Reading the book Rich Dad Poor Dad changed how I look at money.

The one line that stuck with me -

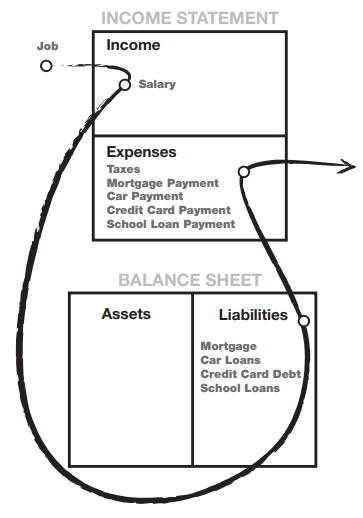

"An asset puts money in your pocket. A liability takes money out."

Simple and Brutal Truth!

Let's understand this in detail 🧵

The one line that stuck with me -

"An asset puts money in your pocket. A liability takes money out."

Simple and Brutal Truth!

Let's understand this in detail 🧵

Most of us are taught to measure wealth by what we own.

House, car, gold, etc.

But the real measure isn’t ownership, it’s cash flow.

Does it pay you, or do you keep paying for it?

House, car, gold, etc.

But the real measure isn’t ownership, it’s cash flow.

Does it pay you, or do you keep paying for it?

E.g., on paper, real estate looks like the ultimate “asset.”

But it depends entirely on the cash flow.

The math on CF is -

Net CF = Rent – (EMI + maintenance + repairs + taxes) + Price Apppreciation (realized during sale)

If +ve, it's an asset; if -ve, it's a liability.

But it depends entirely on the cash flow.

The math on CF is -

Net CF = Rent – (EMI + maintenance + repairs + taxes) + Price Apppreciation (realized during sale)

If +ve, it's an asset; if -ve, it's a liability.

Your own house doesn’t earn rent.

It only generates expenses, i.e., EMIs, taxes, and maintenance.

So while you’re living in it, it’s a liability, not an asset.

It only generates expenses, i.e., EMIs, taxes, and maintenance.

So while you’re living in it, it’s a liability, not an asset.

That doesn’t mean your home has no value. Of course it does, it's where you live, feel secure, and build memories.

It's just from a money lens; it isn’t an asset yet, because it won’t generate cash flow or returns for you while you’re still living in it!

It's just from a money lens; it isn’t an asset yet, because it won’t generate cash flow or returns for you while you’re still living in it!

That same house could become an asset for your kids, though!

They inherit it at zero cost, and if they sell later, it’s pure upside for them!

They inherit it at zero cost, and if they sell later, it’s pure upside for them!

Rich Dad Poor Dad made me realise this -

Real estate is only an asset when it pays you.

Cash flow matters!

That one book made a drastic shift in my mindset about money.

Have you read this book?

Real estate is only an asset when it pays you.

Cash flow matters!

That one book made a drastic shift in my mindset about money.

Have you read this book?

P.S. - If you enjoy my posts, do share and follow me! 😄

It really helps with the morale!

It really helps with the morale!

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh