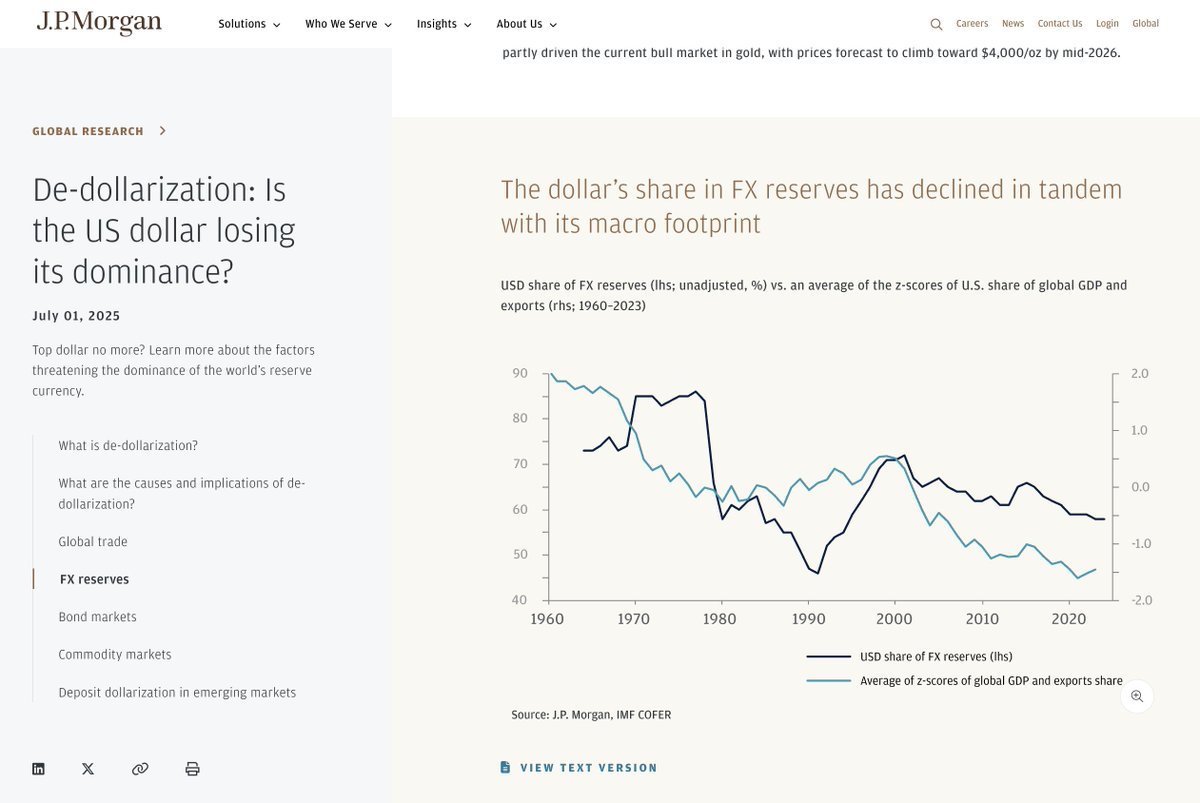

The dollar is losing reserve currency status. It’s down to 42% of global reserves, and gold is rapidly rising.

Digital gold is becoming the reserve currency of the individual.

Gold is returning as the reserve currency of the state.

Original post below.

Gold is returning as the reserve currency of the state.

Original post below.

https://twitter.com/kobeissiletter/status/1962235795622035767

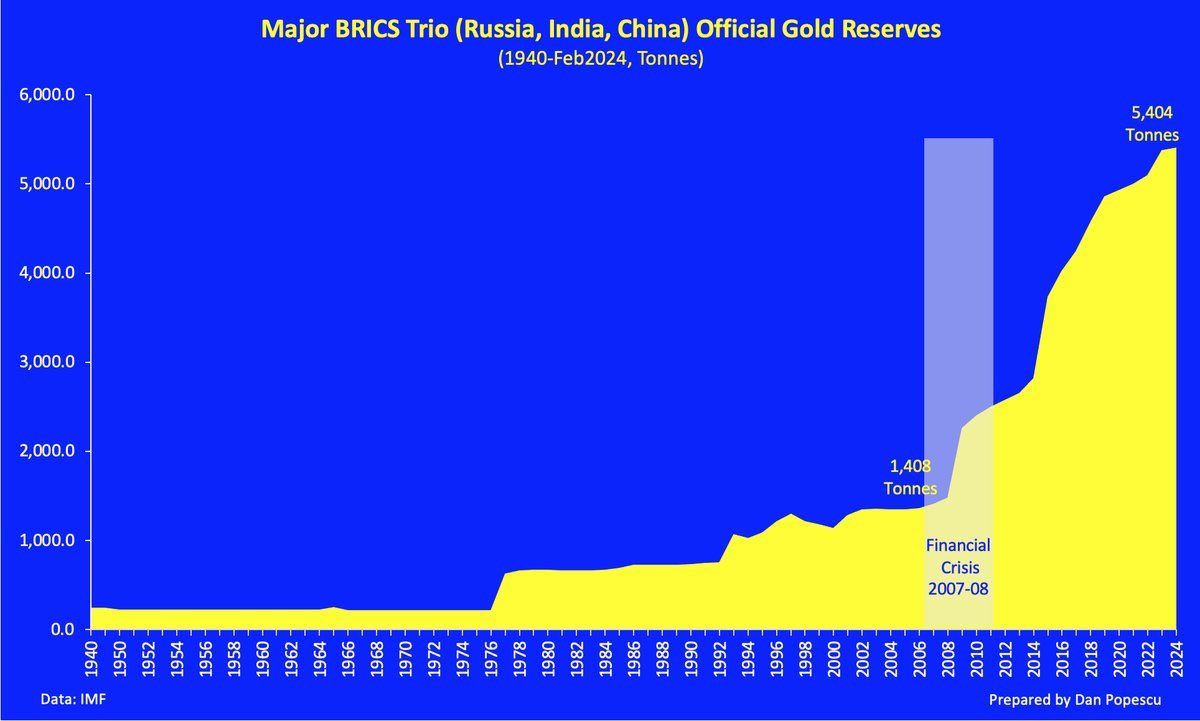

Recall the Fed admitted that a “small number” of countries were switching to gold.

