A colleague asked me yesterday “Can I take a home loan and set autopay via my credit card (like Infinia)?”

You probably already know the answer! It's a strict NO!

You can run subscriptions on card mandates, but not EMIs!

Here’s the full picture of the WHY!🧵

You probably already know the answer! It's a strict NO!

You can run subscriptions on card mandates, but not EMIs!

Here’s the full picture of the WHY!🧵

1⃣In India, EMIs are collected via NACH/e-mandate from your savings account.

2⃣NPCI designed NACH specifically for recurring debits like EMIs, SIPs, premiums.

3⃣Banks like HDFC clearly ask you to set up an e-mandate/NACH for loan repayment.

2⃣NPCI designed NACH specifically for recurring debits like EMIs, SIPs, premiums.

3⃣Banks like HDFC clearly ask you to set up an e-mandate/NACH for loan repayment.

Why not credit card mandates?

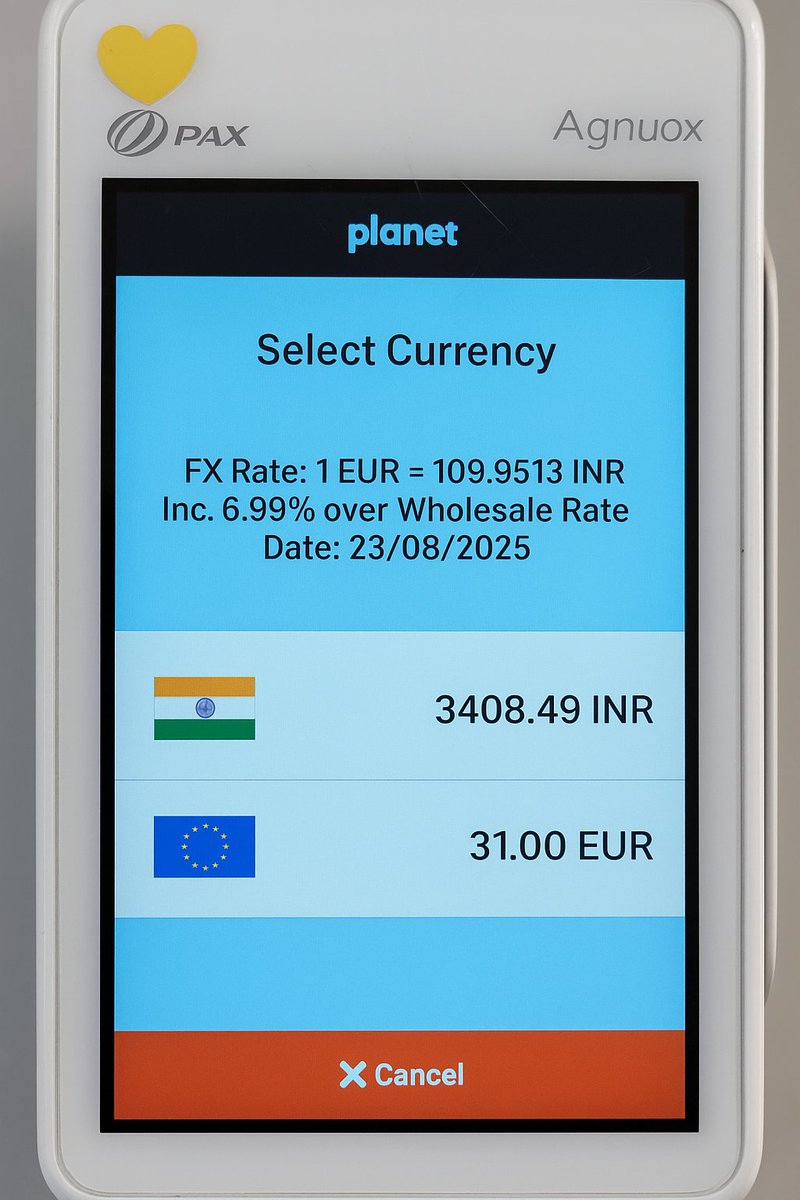

1⃣RBI does allow card mandates (you already use them for Netflix, Spotify, etc.).

2⃣For low-value (<₹15k), they work automatically. For >₹15k, RBI requires pre-debit alerts + OTP (AFA) every time!

1⃣RBI does allow card mandates (you already use them for Netflix, Spotify, etc.).

2⃣For low-value (<₹15k), they work automatically. For >₹15k, RBI requires pre-debit alerts + OTP (AFA) every time!

The regulator’s intent!

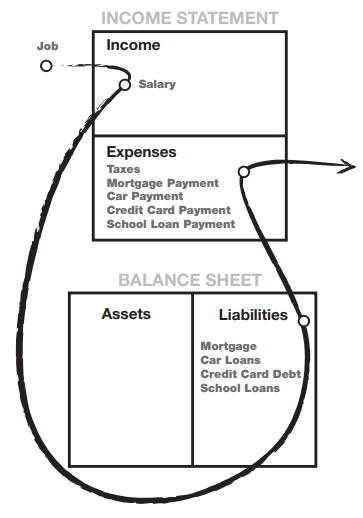

1⃣A credit card is already an unsecured loan.

2⃣An EMI is also a loan repayment.

3⃣Using a CC to pay EMI = debt on debt, which RBI doesn’t want to encourage.

1⃣A credit card is already an unsecured loan.

2⃣An EMI is also a loan repayment.

3⃣Using a CC to pay EMI = debt on debt, which RBI doesn’t want to encourage.

1⃣Networks classify these as MCC 6012 (debt repayment).

2⃣Sometimes one-off payments go through if a bank’s PG allows it, but:

- No rewards points here.

- Not allowed for a recurring mandate.

2⃣Sometimes one-off payments go through if a bank’s PG allows it, but:

- No rewards points here.

- Not allowed for a recurring mandate.

The Economics of MDR!

1⃣Collecting EMIs via credit card costs lenders ~1.5–2% MDR every month.

2⃣₹25k EMI = ₹375–₹500 lost in fees.

3⃣NACH costs much lesser (₹1–₹3 range per EMI debit)

4⃣No bank will burn MDR just to collect its own dues.

1⃣Collecting EMIs via credit card costs lenders ~1.5–2% MDR every month.

2⃣₹25k EMI = ₹375–₹500 lost in fees.

3⃣NACH costs much lesser (₹1–₹3 range per EMI debit)

4⃣No bank will burn MDR just to collect its own dues.

Risk/Compliance

1⃣Card transactions carry chargeback rights (you can dispute a debit).

2⃣EMI collections can’t afford that uncertainty.

3⃣NACH is built for assured, low-dispute debit from savings accounts.

1⃣Card transactions carry chargeback rights (you can dispute a debit).

2⃣EMI collections can’t afford that uncertainty.

3⃣NACH is built for assured, low-dispute debit from savings accounts.

So yes, you can autopay Netflix on your credit card.

But you can’t autopay your HDFC loan on your credit card.

Loans must be linked to your savings account via NACH/e-mandate!

If you liked this thread, do follow for more such content! 😀

But you can’t autopay your HDFC loan on your credit card.

Loans must be linked to your savings account via NACH/e-mandate!

If you liked this thread, do follow for more such content! 😀

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh