Stop Reinvesting dividends! Do this instead.

If you auto drip your dividends you are missing out on massive upside.

Being more hands on will lead to much higher gains. Here’s why. 🧵👇

If you auto drip your dividends you are missing out on massive upside.

Being more hands on will lead to much higher gains. Here’s why. 🧵👇

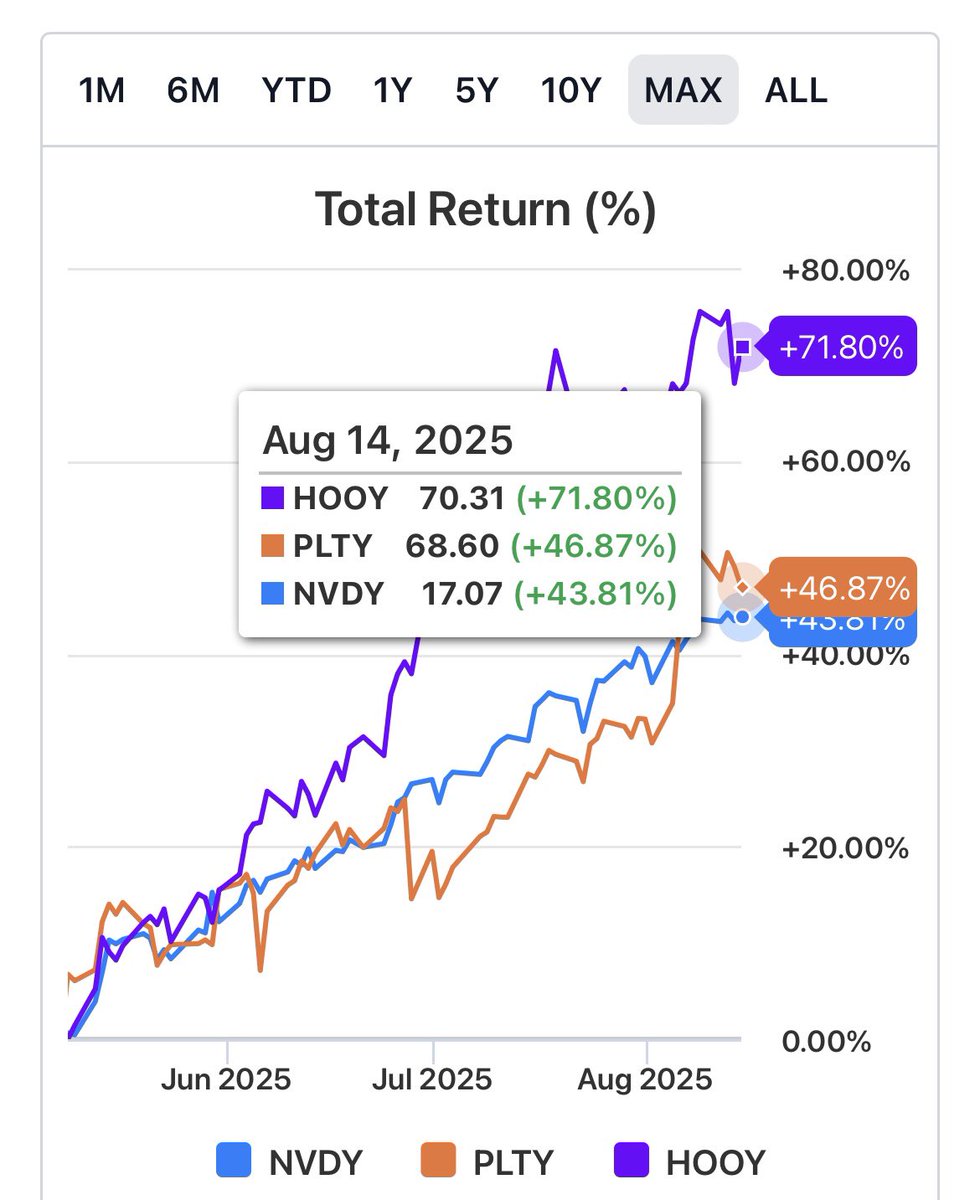

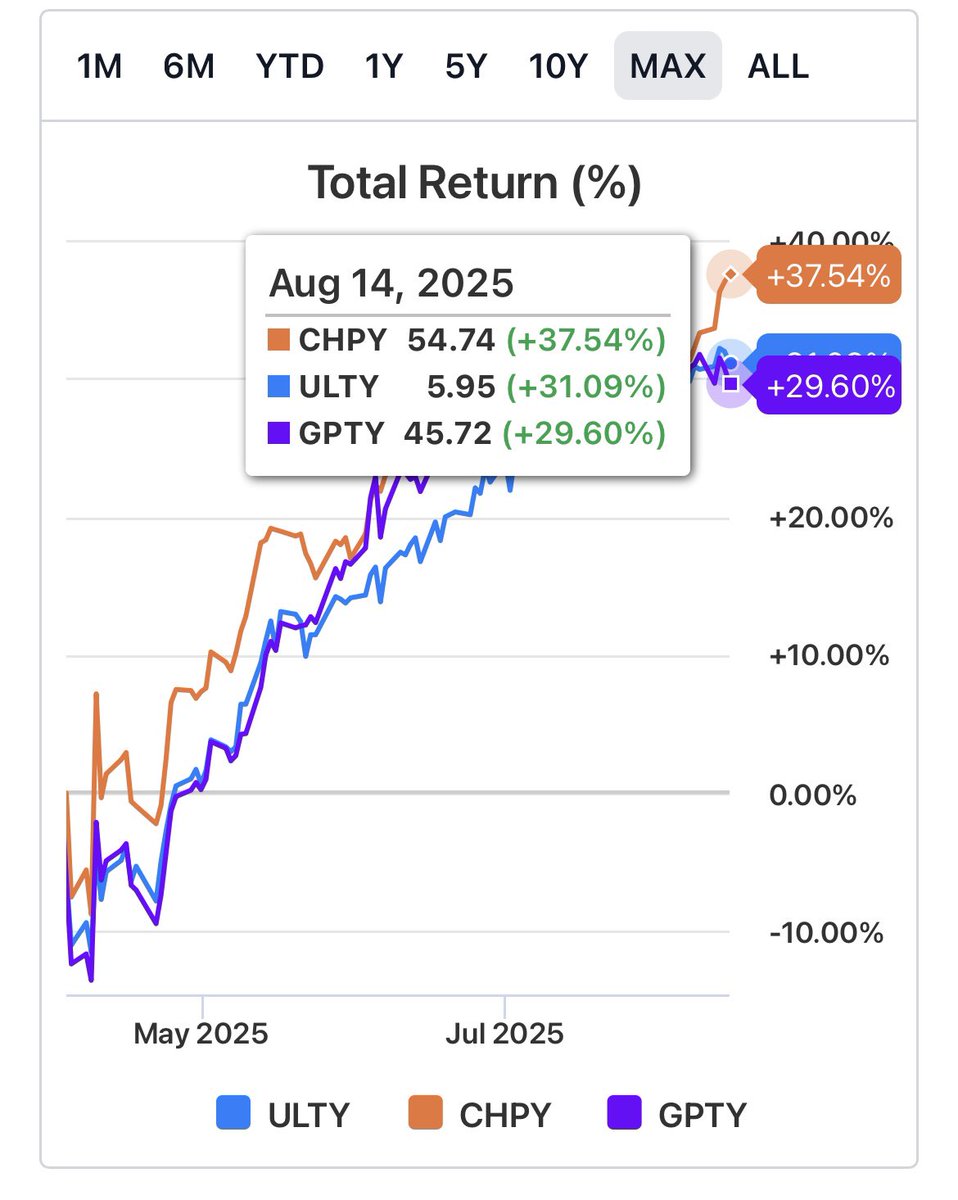

High yield funds that yield 50-100% are all going to decay over time.

While total returns will still be great you’re missing out on a ton of upside.

The cheat code is moving half of your dividends to growth & lower yield funds.

While total returns will still be great you’re missing out on a ton of upside.

The cheat code is moving half of your dividends to growth & lower yield funds.

When you do this you…

✅ Create more upside & gains

✅ Offset NAV erosion

✅ Create sustainability

✅ Further diversify yourself

✅ Create more upside & gains

✅ Offset NAV erosion

✅ Create sustainability

✅ Further diversify yourself

Building out a free growth portfolio is the key to making these work long term.

My favorites for this are $IBIT $SPMO for growth & $BTCI $TDVI for lower yield sustainability.

My favorites for this are $IBIT $SPMO for growth & $BTCI $TDVI for lower yield sustainability.

Instead of drip extract yield. Look too..

• Hold Value

• Get upside appreciation

• Multiply your compounding

• Hold Value

• Get upside appreciation

• Multiply your compounding

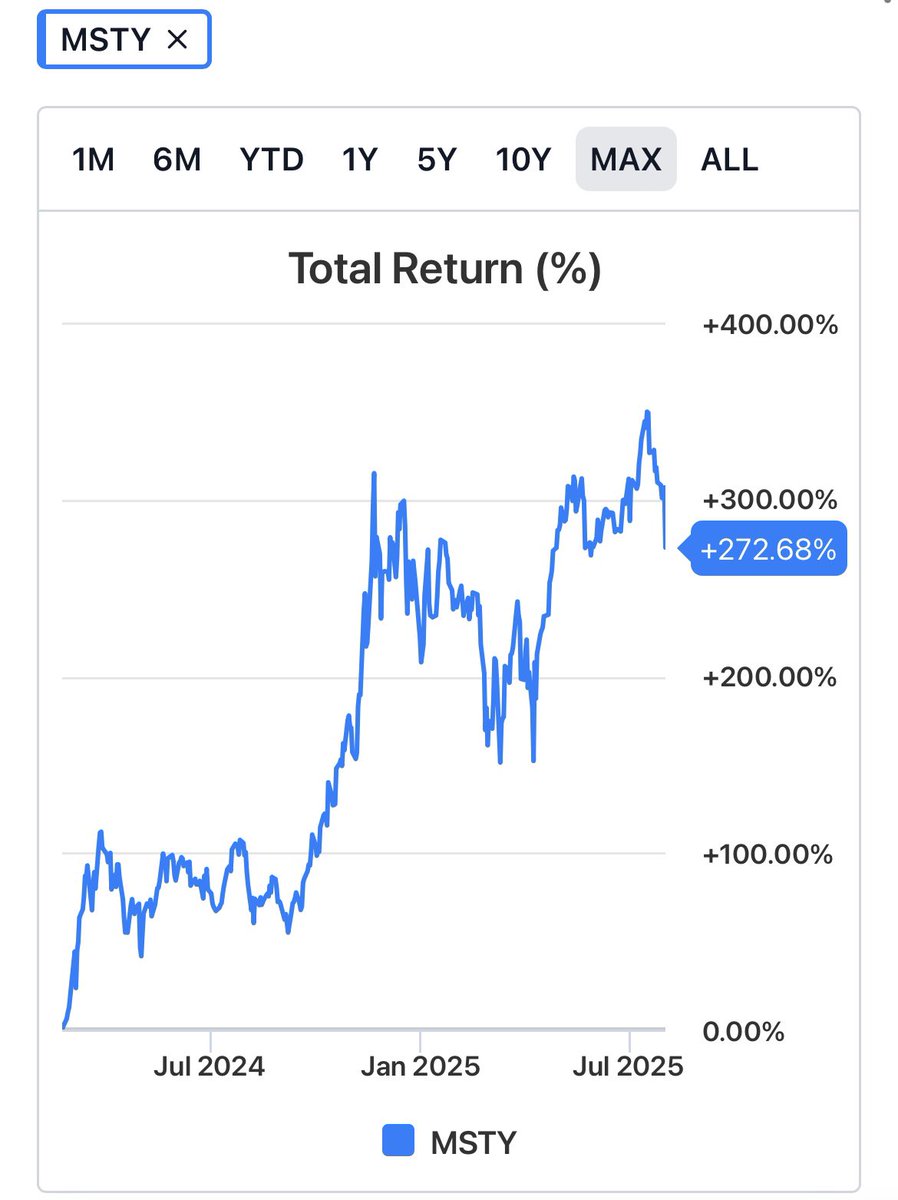

High Yield Math:

$50K in a 60% yield ETF = $30K/year.

If you drip you’re missing out on huge upside long term.

If you divert half of that $30K into BTC annually, over a halving cycle, that’s potentially life-changing compounding.

$50K in a 60% yield ETF = $30K/year.

If you drip you’re missing out on huge upside long term.

If you divert half of that $30K into BTC annually, over a halving cycle, that’s potentially life-changing compounding.

In my experience this how you offset the cons & no longer break a sweat over them.

Once you make that investment view that money as gone and use it as a compounding machine.

Don’t let a bad stretch shake you. You’re going to achieve house money and be further green with each payout.

When you buy some growth with these payouts your dividends create their own gains.

Once you make that investment view that money as gone and use it as a compounding machine.

Don’t let a bad stretch shake you. You’re going to achieve house money and be further green with each payout.

When you buy some growth with these payouts your dividends create their own gains.

Mindset Shift:

Think of high-yield ETFs as a money printer, not a savings account.

• Use them to generate cash.

• Deploy that cash where it grows.

Now you’re creating asymmetric upside alongside an income stream for freedom.

Buy yourself a salary & do both things.

Think of high-yield ETFs as a money printer, not a savings account.

• Use them to generate cash.

• Deploy that cash where it grows.

Now you’re creating asymmetric upside alongside an income stream for freedom.

Buy yourself a salary & do both things.

If you want to scale a high yield portfolio join the world’s best discord. 🅾️🅱️

• High yield

• Option selling

• 0DTE

• Leaps

• Swing trading

• Crypto & more

Hit the link in my bio $20 per month gives you access to my channel. If you want more information on it DM me, “access”.

• High yield

• Option selling

• 0DTE

• Leaps

• Swing trading

• Crypto & more

Hit the link in my bio $20 per month gives you access to my channel. If you want more information on it DM me, “access”.

• • •

Missing some Tweet in this thread? You can try to

force a refresh