A bit of $ETH moon math to start the week…

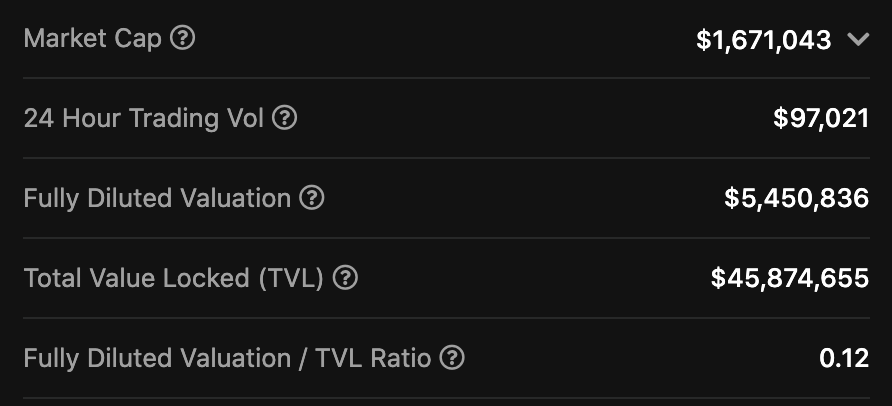

Today, ETH mcap represents 14% of the $3.8T total crypto marketcap today.

But together BTC + ETH make up 70% of the global crypto mcap.

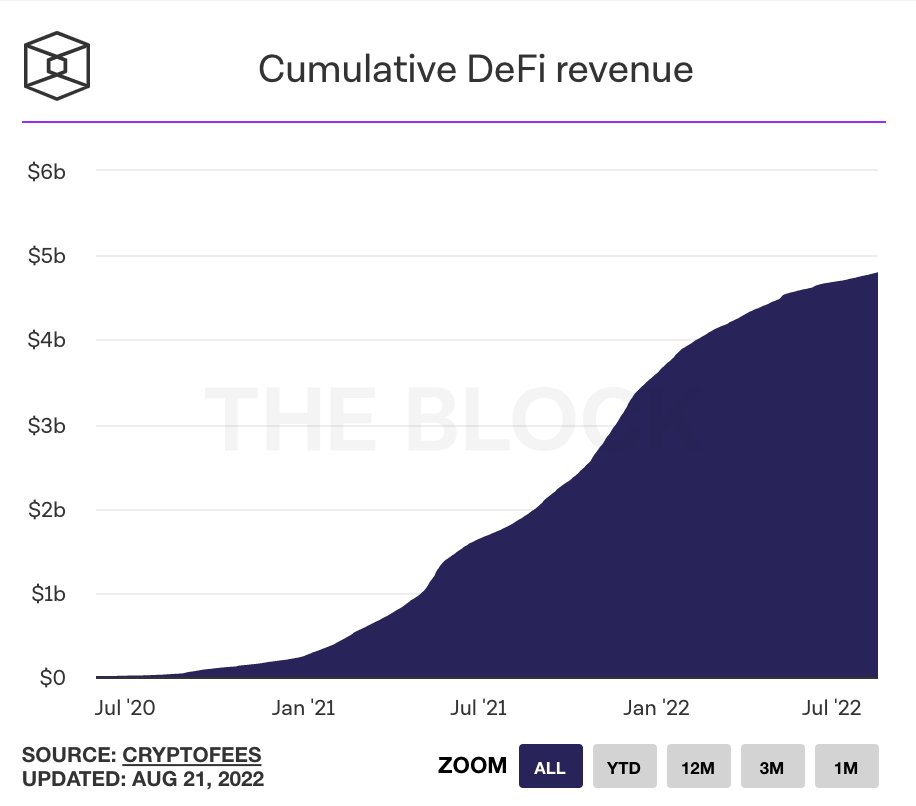

Based on its position as the most trusted and reliable world ledger for stablecoins, RWAs, DeFi native assets and TradFi’s default choice for tokenization… easy to imagine ETH commanding a market cap of $35T or more by 2032/2034 whenever ETH inevitably catches up to or flips BTC mcap.

With a max annual issuance capped at <1.5% (without accounting for ETH burn) and the real net inflation far below 1% closer to 0.14-0.8%, let’s just assume an annual inflation of 0.8% over the next 8 years, so we end up with a total supply of 128M ETH by 2033.

Market cap of $35T with 128M ETH

That’d be 62x up from $4400 ETH

Meaning 1 ETH = $274k 😘

Today, ETH mcap represents 14% of the $3.8T total crypto marketcap today.

But together BTC + ETH make up 70% of the global crypto mcap.

Based on its position as the most trusted and reliable world ledger for stablecoins, RWAs, DeFi native assets and TradFi’s default choice for tokenization… easy to imagine ETH commanding a market cap of $35T or more by 2032/2034 whenever ETH inevitably catches up to or flips BTC mcap.

With a max annual issuance capped at <1.5% (without accounting for ETH burn) and the real net inflation far below 1% closer to 0.14-0.8%, let’s just assume an annual inflation of 0.8% over the next 8 years, so we end up with a total supply of 128M ETH by 2033.

Market cap of $35T with 128M ETH

That’d be 62x up from $4400 ETH

Meaning 1 ETH = $274k 😘

Flipping BTC will only result in even more drastic outcomes like 100x ETH at a $52T mcap

Where 1 ETH = $440k

For now, we have 8 years

The ticker is $ETH 🚀

Where 1 ETH = $440k

For now, we have 8 years

The ticker is $ETH 🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh