These 5 SPY set-ups are good in bull market for 2025. Here's the criteria (bookmark or write it down)

1. Time frames for enty 1min-2min

2. Use 2-3 weeks expiry for scalping and ITM

3. Stop loss is always 0.30-0.40 from entry

4. Target 2x-3x what you are risking on each trade

1. Time frames for enty 1min-2min

2. Use 2-3 weeks expiry for scalping and ITM

3. Stop loss is always 0.30-0.40 from entry

4. Target 2x-3x what you are risking on each trade

Choose only 1 set-up and stick with it. Become an expert at it.

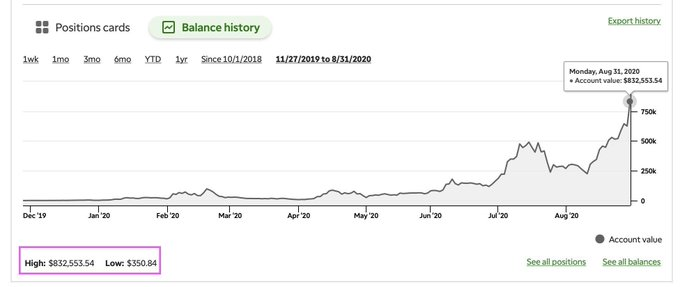

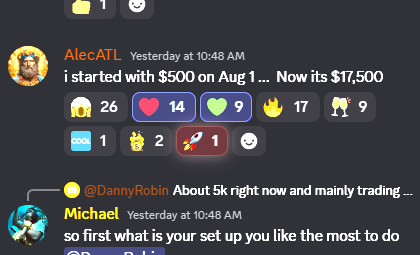

It will get boring but this is how you grow to $50,000 in 3 months with less than $1000:

It will get boring but this is how you grow to $50,000 in 3 months with less than $1000:

https://x.com/SuperLuckeee/status/1670886158211903540

#1. SPY downtrend break entry. This one easiest to take because when SPY sells off for the first 30min-1hour. Watch for SPY to break the downtrend on 2min chart to get in.

#2. SPY double bottom. As soon as the LOW OF DAY is tested with buyers this is when you get in. Then watching for rising volume to confirm move continues. This happens a lot at least 1-3x a week.

#3. SPY retest play. Wait for SPY to breakout first. Let it rip so hard then wait for it come back to RETEST the breakout area for entry (kinda like double bottom)

Make sure to follow us @superluckeee for our FREE content entries and price targets for SPY

https://x.com/SuperLuckeee/status/1953518940132446590

#4. This blue line is VWAP. Once it breaks with volume it can explode for a good high probability scalp. This moves happens best after 10am before 12pm.

#5. SPY breaking downtrend. This one you need to get puts as soon as the UPTREND line is broken. So this set-up works if SPY breakouts hard and keeps spiking. This would be your entry.

Key Bonus tips:

1. The set-up should work within 5minutes or start managing stop loss (react fast)

2. If you can't hold long its becuase you need to work on confidence and conviction

3. Do not jump around strategies stick to 1!

4. Practice is the only to get you better at exection

1. The set-up should work within 5minutes or start managing stop loss (react fast)

2. If you can't hold long its becuase you need to work on confidence and conviction

3. Do not jump around strategies stick to 1!

4. Practice is the only to get you better at exection

Follow me @SuperLuckeee for more of my trading lessons, analysis and plays.

- RT to share with your audience and help others.

- Make sure you ❤️the post below

- BOOKMARK this to study later

- RT to share with your audience and help others.

- Make sure you ❤️the post below

- BOOKMARK this to study later

https://x.com/SuperLuckeee/status/1959571496029876718

• • •

Missing some Tweet in this thread? You can try to

force a refresh