⟠ DeFi super-user, educator, angel

🎙️ Host/Producer of The @Edge_Pod

📰 FREE Newsletter: https://t.co/Pm9e0APe9B

📺 Watch on https://t.co/txxZZAhqsW

💫 Invests at @4RCapital

14 subscribers

How to get URL link on X (Twitter) App

👋 Before I share more, be aware that restaking is not actually restaking--yet. These are pools of staked ETH are sitting in EigenLayer until product(s) go live later in 2024.

👋 Before I share more, be aware that restaking is not actually restaking--yet. These are pools of staked ETH are sitting in EigenLayer until product(s) go live later in 2024.

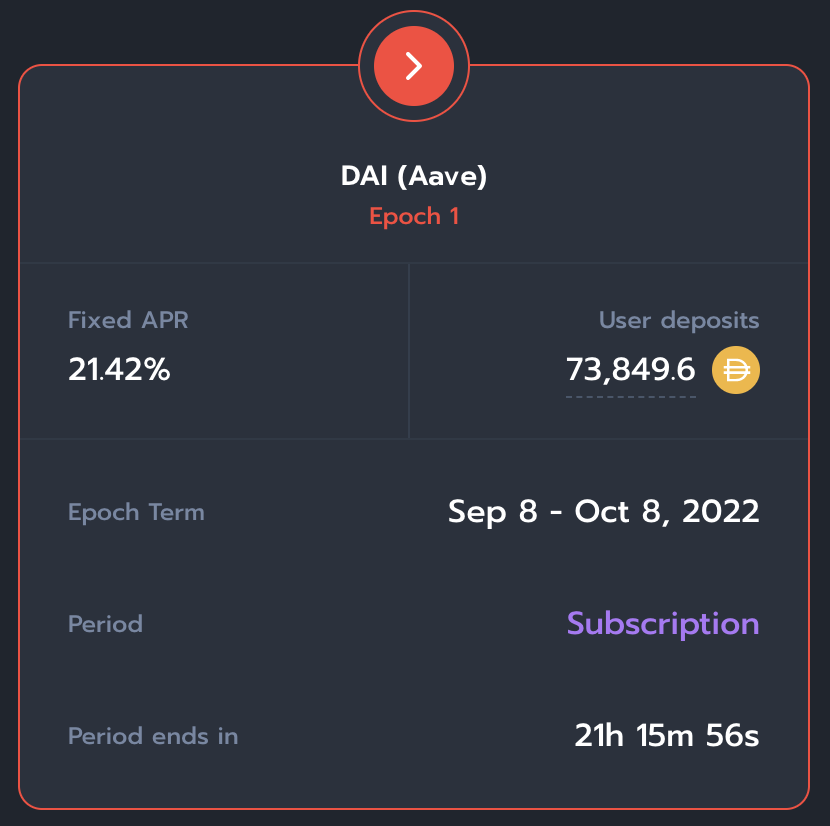

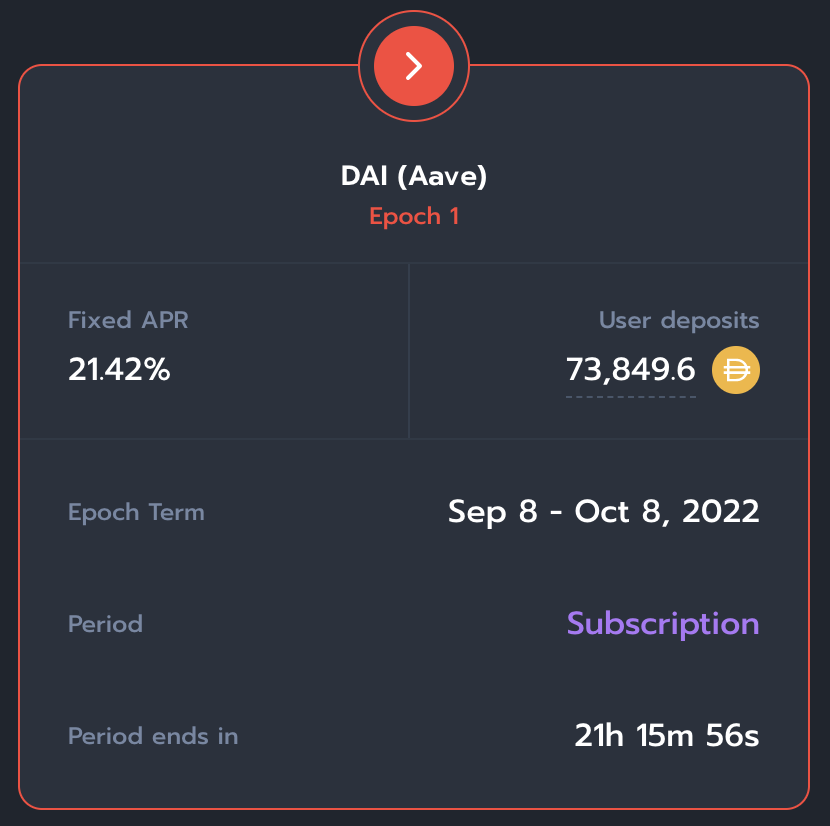

https://twitter.com/Barn_Bridge/status/1566845341818916865

1/ @Barn_Bridge v2 advances DeFi fixed income.

1/ @Barn_Bridge v2 advances DeFi fixed income.

https://twitter.com/NestedFi/status/1519296568100274176⚖️ I loved Social Sets by @tokensets back in 2020 but this is that reimagined without Dutch auctions for rebalancing or worry over traders managing massive funds.

https://twitter.com/optimismPBC/status/1519001562345005057🎉 Go here and scroll to the bottom to check wallet addresses if you're eligible for the OP token coming in May: app.optimism.io/governance

https://twitter.com/constitutiondao/status/1460373967156432896QQ: @ConstitutionDAO who are the 13 signers in the Gnosis Safe?

If you fall into scenario 1⃣ or 2⃣ above, then you should probably choose from Crypto Tax Software Plans. tokentax.co/pricing/crypto/

If you fall into scenario 1⃣ or 2⃣ above, then you should probably choose from Crypto Tax Software Plans. tokentax.co/pricing/crypto/

https://twitter.com/DeFi_Dad/status/1363657211730362380?s=20

⟠2⟠ Always be paranoid with your funds. Become master of cold storage, hardware wallets, and multisig wallets like @gnosisSafe and @argentHQ.

⟠2⟠ Always be paranoid with your funds. Become master of cold storage, hardware wallets, and multisig wallets like @gnosisSafe and @argentHQ.