Jeff Booth just went on Frank Corva’s show to deliver a blunt message: one system must die for Bitcoin to win.

He says money has always been subordinate to law and those who control money rewrite the laws to serve themselves.

But Bitcoin flips the script.

Here’s what Jeff said, what it means, and how Bitcoin changes the game (with my added commentary).

A 🧵:

He says money has always been subordinate to law and those who control money rewrite the laws to serve themselves.

But Bitcoin flips the script.

Here’s what Jeff said, what it means, and how Bitcoin changes the game (with my added commentary).

A 🧵:

1/ The Natural State of Markets

“The natural state of the free market is deflation.”

In a truly free market, innovation drives prices down forever.

Why?

Because humanity progresses by making goods and services cheaper.

However, our credit-based system can’t survive falling prices. Instead, it relies upon constant inflation.

That’s why you see shocking statistics like:

- The average age of first-time homebuyers in the U.S. is now 36, the oldest on record.

- A cart of groceries that cost $100 in 2000 now costs $190.

- Since 1971, the dollar has lost 86% of its purchasing power.

This isn’t random chaos. It’s the system working exactly as designed.

“The natural state of the free market is deflation.”

In a truly free market, innovation drives prices down forever.

Why?

Because humanity progresses by making goods and services cheaper.

However, our credit-based system can’t survive falling prices. Instead, it relies upon constant inflation.

That’s why you see shocking statistics like:

- The average age of first-time homebuyers in the U.S. is now 36, the oldest on record.

- A cart of groceries that cost $100 in 2000 now costs $190.

- Since 1971, the dollar has lost 86% of its purchasing power.

This isn’t random chaos. It’s the system working exactly as designed.

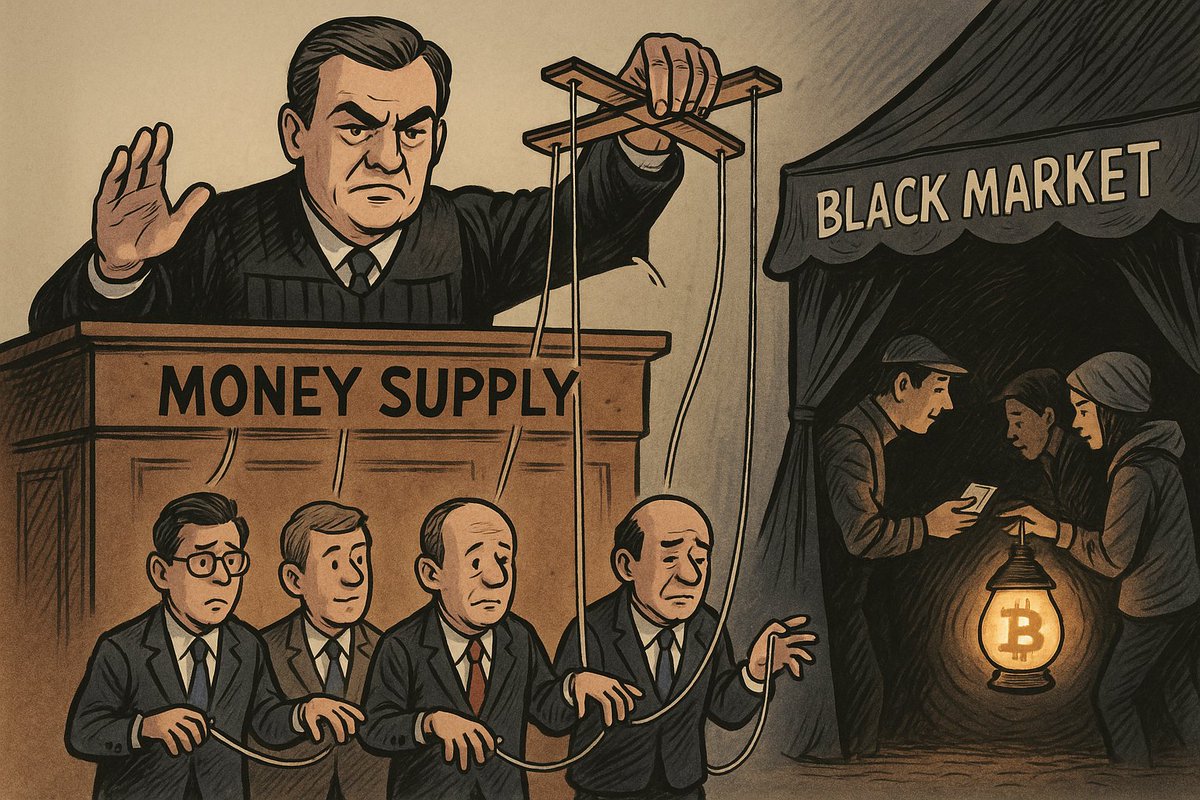

2/ Money vs. Law

“Money has always been subordinate to law.”

Whoever controls the money, changes the laws.

That’s why the countries with the most broken money always develop black markets for strong ones.

From Argentina to Nigeria, the pattern is clear.

People seek honesty in money when their leaders debase it.

Bitcoin is that black market money... but on a global scale.

“Money has always been subordinate to law.”

Whoever controls the money, changes the laws.

That’s why the countries with the most broken money always develop black markets for strong ones.

From Argentina to Nigeria, the pattern is clear.

People seek honesty in money when their leaders debase it.

Bitcoin is that black market money... but on a global scale.

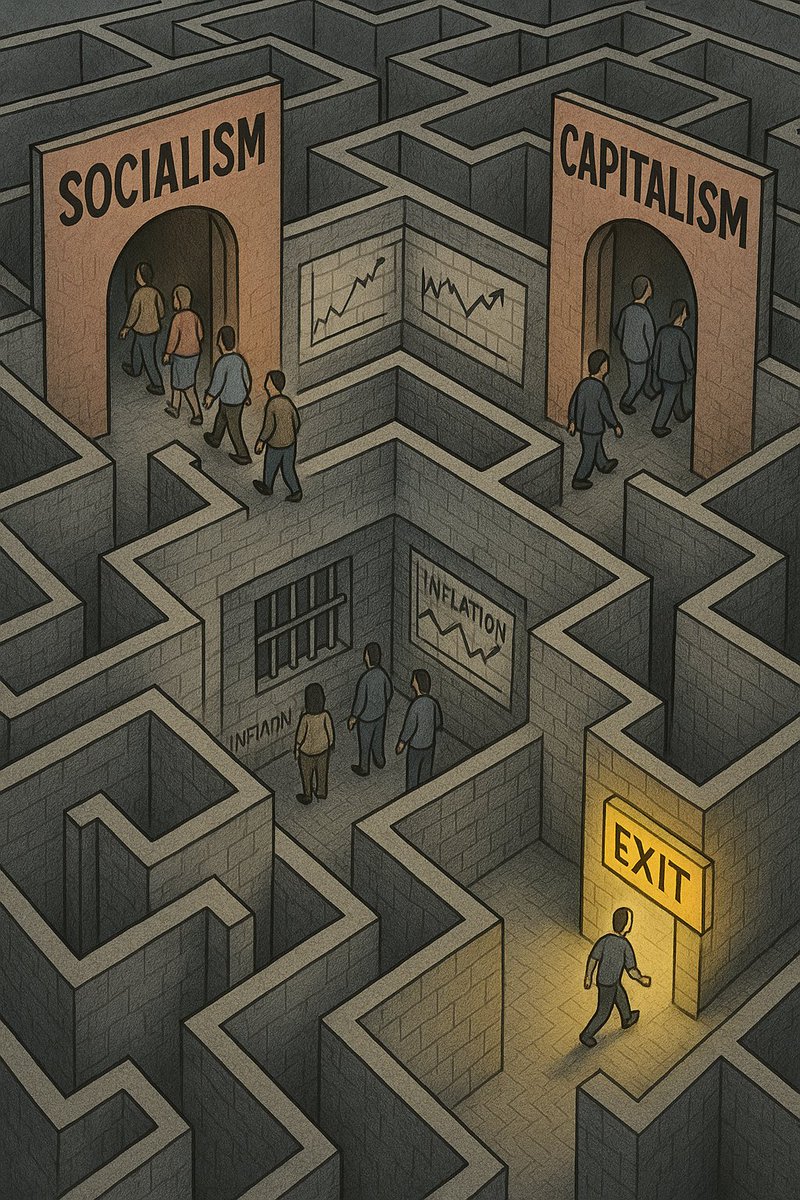

3/ The Illusion of Choice

“Socialism or capitalism… those words don’t mean anything. They’re both control systems.”

No matter the political branding, the result is the same: expanding control, eroding freedoms, and citizens trapped in inflation.

We’ve never lived in a global free market.

We’ve only lived inside systems of control.

Bitcoin is the first exit.

“Socialism or capitalism… those words don’t mean anything. They’re both control systems.”

No matter the political branding, the result is the same: expanding control, eroding freedoms, and citizens trapped in inflation.

We’ve never lived in a global free market.

We’ve only lived inside systems of control.

Bitcoin is the first exit.

4/ Gamifying Suppression

Here’s the genius of Bitcoin: It punishes suppression.

If a country tries to ban it, the capital and talent simply flow to places that embrace it.

If a country welcomes it, they attract entrepreneurs, wealth, and innovation.

Bitcoin turns geopolitics into a game theory tournament... and freedom is the winning strategy.

Here’s the genius of Bitcoin: It punishes suppression.

If a country tries to ban it, the capital and talent simply flow to places that embrace it.

If a country welcomes it, they attract entrepreneurs, wealth, and innovation.

Bitcoin turns geopolitics into a game theory tournament... and freedom is the winning strategy.

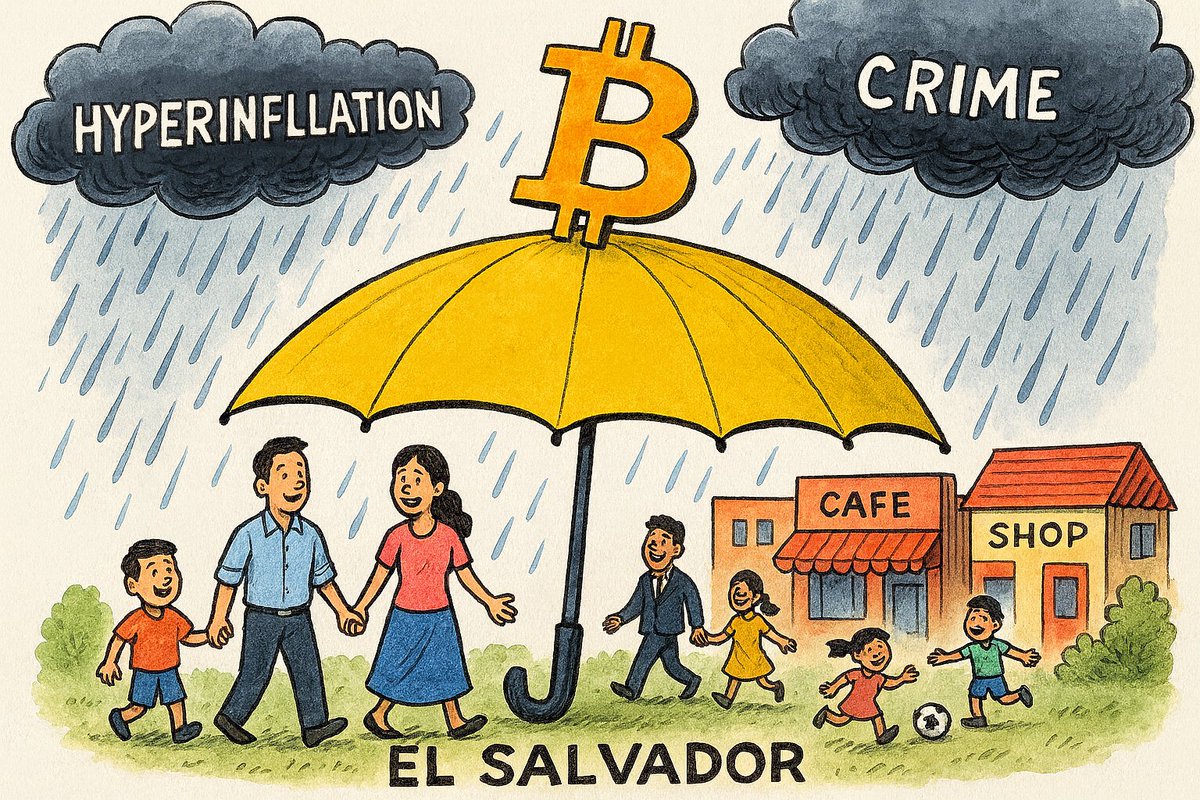

5/ El Salvador: The New Standard

Jeff shared his recent meeting with President Bukele who said “I need more of my people in self-custody. I need more nodes run. I need more people spending Bitcoin in this country.”

That’s not dictator-speak. That’s a leader giving power back to citizens.

El Salvador is proving what happens when a nation embraces Bitcoin as freedom money.

Hyper-inflation stabilizes.

Crime crashes back down to earth.

Citizens prosper.

Jeff shared his recent meeting with President Bukele who said “I need more of my people in self-custody. I need more nodes run. I need more people spending Bitcoin in this country.”

That’s not dictator-speak. That’s a leader giving power back to citizens.

El Salvador is proving what happens when a nation embraces Bitcoin as freedom money.

Hyper-inflation stabilizes.

Crime crashes back down to earth.

Citizens prosper.

6/ Cognitive Dissonance

Whether you like it or not, politicians needs to be involved in order to hyper-Bitcoinize the world.

Booth’s approach with politicians is simple: Start with an absolute truth.

For example, everyone intuitively understands that the natural state of the free market is deflation.

However our credit-based system openly contradict that idea as we experience varying degrees of inflation globally.

This clash of ideals forces leaders to reconcile the lie.

That’s when the orange pill begins to kick in.

Whether you like it or not, politicians needs to be involved in order to hyper-Bitcoinize the world.

Booth’s approach with politicians is simple: Start with an absolute truth.

For example, everyone intuitively understands that the natural state of the free market is deflation.

However our credit-based system openly contradict that idea as we experience varying degrees of inflation globally.

This clash of ideals forces leaders to reconcile the lie.

That’s when the orange pill begins to kick in.

7/ Bitcoin: The Alternative System

So what’s the exit?

Bitcoin.

“It’s an open decentralized secure protocol bounded by energy. If it stays decentralized and secure… it’s very hard to cheat.”

Bitcoin is the first global free market we’ve ever had.

Prices fall in Bitcoin terms forever. Value flows to those who create, not those who control.

This isn’t just money.

It’s a new financial system for humanity.

So what’s the exit?

Bitcoin.

“It’s an open decentralized secure protocol bounded by energy. If it stays decentralized and secure… it’s very hard to cheat.”

Bitcoin is the first global free market we’ve ever had.

Prices fall in Bitcoin terms forever. Value flows to those who create, not those who control.

This isn’t just money.

It’s a new financial system for humanity.

If you enjoyed this post, please like and retweet it for a fellow Bitcoiner!

As an ex-TradFi veteran of 14 years, I am creating something in stealth for the Bitcoin Treasury community.

Follow me @BTCBULLRIDER for similar content in the future!

As an ex-TradFi veteran of 14 years, I am creating something in stealth for the Bitcoin Treasury community.

Follow me @BTCBULLRIDER for similar content in the future!

• • •

Missing some Tweet in this thread? You can try to

force a refresh