The US is laughing on India.

Indians are making the fall of INR into a political issue.

And, are getting swayed by emotions.

Let me break down the complex topic for you:-

- Why is INR falling compared to USD?

- Can India strengthen its rupee?

- Why should you care. And, how this impacts you (financially)?

👇👇

Indians are making the fall of INR into a political issue.

And, are getting swayed by emotions.

Let me break down the complex topic for you:-

- Why is INR falling compared to USD?

- Can India strengthen its rupee?

- Why should you care. And, how this impacts you (financially)?

👇👇

Why is INR losing value?

- 10 years ago INR was 61, now its almost 88; that's a 44% drop compared to USD. But, why does a currency fall?

Answer) If demand for a currency << supply of that currency it falls.

Supply of the currency is driven by the government. They decide how much to print. If they print "too much", it could have inflationary impact. Plus other negative consequences.

While the supply is controlled by the government, the "demand" is market driven.

So what impacts demand?

👇👇

- 10 years ago INR was 61, now its almost 88; that's a 44% drop compared to USD. But, why does a currency fall?

Answer) If demand for a currency << supply of that currency it falls.

Supply of the currency is driven by the government. They decide how much to print. If they print "too much", it could have inflationary impact. Plus other negative consequences.

While the supply is controlled by the government, the "demand" is market driven.

So what impacts demand?

👇👇

What impacts demand? In simple words: it is the usefulness of currency

Here is a real world example

1) India pays an estimated $59.5 billion per year for crude oil and petroleum products imported from Russia (2024 data)

2) Currently, less than 5% of this payment is made in INR. And, 95% is made in AED (UAE, Dirhams)

Most important question here is why? See, the reason is: that if India pays 60Bn$ to Russia in INR. What would Russia do with it?

Fine, they will pay back some of this money back for things they are importing from India. But, here is the problem:-

India's export to Russia is only 5Bn$.

We run a massive trade deficit with them.

So what is Russia supposed to do 55Bn$ worth of INR?

Here is a real world example

1) India pays an estimated $59.5 billion per year for crude oil and petroleum products imported from Russia (2024 data)

2) Currently, less than 5% of this payment is made in INR. And, 95% is made in AED (UAE, Dirhams)

Most important question here is why? See, the reason is: that if India pays 60Bn$ to Russia in INR. What would Russia do with it?

Fine, they will pay back some of this money back for things they are importing from India. But, here is the problem:-

India's export to Russia is only 5Bn$.

We run a massive trade deficit with them.

So what is Russia supposed to do 55Bn$ worth of INR?

Answer) they can't do much with it.

India in the past experimented with a rupee trade settlement system with Russia in 2023 (the same system, we are talking about now with BRICS)

But, it was abandoned.

Why? In simple words our currency is not easily convertible because: there is no real use case of INR for foreign sellers.

This will hurt your emotions. But, the fact remains:

"Most Indian state oil refiners now pay Russia in UAE dirhams (AED) rather than rupees"

The US has no such problem despite its big debt. US$ is easily convertible. In fact 54% of world's trade gets settled in USD.

India in the past experimented with a rupee trade settlement system with Russia in 2023 (the same system, we are talking about now with BRICS)

But, it was abandoned.

Why? In simple words our currency is not easily convertible because: there is no real use case of INR for foreign sellers.

This will hurt your emotions. But, the fact remains:

"Most Indian state oil refiners now pay Russia in UAE dirhams (AED) rather than rupees"

The US has no such problem despite its big debt. US$ is easily convertible. In fact 54% of world's trade gets settled in USD.

Before we understand: how can Indian strengthen its rupee, here is a quick request:-

If you like Economics, Finance, Investing, consider checking out Wisdom Hatch community.

I teach global investing in simple terms. Investing globally serves 2 purpose:

1) It gives you a currency hedge

2) It helps you scout a wider market and build a better/more resilient portfolio.

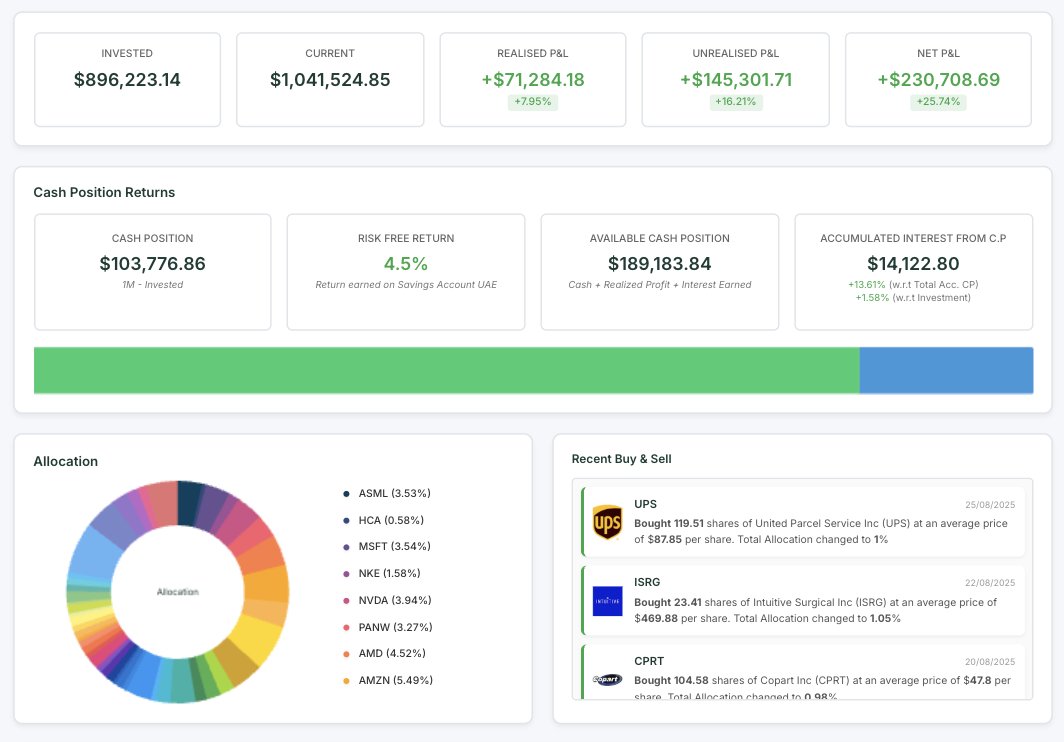

In fact, I build a 1Mn$ portfolio in the US recently. And, it outperforms 99% of funds right now

Check more about the community here: wisdomhatch.com/courses/wisdom…

Now back to thread...

If you like Economics, Finance, Investing, consider checking out Wisdom Hatch community.

I teach global investing in simple terms. Investing globally serves 2 purpose:

1) It gives you a currency hedge

2) It helps you scout a wider market and build a better/more resilient portfolio.

In fact, I build a 1Mn$ portfolio in the US recently. And, it outperforms 99% of funds right now

Check more about the community here: wisdomhatch.com/courses/wisdom…

Now back to thread...

So can India strengthen its rupee?

To do this, we need more:

- Export led growth

- Trade partnerships

- Better relationships with other nations

Consider China. They are working silently, building partnerships with every nation and improving their export competitiveness.

With time, they are using improving the adoption/use-case of their currency

As a matter of fact: In the Russia-India oil trade, Yuan is more used than INR for trade settlements.

Now, an entire thread can be written on how China achieved this. But, for brevity: one key takeaway would be -- that China is creating an export driven model.

So the problem statement for us is: how do we improve our export competitiveness?

To do this, we need more:

- Export led growth

- Trade partnerships

- Better relationships with other nations

Consider China. They are working silently, building partnerships with every nation and improving their export competitiveness.

With time, they are using improving the adoption/use-case of their currency

As a matter of fact: In the Russia-India oil trade, Yuan is more used than INR for trade settlements.

Now, an entire thread can be written on how China achieved this. But, for brevity: one key takeaway would be -- that China is creating an export driven model.

So the problem statement for us is: how do we improve our export competitiveness?

Now before I end the thread, it is also critical to understand that if India remains on its current path. What happens?

1) Our currency continues to go down. You will see INR hitting 110 per dollar in the next 5 years.

2) There will be more capital restrictions (eg. Indian not allowed to send USD abroad or within certain limits)

3) We become a very localized economy. This sounds very good. But, the trouble is: it cuts access to global products.

We are already seeing this when it comes to our automobile Industry. This would percolate to other sectors.

1) Our currency continues to go down. You will see INR hitting 110 per dollar in the next 5 years.

2) There will be more capital restrictions (eg. Indian not allowed to send USD abroad or within certain limits)

3) We become a very localized economy. This sounds very good. But, the trouble is: it cuts access to global products.

We are already seeing this when it comes to our automobile Industry. This would percolate to other sectors.

• • •

Missing some Tweet in this thread? You can try to

force a refresh