If you follow where rich people put their money, you’ll never go broke.

Here's the unsexy asset class private equity billionaires & millionaires are flocking to:

Here's the unsexy asset class private equity billionaires & millionaires are flocking to:

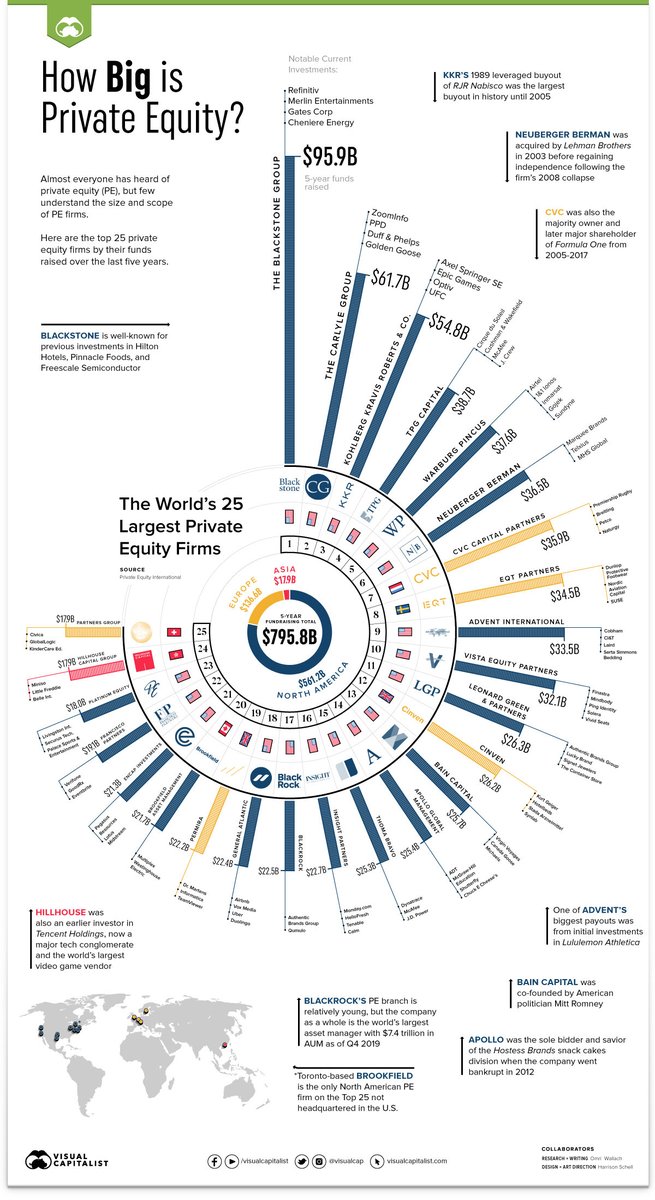

For decades, PE meant massive funds buying massive companies:

• KKR buys RJR Nabisco for $25B

• Blackstone acquires Hilton for $26B

• Apollo takes Harrah's private for $27.8B

The formula was simple: Big money buys big companies, adds big debt, cuts costs.

• KKR buys RJR Nabisco for $25B

• Blackstone acquires Hilton for $26B

• Apollo takes Harrah's private for $27.8B

The formula was simple: Big money buys big companies, adds big debt, cuts costs.

But now? These same Wall Street sharks are swimming downstream - raiding Main Street and buying...

• Your local car wash chain

• Boring IT providers with 20 employees

• That HVAC company with the annoying radio ads

And they're not being quiet about it…

• Your local car wash chain

• Boring IT providers with 20 employees

• That HVAC company with the annoying radio ads

And they're not being quiet about it…

Just follow the money… in 2024 alone:

• Blackstone bought out Copeland, an HVAC giant for $15.45B

• Buffett dropped $11B on truck stops

• $9B+ of PE $$ thrown at collision repair

Wall Street is now targeting boring businesses. The ones most people ignore.

• Blackstone bought out Copeland, an HVAC giant for $15.45B

• Buffett dropped $11B on truck stops

• $9B+ of PE $$ thrown at collision repair

Wall Street is now targeting boring businesses. The ones most people ignore.

This trend has a name: Micro PE.

It's the application of traditional private equity strategies to smaller companies:

• $1-15M in annual revenue

• $500K-$3M in annual profits

• 10-100 employees

• Often family-owned or founder-led

It's the application of traditional private equity strategies to smaller companies:

• $1-15M in annual revenue

• $500K-$3M in annual profits

• 10-100 employees

• Often family-owned or founder-led

To be clear - it’s not just billionaires who are catching on.

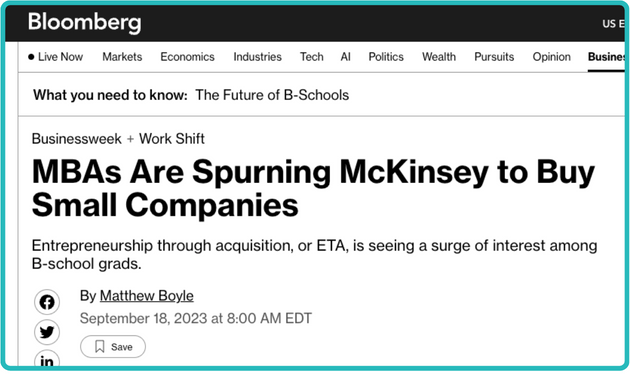

For decades, Harvard/Stanford MBAs followed a predictable path: join McKinsey, a VC-backed startup, or worst case become a banker.

Now they're skipping the building part and going straight to CEO, buying biz's.

For decades, Harvard/Stanford MBAs followed a predictable path: join McKinsey, a VC-backed startup, or worst case become a banker.

Now they're skipping the building part and going straight to CEO, buying biz's.

These MBAs use the search fund model.

They raise money from investors with 1 goal: find a profitable small business to buy and run.

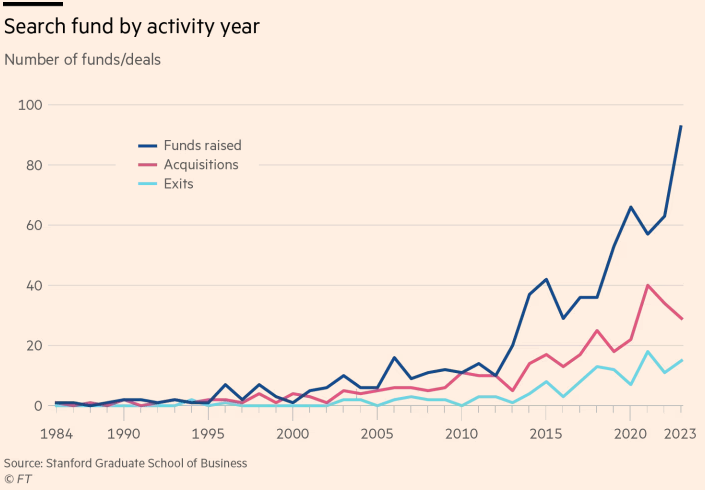

In 2023, a record 94 search funds launched. Almost double 5 years ago.

That's 94 MBAs who decided small biz > unicorn…

They raise money from investors with 1 goal: find a profitable small business to buy and run.

In 2023, a record 94 search funds launched. Almost double 5 years ago.

