Breaking down smart money moves, pointwise!

💲Personal Finance 💳 Credit Cards | ✈️ Travel Hacks | 💡 Side Hustles

How to get URL link on X (Twitter) App

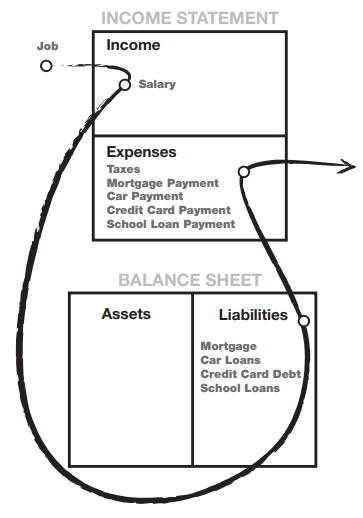

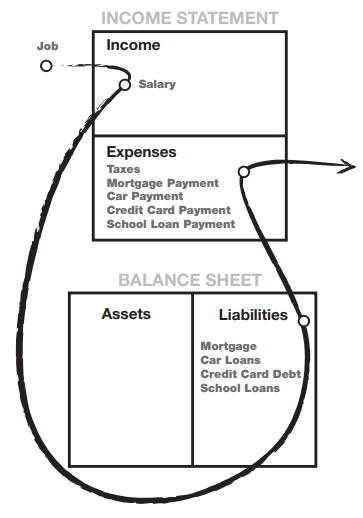

Most of us are taught to measure wealth by what we own.

Most of us are taught to measure wealth by what we own.

Every foreign transaction on Atlas comes with:

Every foreign transaction on Atlas comes with:

EPM gives you ₹1.4L Purchase Protection.

EPM gives you ₹1.4L Purchase Protection.

EPM comes with a ₹3 crore Air Accident Cover!

EPM comes with a ₹3 crore Air Accident Cover!

1⃣In India, EMIs are collected via NACH/e-mandate from your savings account.

1⃣In India, EMIs are collected via NACH/e-mandate from your savings account.

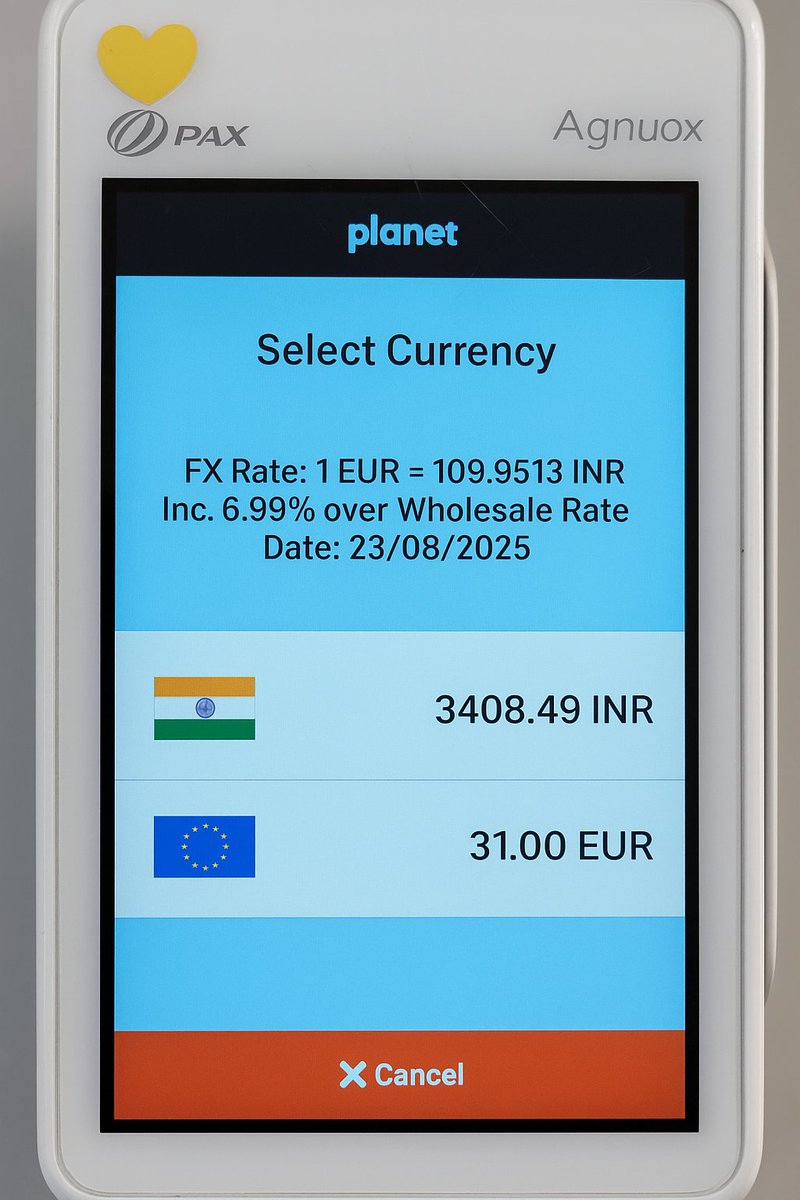

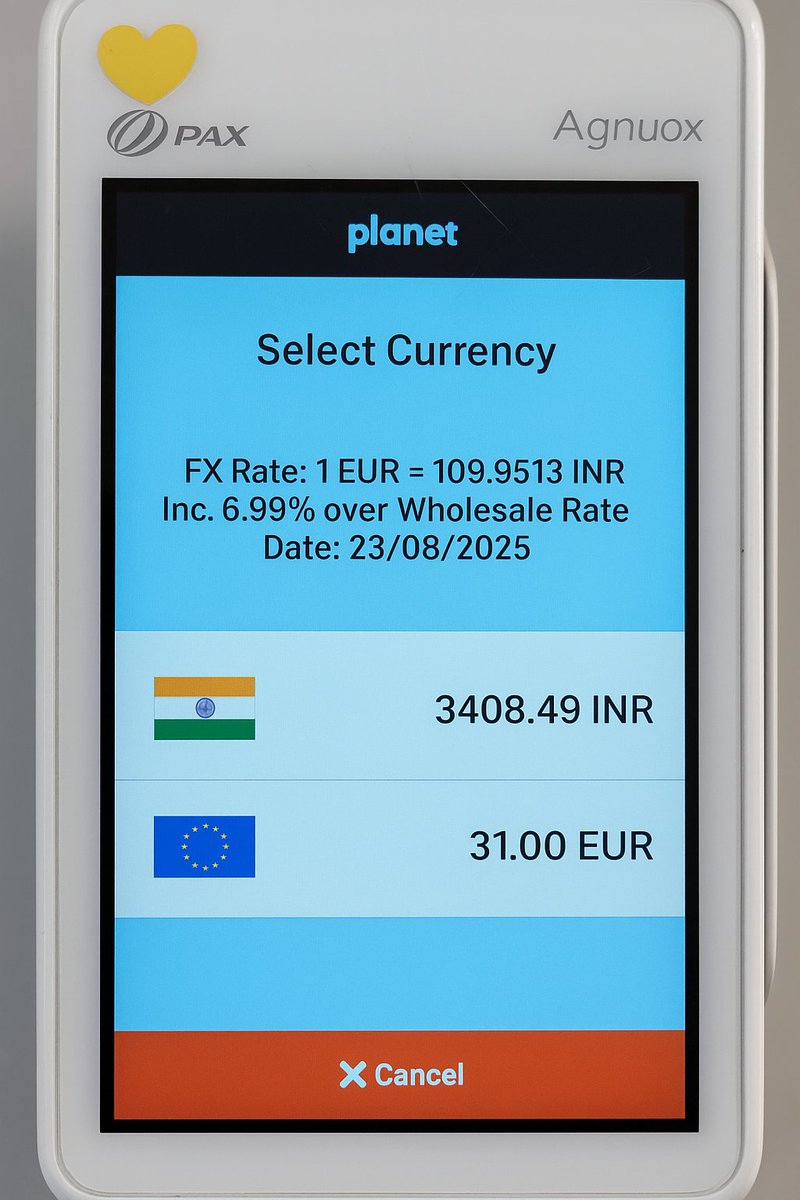

When you swipe at a POS in Europe (or anywhere abroad), the machine often asks:

When you swipe at a POS in Europe (or anywhere abroad), the machine often asks:

I had some reward points on my HDFC DCB.

I had some reward points on my HDFC DCB.