26 | 40k In Annual Dividends | Freedom Through High Yield Investing | My High Yield Portfolio Strategy 👇

How to get URL link on X (Twitter) App

$BLOX is the Nicholas Crypto Income ETF.

$BLOX is the Nicholas Crypto Income ETF.

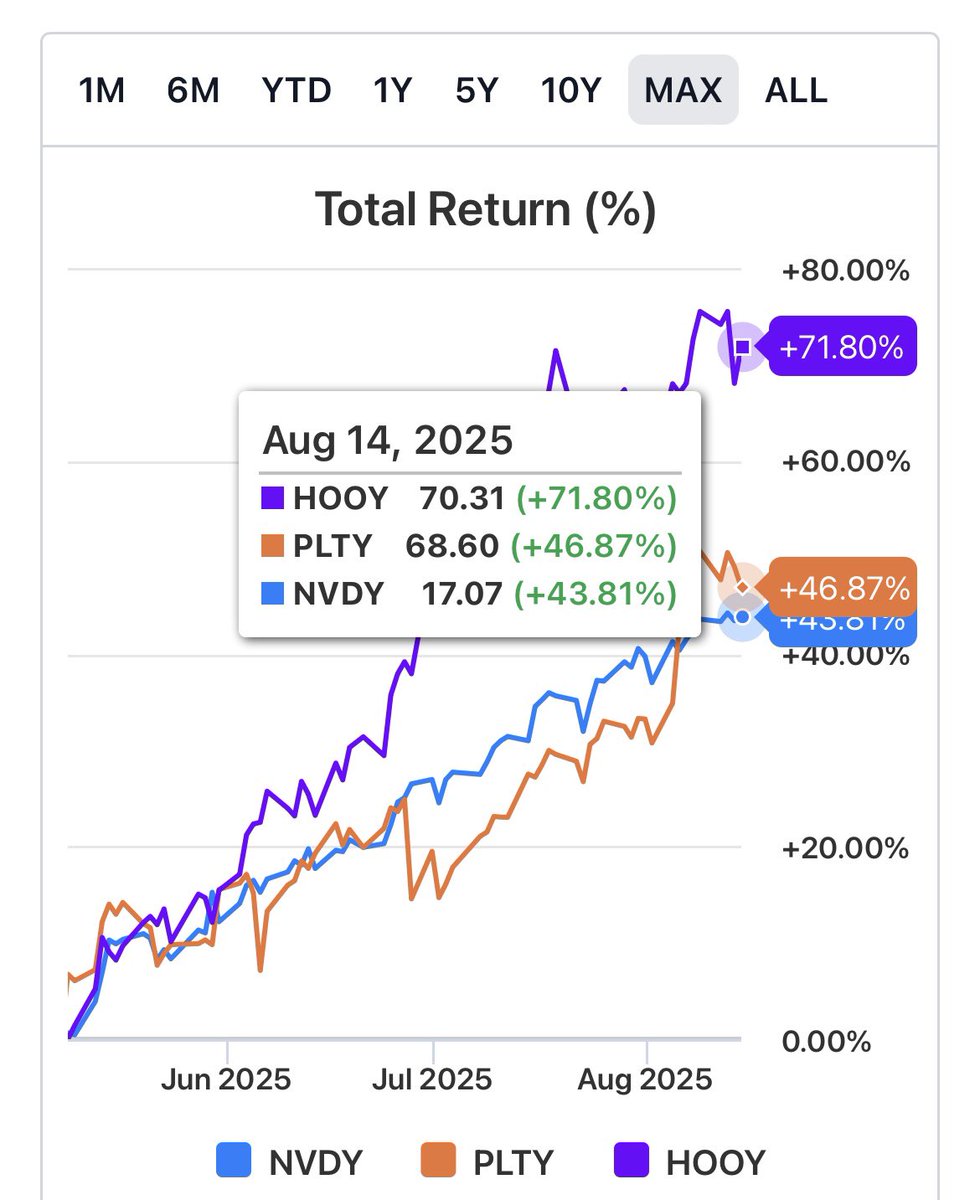

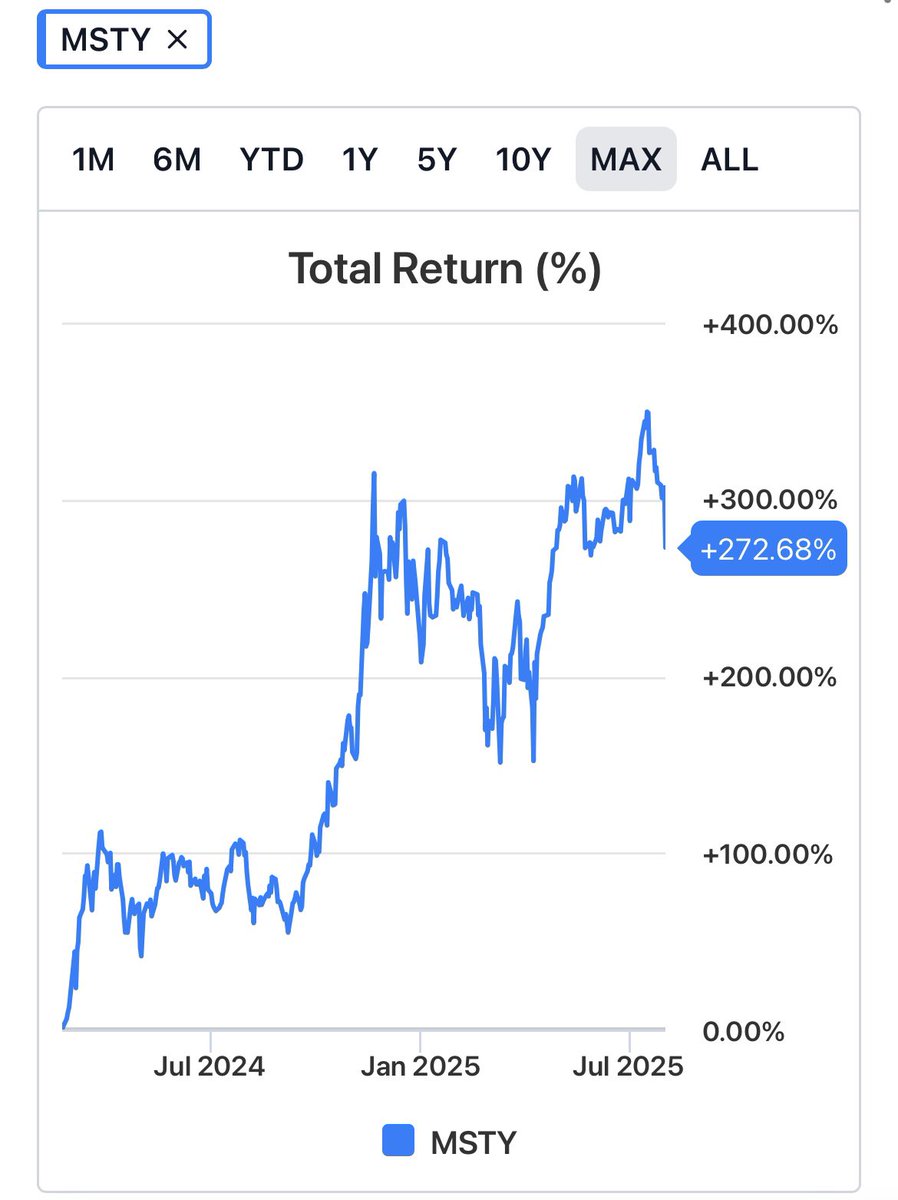

The best way to play ultra high yielders is by creating a funnel into your foundational indexes.

The best way to play ultra high yielders is by creating a funnel into your foundational indexes.

Even among great funds you have to play them a certain way to see great gains. 📈

Even among great funds you have to play them a certain way to see great gains. 📈

1. Strategy:

1. Strategy:

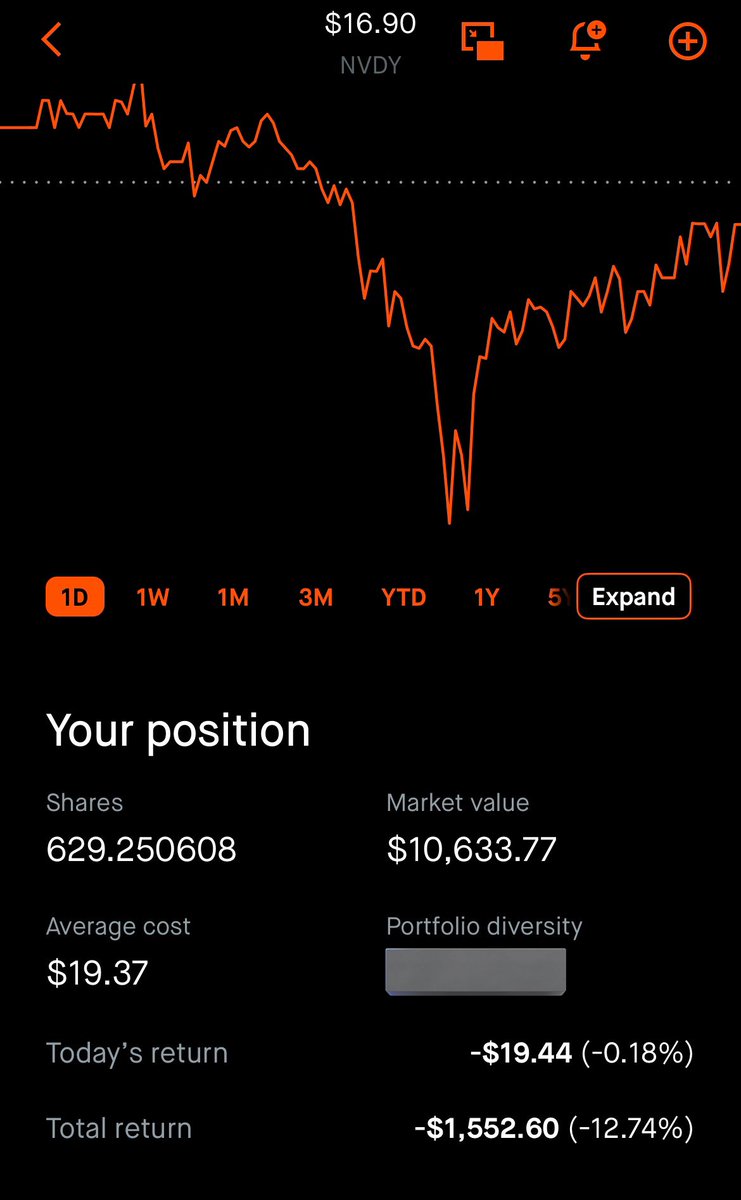

My $NVDY position is one of my longest holds. You may see the capital erosion & wonder how did you make money?

My $NVDY position is one of my longest holds. You may see the capital erosion & wonder how did you make money?

Most focus strictly on yield %. That’s the biggest mistake you can make.

Most focus strictly on yield %. That’s the biggest mistake you can make.

Most people think you need millions to retire. The truth is you need far less. 📉

Most people think you need millions to retire. The truth is you need far less. 📉

First, let’s kill a myth:

First, let’s kill a myth:

High yield funds that yield 50-100% are all going to decay over time.

High yield funds that yield 50-100% are all going to decay over time.

1. Single stock funds

1. Single stock funds

ROC: “But your just getting returned your own capital”

ROC: “But your just getting returned your own capital”