A+ setups will be the majority of your PnL.

But most traders miss them without even knowing it.

I kept wondering why my best trades turned red…

Until I discovered the 4 key factors every setup needs to actually work.

Here’s how to finally nail them and get paid:

But most traders miss them without even knowing it.

I kept wondering why my best trades turned red…

Until I discovered the 4 key factors every setup needs to actually work.

Here’s how to finally nail them and get paid:

Most traders look for reasons to enter a trade.

But that’s backwards.

The real question is:

“Why wouldn’t the market move the other way?”

You’ll never know the exact move

But you don’t need to

But that’s backwards.

The real question is:

“Why wouldn’t the market move the other way?”

You’ll never know the exact move

But you don’t need to

If you get the direction right, you’ll get paid no matter how messy the path looks.

Direction starts as a 50/50 guess.

Stack just a slight edge above that… and your PnL will explode.

Here are the 4 factors I use to tilt the odds:

Direction starts as a 50/50 guess.

Stack just a slight edge above that… and your PnL will explode.

Here are the 4 factors I use to tilt the odds:

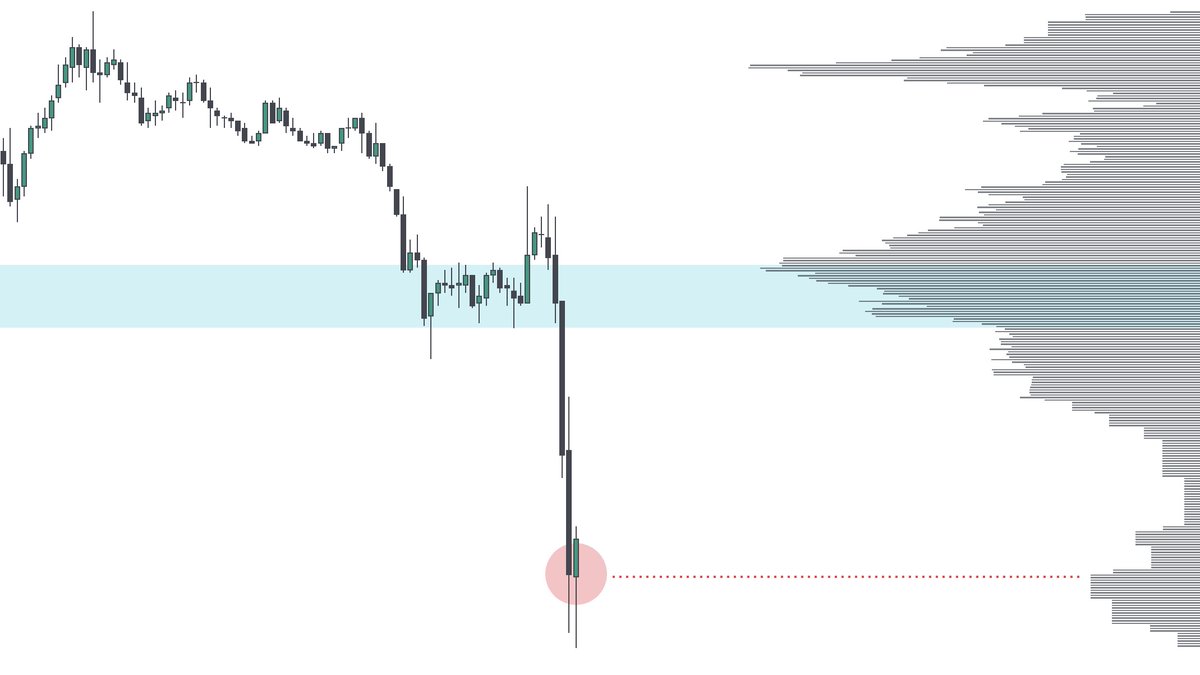

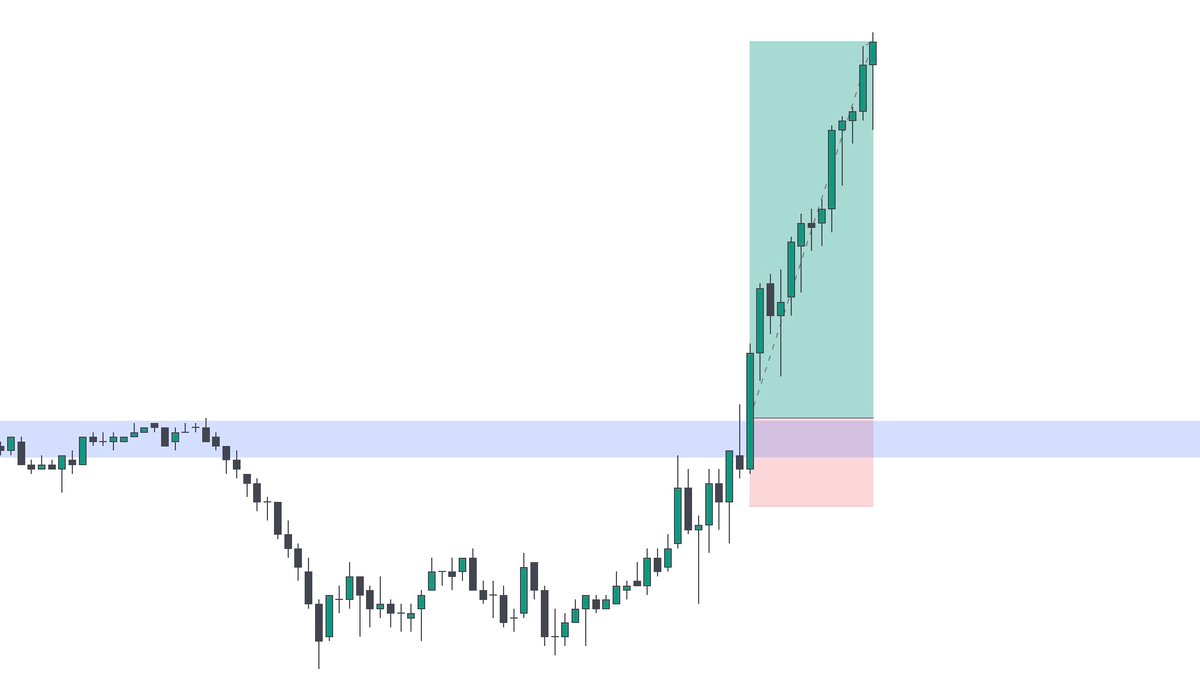

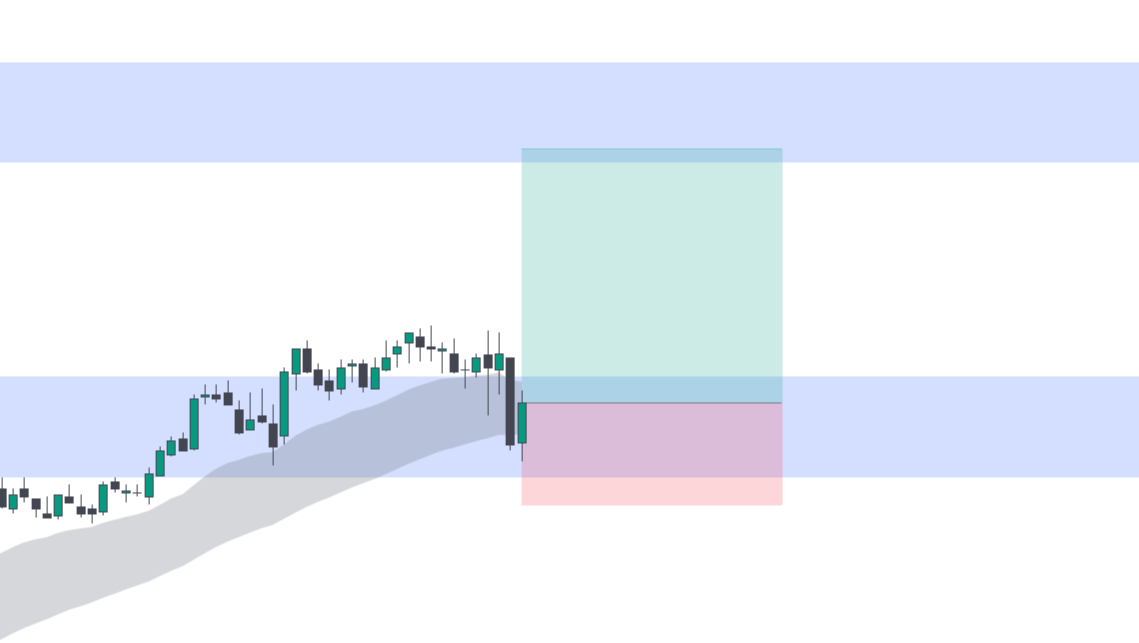

1) Level

Your setups can’t be random.

They need to start at supply or demand - areas where liquidity pools, volume, and the market decides its next move.

Without this first filter, every trade becomes 50/50 at best

With it, you tilt the odds massively in your favor.

Your setups can’t be random.

They need to start at supply or demand - areas where liquidity pools, volume, and the market decides its next move.

Without this first filter, every trade becomes 50/50 at best

With it, you tilt the odds massively in your favor.

A move will always head toward the next supply or demand level

The market needs liquidity, and these zones are where it finds it.

Your only job is to figure out which level it wants first.

That’s where the next 3 factors come into play:

The market needs liquidity, and these zones are where it finds it.

Your only job is to figure out which level it wants first.

That’s where the next 3 factors come into play:

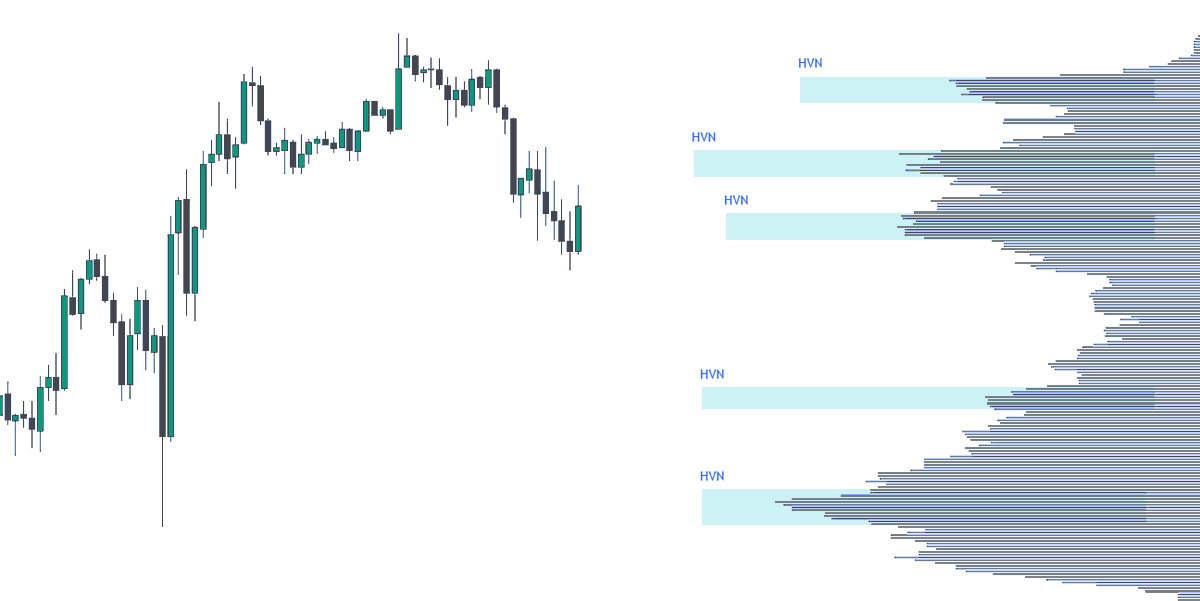

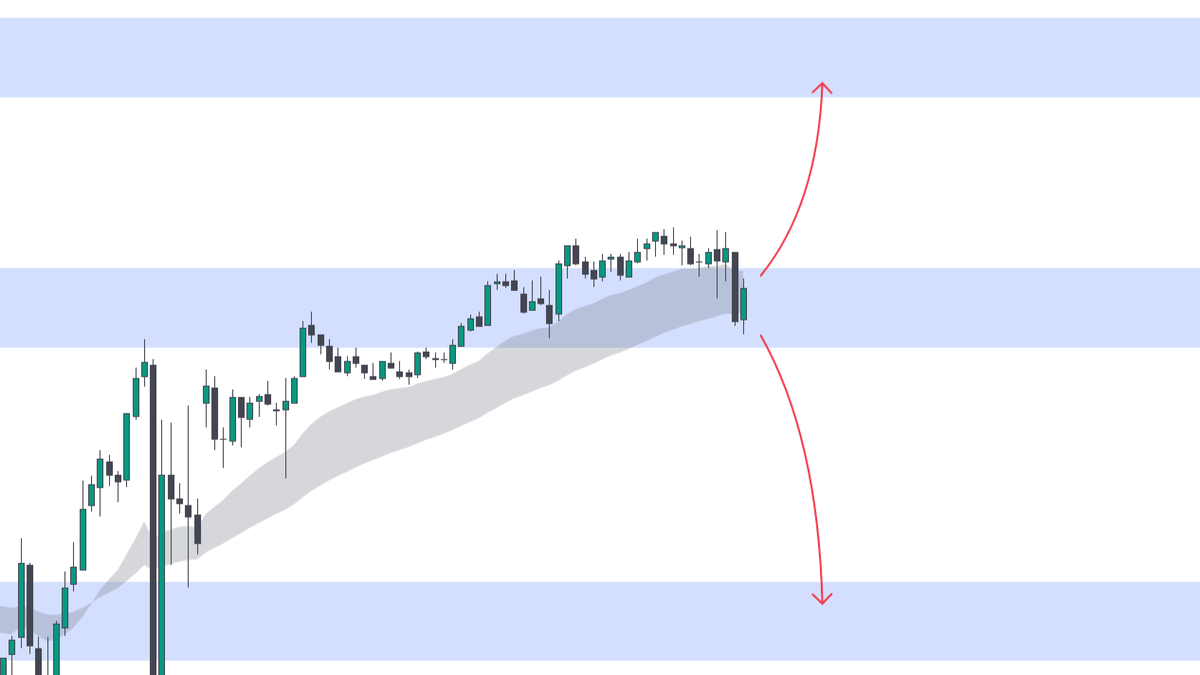

2) Trend

The trend steamrolls anyone fighting it. Your job is to join it.

The EMA cloud makes it simple:

Up slope = only look long

Down slope = only look short

Flat = don’t touch

Filter trades like this and your win rate jumps overnight

The trend steamrolls anyone fighting it. Your job is to join it.

The EMA cloud makes it simple:

Up slope = only look long

Down slope = only look short

Flat = don’t touch

Filter trades like this and your win rate jumps overnight

If we zoom out to the higher timeframe cloud, the story is the same

The slope is still pointing up, with a thick cushion of support beneath price

That confirms the uptrend is backed by structure across all timeframes.

Bulls are in firm control.

The slope is still pointing up, with a thick cushion of support beneath price

That confirms the uptrend is backed by structure across all timeframes.

Bulls are in firm control.

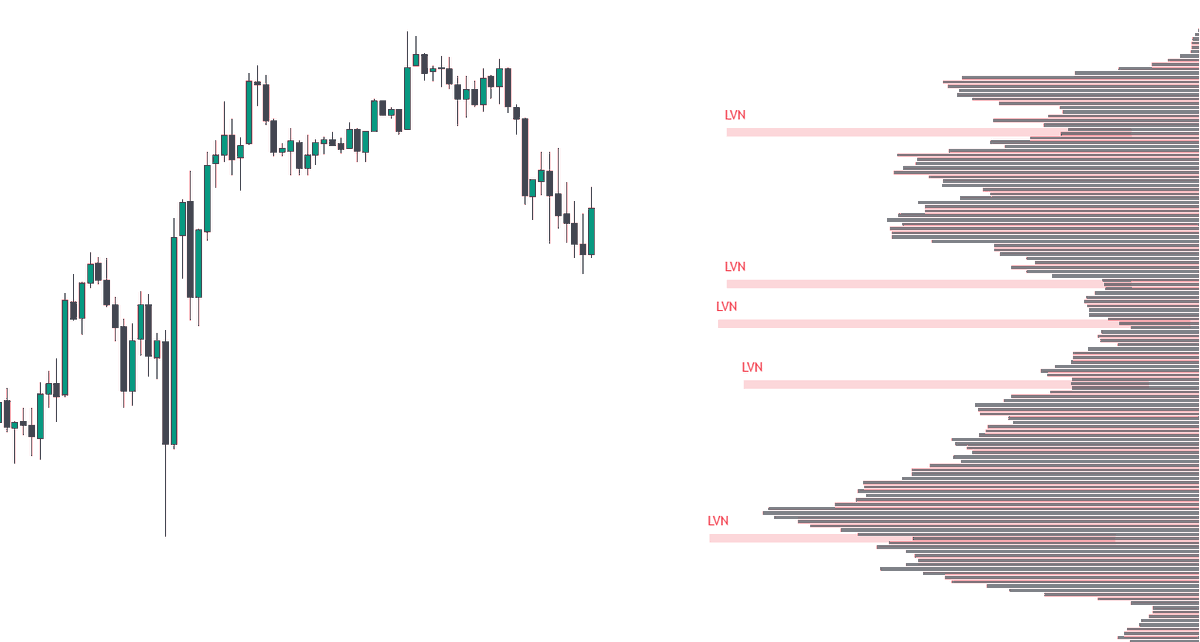

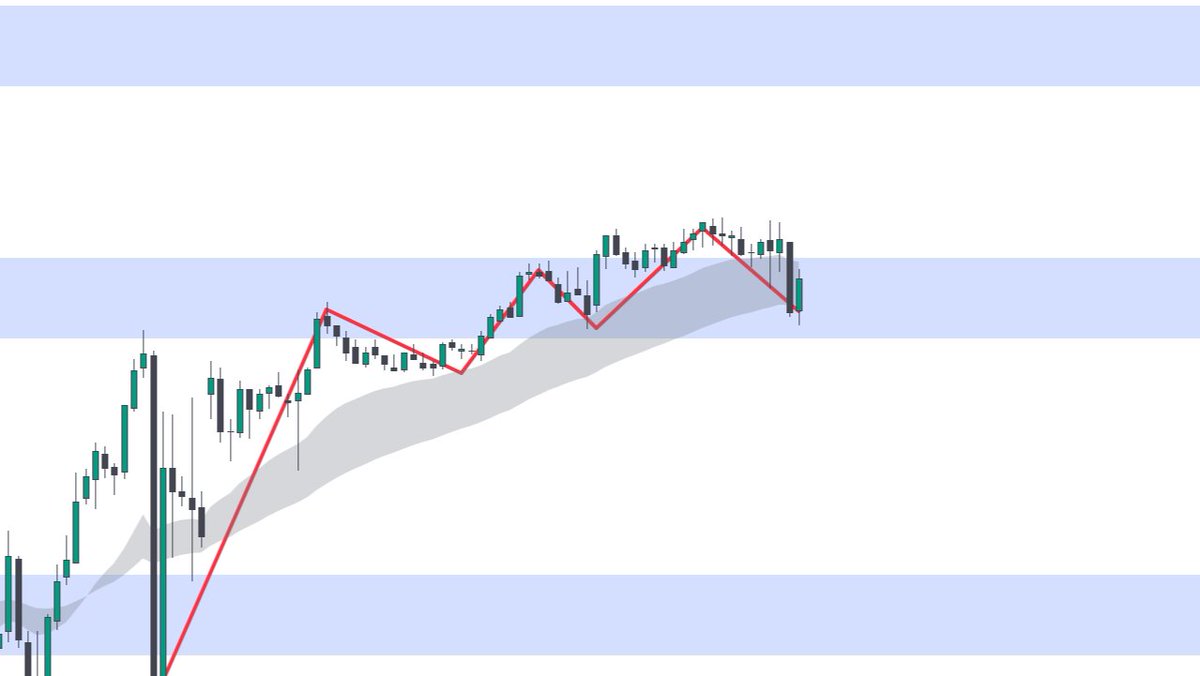

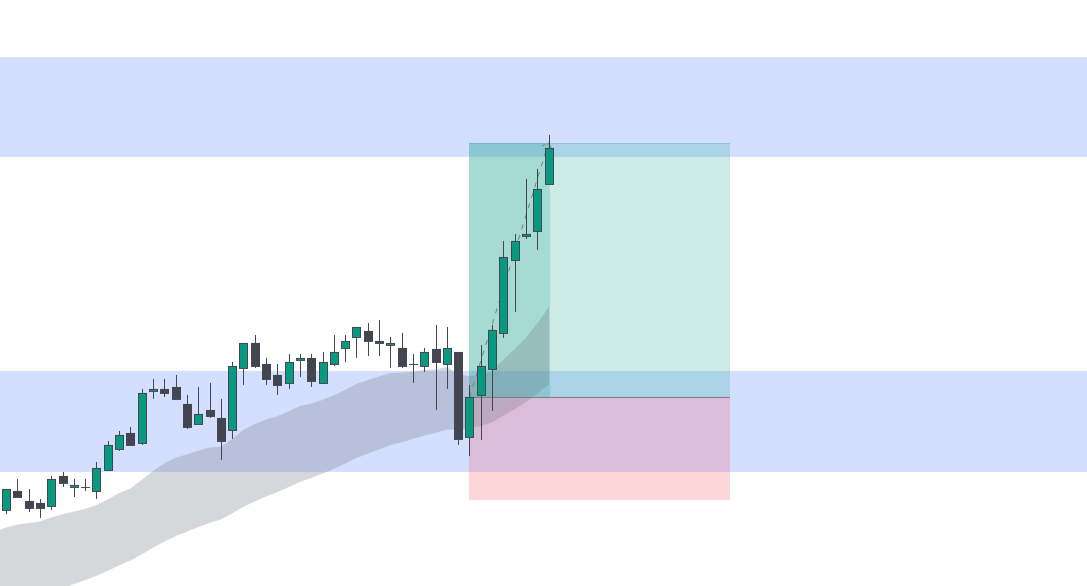

3) Price action

Pay close attention to the highs, lows, and market structure.

Which side is “softer” and easier to break?

By identifying this, you can determine which side tilts the odds in your favor.

Price will always follow the path of least resistance.

Pay close attention to the highs, lows, and market structure.

Which side is “softer” and easier to break?

By identifying this, you can determine which side tilts the odds in your favor.

Price will always follow the path of least resistance.

