You've been lied to.

That insurance policy in your filing cabinet isn't protection.

Some carriers carefully craft contracts designed to fail you when disaster strikes.

Here's how these insurance companies really operate during your darkest hour (& what you can do about it): 🧵

That insurance policy in your filing cabinet isn't protection.

Some carriers carefully craft contracts designed to fail you when disaster strikes.

Here's how these insurance companies really operate during your darkest hour (& what you can do about it): 🧵

August 8, 2023. Lahaina burns to the ground.

102 people dead. 2,200 structures destroyed. $5.5 billion in damages.

Families who thought they owned homes discovered they owned nothing but ashes.

But this was just the beginning of their nightmare...

102 people dead. 2,200 structures destroyed. $5.5 billion in damages.

Families who thought they owned homes discovered they owned nothing but ashes.

But this was just the beginning of their nightmare...

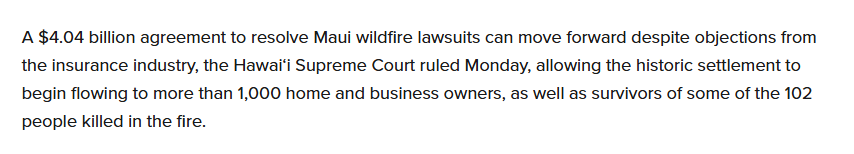

192 insurance companies swooped in immediately.

They paid out $2.6 billion in claims to devastated families.

Homeowners breathed a sigh of relief. Finally, they could rebuild.

What they didn't know? The insurers were about to betray them.

They paid out $2.6 billion in claims to devastated families.

Homeowners breathed a sigh of relief. Finally, they could rebuild.

What they didn't know? The insurers were about to betray them.

Here's the scheme they don't want you to understand:

Step 1: Pay your claim (reluctantly)

Step 2: Sue whoever caused the disaster

Step 3: Block YOUR settlement from other sources

Step 4: Keep both payouts for themselves

It's called "subrogation." And it's perfectly legal.

Step 1: Pay your claim (reluctantly)

Step 2: Sue whoever caused the disaster

Step 3: Block YOUR settlement from other sources

Step 4: Keep both payouts for themselves

It's called "subrogation." And it's perfectly legal.

While victims waited for help, insurers played a different game.

They'd already collected $2.6 billion fighting to block the $4 billion victim settlement.

Think about that math: They spent more money blocking victims than some companies make in a year.

The cruelty was the point.

They'd already collected $2.6 billion fighting to block the $4 billion victim settlement.

Think about that math: They spent more money blocking victims than some companies make in a year.

The cruelty was the point.

The defendants, Hawaiian Electric, the State, Kamehameha Schools—agreed to a $4.04 billion settlement.

$1.99 billion from Hawaiian Electric alone.

$872.5 million from Kamehameha Schools.

$800 million from the State of Hawaii.

But there was one problem...

$1.99 billion from Hawaiian Electric alone.

$872.5 million from Kamehameha Schools.

$800 million from the State of Hawaii.

But there was one problem...

192 insurance companies said: "Not so fast."

They demanded the right to sue these same defendants separately.

Their logic? "We paid victims $2.6 billion. Now we want it back from the people who caused this."

17,000 victims became hostages to corporate greed.

They demanded the right to sue these same defendants separately.

Their logic? "We paid victims $2.6 billion. Now we want it back from the people who caused this."

17,000 victims became hostages to corporate greed.

This is where it gets truly sinister.

Insurance companies had a choice: Join the settlement and help victims, or block it and chase their own money.

They chose greed.

For 18 months, families who lost everything waited. And waited. And waited.

Insurance companies had a choice: Join the settlement and help victims, or block it and chase their own money.

They chose greed.

For 18 months, families who lost everything waited. And waited. And waited.

The timeline of betrayal:

August 2023: Fires destroy Lahaina

August 2024: Settlement announced

February 2025: STILL fighting in court

26 families lost loved ones. Only ONE wrongful death claim was paid.

This wasn't incompetence. This was the system working as designed.

August 2023: Fires destroy Lahaina

August 2024: Settlement announced

February 2025: STILL fighting in court

26 families lost loved ones. Only ONE wrongful death claim was paid.

This wasn't incompetence. This was the system working as designed.

But Hawaii's Supreme Court saw through the charade.

February 10, 2025: Unanimous decision AGAINST the insurance companies.

The Court ruled that victims' rights come before insurer profits.

Finally, after nearly 2 years of hell, families could start to heal.

February 10, 2025: Unanimous decision AGAINST the insurance companies.

The Court ruled that victims' rights come before insurer profits.

Finally, after nearly 2 years of hell, families could start to heal.

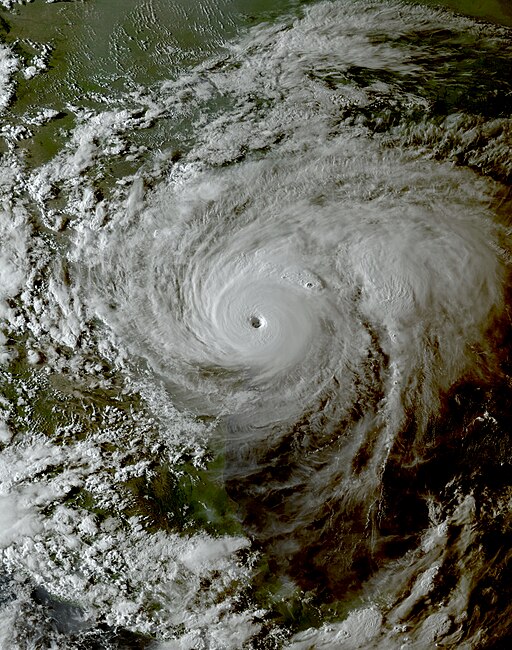

Here's the terrifying truth: This happens after EVERY disaster.

Hurricane Harvey: 68% of 154,000 flooded homes were uninsured.

California fires: "Smoke damage" exclusions kick in.

Texas hailstorms: Claims denied as "wear and tear."

The pattern never changes.

Hurricane Harvey: 68% of 154,000 flooded homes were uninsured.

California fires: "Smoke damage" exclusions kick in.

Texas hailstorms: Claims denied as "wear and tear."

The pattern never changes.

Your policy is riddled with landmines:

• Subrogation clauses that delay settlements

• Exclusions that activate during disasters

• Coverage gaps between what you need and have

Your premium buys you a spot in line, not protection.

• Subrogation clauses that delay settlements

• Exclusions that activate during disasters

• Coverage gaps between what you need and have

Your premium buys you a spot in line, not protection.

Most property owners miss these red flags until it's too late.

"They discover their "comprehensive coverage" excludes the very disasters they need it for most."

But there's a different way to think about protection...

"They discover their "comprehensive coverage" excludes the very disasters they need it for most."

But there's a different way to think about protection...

Smart property owners are taking control of their risk BEFORE disaster strikes.

Instead of hoping insurance companies will honor their promises, they're making their properties genuinely safer.

Wildfire mitigation can reduce your risk AND your insurance costs by up to 80%.

Instead of hoping insurance companies will honor their promises, they're making their properties genuinely safer.

Wildfire mitigation can reduce your risk AND your insurance costs by up to 80%.

The most successful approach combines two strategies:

1) Make your property demonstrably safer through proven mitigation

2) Use that reduced risk to negotiate better coverage at lower costs

This isn't about fear tactics. It's about taking back control from an industry that profits from your vulnerability.

1) Make your property demonstrably safer through proven mitigation

2) Use that reduced risk to negotiate better coverage at lower costs

This isn't about fear tactics. It's about taking back control from an industry that profits from your vulnerability.

If you're a commercial property manager in a fire zone:

We'll help you mitigate wildfire risk while decreasing your insurance costs.

We helped a homeowner save $174k/year while making their $35M property genuinely safe.

Learn more: rockroserisk.com

We'll help you mitigate wildfire risk while decreasing your insurance costs.

We helped a homeowner save $174k/year while making their $35M property genuinely safe.

Learn more: rockroserisk.com

Thanks for reading.

If you don't know me yet:

I'm Andrew. I've built companies from $0 to $120M ARR. At 23, I ran the 2nd largest Allstate agency in California.

Now my mission is to prevent catastrophic disasters before they happen.

If you don't know me yet:

I'm Andrew. I've built companies from $0 to $120M ARR. At 23, I ran the 2nd largest Allstate agency in California.

Now my mission is to prevent catastrophic disasters before they happen.

I hope you've found this thread helpful.

Follow me @aerockrose for more.

Like/Repost the quote below if you can:

Follow me @aerockrose for more.

Like/Repost the quote below if you can:

https://twitter.com/983747994360131584/status/1960688888596586678

• • •

Missing some Tweet in this thread? You can try to

force a refresh