That's 94 MBAs who decided small biz > unicorn…

So why is all this happening? Three forces created the perfect storm:

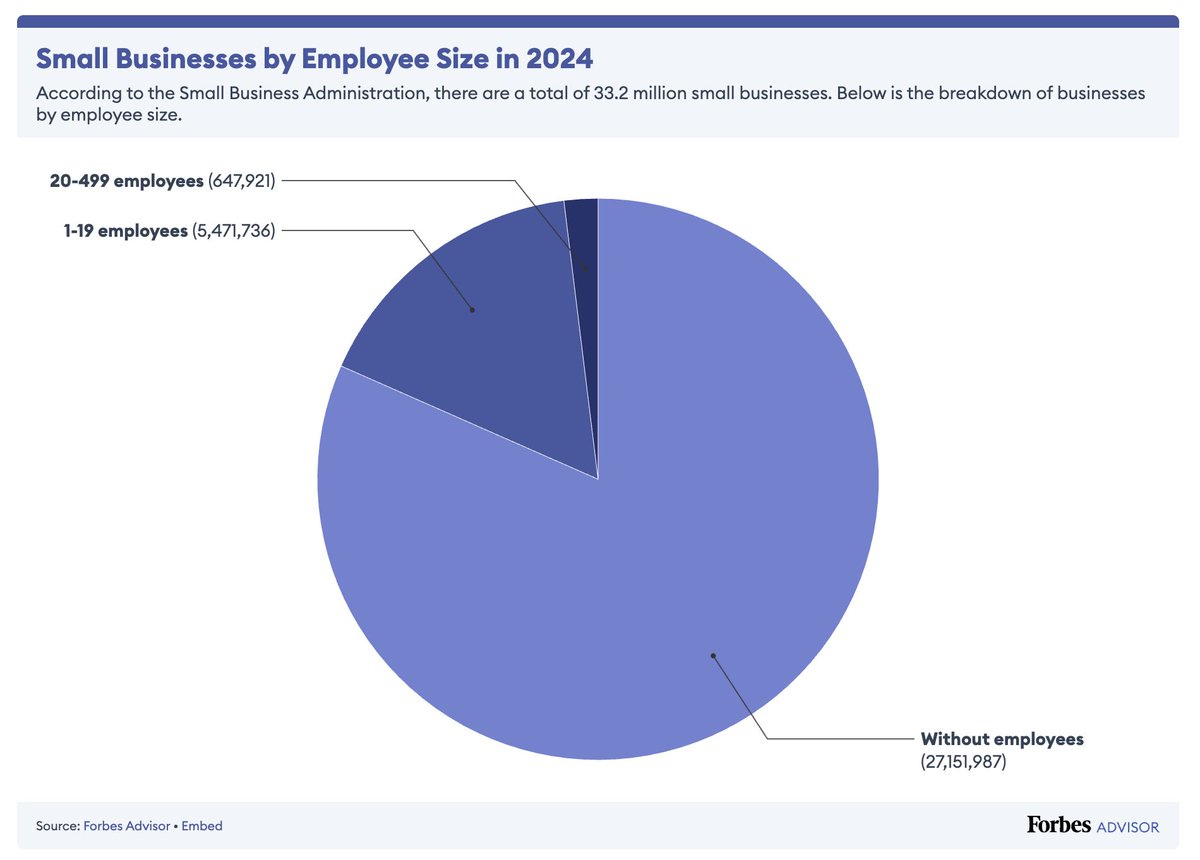

1. Demographics

10,000 boomers retire daily, and they own 50%+ of America's 33.2M small businesses.

Most have no succession plan.

1. Demographics

10,000 boomers retire daily, and they own 50%+ of America's 33.2M small businesses.

Most have no succession plan.

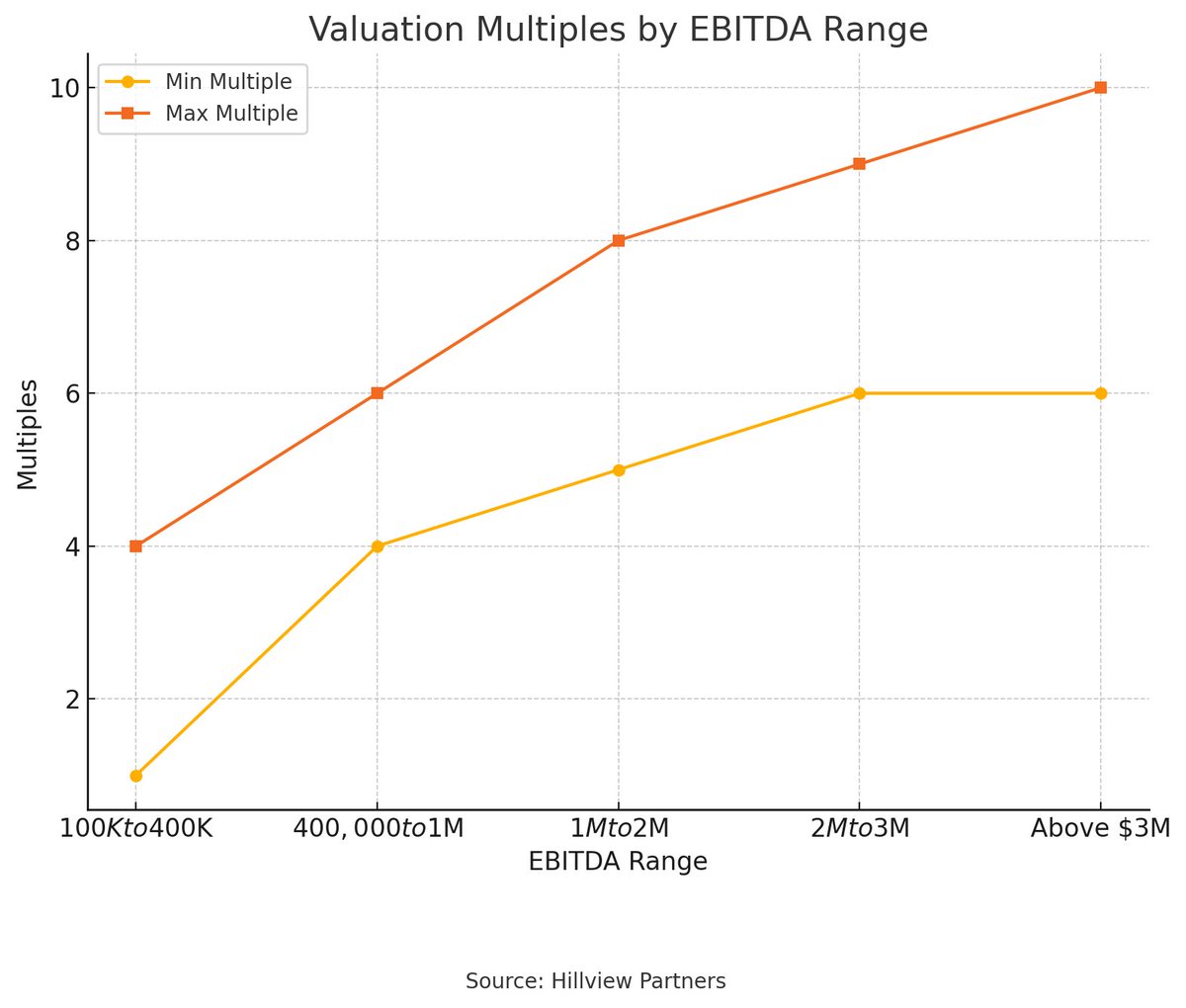

2. “Cheaper” price tags

Rule of thumb, small biz's sell at a lower multiple compared to larger biz's.

Why? They're perceived as riskier - lack of systems, key man risk, etc.

But that means you can sometimes buy a biz cash-flowing $100,000s for as little as 2-3x earnings.

Rule of thumb, small biz's sell at a lower multiple compared to larger biz's.

Why? They're perceived as riskier - lack of systems, key man risk, etc.

But that means you can sometimes buy a biz cash-flowing $100,000s for as little as 2-3x earnings.

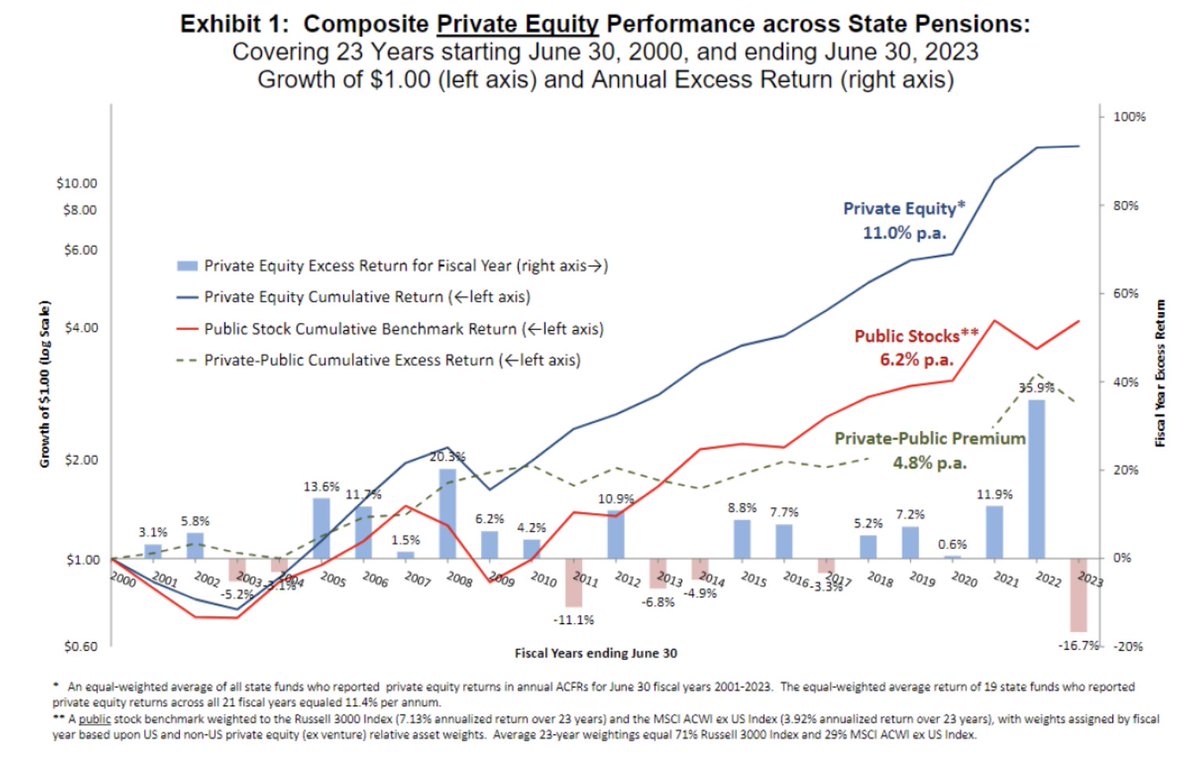

3. Surpassing other asset classes

SMB returns are tricky to track - most don't disclose earnings like public co's.

BUT,

Stanford's 40-year study of 681 search funds offers a reasonable proxy...

It tracks acquisitions ($14.4M median purchase price) with firm characteristics that fall under our micro PE definition.

SMB returns are tricky to track - most don't disclose earnings like public co's.

BUT,

Stanford's 40-year study of 681 search funds offers a reasonable proxy...

It tracks acquisitions ($14.4M median purchase price) with firm characteristics that fall under our micro PE definition.

When we compare the annual returns:

• S&P 500: ~6-10% (depends on what time frame you look at)

• Traditional PE funds: ~11-13%

• Search fund (from 2011-2024): 33-36%

• S&P 500: ~6-10% (depends on what time frame you look at)

• Traditional PE funds: ~11-13%

• Search fund (from 2011-2024): 33-36%

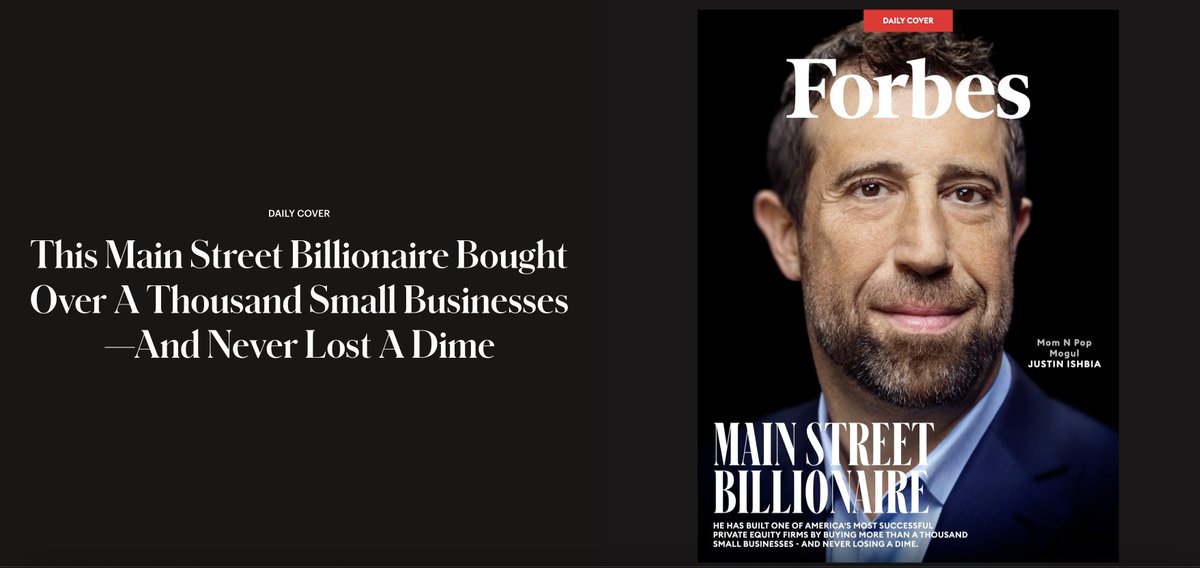

Billionaire Justin Ishbia proved this works at scale...

His playbook is conceptually simple (but requires serious execution):

His playbook is conceptually simple (but requires serious execution):

1. Buy small businesses others ignore (like a 3-location vet practice)

2. Add systems any MBA would implement

3. Roll up into hundreds of locations

His investment firm, Shore Capital, now has a $7 billion portfolio with over 1000+ small businesses.

2. Add systems any MBA would implement

3. Roll up into hundreds of locations

His investment firm, Shore Capital, now has a $7 billion portfolio with over 1000+ small businesses.

So what does this mean for you?

If you own a business: You have more options than you think (and you might be sitting on more value than you realize).

If you're looking to buy: The window is closing as more capital floods this space.

If you're an investor: There's a universe of opportunity hiding in plain sight.

If you own a business: You have more options than you think (and you might be sitting on more value than you realize).

If you're looking to buy: The window is closing as more capital floods this space.

If you're an investor: There's a universe of opportunity hiding in plain sight.

You have two options:

• Path 1: Watch Wall Street buy everything around you

• Path 2: Get in the game yourself

There are ~914k businesses with sales between $1-15M in the US right now.

They're not on Robinhood. But they're available…

• Path 1: Watch Wall Street buy everything around you

• Path 2: Get in the game yourself

There are ~914k businesses with sales between $1-15M in the US right now.

They're not on Robinhood. But they're available…

The truly wealthy have always known this secret:

Building from scratch makes headlines. BUYING what works builds fortunes.

Building from scratch makes headlines. BUYING what works builds fortunes.

If any of this peaked your interest...you should come to MSM Live.

It's a 3 day virtual event designed to teach you how to find & buy a biz that's right for you.

Think of it as your fast track to business ownership.

Check it out:

codiesanchez.com/msm/?utm_sourc…

It's a 3 day virtual event designed to teach you how to find & buy a biz that's right for you.

Think of it as your fast track to business ownership.

Check it out:

codiesanchez.com/msm/?utm_sourc…

• • •

Missing some Tweet in this thread? You can try to

force a refresh