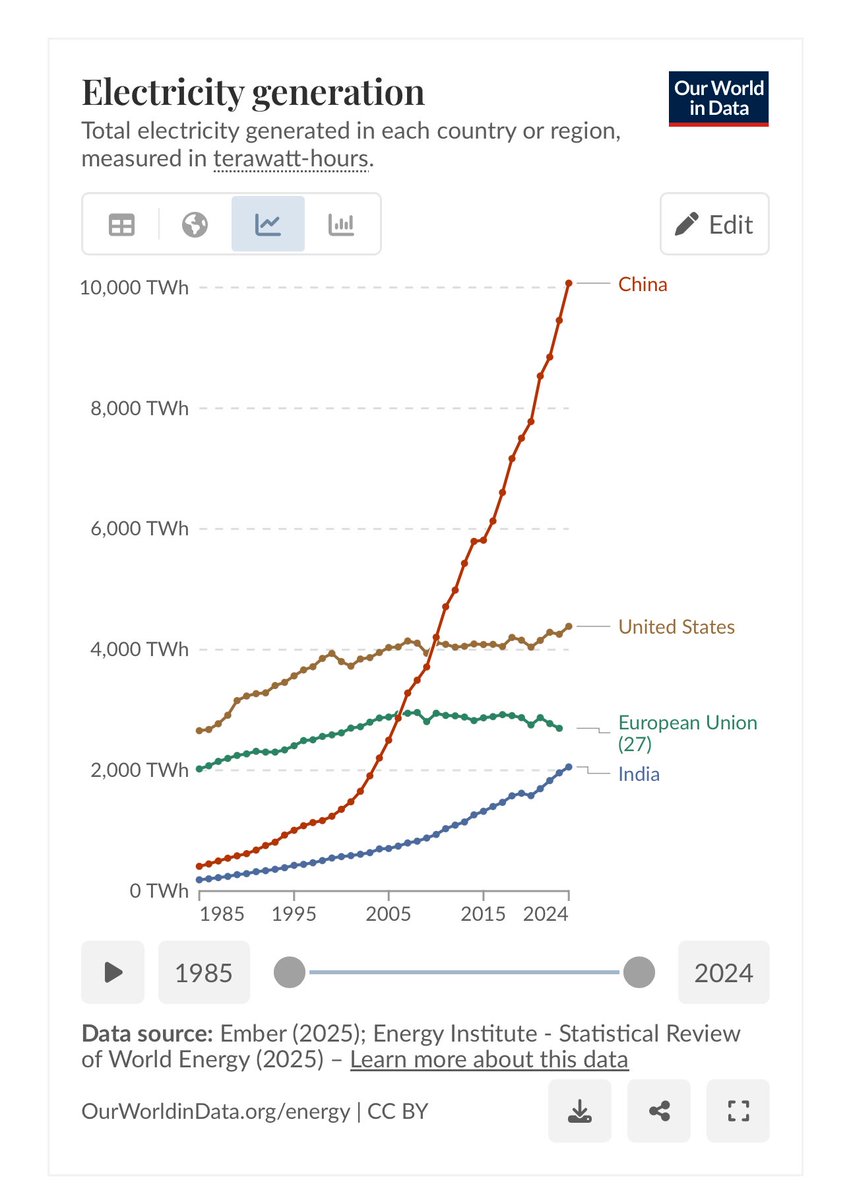

But that small number actually included Russia, India, and China: the RIC of BRICS.

But that small number actually included Russia, India, and China: the RIC of BRICS.

https://twitter.com/balajis/status/1796208316907126841

It is a huge deal, because in 1950 America made things while in 2025 it only prints things.

Specifically, the only two globally competitive exports of the US are (a) the dollar and (b) tech.

And tariffs, sanctions, trade war, and printing are eroding the dollar.

Specifically, the only two globally competitive exports of the US are (a) the dollar and (b) tech.

And tariffs, sanctions, trade war, and printing are eroding the dollar.

https://twitter.com/morlockp/status/1962456947556298961

Or the dollar almost halving.

The true rate of inflation is the rate at which the smart money is exiting the US dollar for hard money.

The true rate of inflation is the rate at which the smart money is exiting the US dollar for hard money.

https://twitter.com/lukeheapwalker/status/1962467017018970565

But why are gold prices rising? Because BRICS is stacking gold bricks, and the Russian sanctions eroded the store-of-value function of the dollar.

And why did the Fed hike rates and devalue Treasuries? Because inflation was eroding the purchasing power of the dollar.

And why did the Fed hike rates and devalue Treasuries? Because inflation was eroding the purchasing power of the dollar.

https://twitter.com/danieldimartino/status/1962517115363045471

• • •

Missing some Tweet in this thread? You can try to

force a refresh