A lot of folks think, “Why do I need miles when my card lets me book hotels directly on an OTA platform?” 🤔

Here’s why it actually matters, and why EPM must start a miles transfer program soon 🧵👇

Here’s why it actually matters, and why EPM must start a miles transfer program soon 🧵👇

I had some reward points on my HDFC DCB.

At the same time, I was short of points in Accor for upcoming hotel stays.

70% of my stays were already going via Accor → so the decision was -

1⃣ Use DCB points to book hotels directly via Smartbuy

2⃣ OR transfer them to Accor

At the same time, I was short of points in Accor for upcoming hotel stays.

70% of my stays were already going via Accor → so the decision was -

1⃣ Use DCB points to book hotels directly via Smartbuy

2⃣ OR transfer them to Accor

If I use HDFC DCB points directly on Smartbuy OTA, I get -

❌ No Accor reward points

❌ No Accor status points

❌ Nights don’t count towards my loyalty tier

Basically, I’d lose all the loyalty benefits of booking inside the Accor ecosystem.

❌ No Accor reward points

❌ No Accor status points

❌ Nights don’t count towards my loyalty tier

Basically, I’d lose all the loyalty benefits of booking inside the Accor ecosystem.

So instead, I transferred DCB points to Accor.

Conversion rate = 1 RP → 0.5 Accor points.

Now, here’s the thing,

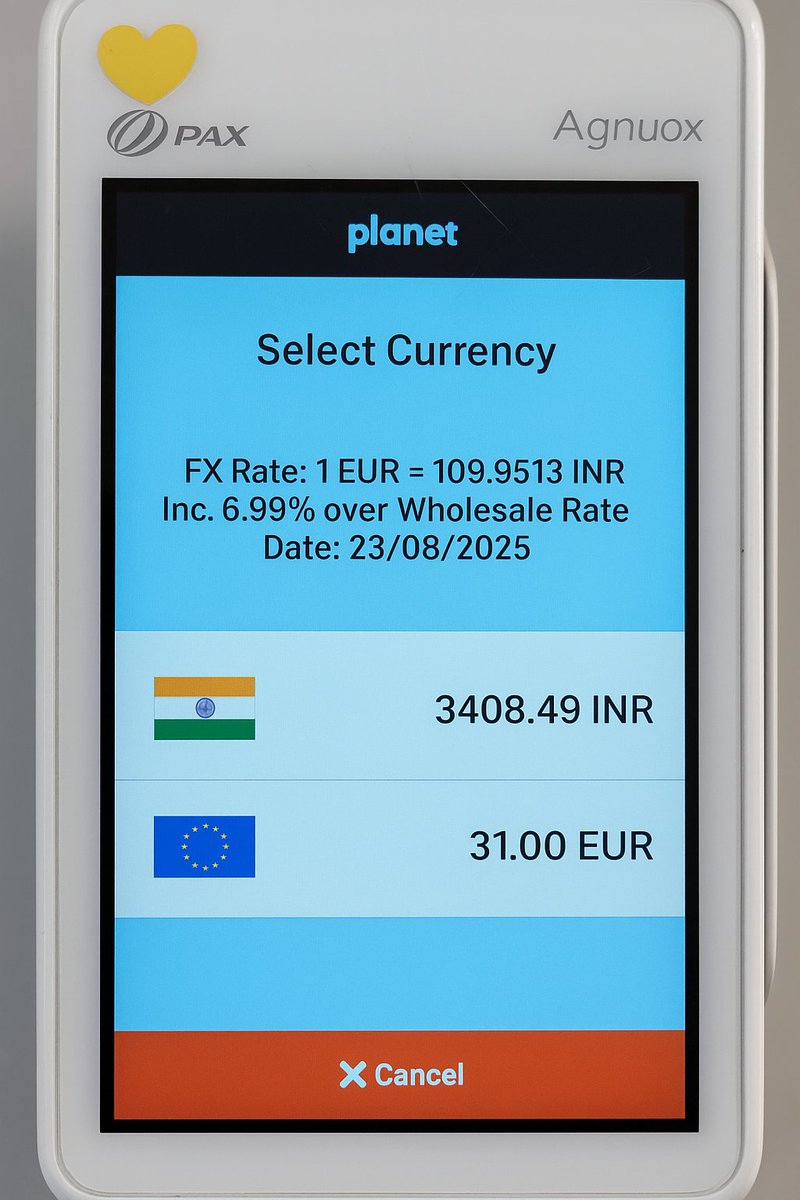

With euro at a high, Accor points gave me almost 2X INR value

Even after 0.5 conversion, I got ~₹1 per RP

PLUS, I earned all my status & reward points on my stays

Conversion rate = 1 RP → 0.5 Accor points.

Now, here’s the thing,

With euro at a high, Accor points gave me almost 2X INR value

Even after 0.5 conversion, I got ~₹1 per RP

PLUS, I earned all my status & reward points on my stays

This is why miles & hotel point transfers matter.

Direct OTA redemptions are fine for one-off trips.

But if you’re inside a loyalty program, then every night, every flight, every point, every tier matters!

Direct OTA redemptions are fine for one-off trips.

But if you’re inside a loyalty program, then every night, every flight, every point, every tier matters!

And that’s why I believe:

If EPM (Emeralde Private Metal) wants to compete head-to-head with cards like Infinia, it must launch a robust miles transfer program.

Without it, it will be “just another OTA redemption and GV card” and that’s not enough in the premium space.

If EPM (Emeralde Private Metal) wants to compete head-to-head with cards like Infinia, it must launch a robust miles transfer program.

Without it, it will be “just another OTA redemption and GV card” and that’s not enough in the premium space.

For frequent travelers, loyalty points > plain OTA bookings.

That’s the gap EPM needs to close with a miles program.

Do you agree?

Or would you still prefer the flexibility of OTAs?

That’s the gap EPM needs to close with a miles program.

Do you agree?

Or would you still prefer the flexibility of OTAs?

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh