(1/7) CCC#1: Saving on Gold with Credit Cards 🧵✨

Thought about buying Gold below market rate?💰

It’s possible with the right credit card + timing combo.

Here is a deep-dive 👇

1️⃣ Mechanics

2️⃣ Preparation

3️⃣ Execution

4️⃣ Closure

5️⃣ Savings Math

Big thanks to @GoldDealsIndia, @SartanparaYash & @ccg33k for the inspo 🙏 — here’s my experience & learnings ⬇️

Thought about buying Gold below market rate?💰

It’s possible with the right credit card + timing combo.

Here is a deep-dive 👇

1️⃣ Mechanics

2️⃣ Preparation

3️⃣ Execution

4️⃣ Closure

5️⃣ Savings Math

Big thanks to @GoldDealsIndia, @SartanparaYash & @ccg33k for the inspo 🙏 — here’s my experience & learnings ⬇️

(2/7) 1️⃣ Mechanics

Tools we used:

💳 HDFC Infinia Metal

🖥️ HDFC Gyftr (Smartbuy)

🛍️ Myntra

The overall flow:

🔖 Buy Myntra GV via Gyftr (Infinia → ~16.7% back in RPs, capped)

🏷️ Load GV → Myntra Credit → wait for BLINKDEAL promo

💰 Add gold coin, apply promo, checkout using Myntra Credit

💵 Sell coin at jeweller → NEFT credit in 2–3 days

💡 stack reward points + promo discount = Gold cheaper than spot rate.

Tools we used:

💳 HDFC Infinia Metal

🖥️ HDFC Gyftr (Smartbuy)

🛍️ Myntra

The overall flow:

🔖 Buy Myntra GV via Gyftr (Infinia → ~16.7% back in RPs, capped)

🏷️ Load GV → Myntra Credit → wait for BLINKDEAL promo

💰 Add gold coin, apply promo, checkout using Myntra Credit

💵 Sell coin at jeweller → NEFT credit in 2–3 days

💡 stack reward points + promo discount = Gold cheaper than spot rate.

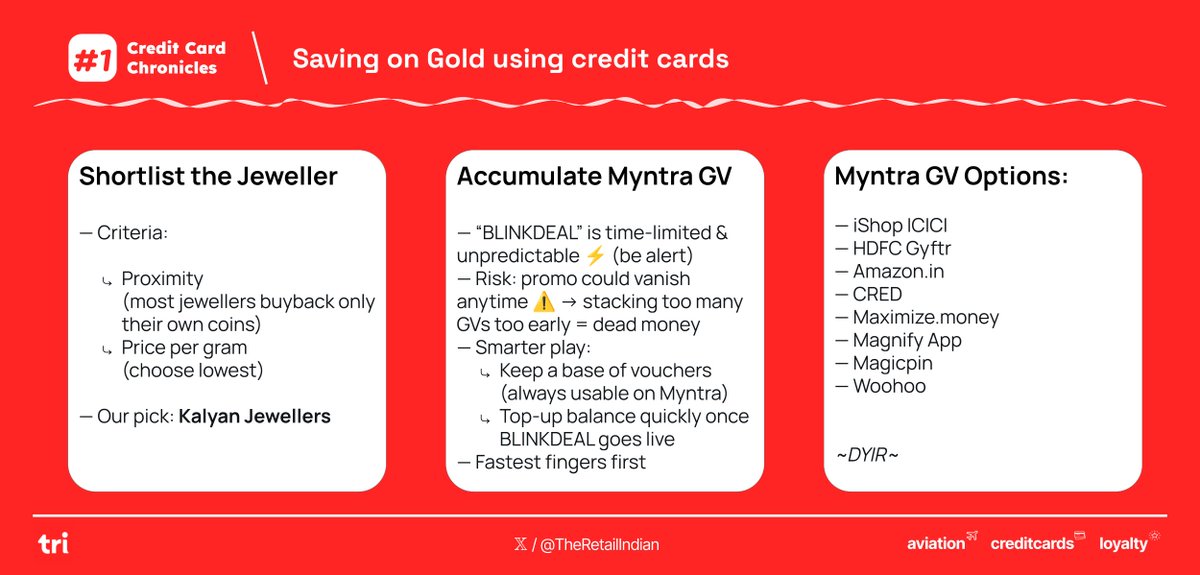

(3/7) 2️⃣ Preparation

☀ Shortlist the jeweller

— Browse Myntra: myntra.com/gold-coin?p=1

— Coins listed from Kalyan, Joyalukkas, etc.

— Criteria:

⤷ Proximity (most jewellers buyback only their own coins)

⤷ Price per gram (choose lowest)

— Our pick: Kalyan Jewellers

☀ Accumulate Myntra Gift Vouchers (GVs)

— “BLINKDEAL” is time-limited & unpredictable ⚡ (follow @GoldDealsIndia for alerts)

— Risk: promo could vanish anytime ⚠️ → stacking too many GVs too early = dead money

— Smarter play:

⤷ Keep a base of vouchers (always usable on Myntra)

⤷ Top-up balance quickly once BLINKDEAL goes live

— Fastest fingers first: GVs run out of stock when promo hits 🚨

GV buying options:

🔹 iShop ICICI (18% back, capped)

🔹 Amazon (₹2.5K x 10, no cashback, no APay)

🔹 CRED (₹2.5K chunks, 2% off + CB%)

🔹 Maximize.money

🔹 MagnifyClub (up to 4.5% off, variable)

🔹 MagicPin

🔹 Woohoo (₹2.5K x 10, 2% off + coin redemption)

🔹 HDFC Gyftr (Max ₹25K/month, 16.7% back with Infinia, 15K RP cap)

Our pick: HDFC Gyftr (no EPM 😔)

⚠️ Myntra product page will show credit card cashback offers on cards like Flipkart SBI, Flipkart Axis etc. — be careful and read T&C before using, gold and jewellery as mostly excluded

☀ Shortlist the jeweller

— Browse Myntra: myntra.com/gold-coin?p=1

— Coins listed from Kalyan, Joyalukkas, etc.

— Criteria:

⤷ Proximity (most jewellers buyback only their own coins)

⤷ Price per gram (choose lowest)

— Our pick: Kalyan Jewellers

☀ Accumulate Myntra Gift Vouchers (GVs)

— “BLINKDEAL” is time-limited & unpredictable ⚡ (follow @GoldDealsIndia for alerts)

— Risk: promo could vanish anytime ⚠️ → stacking too many GVs too early = dead money

— Smarter play:

⤷ Keep a base of vouchers (always usable on Myntra)

⤷ Top-up balance quickly once BLINKDEAL goes live

— Fastest fingers first: GVs run out of stock when promo hits 🚨

GV buying options:

🔹 iShop ICICI (18% back, capped)

🔹 Amazon (₹2.5K x 10, no cashback, no APay)

🔹 CRED (₹2.5K chunks, 2% off + CB%)

🔹 Maximize.money

🔹 MagnifyClub (up to 4.5% off, variable)

🔹 MagicPin

🔹 Woohoo (₹2.5K x 10, 2% off + coin redemption)

🔹 HDFC Gyftr (Max ₹25K/month, 16.7% back with Infinia, 15K RP cap)

Our pick: HDFC Gyftr (no EPM 😔)

⚠️ Myntra product page will show credit card cashback offers on cards like Flipkart SBI, Flipkart Axis etc. — be careful and read T&C before using, gold and jewellery as mostly excluded