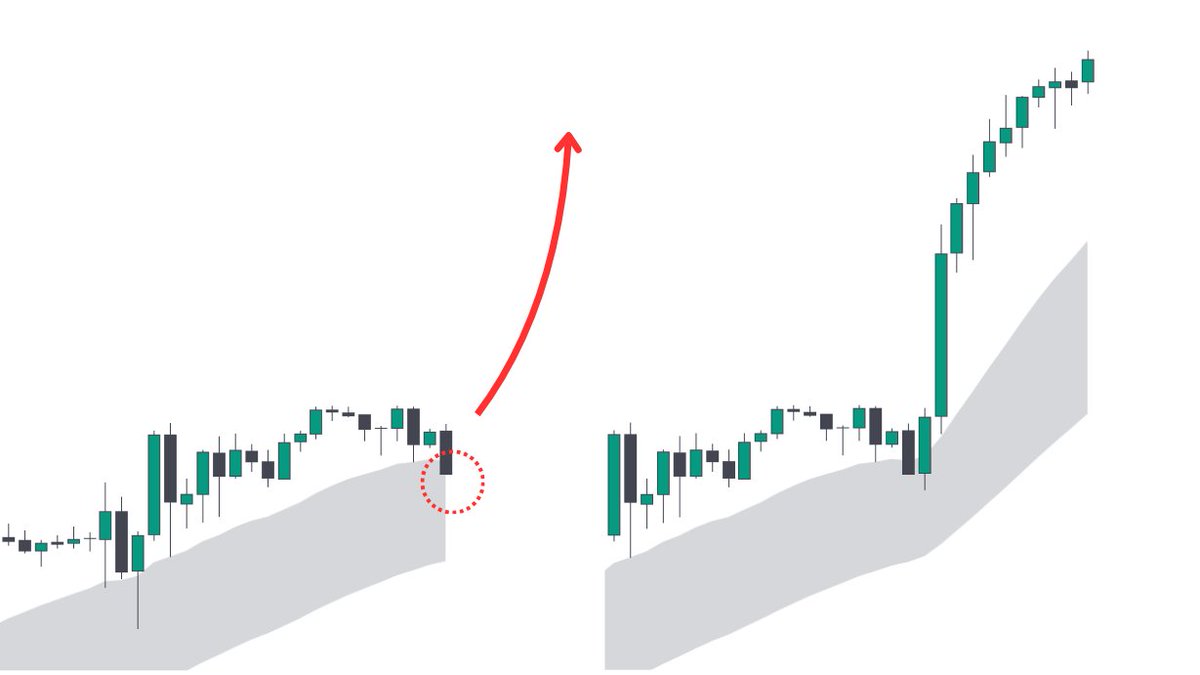

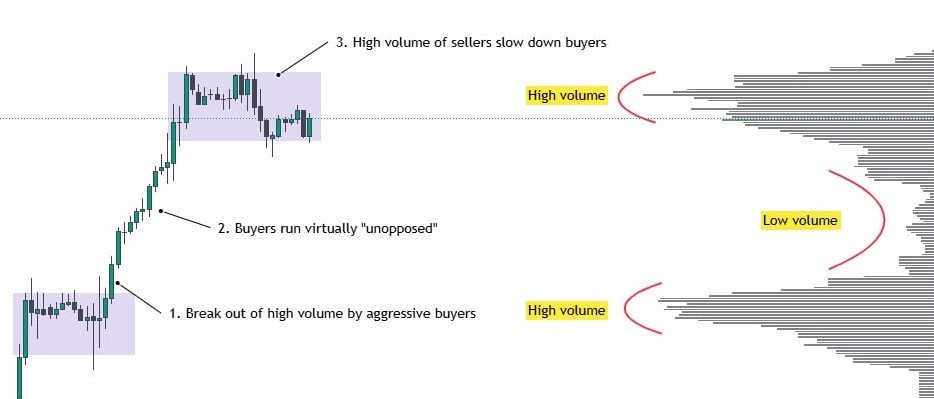

4) Momentum

Watch how price travels.

Speed + consistency matter more than “perfect” candles.

If the cloud is holding and price keeps respecting it, momentum is alive.

That’s your confirmation the trend has fuel

Watch how price travels.

Speed + consistency matter more than “perfect” candles.

If the cloud is holding and price keeps respecting it, momentum is alive.

That’s your confirmation the trend has fuel

In this case, all four factors point bullish

This means we’re safe to take a long & target the next supply level - with a stop under the swing low

This is an A+ setup

This means we’re safe to take a long & target the next supply level - with a stop under the swing low

This is an A+ setup

You’ll never know exactly what the market does.

But you don’t need to.

Stack all 4 factors, and you’ve already won before the trade is even placed.

Then it’s just a matter of collecting.

But you don’t need to.

Stack all 4 factors, and you’ve already won before the trade is even placed.

Then it’s just a matter of collecting.

If you're an ES trader, join my free discord (while it's open)

See how the LCE model turns traders *actually* profitable:

thetradewriter.com/discord

See how the LCE model turns traders *actually* profitable:

thetradewriter.com/discord

Like this thread?

Follow me for more real trading advice

@Tradewrite

Like + retweet👇

Follow me for more real trading advice

@Tradewrite

Like + retweet👇

https://twitter.com/1570129579628531716/status/1961248267699945847

• • •

Missing some Tweet in this thread? You can try to

force a refresh