Donald Trump can crash India’s entire financial system

Not with tariffs but with your CIBIL score

Because CIBIL is majority-owned by a US company

So why did India hand over its financial backbone to a private foreign firm?

THREAD: Is CIBIL India’s silent financial time bomb?

Not with tariffs but with your CIBIL score

Because CIBIL is majority-owned by a US company

So why did India hand over its financial backbone to a private foreign firm?

THREAD: Is CIBIL India’s silent financial time bomb?

Your CIBIL score isn’t just a number. It’s your financial report card.

It tells banks how trustworthy you are with money.

It decides whether you’ll get that iPhone on EMI, a car loan, a dream home, or sometimes even…

It tells banks how trustworthy you are with money.

It decides whether you’ll get that iPhone on EMI, a car loan, a dream home, or sometimes even…

Love it or hate it, this single number has become the key to your financial credibility, making life simpler for both borrowers and lenders.

But this system wasn’t always this smooth.

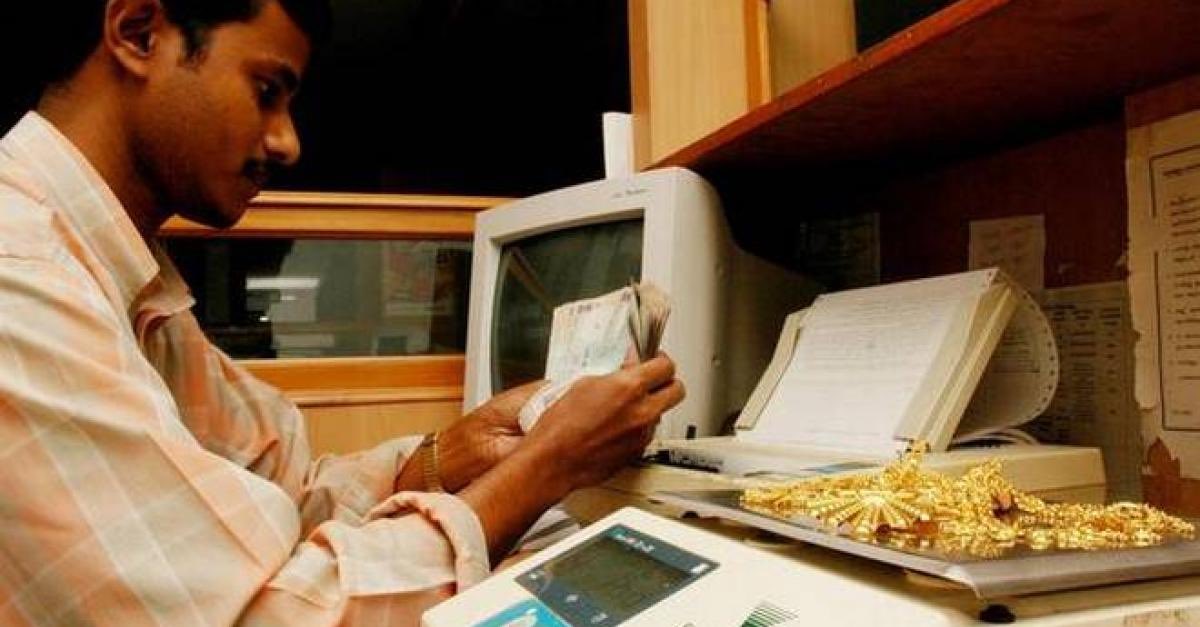

A couple of decades ago, lending in India was pure chaos.

But this system wasn’t always this smooth.

A couple of decades ago, lending in India was pure chaos.

Banks had little data, so loans were given on recommendations or collateral like property and jewellery.

This meant poor or first-time borrowers had almost no chance of formal credit,

— which was holding back not just families but the entire economy!

This meant poor or first-time borrowers had almost no chance of formal credit,

— which was holding back not just families but the entire economy!

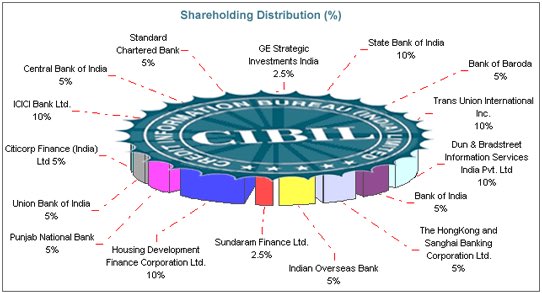

That gap led to the birth of CIBIL in 2000.

Set up after an RBI committee recommendation, it was backed by

👉 Indian Banks’ Association,

👉 big lenders like SBI & HDFC, and

👉 the US credit bureau TransUnion, which had decades of experience running national-level credit systems

Set up after an RBI committee recommendation, it was backed by

👉 Indian Banks’ Association,

👉 big lenders like SBI & HDFC, and

👉 the US credit bureau TransUnion, which had decades of experience running national-level credit systems

And for the first time, India had a system to measure trust in numbers, not word-of-mouth.

