Catching the TREND early is the fastest path to $1k days

Yet 98% of traders miss it because they overthink every move.

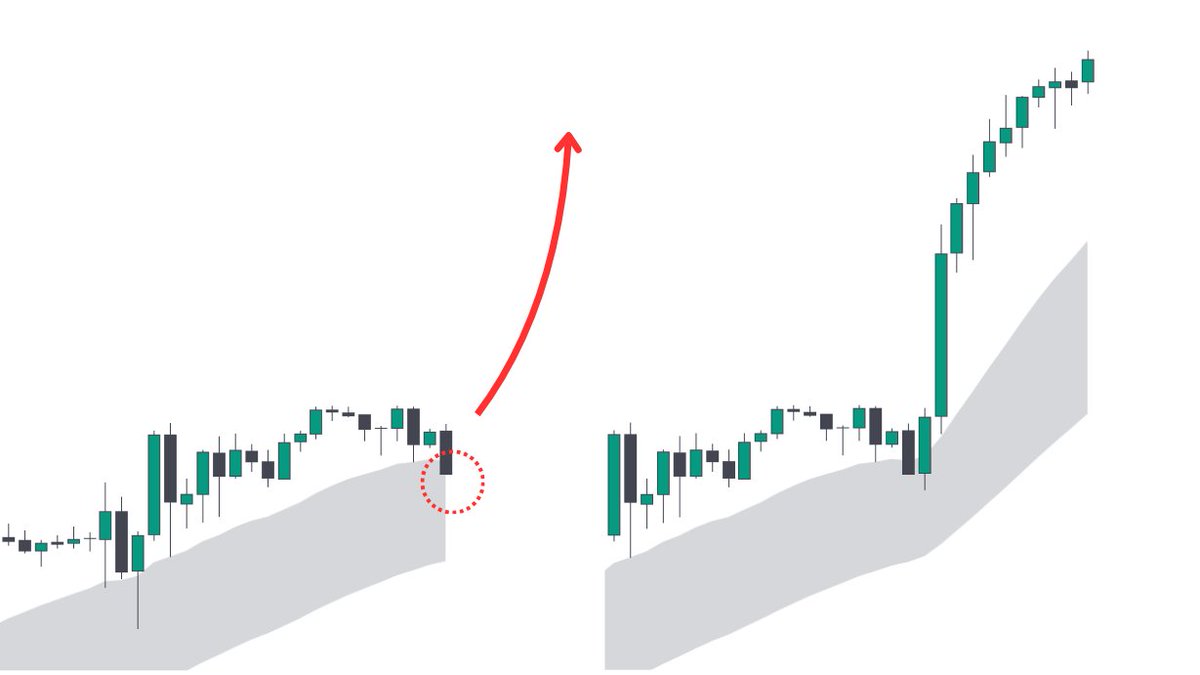

But the cloud bounce makes it ridiculously simple

Here's how to front run the trend before it takes off:

Yet 98% of traders miss it because they overthink every move.

But the cloud bounce makes it ridiculously simple

Here's how to front run the trend before it takes off:

Trading what you think will happen is a losing game.

The market is built to exploit your bias and trap you.

That’s why the only edge is trading what’s actually there.

The market is built to exploit your bias and trap you.

That’s why the only edge is trading what’s actually there.

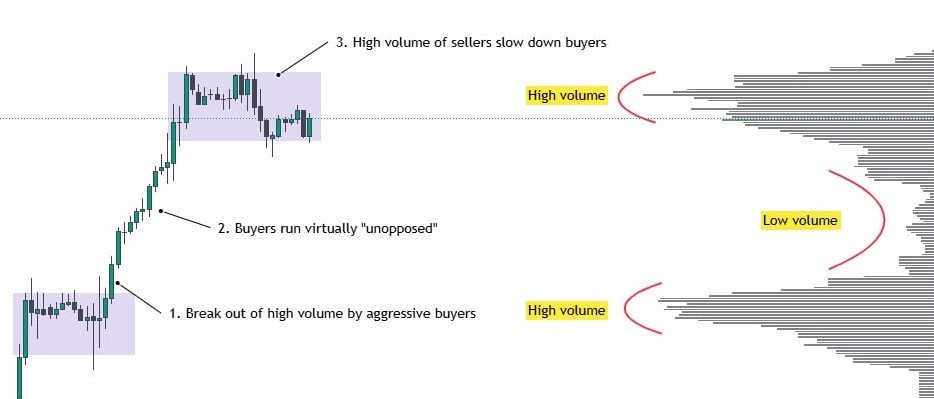

Every move starts the same way:

Price hits a supply/demand zone

Buyers and sellers balance… until one side takes control

That imbalance is the trend, and it lasts until the other side finally steps in.

Price hits a supply/demand zone

Buyers and sellers balance… until one side takes control

That imbalance is the trend, and it lasts until the other side finally steps in.

