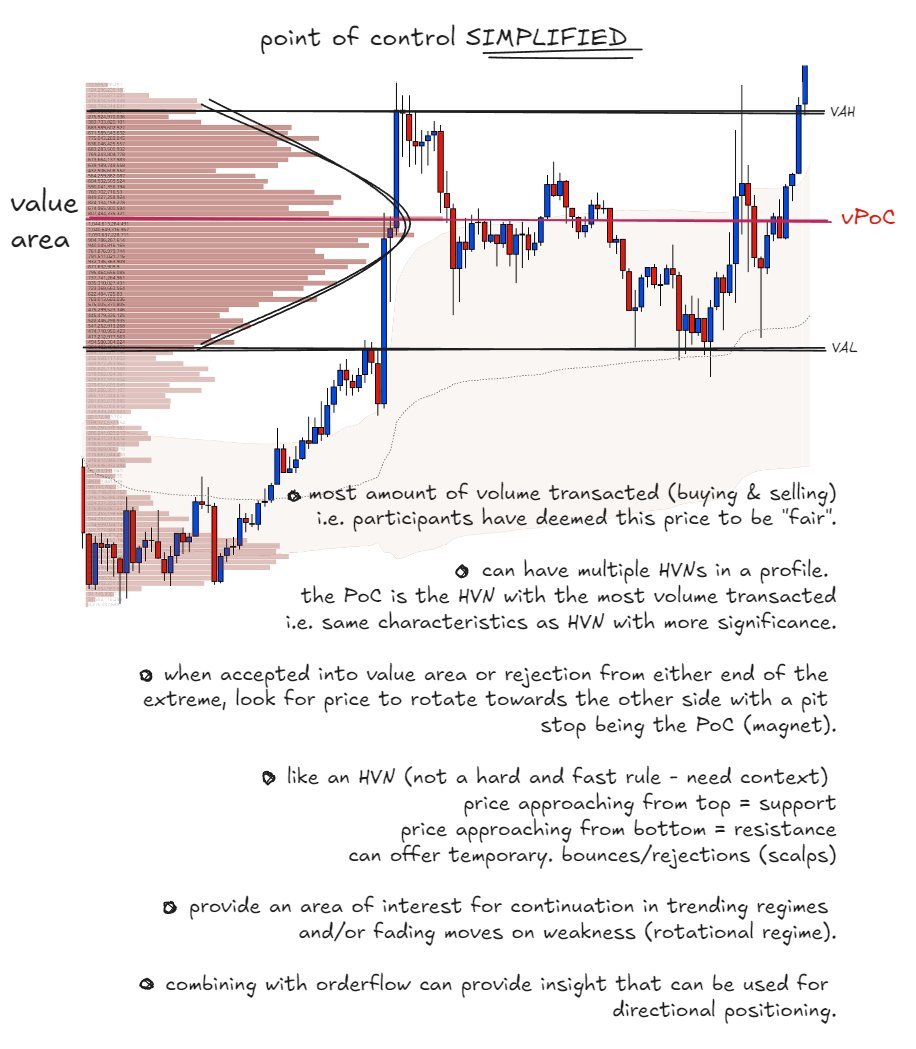

Shifting Value & Value Area Range

Not rocket science but something to look for when it comes to $BTC slowing down on a sell-off and attempting to spot a break in one sided momentum:

1. consecutive days with value shifting lower (little to no over lap) into a few tight sessions sideways.

2. wide days followed by a tighter value area range - observe participation at lows.

ideally trapped sellers can lead to a temporary bounce - if temporary bounce occurs observe buying aggression followed by passive behavior.

i.e. is there follow through on the bounce? is aggression stepping in higher? are dips being cushioned through passive buying gradually shifting higher?

btw a break in the trend could just be a breather for continuation in the same direction but this is the first sign to pay attention to what session value looks like in the succeeding days.

If action starting to slowdown into a key contextual area - pay more attention (additional example below).

Not rocket science but something to look for when it comes to $BTC slowing down on a sell-off and attempting to spot a break in one sided momentum:

1. consecutive days with value shifting lower (little to no over lap) into a few tight sessions sideways.

2. wide days followed by a tighter value area range - observe participation at lows.

ideally trapped sellers can lead to a temporary bounce - if temporary bounce occurs observe buying aggression followed by passive behavior.

i.e. is there follow through on the bounce? is aggression stepping in higher? are dips being cushioned through passive buying gradually shifting higher?

btw a break in the trend could just be a breather for continuation in the same direction but this is the first sign to pay attention to what session value looks like in the succeeding days.

If action starting to slowdown into a key contextual area - pay more attention (additional example below).

the quoted example happened to be a major turning point (this wasn't forecasted at the time but just showing an example that I mentioned at the time).

few.

• • •

Missing some Tweet in this thread? You can try to

force a refresh