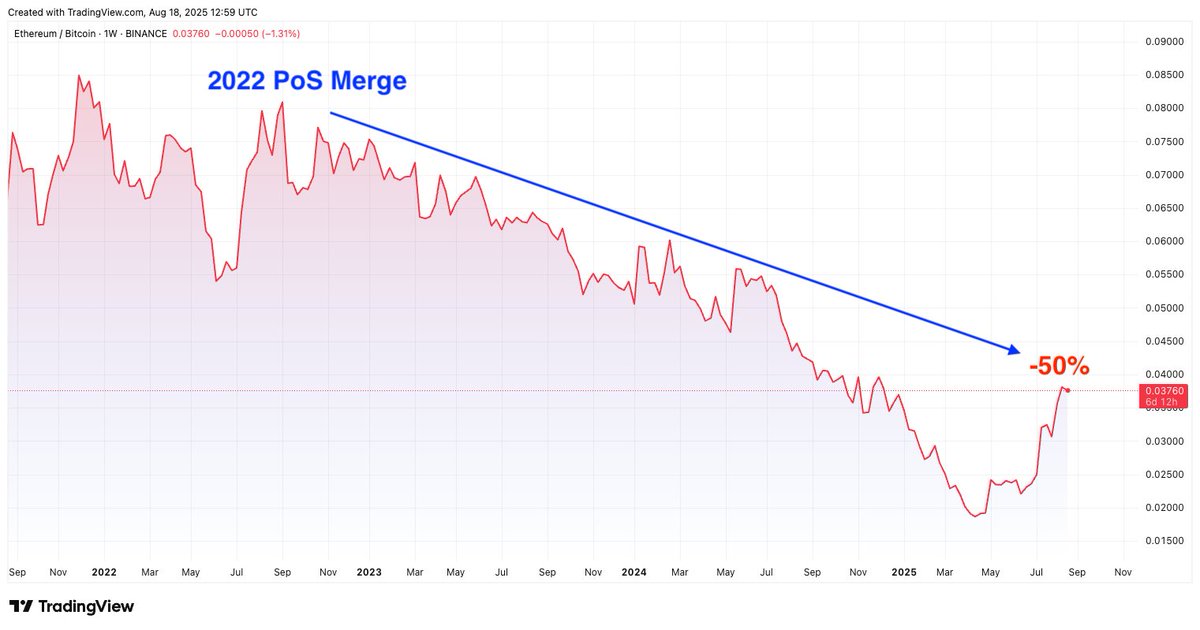

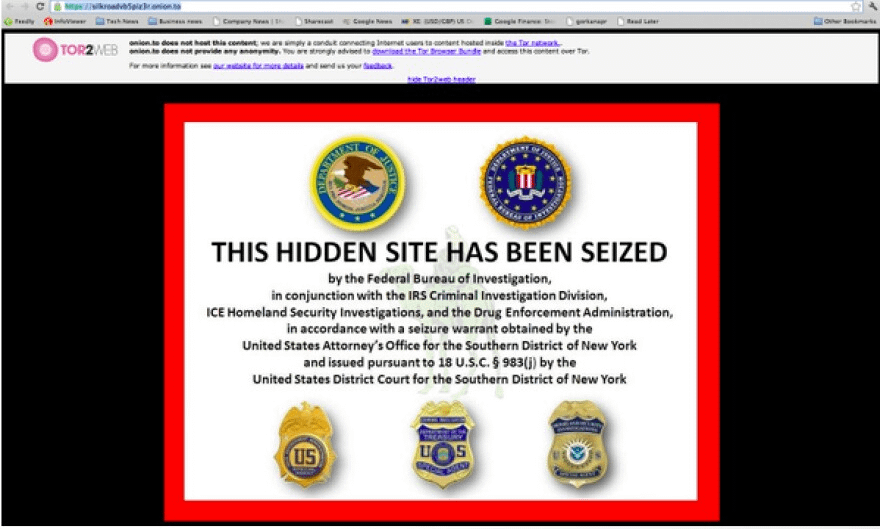

Ethereum holders trust validators. Trust builders. Trust checkpoints. Trust foundations.

Ethereum holders trust validators. Trust builders. Trust checkpoints. Trust foundations.

First, the team.

First, the team.

This wasn't your typical Bitcoin interview.

This wasn't your typical Bitcoin interview.

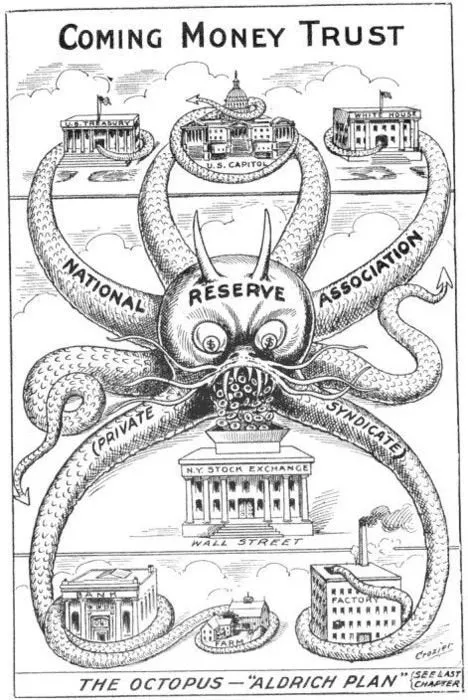

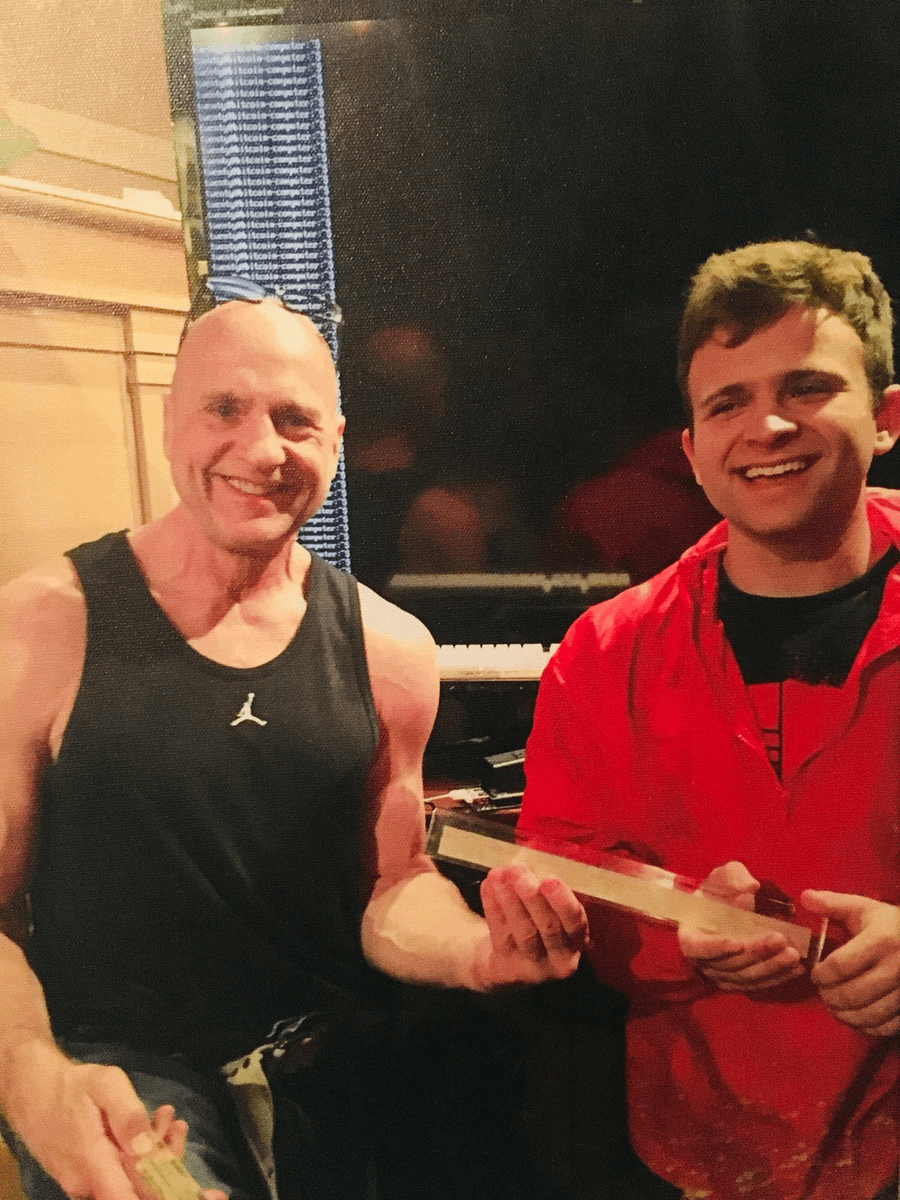

On a recent podcast, Saylor revealed something shocking about capital flows:

On a recent podcast, Saylor revealed something shocking about capital flows:

Picture this:

Picture this:

The Core Thesis:

The Core Thesis:

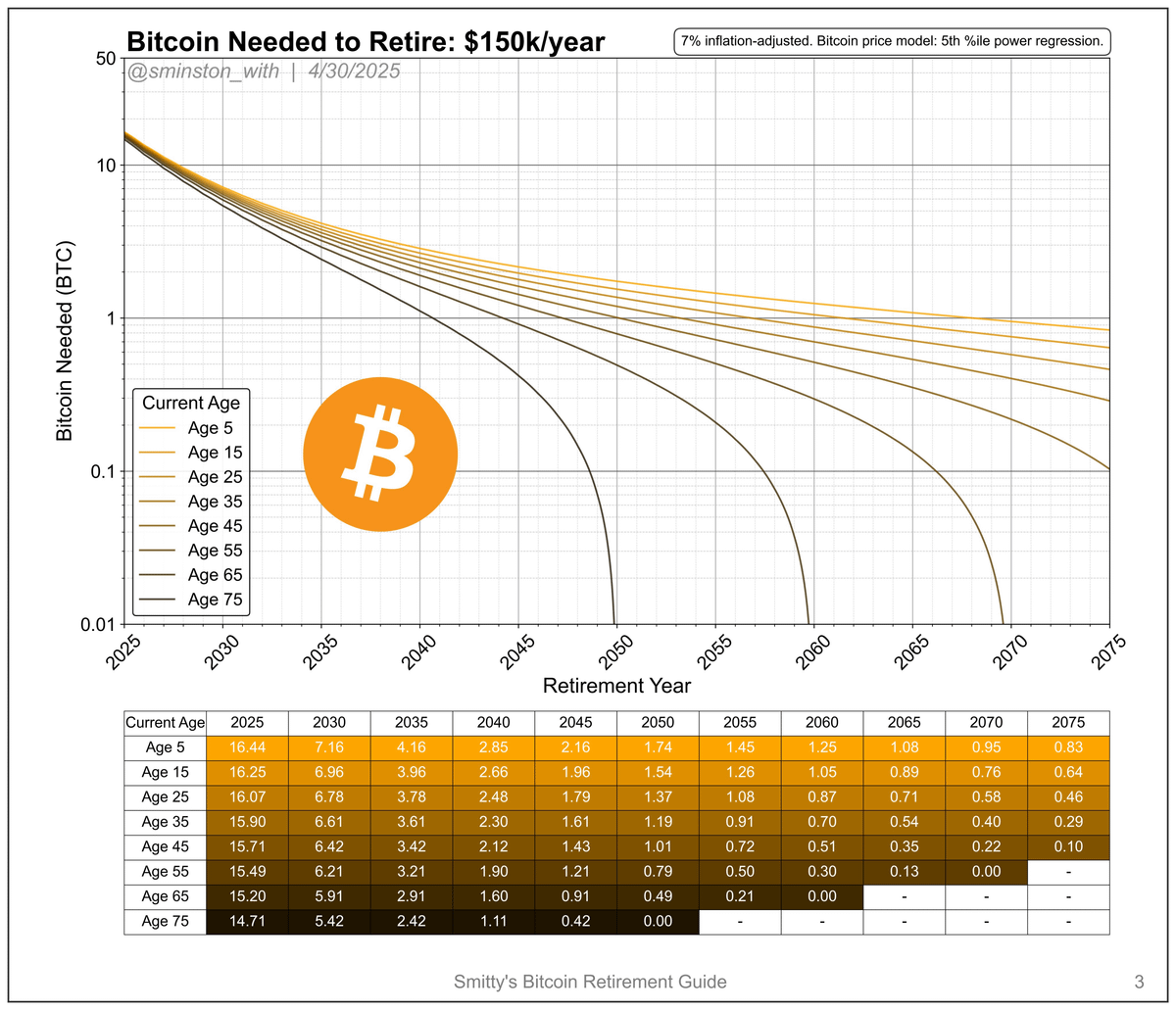

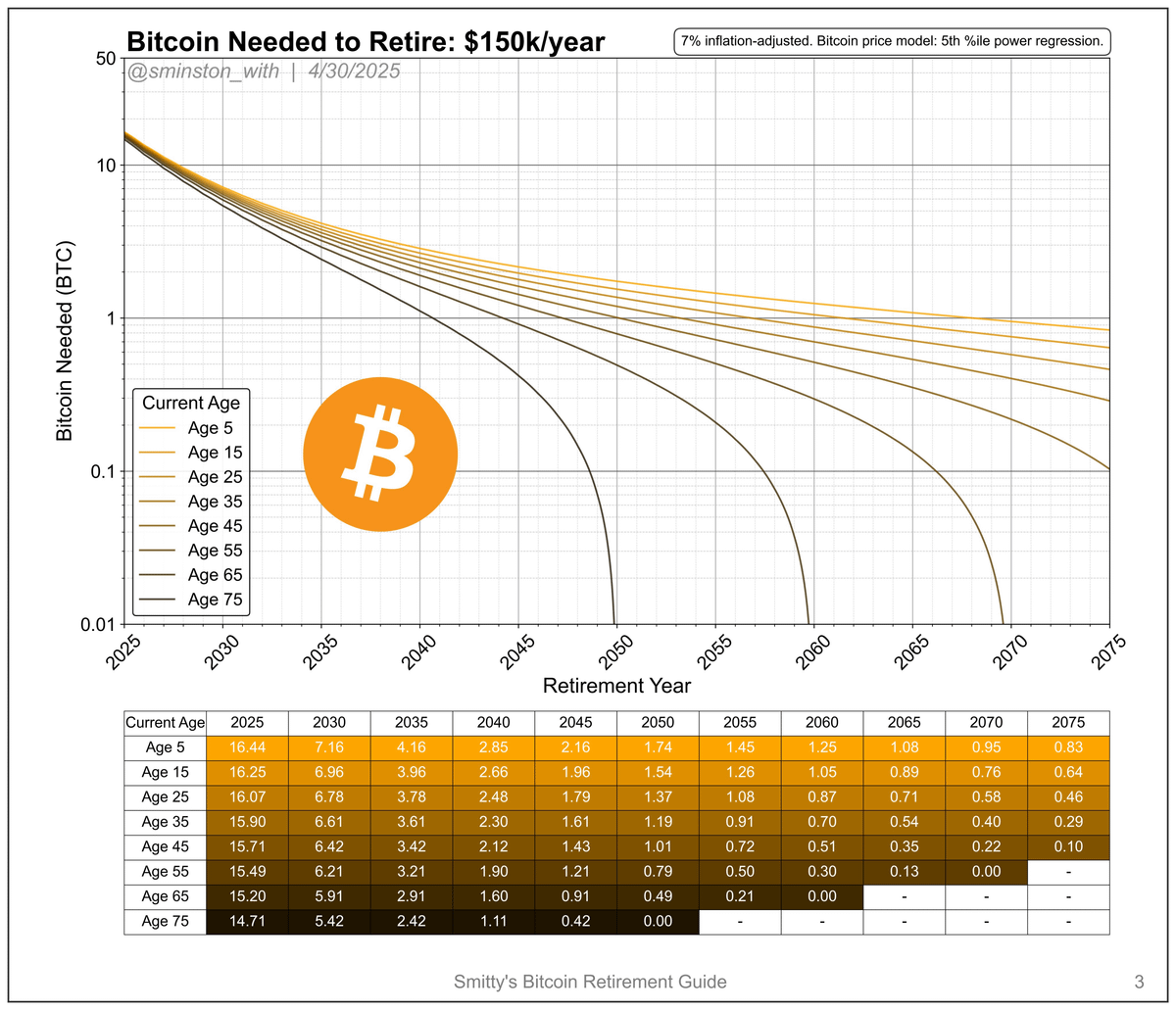

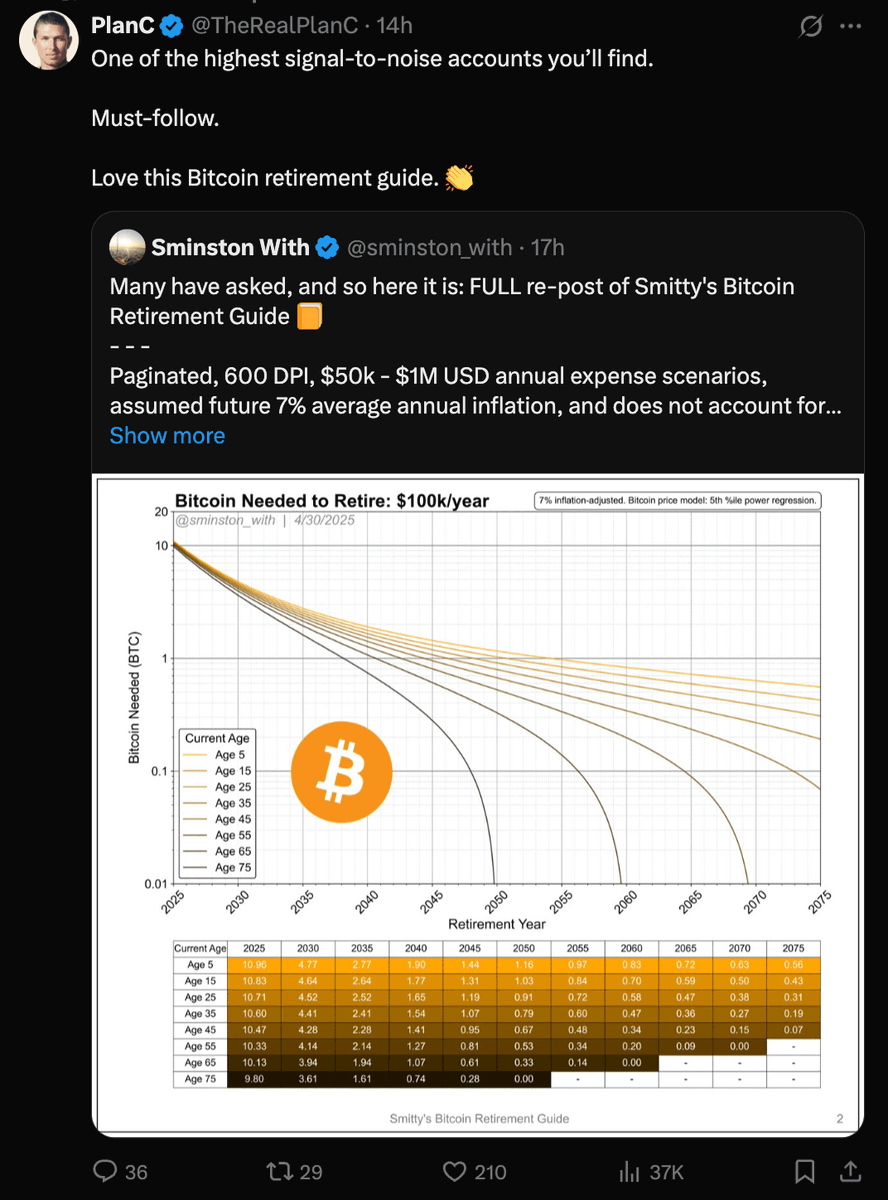

In 2021, anonymous engineer Smitty became a Bitcoiner.

In 2021, anonymous engineer Smitty became a Bitcoiner.

The framing conflict:

The framing conflict:

This thread how we are viewing Trump's tariff strategy, the "Triffin Dilemma," and shows how tariffs may impact investors (particularly Bitcoin investors).

This thread how we are viewing Trump's tariff strategy, the "Triffin Dilemma," and shows how tariffs may impact investors (particularly Bitcoin investors).

Which type of machine will generate the highest return on investment?

Which type of machine will generate the highest return on investment?

Here are our two solutions to solve this problem.

Here are our two solutions to solve this problem.