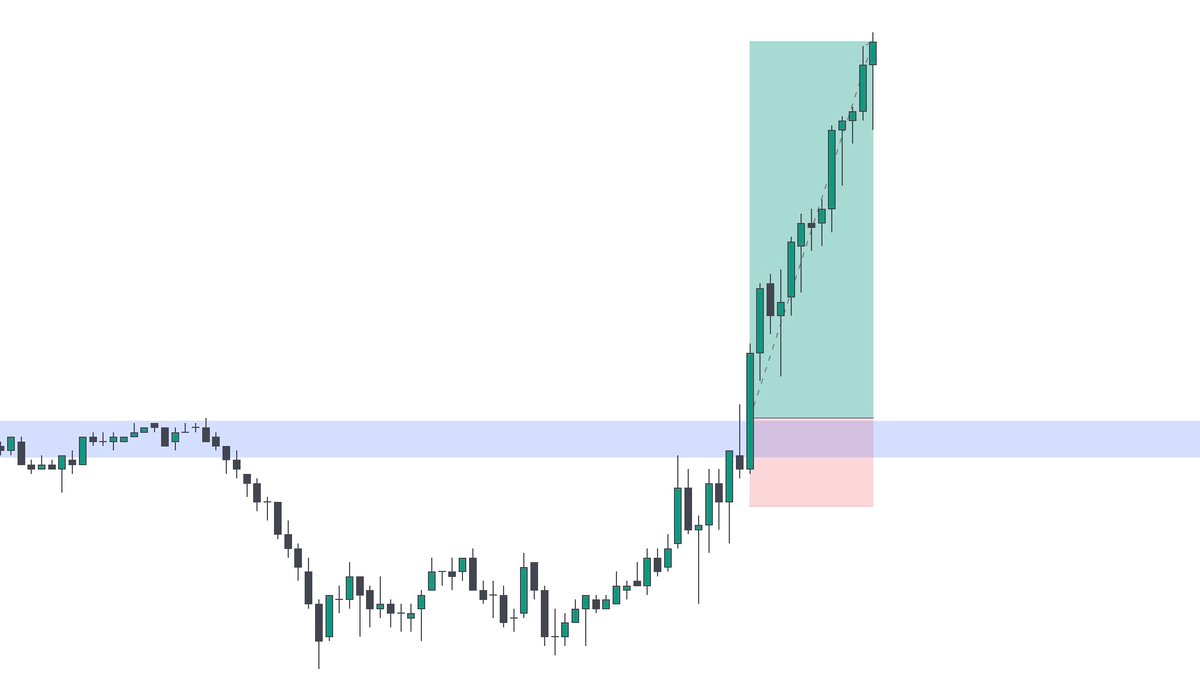

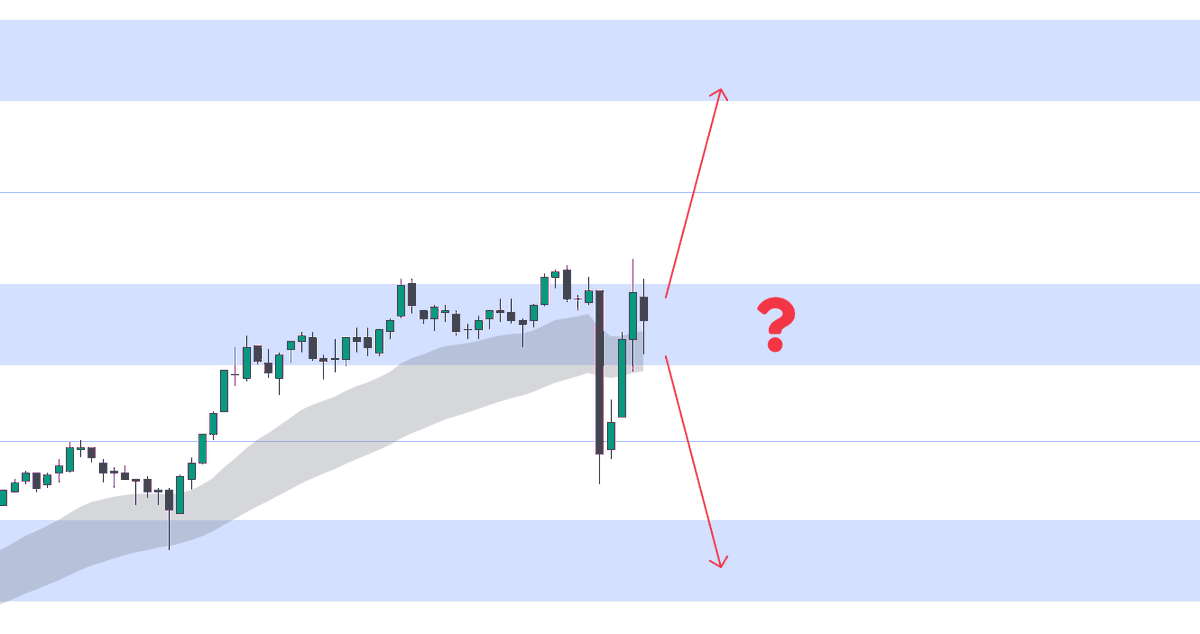

If price returns to the level it came from, it’s a reversal.

If it moves to the next level, it’s a continuation

The cloud flip nails reversals (link below)

For continuations, you want to see a cloud bounce

If it moves to the next level, it’s a continuation

The cloud flip nails reversals (link below)

For continuations, you want to see a cloud bounce

https://twitter.com/1570129579628531716/status/1952547164183511543

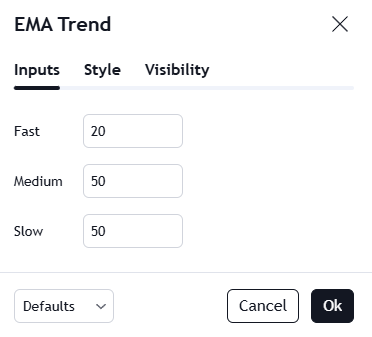

The cloud bounce has three steps

1. The price is in a supply/demand level

2. The higher timeframe cloud is trending (up/down)

3. Price bounces off the cloud

Let’s break it down:

1. The price is in a supply/demand level

2. The higher timeframe cloud is trending (up/down)

3. Price bounces off the cloud

Let’s break it down:

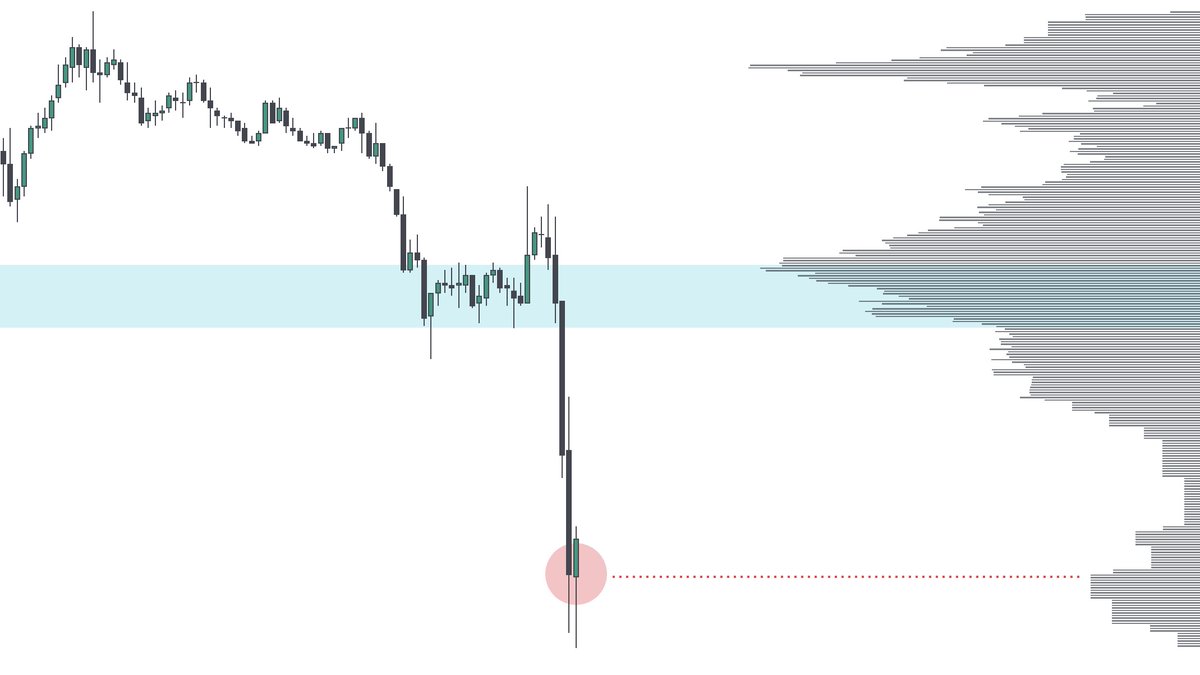

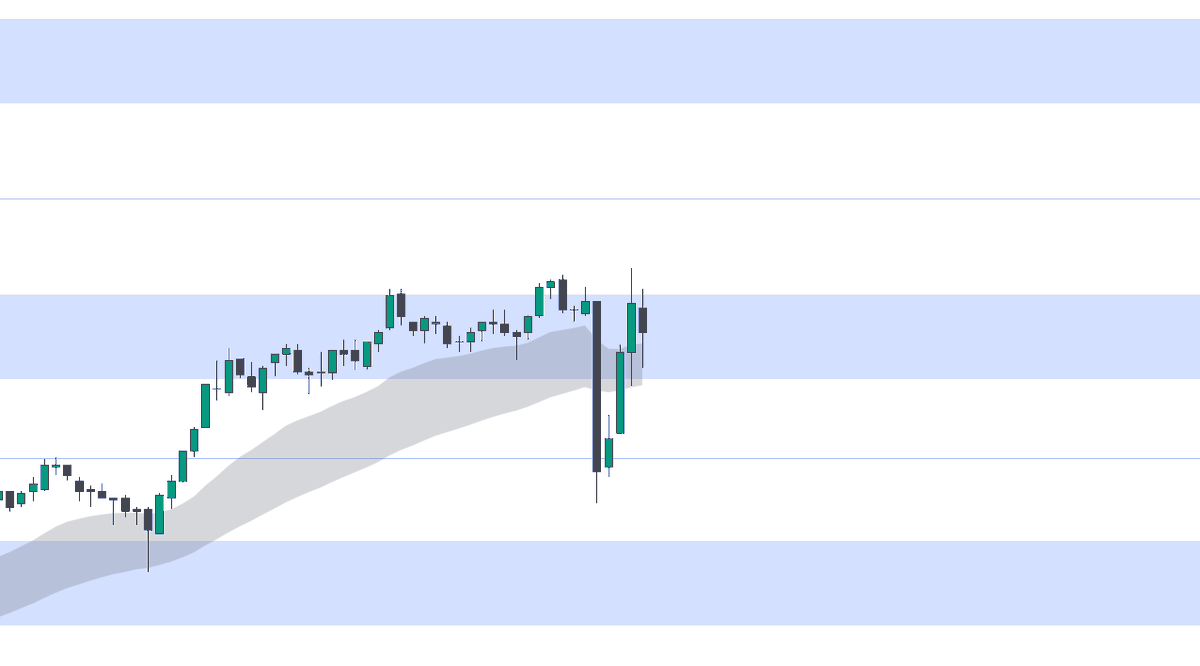

1) The price is in a supply/demand level

Cloud bounces are everywhere, but 90% are garbage.

The only ones that matter are inside zones where real volume sits.

Cloud bounces are everywhere, but 90% are garbage.

The only ones that matter are inside zones where real volume sits.

We’ve tagged supply on the 5-minute chart

Step 1 is complete.

Now it’s time to hunt for the actual setup

Step 1 is complete.

Now it’s time to hunt for the actual setup

We’re in an uptrend.

For continuation, the cloud has to hold and bounce.

If it fails, we’ll see a cloud flip & potential reversal.

Our job is simple: decide if price is headed for supply above or demand below.

For continuation, the cloud has to hold and bounce.

If it fails, we’ll see a cloud flip & potential reversal.

Our job is simple: decide if price is headed for supply above or demand below.

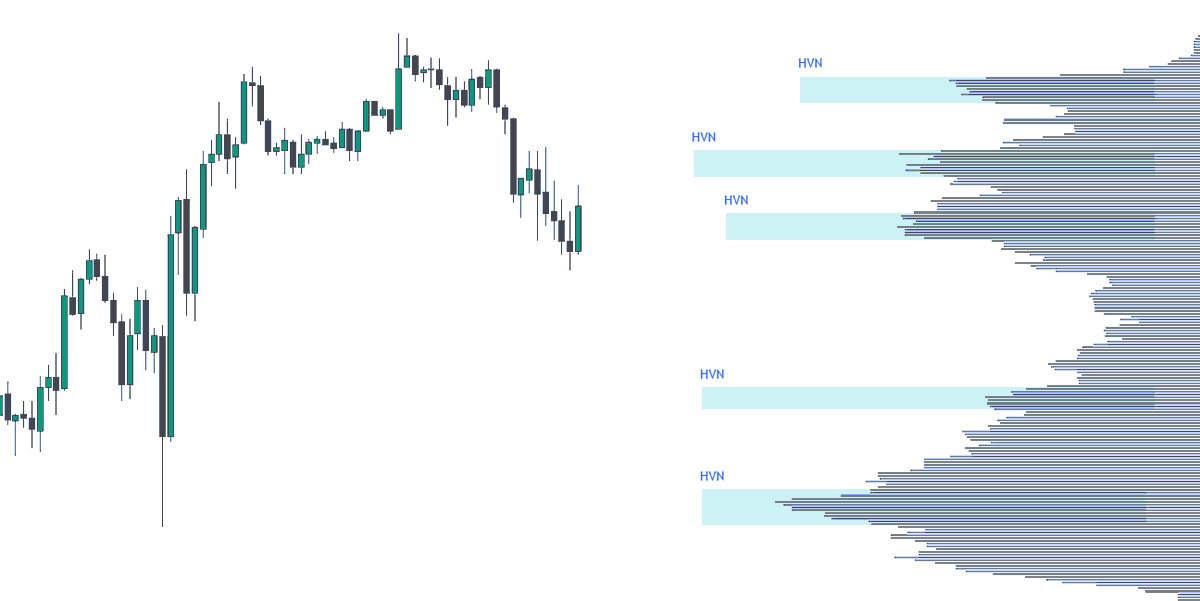

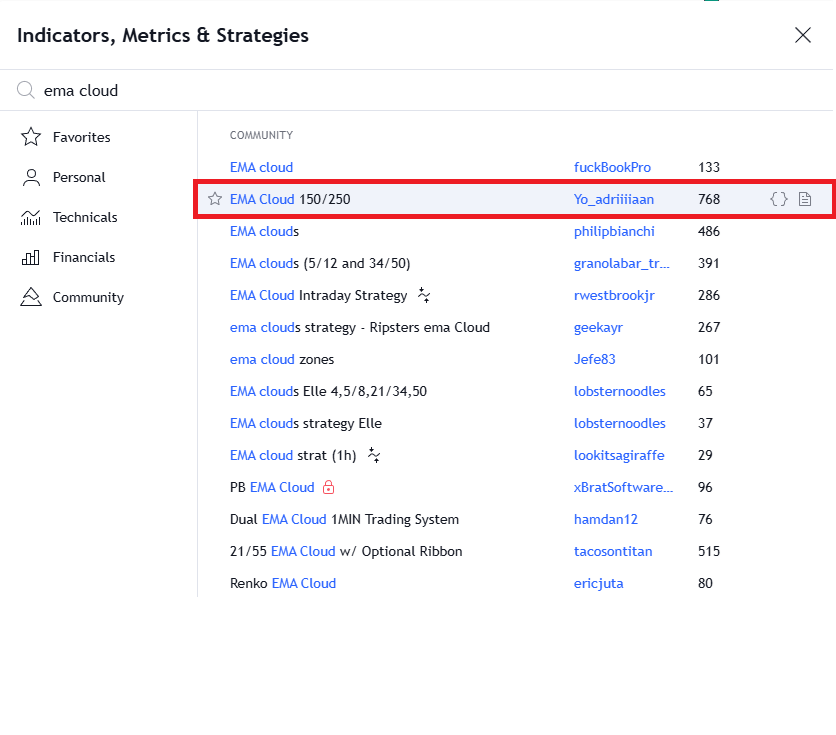

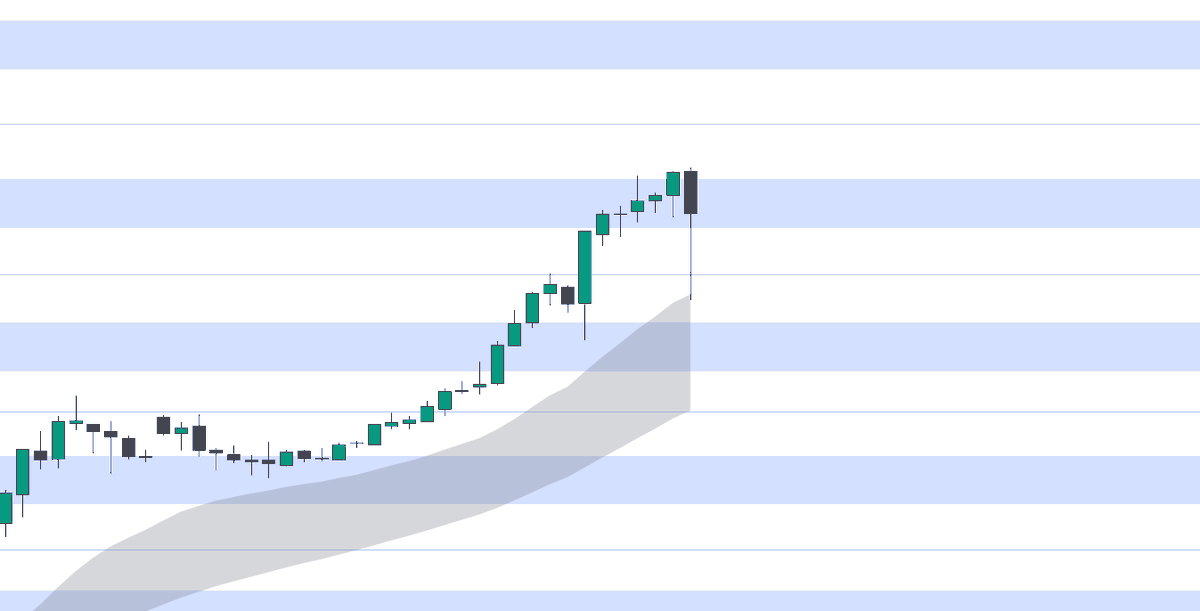

2) The higher timeframe cloud is trending

Every valid setup aligns with the bigger picture.

On the 30 min–2h charts, the EMA cloud tells us which side has control.

In this case, the cloud is trending up, keeping our bias long.

Every valid setup aligns with the bigger picture.

On the 30 min–2h charts, the EMA cloud tells us which side has control.

In this case, the cloud is trending up, keeping our bias long.

Trade what’s in front of you, not what you hope for.

When the cloud trends up across timeframes, structure confirms higher

highs/lows, and resistance isn’t in play,

That’s as clean a signal as you’ll get for continuation.

When the cloud trends up across timeframes, structure confirms higher

highs/lows, and resistance isn’t in play,

That’s as clean a signal as you’ll get for continuation.

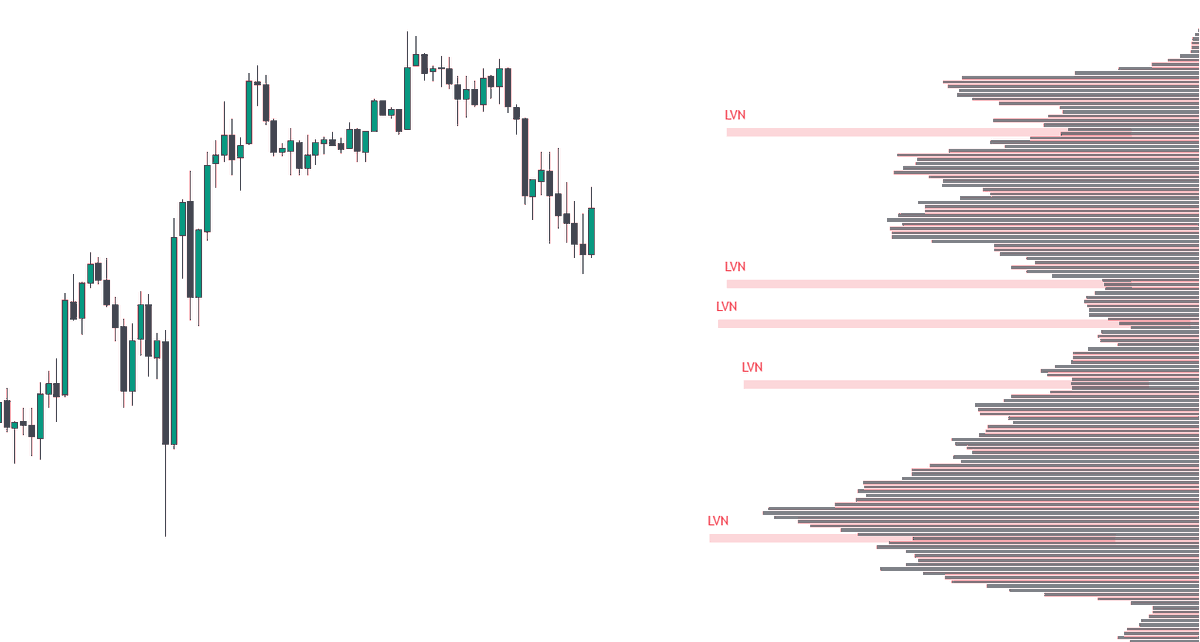

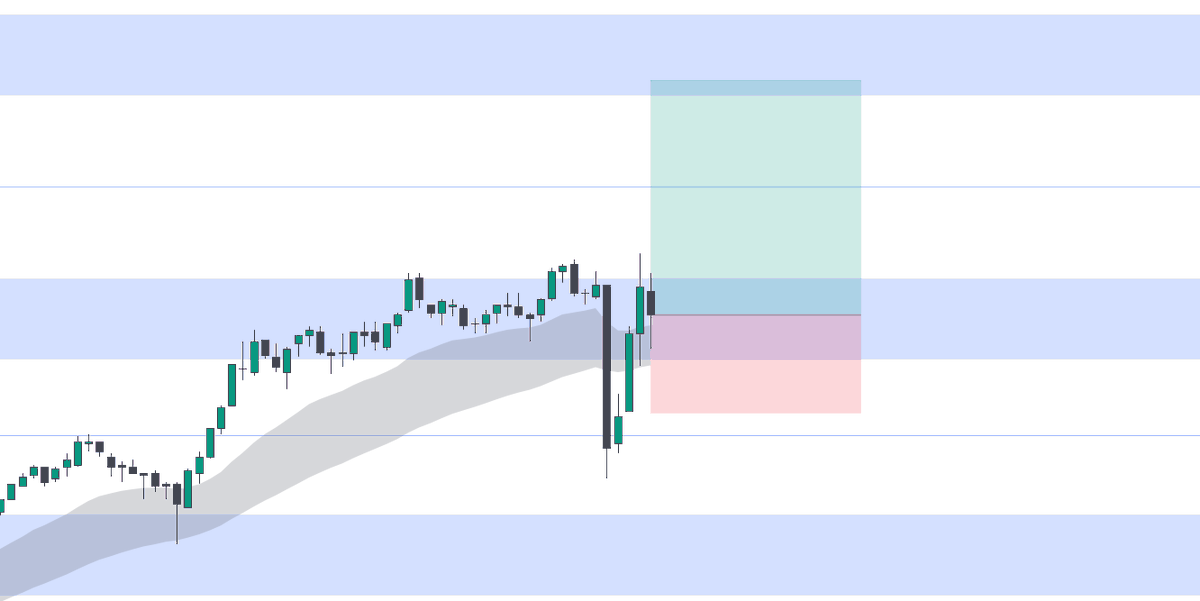

3) Price bounces off the cloud

With the higher timeframe bias confirmed, we zoom back into the 5 min for entry.

The best signal comes when price dips into the cloud, forms a higher low, and bounces back out.

With the higher timeframe bias confirmed, we zoom back into the 5 min for entry.

The best signal comes when price dips into the cloud, forms a higher low, and bounces back out.

This dip into the cloud lets bulls grab liquidity and rebuild structure before ripping higher.

Once the bounce confirms, we enter.

Stop under the cloud, and target the next supply.

Once the bounce confirms, we enter.

Stop under the cloud, and target the next supply.

Now you step aside and let the market do the work.

The trend does the heavy lifting.

Your only job: follow the 3 steps and stack profit consistently.

The trend does the heavy lifting.

Your only job: follow the 3 steps and stack profit consistently.

If you're an ES trader, join my free discord (while it's open)

See how the LCE model turns traders *actually* profitable:

thetradewriter.com/discord

See how the LCE model turns traders *actually* profitable:

thetradewriter.com/discord

Like this thread?

Follow me for more real trading advice

@Tradewrite

Like + retweet👇

Follow me for more real trading advice

@Tradewrite

Like + retweet👇

https://twitter.com/1570129579628531716/status/1961934714752917914

• • •

Missing some Tweet in this thread? You can try to

force a refresh