But from day one, CIBIL wasn’t public. It was private.

Indian banks pooled their customer data, and TransUnion provided the tech & expertise.

But from day one, CIBIL wasn’t public. It was private.

Indian banks pooled their customer data, and TransUnion provided the tech & expertise.

Now, over time, TransUnion gradually bought out the stakes of Indian banks, owning about 92.1% of CIBIL by 2017!

So how exactly did a US firm end up with majority control of India’s credit bureau?

It goes back to the Credit Information Companies (Regulation) Act, 2005.

So how exactly did a US firm end up with majority control of India’s credit bureau?

It goes back to the Credit Information Companies (Regulation) Act, 2005.

This new law gave RBI the authority to license and regulate all credit bureaus, regardless of ownership.

And then in 2016, RBI used that authority to tweak FDI rules, allowing 100% foreign investment in credit bureaus.

And then in 2016, RBI used that authority to tweak FDI rules, allowing 100% foreign investment in credit bureaus.

That’s the policy shift that gave TransUnion the green light to buy out Indian banks and take majority control of CIBIL.

Of course, it came with strict guardrails:

- All credit data must stay inside India

- Reports can only be pulled when you’re applying for credit

Of course, it came with strict guardrails:

- All credit data must stay inside India

- Reports can only be pulled when you’re applying for credit

- No sharing with anyone unauthorized

- Every bureau has to meet tough cybersecurity standards

Now, you must be wondering why would RBI allow this?

Because TransUnion wasn’t just bringing capital (which Indian banks needed to expand).

- Every bureau has to meet tough cybersecurity standards

Now, you must be wondering why would RBI allow this?

Because TransUnion wasn’t just bringing capital (which Indian banks needed to expand).

It was also bringing in better analytics, sharper risk models, and advanced tech,

— all of which helped Indian banks cut bad loans, approve credit faster, and even bring first-time borrowers into the system.

And this really did change everything.

— all of which helped Indian banks cut bad loans, approve credit faster, and even bring first-time borrowers into the system.

And this really did change everything.

For the first time, a bureau in India was tracking every single loan and repayment.

It worked like a simple reward-punishment system:

✅ Pay EMIs on time → your score goes up.

❌ Miss them → credit gets costlier, or doors shut altogether.

It worked like a simple reward-punishment system:

✅ Pay EMIs on time → your score goes up.

❌ Miss them → credit gets costlier, or doors shut altogether.

This shift, from collateral-based lending to behaviour-based lending, unlocked loans for millions who once had no access.

And it was nothing short of a revolution.

Over the years, CIBIL grew into a giant and three more bureaus eventually joined the market.

And it was nothing short of a revolution.

Over the years, CIBIL grew into a giant and three more bureaus eventually joined the market.

But none came close and CIBIL still dominates, with over 7,500 banks, NBFCs, and fintechs feeding it data.

Which means, for most Indians, a single number decides their access to credit today.

And when so much power rests on one number, its reliability becomes everything.

Which means, for most Indians, a single number decides their access to credit today.

And when so much power rests on one number, its reliability becomes everything.

That’s exactly where the problems begin.

Every day, people complain about credit score errors.

A single wrong entry and your home loan, car loan, or even a credit card can get blocked.

Every day, people complain about credit score errors.

A single wrong entry and your home loan, car loan, or even a credit card can get blocked.

You might have repaid on time, but until the bank updates the record, your score still looks bad.

And you can’t fix it directly with CIBIL either.

All this while, CIBIL is tracking the financial history of over 60 crore Indians.

And you can’t fix it directly with CIBIL either.

All this while, CIBIL is tracking the financial history of over 60 crore Indians.

A company that’s majority-owned by a US firm, despite RBI’s oversight, controls your financial fate.

So in times of trade tensions, does it really make sense that such critical financial infrastructure sits in foreign hands?

That worry has even reached the courts.

So in times of trade tensions, does it really make sense that such critical financial infrastructure sits in foreign hands?

That worry has even reached the courts.

In 2024, a Supreme Court case alleged that credit bureaus collect data without proper consent, and might even be storing it abroad.

The Court has asked the RBI, Finance Ministry, and CIBIL to respond.

The case is still live.

The Court has asked the RBI, Finance Ministry, and CIBIL to respond.

The case is still live.

And then there’s the fear of data breaches.

In 2017, US credit bureau Equifax was hacked, leaking the data of 14.3 crore Americans.

One breach, and half a nation was compromised.

So naturally, people ask: what if something like that happened in India?

In 2017, US credit bureau Equifax was hacked, leaking the data of 14.3 crore Americans.

One breach, and half a nation was compromised.

So naturally, people ask: what if something like that happened in India?

Yes, we know CIBIL isn’t some new startup.

It says it follows global security standards like ISO 27001, NIST, and PCI-DSS.

And India’s credit ecosystem today is bigger, faster, and more advanced than ever.

But the trust issues haven’t gone away.

It says it follows global security standards like ISO 27001, NIST, and PCI-DSS.

And India’s credit ecosystem today is bigger, faster, and more advanced than ever.

But the trust issues haven’t gone away.

Which brings us to the bigger question: if credit scores are this critical, why didn’t India just build its own government bureau from day one?

The answer is simple.

Back then, banks weren’t digitised and we lacked the tech backbone.

The answer is simple.

Back then, banks weren’t digitised and we lacked the tech backbone.

So India’s credit system had to get off the ground through private hands,

with foreign expertise leading the way and RBI watching from the sidelines.

And, as you may have already guessed it, there was another fear of government monopoly.

with foreign expertise leading the way and RBI watching from the sidelines.

And, as you may have already guessed it, there was another fear of government monopoly.

One single state-run bureau could have easily turned slow, bureaucratic, or even political.

So India went the other way: multiple private bureaus, all competing under RBI’s watch.

The idea was simple: let innovation thrive, while regulations keep them in check.

So India went the other way: multiple private bureaus, all competing under RBI’s watch.

The idea was simple: let innovation thrive, while regulations keep them in check.

But two decades later, the picture looks very different.

Yes, the fear of a government monopoly still exists.

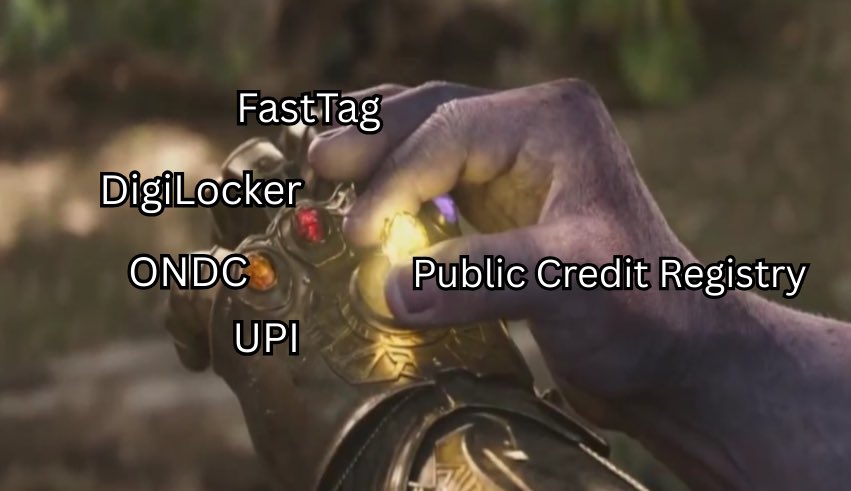

But today, with Aadhaar, UPI, and IndiaStack (the digital framework for identity, payments, and data),

Yes, the fear of a government monopoly still exists.

But today, with Aadhaar, UPI, and IndiaStack (the digital framework for identity, payments, and data),

— India now has the capacity to build a state-backed system that could be faster and far more transparent than before.

That’s exactly what the Public Credit Registry (PCR) is trying to do:

Build a government-run database where borrowers can see and correct their own records.

That’s exactly what the Public Credit Registry (PCR) is trying to do:

Build a government-run database where borrowers can see and correct their own records.

It’s not live yet, but RBI is steadily moving forward.

If it comes together, it could finally take the power away from foreign, private bureaus and place it back in the hands of the people.

It could be a complete game-changer.

If it comes together, it could finally take the power away from foreign, private bureaus and place it back in the hands of the people.

It could be a complete game-changer.

👉 PCR will consolidate all data from banks, NBFCs, external borrowings, GST, insolvency, etc.

👉 Every stakeholder (lenders, regulators, borrowers) can access verified loan records.

👉 No more errors. Borrowers get transparency, banks get cleaner data & the system gains trust.

👉 Every stakeholder (lenders, regulators, borrowers) can access verified loan records.

👉 No more errors. Borrowers get transparency, banks get cleaner data & the system gains trust.

So, is CIBIL a threat? Not exactly.

It’s a tool that has unlocked credit for crores of Indians.

But the real danger is letting private companies, especially foreign-owned ones, decide the financial fate of millions without enough checks.

It’s a tool that has unlocked credit for crores of Indians.

But the real danger is letting private companies, especially foreign-owned ones, decide the financial fate of millions without enough checks.

India doesn’t need to kill CIBIL.

It needs more guardrails, more accountability, and maybe, finally, a strong public alternative.

It needs more guardrails, more accountability, and maybe, finally, a strong public alternative.

If you liked this read, do RePost🔄 the 1st post

and follow us @FinFloww for such reads every Monday, Wednesday and Friday!

and follow us @FinFloww for such reads every Monday, Wednesday and Friday!

Get our WhatsApp newsletter: whatsapp.com/channel/0029Vb…

Subscribe to WHAT THE FLOWW?, our weekly email newsletter where we dive deeper into such concepts: FinFloww.bio.link

• • •

Missing some Tweet in this thread? You can try to

force a refresh