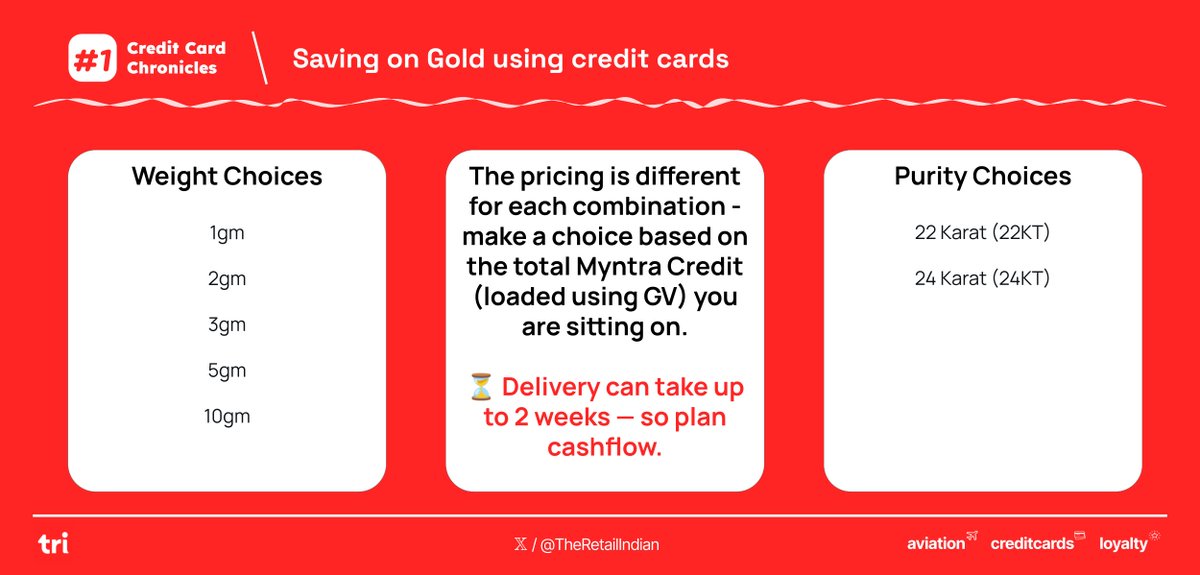

(4/7) 3️⃣ Execution

① Load all Myntra GVs into Myntra Credit

② Add gold coin (1g / 5g / 10g, 22Kt vs 24Kt)

③ Apply BLINKDEAL promo → unlock extra discount

④ Checkout using your Myntra Credit balance

⏳ Delivery can take up to 2 weeks — so plan cashflow.

① Load all Myntra GVs into Myntra Credit

② Add gold coin (1g / 5g / 10g, 22Kt vs 24Kt)

③ Apply BLINKDEAL promo → unlock extra discount

④ Checkout using your Myntra Credit balance

⏳ Delivery can take up to 2 weeks — so plan cashflow.

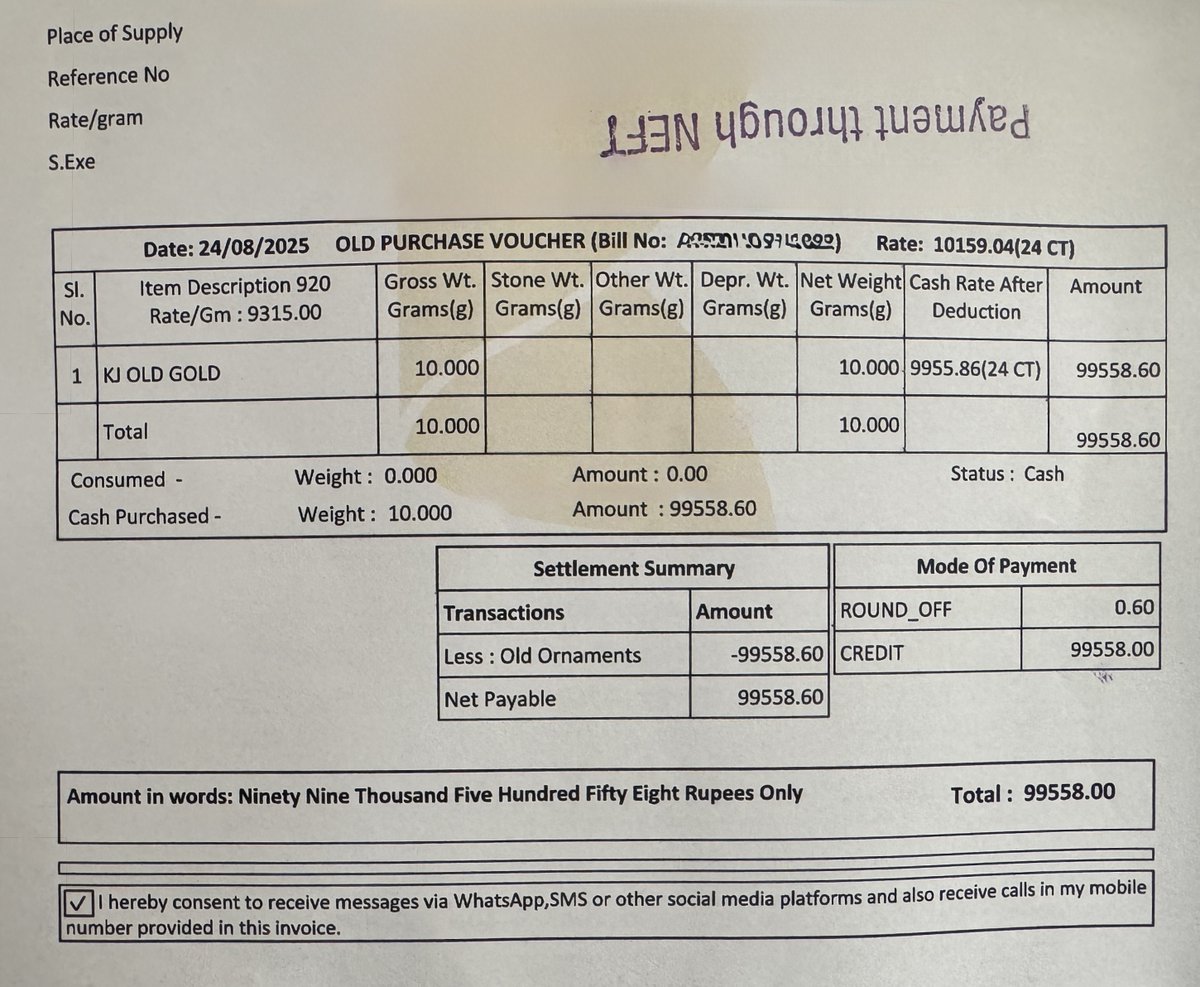

(5/7) 4️⃣ Closure

Once coin is delivered:

① Visit nearest showroom of the same jeweller

② Tell staff you want to sell → buyback at ~98% of day’s rate

③ Agree on rate & fill form (basically bank details)

④ Documents: PAN/Aadhaar + cheque book/net banking details/passbook (soft copies usually okay via WhatsApp)

⑤ Jeweller issues bill, NEFT in 2–3 days (mine was credited next day ✅)

💡Pro tip: Picking the right jeweller makes closure smooth as most big jewellers only buyback their own gold coins

Once coin is delivered:

① Visit nearest showroom of the same jeweller

② Tell staff you want to sell → buyback at ~98% of day’s rate

③ Agree on rate & fill form (basically bank details)

④ Documents: PAN/Aadhaar + cheque book/net banking details/passbook (soft copies usually okay via WhatsApp)

⑤ Jeweller issues bill, NEFT in 2–3 days (mine was credited next day ✅)

💡Pro tip: Picking the right jeweller makes closure smooth as most big jewellers only buyback their own gold coins

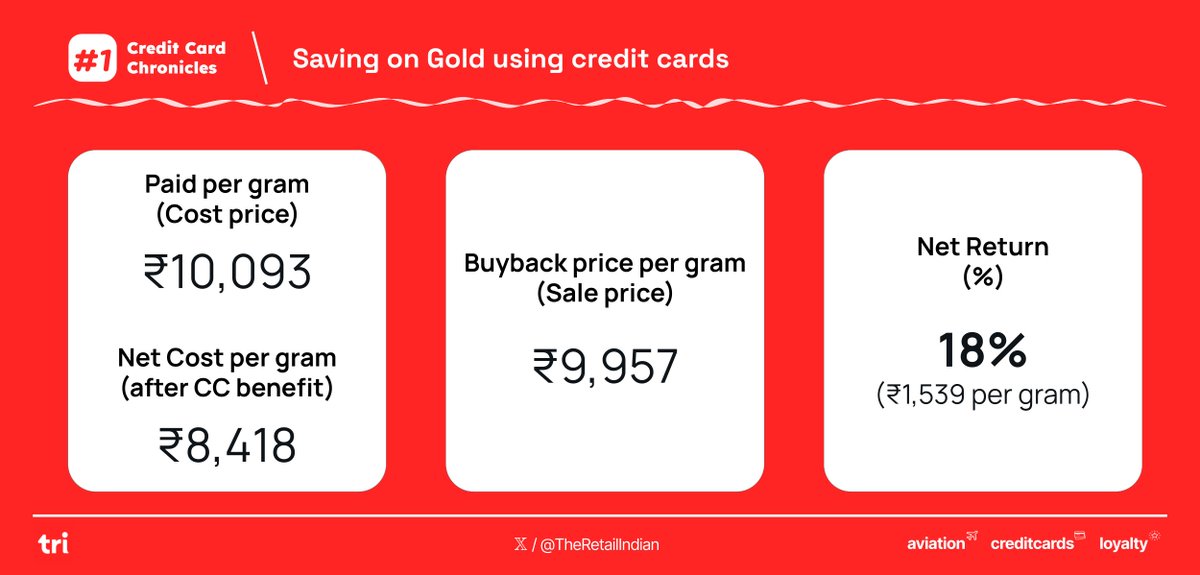

(6/7) 5️⃣ Savings Math 📊 (all numbers per gram of gold)

Myntra list price/gm: ₹12,044

— Myntra base discount: ₹1,095 (~9%)

— BLINKDEAL discount: ₹876

— Platform fee: ₹20

Paid/gm = ₹10,093

Market rate on buy date: ₹10,120 (but direct purchase = +making charges + 3% GST 🚨)

👉 HDFC Infinia RP value/gm: ₹1,675

Net effective cost = ₹8,418/gm

Sale after ~1 month:

Market rate = ₹10,160

Buyback @98% = ₹9,957

✅ Net return = 9,957 / 8,418 – 1 = ~18% 🚀

Myntra list price/gm: ₹12,044

— Myntra base discount: ₹1,095 (~9%)

— BLINKDEAL discount: ₹876

— Platform fee: ₹20

Paid/gm = ₹10,093

Market rate on buy date: ₹10,120 (but direct purchase = +making charges + 3% GST 🚨)

👉 HDFC Infinia RP value/gm: ₹1,675

Net effective cost = ₹8,418/gm

Sale after ~1 month:

Market rate = ₹10,160

Buyback @98% = ₹9,957

✅ Net return = 9,957 / 8,418 – 1 = ~18% 🚀

(7/7) CCC#1: Saving on Gold with Credit Cards 🧵

TL;DR:

Gyftr (Infinia → 16.7% RP) → Myntra Credit → BLINKDEAL promo → Buy gold coin → Sell at jeweller → Profit 💰

⚠️ Caveats:

🔹 BLINKDEAL is unpredictable & may discontinue

🔹 GV order limits & caps vary by platform

🔹 Gold coin delivery may take 2-3 weeks — patience needed

Like ❤️ | Share ♻️| Bookmark 🔖

Not financial advice, just showing how CC + timing = hidden alpha ✨

x.com/TheRetailIndia…

TL;DR:

Gyftr (Infinia → 16.7% RP) → Myntra Credit → BLINKDEAL promo → Buy gold coin → Sell at jeweller → Profit 💰

⚠️ Caveats:

🔹 BLINKDEAL is unpredictable & may discontinue

🔹 GV order limits & caps vary by platform

🔹 Gold coin delivery may take 2-3 weeks — patience needed

Like ❤️ | Share ♻️| Bookmark 🔖

Not financial advice, just showing how CC + timing = hidden alpha ✨

x.com/TheRetailIndia…

@BoardingArea @greatindianmile @MagnifyClub @Savesage_club @cards_wizard @VoyageBliss @thetrickytrade @iSatishAgarwal @Being_Shailesh @drgrudge @threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh